Discovering the precise rental property isn’t straightforward. It wants to suit your funds and purchase field, and should you’re home hacking, you’ll wish to purchase in a neighborhood you’re comfy dwelling in. These are only a few of many roadblocks rookies face, however we’re going to point out you tips on how to thread the needle in in the present day’s episode!

Welcome to a different Rookie Reply! We’re again with extra questions from the BiggerPockets Boards and the Actual Property Rookie YouTube channel, and first up, we’ll hear from an investor who’s struggling to discover a property that checks all the precise bins. Ought to they accept what they’ll afford or save up for one thing higher? Ought to they store round for several types of financing? Keep tuned to seek out out!

We’ll additionally hear from an investor who desires to make use of the dwelling fairness from their first rental property to assist purchase their subsequent one. Ought to they get a HELOC (dwelling fairness line of credit score), use a cash-out refinance, or promote their property? We’ll weigh the professionals and cons and assist them make the neatest transfer. Lastly, should you personal leases for lengthy sufficient, you’re certain to have friction with neighbors. We’ll present you tips on how to defuse rigidity and construct rapport!

Ashley:

For those who’re fighting tips on how to decipher all your financing choices, or perhaps you’re simply questioning what’s the greatest form of market to take a position on this episode is for you. At this time, we’re going to deal with the largest roadblocks rookie buyers face from accessing capital to creating good neighborhood choices that may set you up for long-term success.

Tony:

Now whether or not you’re making an attempt to determine should you ought to home hack in a C class neighborhood, or wait to avoid wasting up for one thing extra premium, we’ve obtained you lined with some recommendation in in the present day’s episode. Plus, we’re breaking down precisely how HELOC loans work so you possibly can really feel assured leveraging that fairness in your subsequent funding. Now, what I really like about in the present day’s questions is that they’re coming from folks at totally different levels, some with fairness already constructed up and others making an attempt to make that essential first funding choice. So irrespective of the place you’re in your journey, in the present day’s episode has one thing invaluable only for you.

Ashley:

