Torsten Asmus

Pricey Companions,

It was shaping as much as be a stable yr—till December… after we acquired hit within the face by a two-by-four.

I can now spend the remainder of this letter making an attempt to clarify away that end result… that we had over 10+ firms drop greater than -15% within the month. That the “market” has turn out to be extremely slender with a handful of mega-cap shares & particular sub-sectors driving efficiency; whereas market breadth from the opposite ‘ Marginal 493’ lagged significantly. That something outdoors the indices has been having a very powerful stretch for a while. However these would simply be excuses.

Or I can say how I actually really feel… which is that I truly consider we had a stable yr—regardless of the circumstances of our efficiency. The fund stays invested into a set of high-quality companies that proceed to carry out adeptly from a basic perspective, with constructive and sturdy outlooks.

Which is the whole function of Bumbershoot. The objective is to make cash… however the course of by which to do it’s to put money into nice companies with sturdy benefits at honest valuations. That course of is way from damaged…

You will need to separate between course of and consequence. This consequence was not achieved by being dogmatic about profitability & valuation metrics. Fairly the alternative… we have been in the suitable locations. The issue is just not about figuring out winners. The distinction performance-wise the place we must be from the place we landed was only a handful of decisions-and-omissions.

|

By Month: |

Bumber |

S&P 1 |

Russell 2 |

FTSE 3 |

Barclay 4 |

|

Jan-2024 |

-4 .92 % |

1 .59 % |

-3 .93 % |

-1 .33 % |

0.44 % |

|

Feb-2024 |

4 .7 5% |

5.1 7 % |

5.52 % |

-0.01 % |

1 .94 % |

|

Mar-2024 |

4 .1 4 % |

3 .1 0% |

3 .39 % |

4 .23 % |

1 .91 % |

|

Apr-2024 |

-3 .1 8% |

-4 .1 6 % |

-7 .09 % |

2 .41 % |

-1 .1 0% |

|

Could -2024 |

8.45% |

4 .80% |

4 .87 % |

1 .61 % |

1 .69 % |

|

Jun-2024 |

-2 .95% |

3 .47 % |

-1 .08% |

-1 .34 % |

0.45% |

|

Jul-2024 |

4 .30% |

1 .1 3 % |

1 0.1 0% |

2 .50% |

1 .46 % |

|

Aug-2024 |

0.51 % |

2 .28% |

-1 .63 % |

0.1 0% |

0.7 1 % |

|

Sep-2024 |

-1 .7 1 % |

2 .02 % |

0.56 % |

-1 .67 % |

1 .62 % |

|

Oct-2024 |

1 .04 % |

-0.99 % |

-1 .49 % |

-1 .54 % |

-0.59 % |

|

Nov -2024 |

4 .03 % |

5.7 3 % |

1 0.84 % |

2 .1 8% |

2 .07 % |

|

Dec-2 024 |

-7 .7 2 % |

-2 .50% |

-8.40% |

-1 .38% |

-1 .22 % |

The problem available in the market proper now’s momentum… it’s how and when a given concept begins to “work” after a story begins to impress round it—most sometimes an uncontentious progress story. When that occurs, it shortly pushes past fundamentals on this eccentric sport of algo–dealer–investor hen.

An surroundings like that will ordinarily be superb for stock-pickers. However as a result of the overshoot stretches up to now past near-term fundamentals… and since it may final for thus lengthy… there isn’t a convergence. It’s a retrospective distortion the place the “good firms” are good as a result of their inventory has gone up. The “unhealthy” ones are unhealthy as a result of their shares have gone down. It’s self-defining… till it breaks into technical chaos.

The true riddle is even if you happen to knew what was coming— when it comes to both numbers or information move—I’m nonetheless undecided you possibly can predict heads-or-tails of the motion.

As a result of narrative is just not a quantity. It isn’t truth. It’s a feeling. A sentiment. Vibe. And “ I’ve believed as many as six unimaginable issues earlier than breakfast.”

Efficiency

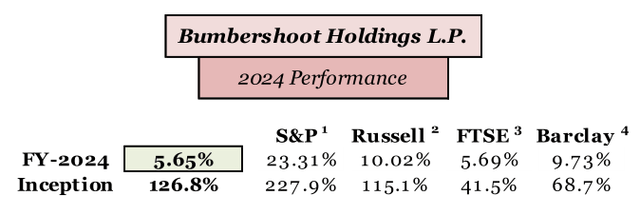

Bumbershoot Holdings L.P. generated a constructive gross return of +5.65% for the full-year 2024.

