With so many inventory selecting providers and monetary analysis platforms obtainable immediately, it may be arduous to separate the noise from the worth. One identify that has gained traction lately is Moby Premium, a subscription-based funding analysis platform targeted on delivering mannequin portfolios, knowledgeable evaluation, and actionable inventory picks. However in a world with choices like Motley Idiot Inventory Advisor, Looking for Alpha Premium, and different monetary providers, a good query arises: Is Moby Premium value it?

On this deep-dive evaluate, we’ll take a look at Moby Premium’s options, monitor file, funding analysis methodology, pricing construction, and why 89% of trustpilot opinions fee Moby at 5 stars. We’ll additionally discover the way it compares to different premium providers, and whether or not it’s a superb match for newbie, intermediate, or skilled buyers seeking to construct or refine their funding technique.

What Is Moby Premium?

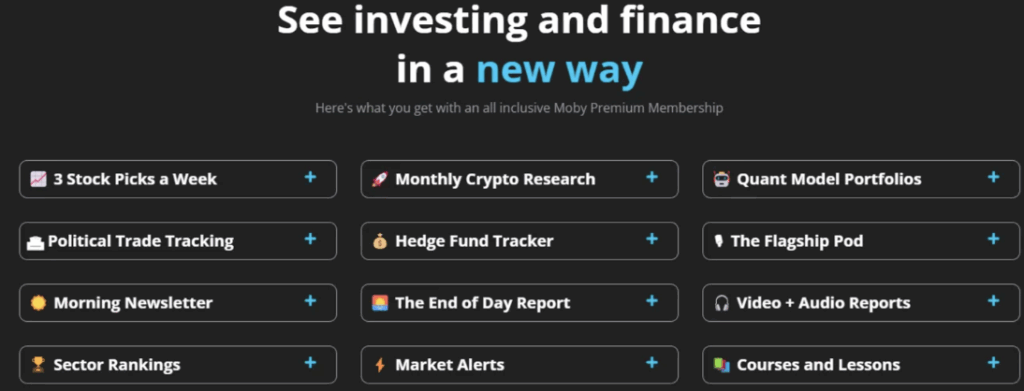

Moby Premium is the paid model of the Moby app, a monetary training and inventory market analysis device designed to assist buyers make knowledgeable funding choices. The service provides quite a lot of premium content material varieties together with:

- Curated inventory suggestions with supporting evaluation

- Mannequin portfolios primarily based on themes corresponding to development, know-how, or market volatility

- Each day monetary information and market summaries

- Unique analysis experiences and insights

- Actual-time alerts and portfolio monitoring instruments

Moby is at the moment providing a free inventory decide right here and providing 50% off for brand spanking new subscribers.

With the WallStreetSurvivor Unique provide on this web page, enter your e-mail, after which it can save you 50% 1 12 months for under $99.

Don’t miss out on their subsequent decide and bear in mind they’ve 30 day a reimbursement assure.

The Moby workforce, made up of former hedge fund analysts and Wall Avenue veterans, builds its suggestions utilizing quantitative fashions, elementary evaluation, and a mixture of proprietary metrics that intention to uncover undervalued know-how corporations and rising developments.

Key Options of a Moby Premium Subscription

Subscribers to Moby Premium acquire entry to a variety of instruments and experiences designed to help long-term wealth constructing. Let’s break down what you get:

Inventory Picks and Evaluation

Each week, Moby Premium delivers detailed inventory picks, full with value targets, supporting knowledge, and technical evaluation. These picks are backed by the Moby funding workforce’s analysis and sometimes characteristic alternatives in development companies and high-performing sectors.

Mannequin Portfolios

Moby Premium consists of a number of mannequin portfolios primarily based on completely different funding methods, corresponding to dividend development, tech leaders, and inflation-resistant belongings. These are constructed utilizing each proprietary algorithms and human oversight to match numerous danger tolerance ranges.

Moby is at the moment providing a free inventory decide right here and providing 50% off for brand spanking new subscribers.

With the WallStreetSurvivor Unique provide on this web page, enter your e-mail, after which it can save you 50% 1 12 months for under $99.

Don’t miss out on their subsequent decide and bear in mind they’ve 30 day a reimbursement assure.

Analysis Experiences and Alerts

Along with inventory picks, Premium members get entry to in-depth analysis experiences, each day market updates, and real-time alerts when new alternatives are recognized. The Moby app supplies push notifications for key insights, making it straightforward to remain updated.

Academic Assets

The service provides a sturdy library of instructional content material aimed toward serving to buyers perceive core ideas, developments, and instruments. From decoding inflation experiences to understanding asset lookup instruments and studying the financial calendar, the assets are geared towards serving to customers construct confidence.

Portfolio Monitoring and In-App Instruments

Customers can join their current funding portfolios and monitor efficiency towards Moby’s mannequin portfolios. The in-app buying and selling instruments permit for simpler administration and comparability, making the expertise seamless and intuitive.

The Group Behind the Picks: Moby’s Analysts and Methodology

The power of any inventory selecting service comes all the way down to the standard of its evaluation. Moby Premium is constructed round a workforce with backgrounds in hedge funds, institutional analysis, and algorithmic modeling. Their strategy blends quantitative instruments with human perception.

A lot of Moby’s suggestions have targeted on undervalued know-how corporations, clear power shares, and mid-cap development companies, reflecting a bias towards innovation and long-term funding objectives. Experiences typically embody comparisons to broader market circumstances, evaluation of firm fundamentals, and historic monitor data.