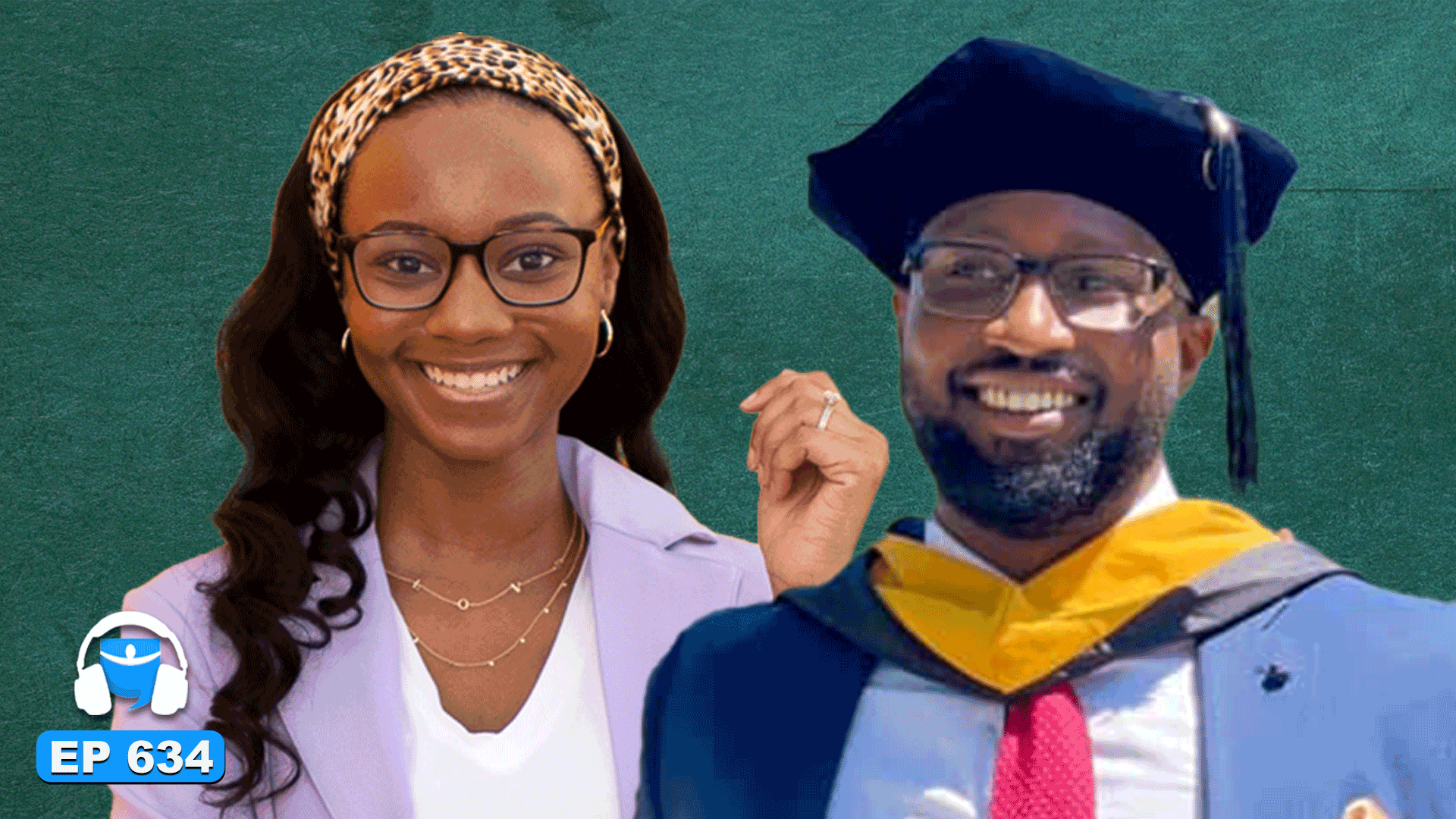

I’m Ashley Kehr.

Tony:

And I’m Tony j Robinson,

Ashley:

And welcome to the Actual Property Rookie Podcast. Okay, let’s begin off with our first query in the present day. That is from the BiggerPockets boards and it’s ought to I begin off with a home hack and a D or C class neighborhood or ought to I save extra and go along with a B class neighborhood proper out of the gate? Any recommendation can be appreciated and please clarify why. Okay, so first, Tony, we should always in all probability break down what really a category neighborhood means between A, B, C, D, perhaps an E. Is there an E class neighborhood? So

Tony:

When you consider a category neighborhood, these are going to be your luxurious leases. These are going to be those which have the good flooring, the good counter tops, the premium fixtures, perhaps all of the loopy facilities, that’s an A category and so they’re clearly charging premium rinse. And on the alternative finish of that spectrum, a D class neighborhood can be form of the alternative of that, proper? The place the leases themselves in all probability aren’t as good. Perhaps the demographics of that neighborhood by way of revenue, by way of employment is perhaps a little bit bit decrease. The turnover of your tenant base, perhaps it’s a little bit bit increased. The delinquency charges in the case of the random paying on time is perhaps a little bit bit increased. So simply barely totally different property varieties and barely totally different demographic of individuals filling these varieties of properties.

Ashley:

So again to the query and the query is asking, ought to I home hack in a D or C class or ought to I save extra and go along with a B class neighborhood? So I believe because you’re going to be home hacking and also you’re going to be dwelling there, there’s some form of emotional, normally we are saying depart the emotion out of your offers, but when it’ll be your main residence, I believe that ought to weigh into half as to the place do you’re feeling comfy dwelling? The place do you wish to dwell or the place do you wish to dwell? So let’s say not even with the lessons of neighborhood, however how distant is that this property out of your job? So in a single neighborhood it’s going to be an hour commute the place one other neighborhood, it’s going to be a ten minute commute. Does that play an element? So while you’re considering of your self dwelling in these properties, have a look at all of the elements, what that may have an effect on you personally too.

