Revealed on Might twenty first, 2025 by Bob Ciura

There are good causes for traders to personal worldwide shares, reminiscent of diversification. Many firms that function exterior the U.S. have entry to geographic markets that might outperform the U.S. within the occasion of a home financial downturn.

After all, there are dangers to buying worldwide shares, reminiscent of forex threat.

Nonetheless, earnings traders searching for high quality dividend shares shouldn’t all the time ignore worldwide shares. Certainly, there are numerous high quality worldwide shares which have compiled spectacular dividend development histories.

Revenue traders are probably accustomed to the Dividend Aristocrats, that are a number of the highest-quality shares to purchase and maintain for the long run.

You possibly can obtain the complete Dividend Aristocrats checklist, together with vital metrics like dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

Disclaimer: Certain Dividend shouldn’t be affiliated with S&P International in any approach. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet relies on Certain Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s based mostly. Not one of the data on this article or spreadsheet is official information from S&P International. Seek the advice of S&P International for official data.

The checklist of Dividend Aristocrats is diversified throughout a number of sectors, together with shopper items, financials, industrials, and healthcare. However it isn’t diversified geographically to incorporate worldwide shares.

With this in thoughts, this text will focus on 10 worldwide dividend development shares which have raised their dividends for over 25 consecutive years, of their dwelling currencies.

Desk of Contents

The desk of contents beneath permits for simple navigation. The shares are listed by 5-year annual anticipated returns, in ascending order.

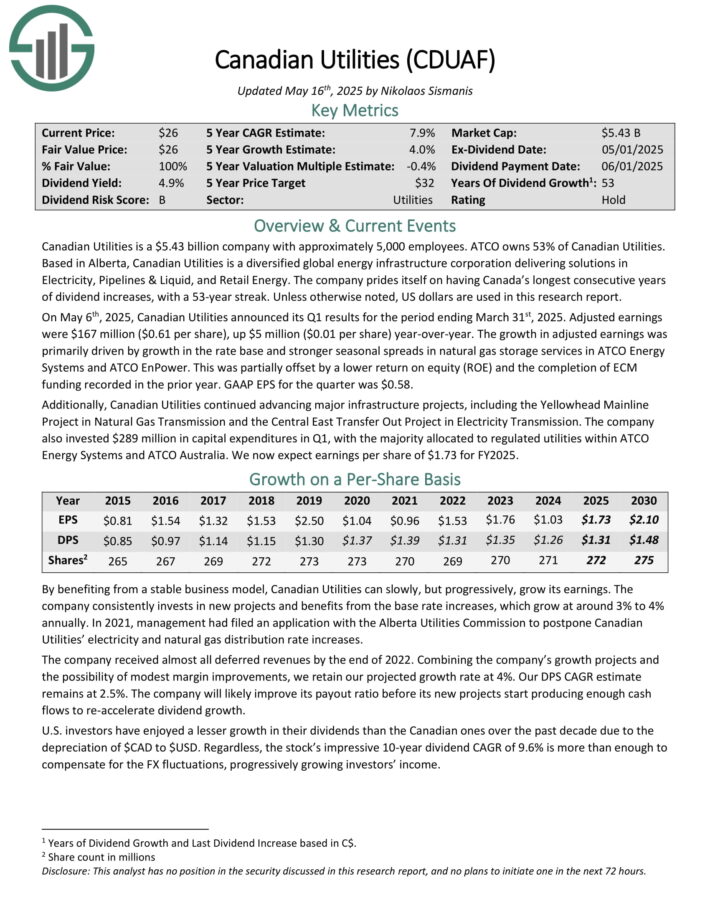

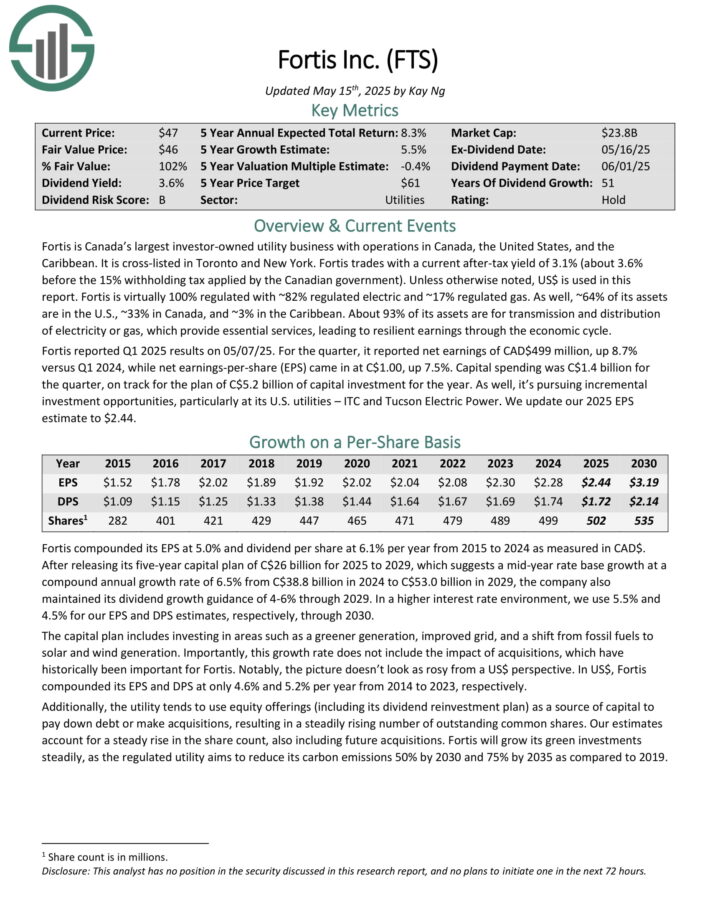

Worldwide Dividend Aristocrat #10: Canadian Utilities Ltd. (CDUAF)

- Consecutive Years Of Dividend Will increase: 53

- Annual Anticipated Returns: 7.5%

Canadian Utilities is a utility firm with roughly 5,000 staff. ATCO owns 53% of Canadian Utilities. Based mostly in Alberta, Canadian Utilities is a diversified world power infrastructure company delivering options in Electrical energy, Pipelines & Liquid, and Retail Vitality.

The corporate prides itself on having Canada’s longest consecutive years of dividend will increase, with a 53-year streak. Except in any other case famous, US {dollars} are used on this analysis report.

