Printed on July 14th, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an fairness funding portfolio value over $360 billion, as of the top of the 2022 first quarter.

Berkshire Hathaway’s portfolio is full of high quality shares. You may comply with Warren Buffett shares to seek out picks for your portfolio. That’s as a result of Buffett (and different institutional buyers) are required to periodically present their holdings in a 13F Submitting.

You may see all Warren Buffett shares (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

Observe: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

As of March thirty first, 2022, Buffett’s Berkshire Hathaway owned virtually 8.3 million shares of Visa Inc. (V) for a market worth of $1.8 billion. Visa Inc. represents about 0.5% of Berkshire Hathaway’s funding portfolio. This marks it because the 21st rating place within the public inventory portfolio.

This text will analyze the credit score providers firm in higher element.

Enterprise Overview

Visa is the world’s chief in digital funds, with exercise in additional than 200 nations. The inventory went public in 2008 and its IPO has confirmed to be one of the profitable in U.S. historical past.

The corporate’s international processing community supplies safe and dependable funds world wide and is able to dealing with over 65,000 transactions a second. In fiscal 12 months 2021, the corporate generated almost $13 billion in revenue.

On April twenty sixth, 2022, Visa reported Q2 fiscal 12 months 2022 outcomes. For the quarter, Visa generated income of $7.2 billion, adjusted internet earnings of $3.8 billion and adjusted earnings-per-share of $1.79, marking will increase of 25%, 27% and 30%, respectively.

Supply: Investor Presentation

These outcomes have been pushed by a 17% acquire in Funds Quantity, a 47% acquire in Cross-Border Quantity and a 19% acquire in Processed Transactions.

In the course of the quarter, Visa returned $3.7 billion to shareholders through dividends and share repurchases.