Tony:

Yeah, I couldn’t agree extra. I believe the concept of, hey, what I really feel comfy dwelling right here is a crucial one to reply for your self, however I believe even perhaps simply earlier than C or D class, it’s like how a lot of a distinction in price has it really in your particular neighborhood to go from a D class neighborhood to a B class neighborhood? As a result of should you’re utilizing FHA 3.5% down, going from a, I don’t know, regardless of the worth distinction is, how way more out of pocket is definitely going to be for you? And have you ever coached these numbers? And much more so are there perhaps different mortgage merchandise on the market the place perhaps you don’t have any money out of pocket? There’s first time dwelling purchaser help grants. There’s issues just like the VA mortgage should you’re a veteran, there’s issues like naca should you’re not a veteran, Ashley talks in regards to the USDA mortgage. So have you ever actually explored even the entire financing alternatives which are accessible to you that perhaps would mean you can get into that B class neighborhood with the money you may have readily available presently?

Ashley:

And I believe run the numbers. So take a property that’s a B class property after which take a property that’s in a C or D class neighborhood, and what’s the distinction within the money move of the properties? How do they carry out towards one another? And like we had talked about to start with that mainly to summarize, to elucidate a de class neighborhood, it’s extra of a headache. There might be totally different points, totally different issues than you’d have. I imply there nonetheless might be the identical issues that you just’d have, however for instance, a de class neighborhood, it’s not going to make sense for rental revenue or for resale worth. For those who make this property actually, very nice, you set within the granite counter tops, you set in hardwood flooring, no one goes to pay a premium to have these finishes as a result of it’s simply not inexpensive in that space the place perhaps that’s the form of consolation you wish to dwell in.

Then while you go and resell it, no one’s going to pay the premium for these high-end finishes in that neighborhood as a result of they don’t wish to dwell there. So you need to keep in mind that too while you’re trying on the property as to what extent of any rehab rework these properties would wish to get it to an appropriate dwelling situation for you and your tenants. What’s that going to price? You’re taking a look at issues which are already turnkey. Let’s have a look at the upkeep and the CapEx on the 2 totally different properties. So is there extra upkeep in CapEx that must be carried out on one? So perhaps the category C property is definitely higher that you just discovered as a result of it really has been up to date. So you bought to have a look at all of the numbers, run the numbers and see the place the variations are, evaluate and distinction. Actually go onto Zillow proper now, discover a property that’s in every of a kind of neighborhoods you’re contemplating and simply run the numbers on every of them to offer you an thought of what that comparability seems like.

Tony:

Yeah, I believe one different factor so as to add to is say you do determine to maneuver ahead with the C or the D class neighborhood, I might actually encourage you to spend much more time than you sometimes would screening all your tenants, proper? As a result of in case you are home hacking and perhaps part of city the place it’s identified to have tenants that may doubtlessly trigger issues. You wish to ensure that whoever you’re sharing partitions with is somebody that you just’re going to take pleasure in sharing partitions with. So even when you’ve got an extended line of individuals banging down your door to get into your home, I might be very, very throughout the purpose or throughout the confines of what’s authorized as a landlord, I might be very, very choosy about who I enable in and I would even give myself extra emptiness on the entrance finish to ensure that on the backend of truly dwelling on this place for the subsequent 12 months or nonetheless lengthy it’s that you just really take pleasure in it. So simply taking your time leasing up this property,

Ashley:

And also you do have a profit as home hacking, like a few of the truthful housing legal guidelines don’t apply to you as a result of you can be dwelling on the property. So that you do have extra of a say as to who can really dwell with you.

Tony:

That’s cool. So there are particular issues that apply to landlords that don’t apply to landlords who’re home hacking.