On Might sixth, 2025, Canadian Utilities introduced its Q1 outcomes. Adjusted earnings have been $167 million ($0.61 per share), up $5 million ($0.01 per share) year-over-year.

The expansion in adjusted earnings was primarily pushed by development within the price base and stronger seasonal spreads in pure gasoline storage providers in ATCO Vitality Methods and ATCO EnPower. This was partially offset by a decrease return on fairness (ROE) and the completion of ECM funding recorded within the prior 12 months. GAAP EPS for the quarter was $0.58.

Moreover, Canadian Utilities continued advancing main infrastructure tasks, together with the Yellowhead Mainline Mission in Pure Gasoline Transmission and the Central East Switch Out Mission in Electrical energy Transmission.

Click on right here to obtain our most up-to-date Certain Evaluation report on CDUAF (preview of web page 1 of three proven beneath):

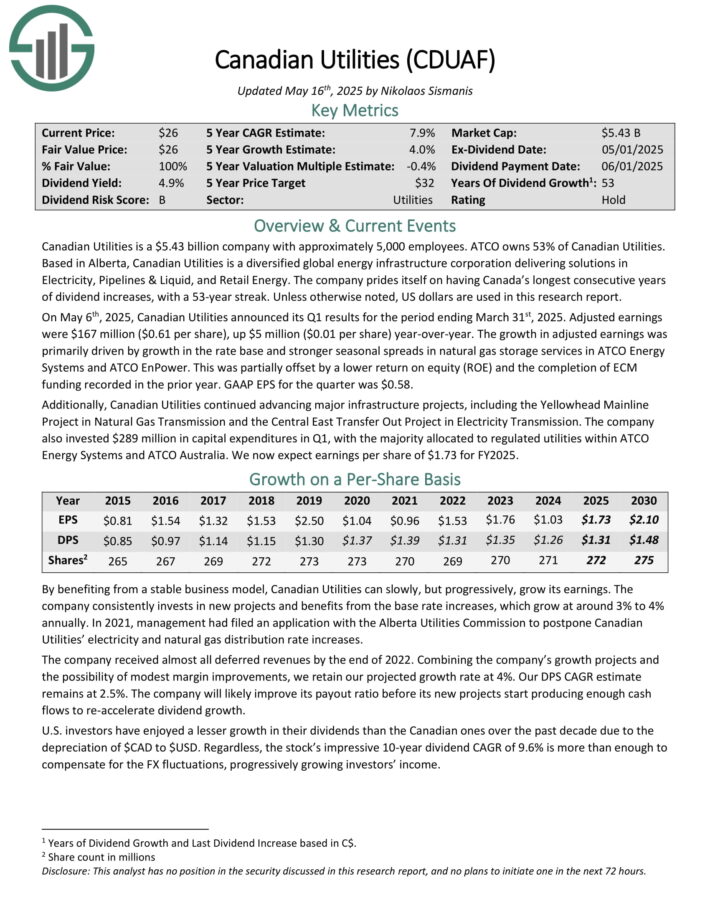

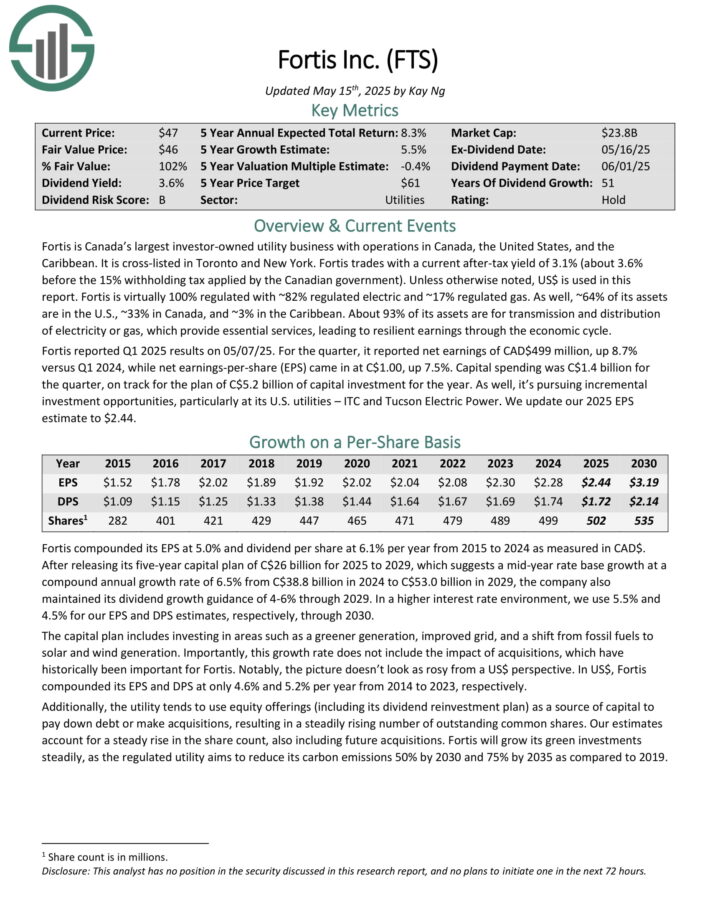

Worldwide Dividend Aristocrat #9: Fortis Inc. (FTS)

- Consecutive Years Of Dividend Will increase: 51

- Annual Anticipated Returns: 7.9%

Fortis is Canada’s largest investor-owned utility enterprise with operations in Canada, the US, and the Caribbean. It’s cross-listed in Toronto and New York.

Fortis is just about 100% regulated with ~82% regulated electrical and ~17% regulated gasoline. As properly, ~64% of its property are within the U.S., ~33% in Canada, and ~3% within the Caribbean. About 93% of its property are for transmission and distribution of electrical energy or gasoline, which offer important providers, resulting in resilient earnings by the financial cycle.

Fortis reported Q1 2025 outcomes on 05/07/25. For the quarter, it reported internet earnings of CAD$499 million, up 8.7% versus Q1 2024, whereas internet earnings-per-share (EPS) got here in at C$1.00, up 7.5%.

Capital spending was C$1.4 billion for the quarter, on monitor for the plan of C$5.2 billion of capital funding for the 12 months.

After releasing its five-year capital plan of C$26 billion for 2025 to 2029, which suggests a mid-year price base development at a compound annual development price of 6.5% from C$38.8 billion in 2024 to C$53.0 billion in 2029, the corporate additionally maintained its dividend development steering of 4-6% by 2029.