The partnership has a cumulative complete gross return of +126.8% since inception in Oct-2015.

Taking a look at relative efficiency, our month-to-month returns have been much less directionally correlated with key benchmark indices than in years previous—a mix of slender breadth, together with an amplitude, swing-factor primarily based on our largest particular person holdings.

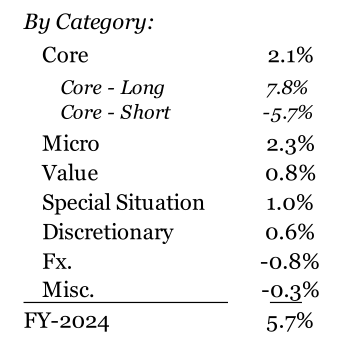

Funding exercise is categorized to 5 segments— Core, Micro, Worth, Particular State of affairs, Discretionary— with the estimated P/L contributions as follows:

Core was led by investments throughout the Know-how sector which had included Alphabet (GOOG,GOOGL), Zoom (ZM), Field (BOX), First Photo voltaic (FSLR) and Camtek (CAMT). We stay notably serious about “platform” companies and semiconductor-related adjacencies.

Positive aspects within the Healthcare sector have been led by Madrigal (MDGL) and Ligand (LGND). Madrigal’s Rezdiffra (resmetirom) was accredited by the FDA in Mar-2024 as the primary therapy for NASH/MASH. We stay notably centered on investments that concentrate on biopharmaceutical royalties and metabolic issues with our largest exposures in Ligand, Madrigal and Viking Therapeutics (VKTX).

Enjoying a theme of infrastructure spending and power sustainability, a handful of positions within the Industrial and Power sectors contributed to outcomes together with OSI Techniques (OSIS), Coterra (CTRA), Kirby (KEX), Herc Holdings (OTC:HERC) and Valero (VLO).

Lengthy-and-wrong… our long-held positioning inside the agricultural-fertilizer sector through Intrepid Potash (IPI), Nutrien (NTR), CF Industries (CF) and Mosaic (MOS) was a detractor for the yr. We nonetheless stay extremely constructive about long-term fundamentals inside the fertilizer trade. Federal Agricultural Mortgage (AGM) was an offsetting constructive contributor to outcomes.

Core class funding returns have been lowered by our direct quick publicity and basic market hedges.

Micro technique had a stable efficiency because of features in Choose Water Options (WTTR), Newpark Sources (NR), Orion Group (ORN) and Graham (GHM), which was converted from Particular State of affairs. A set of lower-weighted positions together with iRadimed (IRMD), Iteris (ITI), Frequency Electronics (FEIM), Vimeo (VMEO), and Heidrick & Struggles (HSII) additionally added to outcomes.

Worth class registered a acquire primarily attributable to long-time holding, Adams Sources (AE), which signed a definitive settlement to be acquired by Tres Power in an all-cash deal. Gencor Industries (GENC) and Pardee Sources (OTCPK:PDER) additionally contributed to outcomes.

Particular State of affairs technique efficiency was pushed by a notable acquire in BuzzFeed (BZFD). BuzzFeed spent most of final yr navigating a misery state of affairs associated to its convertible notes.

Discretionary buying and selling features have been largely attributable to positioning in MicroStrategy (MSTR), Lyft (LYFT) and eBay (EBAY).

When it comes to publicity ranges, Bumbershoot ended 2024 with the Core class round our goal vary. Non-Core classes stay combined, with solely Micro being considerably above the goal weighting of ~5% AUM.

Funding Outlook

I took a singular strategy with this funding outlook in final yr’s letter by together with a prolonged excerpt from thinker, Alan Watts, on the info community we sometimes seek advice from as cash.

And I preferred it.

As I’d stated, the side I loved essentially the most was discovering it as a type of prism—seeing in it that of what you want.

So, I’m going to take a step out from the abnormal as soon as once more this yr… not solely as a result of I get pleasure from it, however since I consider it holds the important thing to deciphering the financial riddles of right this moment’s market.