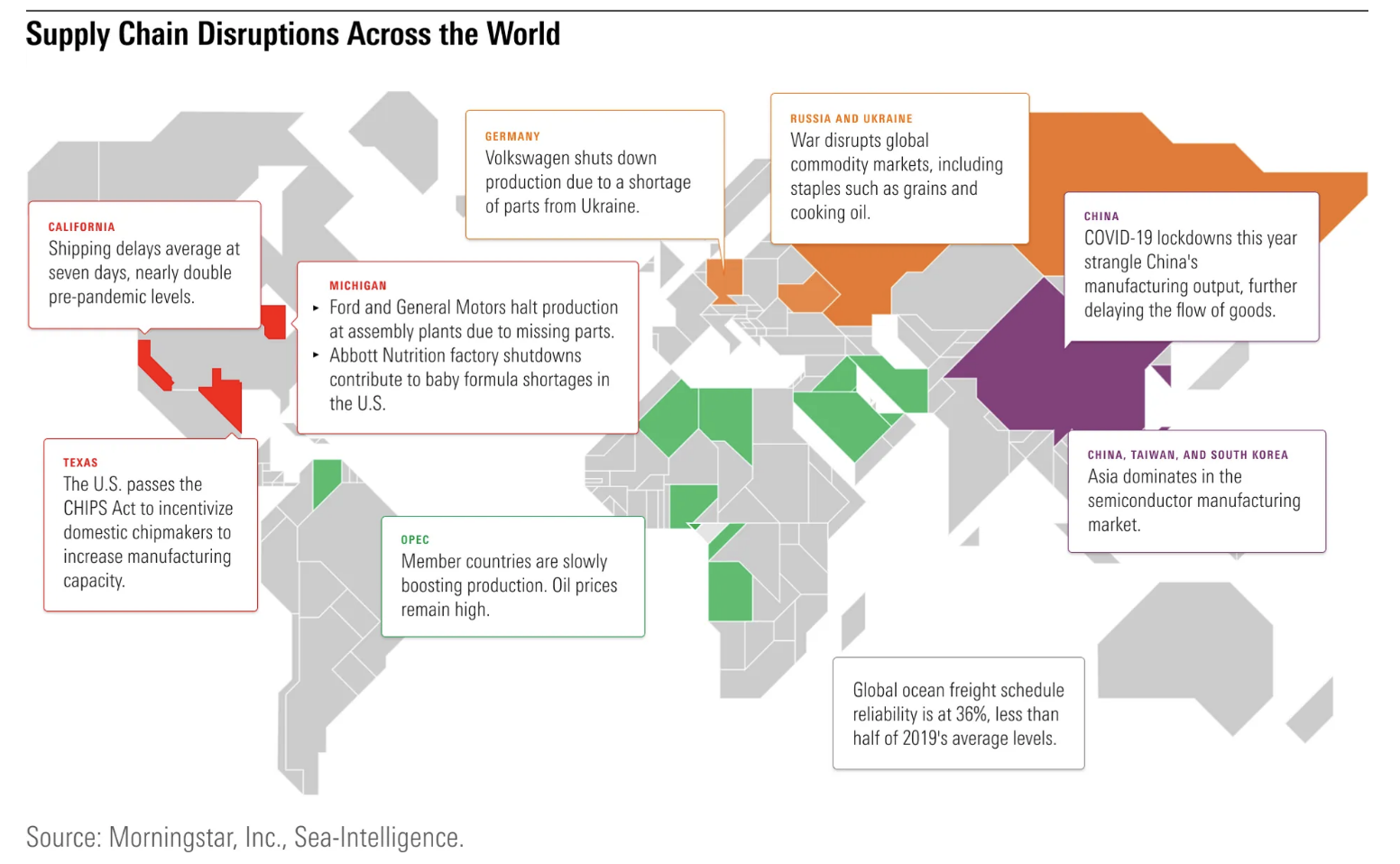

Because of financial sanctions imposed on Russia by the U.S., European Union, United Kingdom, and others, Visa introduced in March 2022 that they have been suspending operations in Russia, and since then are not producing income from actions associated to Russia.

Russia accounted for roughly 4% of complete internet revenues for the primary half of fiscal 2022 and the complete 12 months fiscal 2021.

We estimate that Visa can generate $7.15 in earnings-per-share for the fiscal 2022 12 months.

Progress Prospects

Up till the COVID-19 pandemic in 2020, Visa’s earnings-per-share rose each single 12 months at a powerful annualized common progress price of twenty-two%.

Over the long-term, we imagine Visa has loads of area to continue to grow because of the worldwide transition in the direction of a cashless society. World digital cost quantity has not too long ago exceeded money for the primary time in historical past.

Nevertheless, there are nonetheless about 2 billion folks worldwide who lack entry to cashless funds. Notably, China and India, which have 1.4 billion folks every, are nonetheless within the early phases of their transition in the direction of a cashless financial system. Due to this fact, there’s a huge progress potential for Visa in these two nations.

By way of a mix of rising the variety of playing cards, a rising variety of transactions per card holder, basic financial enlargement and share repurchases, Visa ought to be capable to generate enticing earnings-per-share progress over the approaching years.

We undertaking that the corporate can proceed to develop earnings per share by about 10.0% yearly by way of 2027.

Aggressive Benefits & Recession Efficiency

Visa has huge aggressive benefits, because it is likely one of the largest and most well-known cost processors throughout the globe. Visa has cultured a robust model and the corporate continues to put money into vital sponsorships to additional reinforce its model power.

The corporate is ready to direct giant quantities of free money stream to shareholders by way of share buybacks and dividends, or to put money into acquisitions, because the firm spends solely a small portion on capital expenditures.

Nevertheless, Visa isn’t proof against recessions. Since Visa’s income rely on the entire quantity of transactions worldwide, the corporate is affected by an financial disaster, which ends up in decrease spending and decrease transaction volumes. This was demonstrated within the 2020 pandemic 12 months which broke Visa’s earnings progress streak.

Nonetheless, objects like gasoline, groceries and garments are requirements. Even with a drop in spending, shoppers will probably proceed to make use of debit and bank cards for his or her purchases. Thus, there may be some recession-resistance to the corporate.

Visa has raised its dividend for fourteen consecutive years thus far. The corporate’s management place in its trade affords it the flexibility to always enhance its dividend at a particularly sturdy progress price, and nonetheless preserve a really affordable payout ratio of roughly 21%. We anticipate continued dividend progress from Visa of about 10% every year, in-line with earnings progress.

Valuation & Anticipated Returns

Shares of Visa have traded for a mean price-to-earnings a number of of round 27.5 within the final ten years. Shares are actually buying and selling above this common, which signifies that shares could possibly be overvalued on the present 28.6 occasions earnings.

Our honest worth estimate for Visa inventory is 25.0 occasions earnings. If this proves right, the inventory will incur a -2.6% annualized drag in its returns by way of 2027.

Shares of Visa presently yield 0.7%, which is in-line with the common yield of 0.75%. On a dividend yield foundation, Visa shares appear to be buying and selling at about honest worth. Visa has massively elevated the dividend over the past decade, and this progress has stored up with the share worth, leading to a constant dividend yield.

Placing all of it collectively, the mix of valuation adjustments, EPS progress, and dividends produces complete anticipated returns of seven.9% per 12 months over the subsequent 5 years. This makes Visa Inc. a maintain.

Last Ideas

Visa has produced excellent progress over the past decade, together with vital revenue, dividend, and share worth positive factors. We anticipate that future efficiency will probably be a bit extra tame than the 20%+ earnings-per-share progress exhibited within the 2009 to 2019 stretch. Nonetheless, Visa has a really sturdy earnings progress outlook.

Shares seem like barely overvalued right here, so there could also be a greater entry level sooner or later, however the firm’s progress thesis stays intact. And we anticipate continued double-digit dividend will increase within the intermediate time period.

Different Dividend Lists

Worth investing is a useful course of to mix with dividend investing. The next lists include many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].