The capital plan contains investing in areas reminiscent of a greener technology, improved grid, and a shift from fossil fuels to photo voltaic and wind technology.

Click on right here to obtain our most up-to-date Certain Evaluation report on FTS (preview of web page 1 of three proven beneath):

Worldwide Dividend Aristocrat #8: Canadian Nationwide Railway (CNI)

- Consecutive Years Of Dividend Will increase: 30

- Annual Anticipated Returns: 7.9%

Canadian Nationwide Railway is the most important railway operator in Canada. The corporate has a community of roughly 20,000 route miles and connects three coasts: the Atlantic, the Pacific and the Gulf of Mexico. It handles over $200 billion value of products yearly and carries over 300 million tons of cargo.

On January thirtieth, 2025, Canadian Nationwide Railway elevated its dividend 5% for the March thirty first, 2025 cost date.

On Might 1st, 2025, Canadian Nationwide Railway reported first quarter outcomes. For the quarter, income grew 2.3% to $3.18 billion, which was $25 million greater than anticipated. Adjusted earnings-per share of $1.40 in contrast favorably to $1.26 within the prior 12 months and was $0.12 above estimates.

For the quarter, Canadian Nationwide Railway’s working ratio improved 20 foundation factors to 63.4%. Income ton miles improved 1% from the prior 12 months whereas carloads declined 2.2%.

Income outcomes have been combined for many of the firm’s particular person product classes. Utilizing fixed forex, Coal (+9%), Grain and Fertilizers (+7%), and Petroleum and Chemical compounds (+3%) have been all larger for the interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on CNI (preview of web page 1 of three proven beneath):

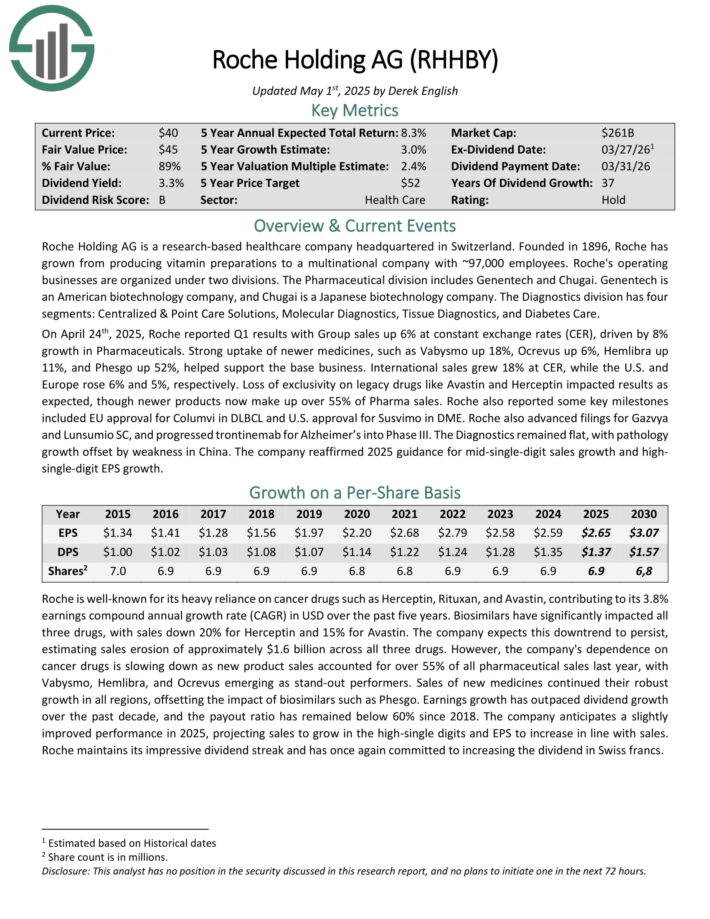

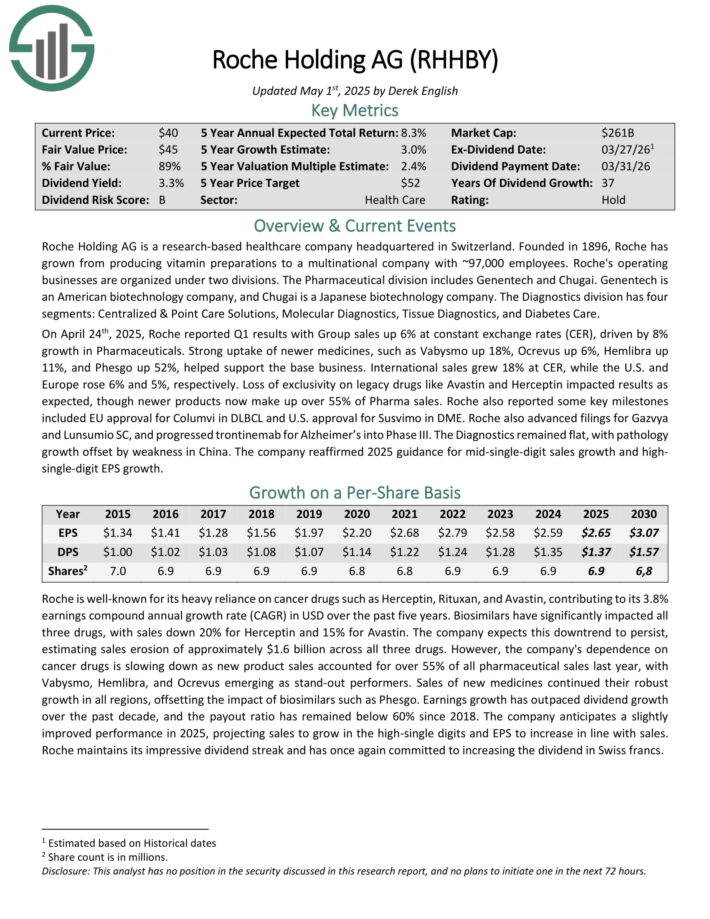

Worldwide Dividend Aristocrat #7: Roche Holding AG (RHHBY)

- Consecutive Years Of Dividend Will increase: 37

- Annual Anticipated Returns: 8.4%

Roche Holding AG is a research-based healthcare firm headquartered in Switzerland. Based in 1896, Roche has grown from producing vitamin preparations to a multinational firm with ~97,000 staff. Roche’s working companies are organized beneath two divisions.