Ashley:

Yeah. So okay, I’m a feminine and I’m renting out certainly one of my rooms. It’s okay for me to say I solely desire a feminine in that room and to choose based mostly off of character actually. We simply had Miller MCs swen on and he’s writing the co-living factor. For those who’re dwelling within the property can a lot of the occasions you’re interviewing the particular person as to what I like dwelling with them.

Tony:

I solely need Lakers followers dwelling with me with

Ashley:

Seasons tickets. So this query and so many others are precisely the kind of issues you will get answered at BP Con should you’re seeking to take your investing to the subsequent degree. BP Con in Las Vegas is the reply, early chicken pricing was really prolonged to April thirtieth. So seize a ticket now and are available and say hello to Tony and I. Now a fast phrase from our present sponsors. Okay, welcome again. So this second query, I really like this. We really pulled this from the true property rookie YouTube channel. This was a touch upon certainly one of our movies and I really like that we’re getting a lot engagement on YouTube. For those who guys aren’t watching on YouTube or in case you are, be sure to depart a remark beneath, ask your questions or interact with the others right here which are commenting. Okay, so this query says, hello guys. I only in the near past realized about this podcast.

Welcome, and that is by far my favourite. I’ve been listening to a number of the success tales and the enjoyable journeys of the buyers you may have in your present and thanks. We love that they take the time to return on in and discuss us to. Okay, in order query is, I’m simply questioning if anybody on this neighborhood may give me any recommendation on what to do. Me and my spouse personal a half duplex. We purchased it for 305,000 a pair years in the past at 5.4%. It’s 5 years mounted on 25 years amortization. So earlier than I’m going on actual fast, let’s simply break that down. So their rate of interest is 5.4% and it’s solely mounted for 5 years, however their funds are amortized over 25 years. So after that 5 yr mark, they’ll go and refinance or it is going to normally go right into a variable price for the remaining 20 years. Okay, so the query continues on. We at the moment are left with $264,000 mortgage steadiness. The home has a 345,000 metropolis appraisal, nonetheless the identical home was offered in my neighborhood for 365,000. We’re considering of shopping for a second property to make use of as a rental utilizing the fairness that’s accessible to us. Any recommendation on what ought to be the most effective plan of action to absorb this example? Okay, so Tony, I even have a query for you. What’s a metropolis appraisal?

Tony:

I used to be going to say the identical factor. I didn’t know that appraise properties and there’s a tax assessed worth, however that sometimes doesn’t precisely replicate the true world worth of a property and we sometimes see that to be quite a bit decrease than what a property would sometimes promote for. So I really haven’t heard of a quote metropolis appraisal

Ashley:

And I ponder if there’s some confusion there as a result of I’ve spoken to lots of people which have mistaken these phrases, town evaluation in your taxes with appraisal, like getting that reversed as to the language. So perhaps for this sake they may each methods so far as they really obtained an appraisal finished and it’s 345,000, but when this was the fallacious phrase was mistaken, it’s really the evaluation on the property taxes. Like Tony mentioned, that’s normally not an correct worth of the property. So in your property taxes you’ll have the market worth which is definitely nearer to what the property might be valued. After which the assessed worth is a proportion of that and it’s decrease and that’s what they based mostly your taxes off of. However even the market worth, I have a look at a few of my property taxes, that’s undoubtedly not what the worth is, however I’m not going to complain as a result of I don’t need my taxes to extend by saying, Hey, my property is definitely price this. And that’s why, and this adjustments by state and county to while you promote the property. If the city does a reassessment, that’s the place they go and say, okay, we see you’ve obtained these permits, you added one other bed room, you probably did all these things on the outside, your property is now really assessed at this worth and your property taxes have elevated. So the very first thing I’m going to say is that if that is the assessed worth, it is sort of a Zillow estimate. It’s not dependable because the precise dwelling’s worth.