The Moby workforce additionally releases occasional experiences on themes like rising markets, political commerce monitoring, and machine studying developments in finance. These insights assist diversify customers’ publicity past conventional sectors.

Evaluating Moby Premium to Different Companies

It’s vital to check your choices when paying for a premium investing service. We maintain that and evaluate Moby to a number of the high choices available on the market.

Moby vs. Motley Idiot Inventory Advisor

Motley Idiot is probably the best-known inventory advisor platform in the US, with an extended historical past of efficiency knowledge and model recognition. It focuses on high-conviction long-term inventory picks, typically providing two picks per thirty days. Whereas Motley Idiot excels in model legacy, it doesn’t provide in-app buying and selling, portfolio monitoring, or each day monetary information like Moby does.

Moby vs. Looking for Alpha Premium

Looking for Alpha Premium provides deep analyst protection and instruments like quant scores, valuation grades, and dividend evaluation. Nonetheless, its interface and articles typically cater to intermediate buyers and might be dense. Moby Premium’s benefit lies in its jargon-free, mobile-first interface and streamlined alerts.

Moby vs. Conventional Monetary Advisors

For these evaluating Moby to human monetary advisors, it’s value noting that Moby Premium is a analysis service, not a customized monetary planner. It provides common insights, not bespoke funding portfolio allocations tailor-made to particular person wants or full monetary planning.

Pricing: What Does Moby Premium Value in 2025?

As of Could 2025, Moby Premium is priced at $29.95 per thirty days or $199.95 per 12 months ($100 for brand spanking new customers that use our code). New customers are protected by a 30-day money-back assure, which permits for full entry to the platform and all content material.

Moby is at the moment providing a free inventory decide right here and providing 50% off for brand spanking new subscribers.

With the WallStreetSurvivor Unique provide on this web page, enter your e-mail, after which it can save you 50% 1 12 months for under $99.

Don’t miss out on their subsequent decide and bear in mind they’ve 30 day a reimbursement assure.

This pricing places it squarely in competitors with different funding providers and premium subscriptions, although Moby ceaselessly runs promotional provides that deliver the worth down by way of seasonal reductions or first-year financial savings.

Who Is Moby Premium For?

Newbie Buyers: The platform’s clear interface, instructional supplies, and thematic portfolios make it a robust start line for these simply starting to construct a inventory market technique.

Intermediate Buyers: For customers who already perceive the fundamentals however need assist discovering funding concepts or constructing a extra structured funding portfolio, Moby supplies a mix of steering and autonomy.

Skilled Buyers: These with a agency grasp on their very own analysis should still profit from Moby’s mannequin portfolios, different knowledge instruments, and extra protection of sectors or shares they might not be monitoring.

Does Moby Assure Outcomes?

Like all platforms on this house, Moby is cautious to state that previous efficiency doesn’t assure future outcomes. Whereas the Moby workforce has a strong monitor file, no device or analyst can absolutely predict future market habits. All buyers are suggested to conduct their very own due diligence and perceive their danger tolerance earlier than appearing on third-party suggestions.

That stated, Moby’s transparency, readability in funding evaluation, and the supply of a money-back assure do provide peace of thoughts.

Execs and Cons of Moby Premium

Execs:

- Clear and accessible monetary analysis

- Cell-friendly expertise by way of the Moby app

- Weekly inventory picks and real-time updates

- Mannequin portfolios fitted to quite a lot of objectives and danger ranges

- Academic content material for all expertise ranges

- 30-day money-back assure

Cons:

- No personalised monetary recommendation or one-on-one planning

- Restricted worldwide inventory protection

- Targeted extra on U.S. equities and know-how sectors

Ultimate Verdict: Is Moby Premium Value It?

After reviewing the content material, instruments, and efficiency historical past, the reply is dependent upon your wants. For buyers who desire a inventory selecting service with expert-backed insights, a clear cellular interface, and an reasonably priced subscription, Moby Premium represents a strong choice.

Its mix of analysis experiences, mannequin portfolios, and instructional content material positions it as a robust participant in a rising discipline of accessible funding instruments. In case you’re attempting to chop by way of the noise and discover a structured strategy to analyze the markets, Moby Premium delivers good worth, particularly at its present pricing.

Whereas it gained’t substitute a human monetary advisor or provide ensures, its stability of affordability, usability, and efficiency monitoring makes it value contemplating for a lot of buyers.

In case you are in search of one of the best Moby Promo codes obtainable, try our Greatest Moby App Promo & Low cost Codes article.

FAQ

A Moby Premium subscription consists of weekly inventory picks, mannequin portfolios, analysis experiences, market updates, instructional content material, and in-app instruments for monitoring your portfolio.

Sure. Moby Premium comes with a 30-day money-back assure, permitting new customers to attempt the platform risk-free.

Moby sometimes supplies new inventory picks on a weekly foundation, typically supported by knowledgeable evaluation and market context.

Sure. The Moby app is offered for each iOS and Android units, and the platform is optimized for cellular use.

Sure. Whereas it’s beginner-friendly, Moby additionally supplies sufficient depth and knowledge to profit skilled buyers searching for new concepts or different analysis angles.

Moby provides a extra mobile-centric expertise with real-time alerts, mannequin portfolios, and extra frequent updates, whereas Motley Idiot Inventory Advisor is extra targeted on long-term inventory picks and academic articles.

No. Like all funding platform, Moby doesn’t assure outcomes. All inventory picks are topic to market danger and customers ought to consider picks in keeping with their very own danger tolerance.