The Pharmaceutical division contains Genentech and Chugai. Genentech is an American biotechnology firm, and Chugai is a Japanese biotechnology firm. The Diagnostics division has 4 segments: Centralized & Level Care Options, Molecular Diagnostics, Tissue Diagnostics, and Diabetes Care.

On April twenty fourth, 2025, Roche reported Q1 outcomes with Group gross sales up 6% at fixed trade charges (CER), pushed by 8% development in Prescription drugs. Sturdy uptake of newer medicines, reminiscent of Vabysmo up 18%, Ocrevus up 6%, Hemlibra up 11%, and Phesgo up 52%, helped assist the bottom enterprise.

Worldwide gross sales grew 18% at CER, whereas the U.S. and Europe rose 6% and 5%, respectively. Lack of exclusivity on legacy medication like Avastin and Herceptin impacted outcomes as anticipated, although newer merchandise now make up over 55% of Pharma gross sales.

Roche additionally reported some key milestones included EU approval for Columvi in DLBCL and U.S. approval for Susvimo in DME. Roche additionally superior filings for Gazvya and Lunsumio SC, and progressed trontinemab for Alzheimer’s into Part III.

Click on right here to obtain our most up-to-date Certain Evaluation report on RHHBY (preview of web page 1 of three proven beneath):

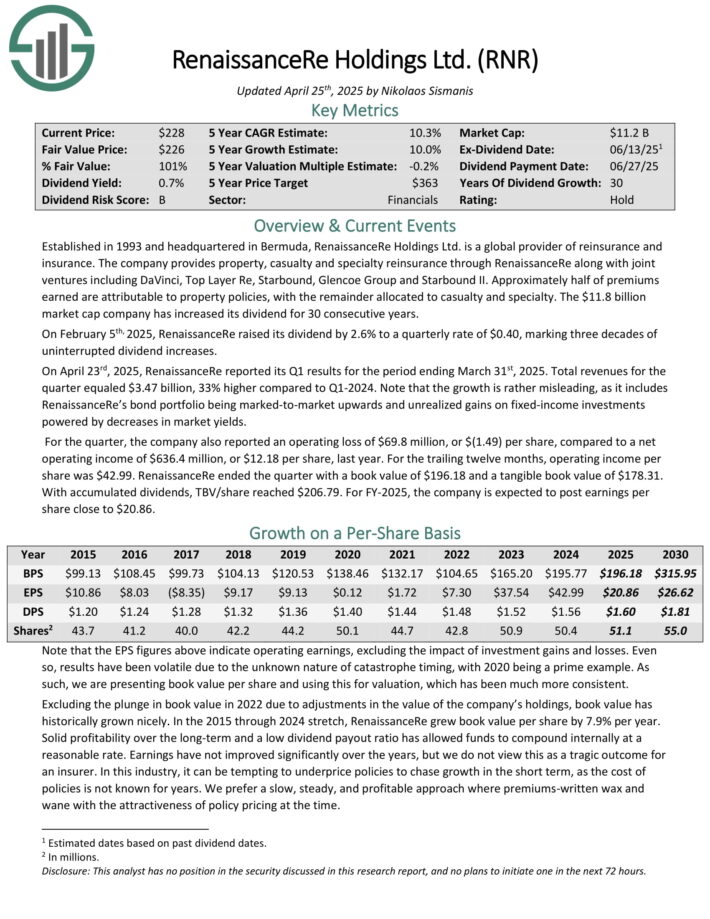

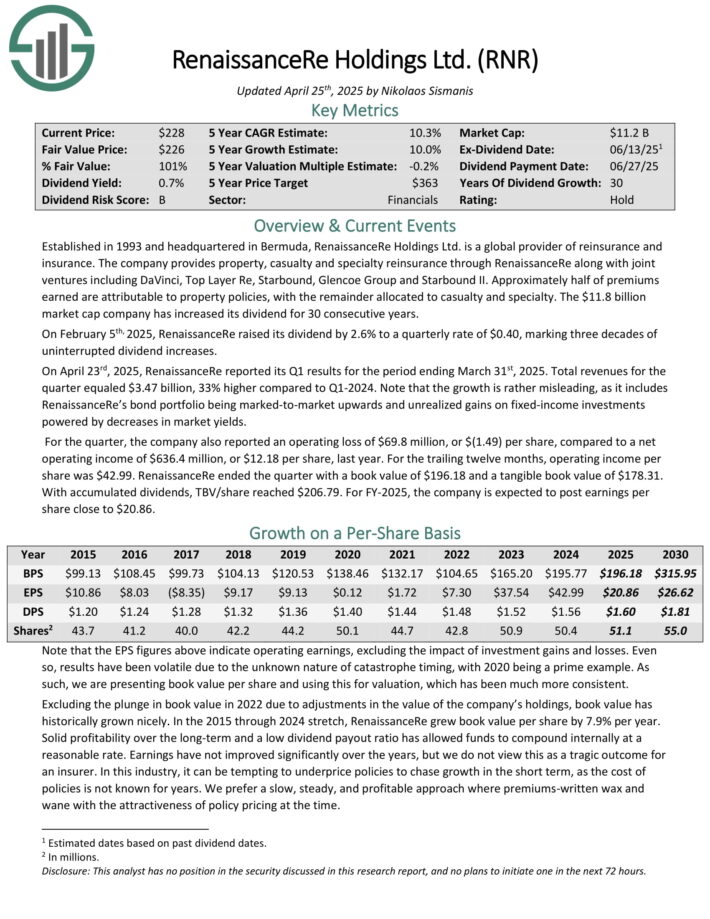

Worldwide Dividend Aristocrat #6: RenaissanceRe Holdings Ltd. (RNR)

- Consecutive Years Of Dividend Will increase: 30

- Annual Anticipated Returns: 8.7%

Established in 1993 and headquartered in Bermuda, RenaissanceRe Holdings Ltd. is a worldwide supplier of reinsurance and insurance coverage.

The corporate gives property, casualty and specialty reinsurance by RenaissanceRe together with joint ventures together with DaVinci, High Layer Re, Starbound, Glencoe Group and Starbound II.

Roughly half of premiums earned are attributable to property insurance policies, with the rest allotted to casualty and specialty.

On February fifth, 2025, RenaissanceRe raised its dividend by 2.6% to a quarterly price of $0.40, marking three a long time of uninterrupted dividend will increase.

On April twenty third, 2025, RenaissanceRe reported its Q1 outcomes for the interval ending March thirty first, 2025. Whole revenues for the quarter equaled $3.47 billion, 33% larger in comparison with Q1-2024.