Tony:

So I suppose let’s get into their choices right here then, proper? I imply as a result of assuming that the 365 of the home that offered across the nook is perhaps a extra cheap goal, they’ve obtained a few hundred thousand {dollars} in fairness now. They will’t faucet into all of that. Other ways of tapping into your fairness are going to perhaps restrict you as much as 90% someplace in that ballpark. However I suppose there’s form of two choices right here. You’ve obtained, or I suppose technically there’s three choices, proper? Possibility one is you promote the property, however it sounds such as you wish to hold it. So perhaps we take that one off the desk. So your two remaining choices are you possibly can refinance the property the place you exchange the preliminary mortgage, that 5.4% on a 25 yr am you exchange that with new debt. After which the second choice is perhaps a heloc, a house fairness line of credit score the place you’re getting a line of credit score utilizing that fairness.

Now between these two choices, there’s professionals and cons to every. A HELOCs going to play extra like a bank card the place you get charged for what you draw towards that line of credit score, whereas the refinance is like, Hey, you’re getting all that cash on day one and no matter whether or not or not you really use it, you’re going to begin paying on it. So there’s professionals and cons to every, however I don’t know. I believe of their place, Ashley, in the event that they’ve obtained this 5.4 price presently, if it was mounted for the whole lot of the mortgage, I would lean extra so in the direction of the HELOC simply to maintain that 5% in place as a result of it’s higher than what we’re getting in the present day. But when it’s going to regulate based mostly on some prime plus no matter, they perhaps find yourself paying 9%, who is aware of what that new price goes to be. So to me, if that flex on that price will get you above and past what the prevailing charges are in the present day, I’m in all probability simply going to go along with the refinance as a result of it’s cheaper. But when that floating price finally ends up being decrease than seven, which in all probability isn’t going to occur, then I would go along with the heloc. That’s my preliminary ideas, Ash. I do know. What do you assume on that?

Ashley:

I believe it says they’ve owned the home for a pair years, so let’s say they’re two years, they obtained three years left on the repair. I undoubtedly would go and discover out what present charges are to both get refinance for an additional 5 yr repair since you’re more than likely going to get a decrease rate of interest. I did simply discuss to some banks and there really was one financial institution, which actually shocked me. The speed was increased for a 5 yr mounted or a seven yr repair in comparison with the 30 yr repair, which actually shocked me. Everyone else although, the much less time frame you had been guaranteeing to repair it, the rate of interest was decrease.

Tony:

And I ponder why that’s, proper? In the event that they’re providing you with higher charges for the long run mounted, are they assuming that? Yeah, I ponder what their thought course of do they assume charges are going to

Ashley:

Proper? And it was simply this one financial institution and I used to be shocked by it as a result of I’ve all the time skilled that it’s decrease rate of interest while you’re solely fixing. So my solely thought is is that they’ve extra of a assure that you just’ll stick with them for an extended time frame and so they’ll find yourself making extra curiosity should you do signal the 30 yr one in comparison with you refinancing at 5 years within the danger you go and refinancing at one other financial institution. That’s actually the one factor I can consider. However that’s tremendous hypothetical

Tony:

And I used to be considering of it from a barely totally different angle the place in the event that they’re going to cost, you name it 10% for a 5 yr be aware, my thought course of was that perhaps they assume that charges are literally going to extend within the subsequent 5 years. So in the event that they lock you in for a decrease price, they’re really going to finish up dropping cash in that 5 yr time period. In order that’s them form of making an attempt to hedge their guess. So perhaps this financial institution is aware of one thing we don’t find out about the place charges are going.