Word that the expansion is quite deceptive, because it contains RenaissanceRe’s bond portfolio being marked-to-market upwards and unrealized positive factors on fixed-income investments powered by decreases in market yields.

For the quarter, the corporate additionally reported an working lack of $69.8 million, or $(1.49) per share, in comparison with a internet working earnings of $636.4 million, or $12.18 per share, final 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on RNR (preview of web page 1 of three proven beneath):

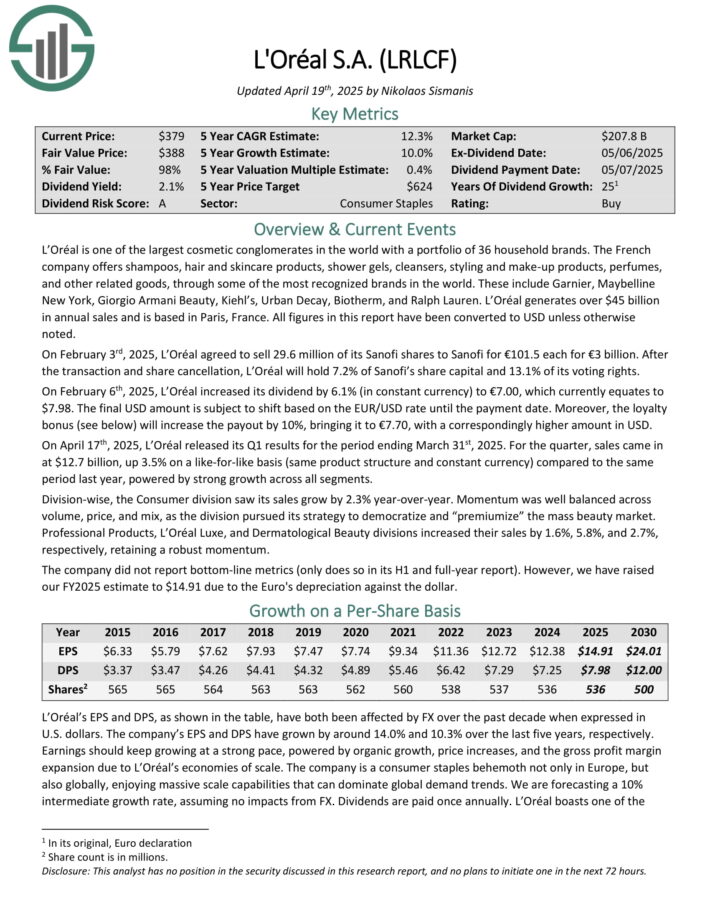

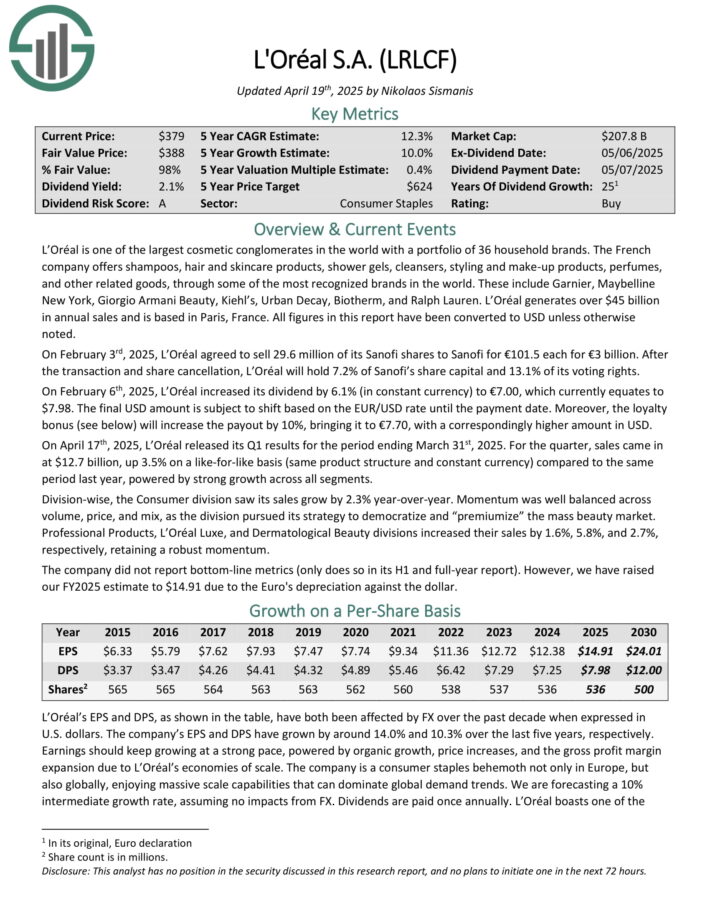

Worldwide Dividend Aristocrat #5: L’Oreal (LRLCF)

- Consecutive Years Of Dividend Will increase: 25

- Annual Anticipated Returns: 10.1%

L’Oréal is among the largest beauty conglomerates on the earth with a portfolio of 36 family manufacturers. The French firm presents shampoos, hair and skincare merchandise, bathe gels, cleansers, styling and make-up merchandise, perfumes, and different associated items, by a number of the most acknowledged manufacturers on the earth.

These embody Garnier, Maybelline New York, Giorgio Armani Magnificence, Kiehl’s, City Decay, Biotherm, and Ralph Lauren. L’Oréal generates over $45 billion in annual gross sales and relies in Paris, France. All figures on this report have been transformed to USD until in any other case famous.

On February third, 2025, L’Oréal agreed to promote 29.6 million of its Sanofi shares to Sanofi for €101.5 every for €3 billion. After the transaction and share cancellation, L’Oréal will maintain 7.2% of Sanofi’s share capital and 13.1% of its voting rights. On February sixth, 2025, L’Oréal elevated its dividend by 6.1% (in fixed forex) to €7.00.

On April seventeenth, 2025, L’Oréal launched its Q1 outcomes for the interval ending March thirty first, 2025. For the quarter, gross sales got here in at $12.7 billion, up 3.5% on a like-for-like foundation (similar product construction and fixed forex) in comparison with the identical interval final 12 months, powered by sturdy development throughout all segments.

Click on right here to obtain our most up-to-date Certain Evaluation report on LRLCF (preview of web page 1 of three proven beneath):

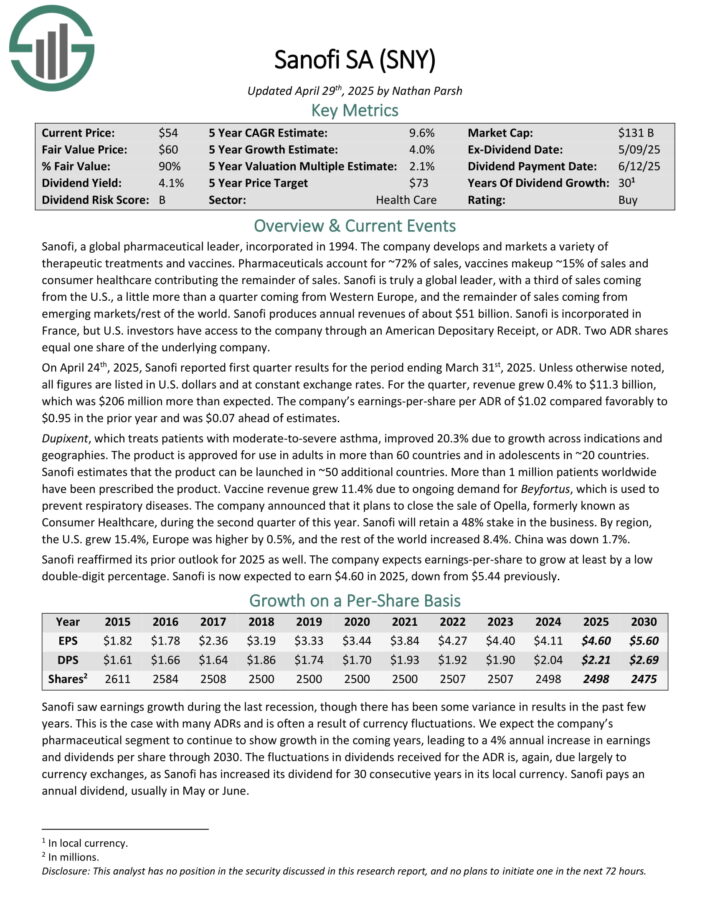

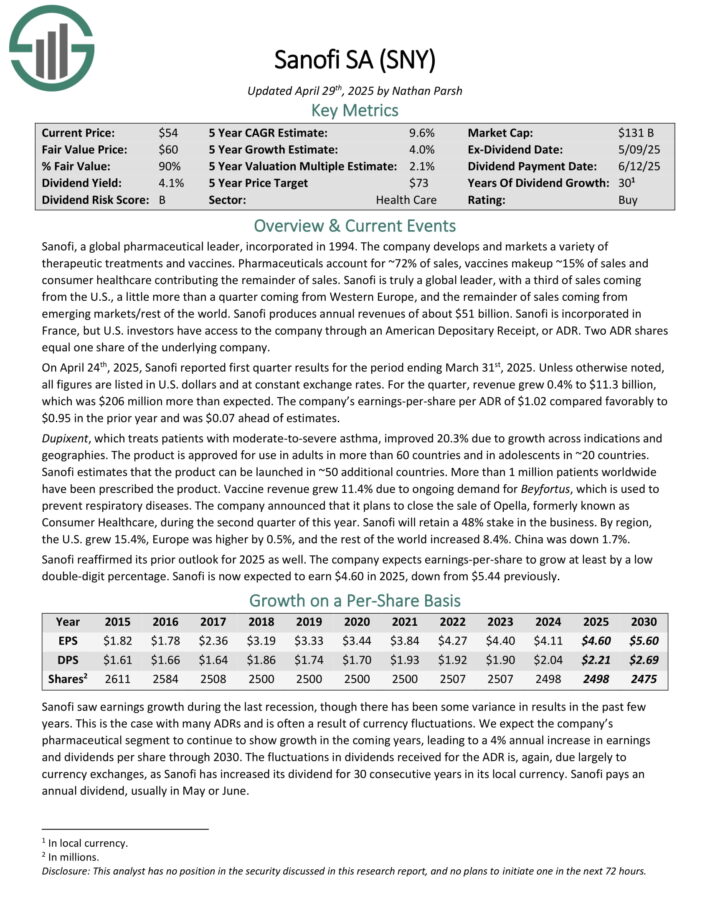

Worldwide Dividend Aristocrat #4: Sanofi (SNY)

- Consecutive Years Of Dividend Will increase: 30

- Annual Anticipated Returns: 10.1%

Sanofi is a worldwide pharmaceutical firm that develops and markets quite a lot of therapeutic therapies and vaccines. Prescription drugs account for ~72% of gross sales, vaccines make-up ~15% of gross sales and shopper healthcare contributing the rest of gross sales.

Sanofi produces annual revenues of about $51 billion. It’s included in France, however U.S. traders have entry to the corporate by an American Depositary Receipt, or ADR. Two ADR shares equal one share of the underlying firm.

On April twenty fourth, 2025, Sanofi reported first quarter outcomes for the interval ending March thirty first, 2025. Except in any other case famous, all figures are listed in U.S. {dollars} and at fixed trade charges.

For the quarter, income grew 0.4% to $11.3 billion, which was $206 million greater than anticipated. The corporate’s earnings-per-share per ADR of $1.02 in contrast favorably to $0.95 within the prior 12 months and was $0.07 forward of estimates.

Dupixent, which treats sufferers with moderate-to-severe bronchial asthma, improved 20.3% because of development throughout indications and geographies. The product is authorized to be used in adults in additional than 60 nations and in adolescents in ~20 nations. Sanofi estimates that the product could be launched in ~50 further nations.

Vaccine income grew 11.4% because of ongoing demand for Beyfortus, which is used to forestall respiratory ailments.