Ashley:

I believe determine that out as to what price you possibly can really get on refinancing your property. Additionally too, it’s on a 25 yr amortization. So should you did a 30 yr amortization, that may really even with a little bit bit increased price, that would make your fee nearer to what it’s now by rising that amortization, I might then additionally have a look at how lengthy do you really plan to remain in that property. So should you plan to maneuver in a yr or two years, then okay, perhaps you don’t refinance and pay these further closing prices and also you keep within the property and then you definately’re going to promote it in any case. However should you plan to remain there for a very long time, take into account refinancing and looking out the comparability of charges and phrases and amortization interval. Additionally, the subsequent factor to have a look at is what are you going to make use of the funds for?

So is it going to be for a down fee? Is it going to be for the total buy worth of the property? Are you going to do some form of burr technique the place you’re going to buy the property? Then you definately’re really going to go and refinance in any case as a result of should you do the road of credit score, you sooner or later need to pay that cash again and also you’re simply paying curiosity solely. There are traces of credit score the place after a sure time frame, if you don’t pay it again, it routinely converts into some form of amortization. So say you get a line of credit score, no matter your steadiness is due and after two years that may routinely flip right into a mortgage and you’ll have the choice to purchase a set price at the moment, and there’s totally different intricacies of this, however then they’ll put it into funds amortized over 25 years or one thing.

So then it does flip right into a long-term mortgage. So that you’d wish to discover out what that rates of interest are, what these phrases are should you don’t repay the road of credit score through the X period of time. But when it’s one thing such as you simply wish to use it for the down fee and also you’re going to pay it off rapidly, when you’ve got the cashflow from that property, when you’ve got cash out of your W2 the place you simply don’t wish to delay buying one thing, so that you’re going to borrow from the road of credit score in your down fee and then you definately’re going to quickly pay again that line of credit score, then I believe that’s a superb choice. However when you’ve got no thought or no plan of action or plan to truly go and pay that off instantly, that line of credit score, simply bear in mind on prime of your mortgage fee from that second rental, you’re going to have these curiosity funds to the road of credit score. So I believe that’s a very essential piece to have a look at as to which approach you go as to the way you’re going to make use of the funds too.

Tony:

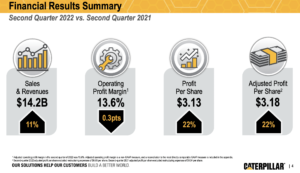

And I believe the very last thing to name out right here is simply how a lot money are you really going to have the ability to get since you’ve solely, and I say solely, proper, however you’ve obtained 100 thousand {dollars} in fairness and let’s say that you just’re proper, perhaps the home really does appraise for 365 say that you just’re in a position to rise up to 80% of that worth. 80% of 365 is 292, you owe 2 64, so that you’re not even getting 2 92 minus 2 64. It’s $28,000 is what you’d be getting should you had been to entry 80%. It goes up a little bit bit should you can faucet into 90, however simply making an attempt to ensure that there’s some context right here on how a lot of that fairness you’ll really have the ability to faucet into with a few of these refinance choices. We’re exploring HELOC proper now, and I believe we had been quoted proper at about 80%. What’s the very best mortgage to worth that you just’ve seen on a line of credit score ash?

Ashley:

95%, however that was 9 years in the past. My first ever associate. That’s how we funded our second deal was he tapped into his fairness and obtained a HELOC on his main residence and it was as much as 95% he was in a position to take for the heloc. Yeah,

Tony:

That’s true. It is perhaps increased should you’re doing it on a main, we’re pulling a line on an funding dwelling, so perhaps it’s a little bit bit totally different there. However yeah, should you can rise up to 90, that adjustments issues a little bit bit. I believe you’ll in all probability go from like 30,000 to 60,000 someplace in that ballpark. However I simply wish to make certain, even for the rookies which are listening, simply because you may have 100 thousand {dollars} in fairness doesn’t imply you’re going to get all of that $100,000, proper? There’s all the time a little bit little bit of limitation there.