Click on right here to obtain our most up-to-date Certain Evaluation report on SNY (preview of web page 1 of three proven beneath):

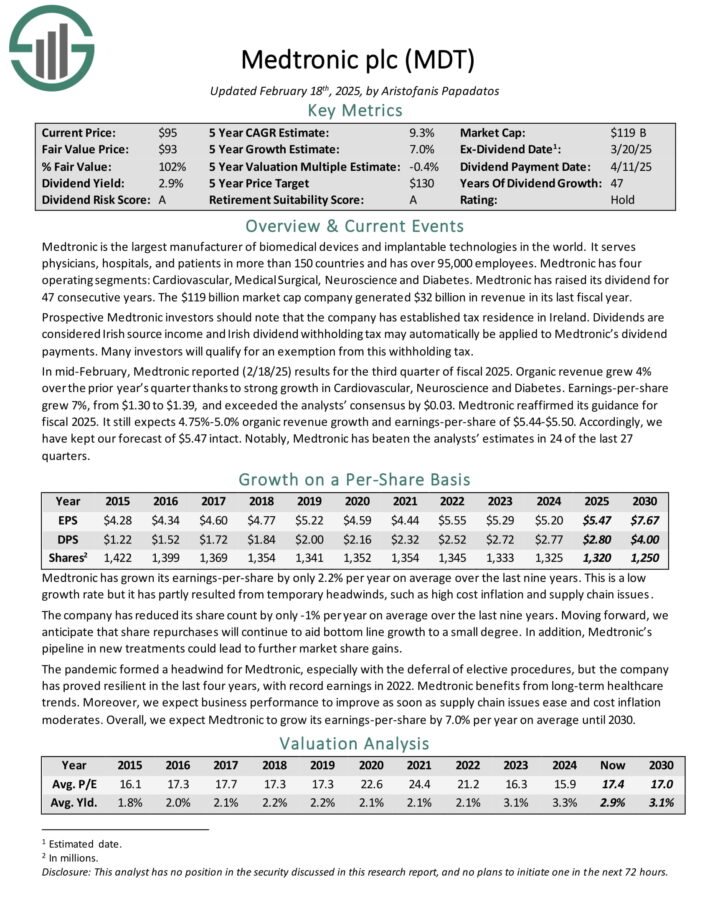

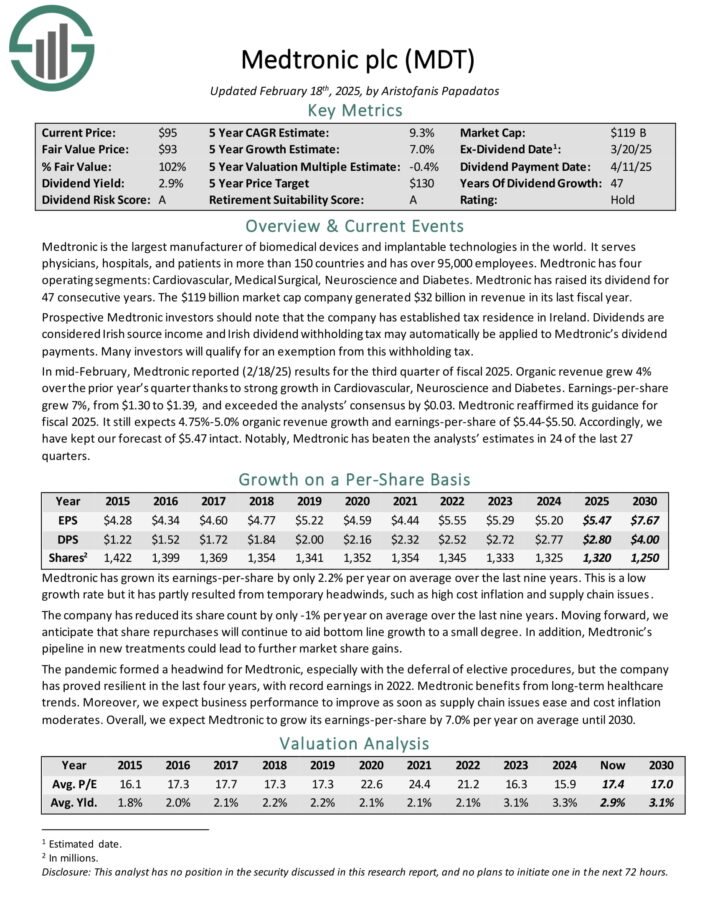

Worldwide Dividend Aristocrat #3: Medtronic plc (MDT)

- Consecutive Years Of Dividend Will increase: 47

- Annual Anticipated Returns: 11.2%

Medtronic is the most important producer of biomedical gadgets and implantable applied sciences on the earth. It serves physicians, hospitals, and sufferers in additional than 150 nations and has over 95,000 staff.

Medtronic has 4 working segments: Cardiovascular, Medical Surgical, Neuroscience and Diabetes. Medtronic has raised its dividend for 47 consecutive years. The corporate generated $32 billion in income in its final fiscal 12 months.

Potential Medtronic traders ought to observe that the corporate has established tax residence in Eire. Dividends are thought of Irish supply earnings and Irish dividend withholding tax could routinely be utilized to Medtronic’s dividend funds. Many traders will qualify for an exemption from this withholding tax.

In mid-February, Medtronic reported (2/18/25) outcomes for the third quarter of fiscal 2025. Natural income grew 4% over the prior 12 months’s quarter due to sturdy development in Cardiovascular, Neuroscience and Diabetes.

Earnings-per-share grew 7%, from $1.30 to $1.39, and exceeded the analysts’ consensus by $0.03. Medtronic reaffirmed its steering for fiscal 2025. It nonetheless expects 4.75%-5.0% natural income development and earnings-per-share of $5.44-$5.50.

Click on right here to obtain our most up-to-date Certain Evaluation report on MDT (preview of web page 1 of three proven beneath):