Ashley:

And one factor too, and let me know if that is totally different in your business line of credit score, prefer it being an funding property, as a result of I can’t bear in mind on mine, it’s been a very long time since I’ve really opened one, however normally while you do a eloc, there’s normally no closing price and a number of occasions the financial institution will even pay for the appraisal or determine.com. They really do an in-house appraisal too and may really get you authorised in 5 minutes and you’ll really get funded in 5 days. However with doing a refinance, there might be closing prices connected to that. There are refinances the place you are able to do no closing price loans, however your rate of interest goes to be a little bit bit increased. So you need to evaluate how a lot am I paying further yearly in comparison with what the closing prices had been. In order that’s one thing else to absorb comparability to as to the cash you would wish upfront to pay for closing prices or that may come out. So say you possibly can borrow 80,000, you would need to take 8,000 of that and pay the financial institution for the closing prices and the charges for that property. Have you learnt, are you paying closing prices in your line of credit score in your funding property?

Tony:

We undoubtedly didn’t pay for an appraisal. I do know that the lender we’re working with is charging some factors. I dunno, it is perhaps a degree or two that they’re charging us on the road of credit score to get it established for us, however we’re not even paying for that upfront. It’s simply getting rolled into the road of credit score itself. So out of pocket expense for us is mainly zero. However yeah, there are some charges going again to the lender that’s within the HELOC for us.

Ashley:

We’re going to take a fast break earlier than our final query, however whereas we’re gone, make sure you subscribe to the true property Rookie YouTube channel at realestate Rookie. We’ll be proper again with extra after this.

Tony:

Alright guys, let’s soar again in with our final query. So this one comes from a short-term rental host and it’s undoubtedly a difficulty that I’ve handled in varied types earlier than as effectively. However this query says our neighbor has 100 acres and freaks out when anybody walks on his property. So their property land’s proper subsequent to one another beside our fireplace pit is the highest of a mountain that considerably drops off. He simply put up this short-term barrier and should you’re watching on YouTube, you possibly can see the photograph of it. However should you’re on the podcast over to the YouTube channel, you possibly can see this photograph, however it’s actually a take into consideration development zone kind barrier that he’s put up proper in entrance of this particular person’s fireplace pit for his or her short-term rental. The query goes on to say, I’ll in all probability get the survey to get the precise location for the property line. I’ve obtained one thought to perhaps plant some evergreen bushes that don’t develop too excessive. However the primary gist of this query is how ought to this property proprietor perhaps reply or take care of this very, I suppose, overzealous neighbor form of making an eyesore at what ought to be a focus for a short-term rental?

Ashley:

Tony, I’ve to say that I actually would in all probability be this neighbor. I wouldn’t need folks constantly logging on my property both. I really feel like there’s undoubtedly a approach higher option to deal with it than placing up a development barrier fence for certain. However I suppose you’re the short-term rental knowledgeable right here, and should you guys are watching on YouTube, you possibly can see the image right here of this otherwise you noticed it and also you’re not on the podcast, you’re simply listening on the podcast. So proper now, it is a stunning outside setting. They’ve a very nice cabana with it seems like a hearth pit, all this stunning stonework, after which proper behind it you see this ugly orange and yellow development fence mainly blocking the view. So I suppose, Tony, if this was your property, what can be the primary response, your first plan of action on this?

Tony:

I believe earlier than even getting so far, we all the time attempt to attain out to neighbors after we launch a brand new property as a result of a number of occasions while you’re establishing, you’ll see ’em outdoors poking their heads out, and we’ll simply stroll over and say, Hey, more often than not typically you get neighbors who can simply inform don’t need you to be there. And we’re identical to, all proper, cool. Then there’s not a lot we are able to do. However sometimes we wish to begin constructing these neighbor relations after we launch and simply go over there and shake fingers and say, Hey, my identify’s Tony. That is my spouse Sarah. We personal this property subsequent door. Hey, there’s a short-term rental. However hey, we do our greatest to be actually accountable hosts. Our friends are sometimes fairly superior folks, however hey, look, if there’s ever a difficulty, right here’s our quantity. Give us a name. We’ll make certain to get it addressed for you. So I believe simply extending that olive department on day one is essential. After which in the event that they ever do name, simply ensuring that you just’re really following up on these points and maintaining them abreast.

We’ve had fairly just a few neighbor points with totally different properties that we personal virtually the inverse of this, however we needed to construct a fence as a result of we had a neighbor who was simply inflicting a nuisance for our friends. So I believe on this scenario, I might attain out to the neighbor first and I’d say, Hey, look, I observed you set a, Hey, I get it, however hey, what I suppose had been you seeing or what had been you experiencing that made you’re feeling that this was crucial? And simply allow them to vent and so they’re simply going to go on, they’re going to complain about your friends. Had been stepping on my property line and blah, blah, blah, and no matter it could be, understanding that, hey, I get it. Positively not our intention, and I believe there’s in all probability a approach that we are able to ensure that our friends respect your property line a little bit bit higher. However hey, is there a approach that we might perhaps do it with out the form of eyesore of this development tape that you just’ve put up, how cowl the price? However simply let me know if there’s one thing we are able to do to get you to take it down in your facet. So I believe that may be my first step is calm a levelheaded method to the neighbor and seeing if we are able to come to an answer that works for each of us.

Ashley:

I imply, even barbed wire fencing would look higher. Oh, good and rustic Yellowstone characteristic of the barbed wire fence, the origin yellow development fence. Yeah, I believe that’s an excellent suggestion.

Tony:

I imply, you possibly can’t hold each neighbor completely satisfied, and sadly, if that’s the case, that’s the case. However yeah, I in all probability would, if the neighbor’s not going to wish to play ball, I might put up one thing on my facet of the property line that’s a little bit bit extra aesthetically according to what we might need for that house. So yeah, privateness, hedges, no matter it could be. For those who put up your personal fence, it’s really you’re lacking that view. You’ve obtained a good looking view, and also you’ve in all probability marketed that a little bit bit together with your Airbnb, however higher that than what we see right here.

Ashley:

Yeah, we really, one of many A-frame cabin, it’s simply on three acres, however it’s form of out in the course of nowhere or a lot of the surrounding properties have extra land. And the one neighbor, as soon as they heard that it was going to be an Airbnb, they went and put posted indicators. Really, it saved us work from having to place up any indicators to verify no one goes throughout that. However we additionally present in our guidebook an aerial view and form of an overview of that is the property you may have entry to. These are the property traces the place you possibly can go and luxuriate in and stuff like that. However they winded in to date. Knock on wooden, we haven’t had any points in any respect with our neighbors.

Tony:

Neighbors could make issues powerful for everyone. So neighbor relations day one, all the time tremendous essential.

Ashley:

Effectively, are you guys having fun with our podcast? As a result of your help would imply the world to us, and it simply takes 30 seconds. For those who might please depart us evaluate on Apple Podcasts, it might make an enormous distinction. Your suggestions not solely motivates us, but in addition our crew, and we actually really admire it. So Tony, I noticed that you’ve got a shout out.

Tony:

We do. Somebody left a glowing 5 star evaluate on Apple Podcast. So once more, should you’re having fun with the podcast, make sure you depart your trustworthy ready and evaluate. However this one comes from AJ 1800 and it says, I really like listening to this podcast. Hear every time driving to and from my hospital rotation with three exclamation marks. So we admire you AJ 1800, and thanks for supporting the podcast.

Ashley:

Sure, thanks, aj. Effectively, I’m Ashley. And hes Tony. Thanks a lot for listening to this episode of Actual Property Rookie. We’ll be again with one other episode.

Assist us attain new listeners on iTunes by leaving us a ranking and evaluate! It takes simply 30 seconds and directions might be discovered right here. Thanks! We actually admire it!

Desirous about studying extra about in the present day’s sponsors or changing into a BiggerPockets associate your self? Electronic mail [email protected].