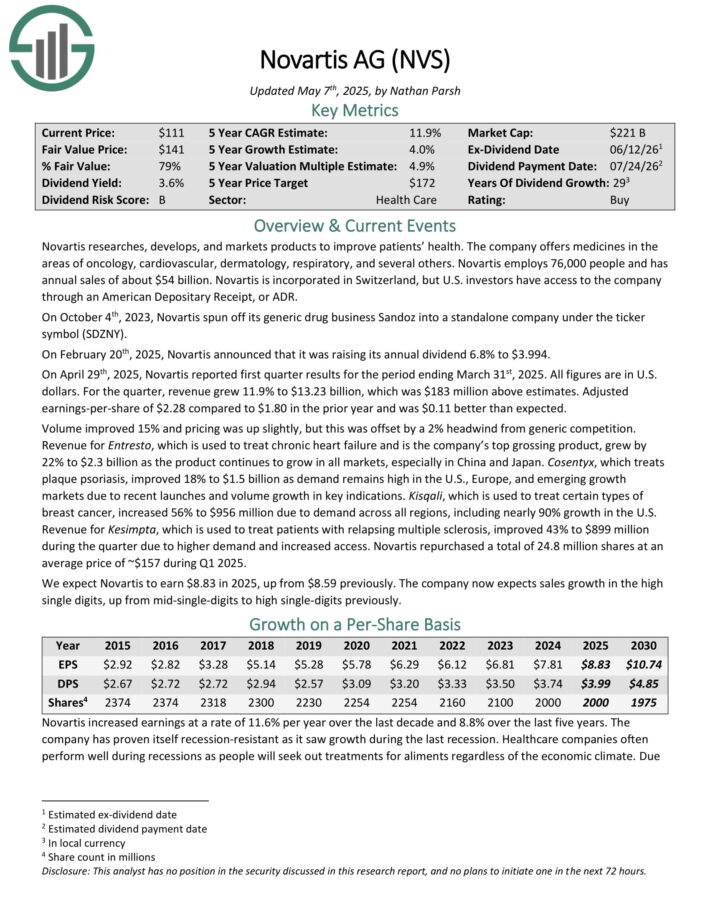

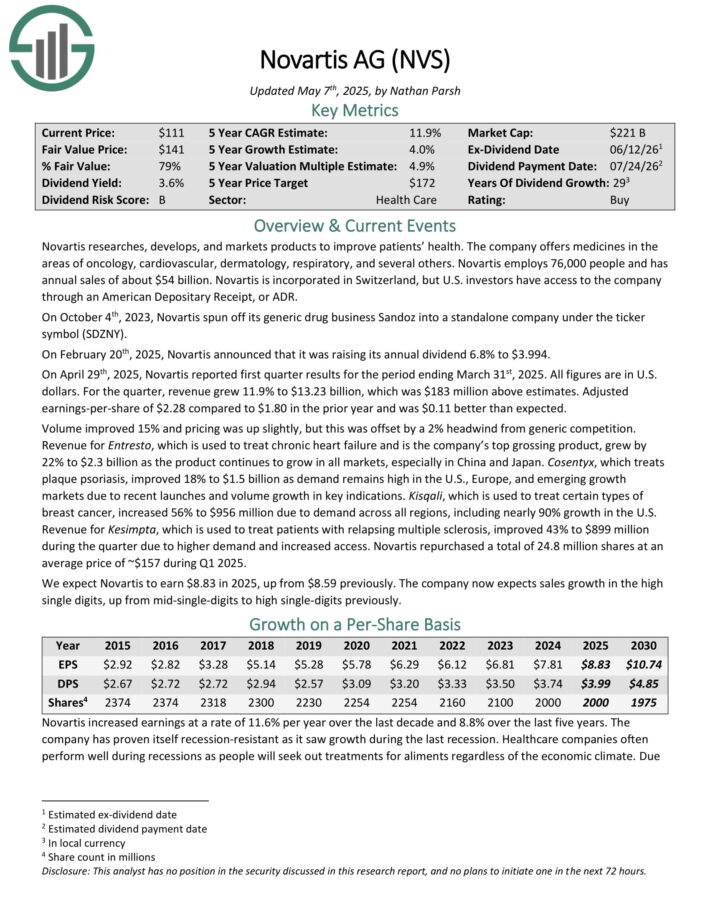

Worldwide Dividend Aristocrat #2: Novartis AG (NVS)

- Consecutive Years Of Dividend Will increase: 29

- Annual Anticipated Returns: 11.5%

Novartis researches, develops, and markets merchandise to enhance sufferers’ well being. The corporate presents medicines within the areas of oncology, cardiovascular, dermatology, respiratory, and several other others. Novartis employs 76,000 folks and has annual gross sales of about $54 billion.

Novartis is included in Switzerland, however U.S. traders have entry to the corporate by an American Depositary Receipt, or ADR.

On February twentieth, 2025, Novartis introduced that it was elevating its annual dividend 6.8% to $3.994.

On April twenty ninth, 2025, Novartis reported first quarter outcomes. All figures are in U.S. {dollars}. For the quarter, income grew 11.9% to $13.23 billion, which was $183 million above estimates. Adjusted earnings-per-share of $2.28 in comparison with $1.80 within the prior 12 months and was $0.11 higher than anticipated.

Quantity improved 15% and pricing was up barely, however this was offset by a 2% headwind from generic competitors. Income for Entresto, which is used to deal with continual coronary heart failure and is the corporate’s high grossing product, grew by 22% to $2.3 billion because the product continues to develop in all markets, particularly in China and Japan.

Cosentyx, which treats plaque psoriasis, improved 18% to $1.5 billion as demand stays excessive within the U.S., Europe, and rising development markets because of latest launches and quantity development in key indications..

Click on right here to obtain our most up-to-date Certain Evaluation report on NVS (preview of web page 1 of three proven beneath):

Worldwide Dividend Aristocrat #1: Novo Nordisk (NVO)

- Consecutive Years Of Dividend Will increase: 29

- Annual Anticipated Returns: 18.8%

Novo Nordisk A/S ADR is a big world pharmaceutical firm headquartered in Denmark. The corporate focuses on two core enterprise segments: Diabetes & Weight problems Care and Uncommon Illnesses.

The Diabetes & Weight problems Care section manufactures insulin, associated supply techniques, oral anti-diabetic merchandise, and merchandise to deal with weight problems. The Uncommon Illnesses section manufactures merchandise for hemophilia and different continual ailments. Novo Nordisk derives ~92% of income from diabetes and weight problems.

Novo Nordisk reported glorious Q1 2025 outcomes on Might seventh, 2025. Firm-wide gross sales have been up 19% in Danish kroner to and diluted earnings per share (“EPS”) rose 15% on a year-over-year foundation.

Diabetes & Weight problems gross sales elevated 21% pushed by will increase in Ozempic and Rybelsus (GLP-1), Wegovy (weight problems), long-acting insulin, and fast-acting insulin, offset by decrease gross sales for premix insulin, Saxenda (weight problems), Victoza (GLP-1), and flat human insulin.

The Uncommon Illness section gross sales rose 5% attributable to rising uncommon blood and endocrine problems medication. The agency is increasing its blockbuster GLP-1 and weight problems medication to different indications and dosing sizes.

The corporate lowered its outlook to 13 – 21% gross sales development and 16%- 24% working revenue development in 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on NVO (preview of web page 1 of three proven beneath):

Extra Studying

The next Certain Dividend databases include essentially the most dependable dividend growers in our funding universe:

In case you’re searching for shares with distinctive dividend traits, contemplate the next Certain Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].