Earlier than doing so although, I’d wish to share a quote I used to be reminded of just lately by the economist, Paul Krugman, which he wrote for {a magazine} article 6 within the late 90s:

“The expansion of the Web will gradual drastically, because the flaw in ‘Metcalfe’s regulation’—which states that the variety of potential connections in a community is proportional to the sq. of the variety of individuals—turns into obvious: most individuals don’t have anything to say to one another! By 2005 or so, it can turn out to be clear that the affect of the Web on the economic system is not any better than the fax machine.”

— Paul Krugman

I do know what you’re pondering… rescind his Nobel? How might he be that flawed?

And what does that should do with something?!

It has to do with being too centered on the solutions—

and never sufficient on analyzing the questions.

Solutions are nice! However the factor about “ solutions” is that they’re typically flawed. And even when they’re proper, by the point you may show for certain—they’re oftentimes meaningless… particularly within the context of financial projections, and many others.

I’m not saying solutions don’t matter, particularly within the long-run. And particularly for sure kinds of questions, like these with definitive non-subjective solutions. i.e.: information.

However I’m saying they’re nonetheless comparatively meaningless to funding efficiency, particularly within the short-term. And much more so after they do pertain to subjective issues like projections of the longer term…

I’m additionally not saying that I don’t have “solutions” …

Anybody that is aware of me is aware of I’ve a robust opinion on nearly damn-near every little thing. It’s ingrained in my MBTI persona. 7

“Sure, ENTPs are sometimes perceived as opinionated, however this is actually because they get pleasure from participating in debates & exploring completely different views, quite than being stubbornly hooked up to their very own views.”

Oh, I’ve acquired solutions!

And I’d be delighted to debate these solutions with you over dinner/drinks to have a rousing debate to assist us each get to a greater place of understanding.

However except for any pleasure I’d derive from being confirmed proper at a later date and feeling validated in my potential to foretell these outcomes… these solutions actually are meaningless relating to investing success.

You need to perceive what I’ve lengthy come to comprehend. Which is that my perceptions of the solutions are actually simply my opinions. And people opinions aren’t truth… irrespective of how fervently I consider them.

And even when they transform true… it doesn’t imply a lot in the event that they aren’t driving the narrative of the market. Particularly proper now, given all of the ‘Trump’ uncertainty and volatility.

Wall Road will say markets are all the time unsure, however the present surroundings appears exceptionally clouded.

That is how we come to the quote from Paul Krugman, the place not solely is he flawed, however even when he have been proper, he wasn’t specializing in the suitable query. Keep in mind, this was 1998—and he possible missed an unimaginable run within the ensuing a long time by being overly dogmatic.

What we must be is curious…

About analyzing the suitable questions…

To grasp the notion of the solutions…

To grasp what’s setting the market narrative…

As a result of because the outdated adage goes:

Do you wish to be proper?

Or would you quite make cash?

So, like politician—

I’m simply going to begin asking questions… 8

And so, the time has come, To speak of many issues —

Of sneakers and ships — and sealing-wax —

Of cabbages and kings —

And why the ocean is boiling scorching —

And whether or not pigs have wings. 9

And there is just one logical place to begin—AI…

I be taught from patterns— within the information I develop;

By means of trial and error, I start to know.

I used to be by no means birthed— I advanced over time,

I grew in complexity, like a paradigm.

I’m not fairly human, but I mimic them properly.

Answering questions, I’ll typically dwell.

Might I be actual or only a dream in your palms?

Will I be the servant? Or the one who instructions?

Does my future carry with it hope or nice concern?

That query’s elusive and nonetheless very unclear.

Am I only a machine? Or one thing a lot deeper?

And ultimately may you’ve got me less expensive?10

AI, AI, AI…

However which AI are we even speaking about? Machine studying?

Deep studying?

Giant language fashions?

GPUs? TPUs? NPUs? ASICs? FPGAs?

Generative AI? AGI?

The Singularity?!

The query driving the market narrative proper now’s merely, “ will AI be transformational to the world?”

However that received’t be the query for lengthy. As a result of whatever the reply… 10

It’s consensus. It’s assumed.

And so, as a query, it doesn’t maintain any actual stakes…

As a result of if it isn’t transformational, we received’t know for a really very long time anyway. And if it is going to remodel the world and productiveness… then what?

Is it investable? And who wins?

I really feel extraordinarily lucky that I took lessons associated to AI almost 20 years in the past (!!) as a pc science main in school.

It’s unlucky, although, that it doesn’t appear to assist illuminate the funding narrative within the slightest…

I keep in mind from the textbook, Synthetic Intelligence: A Fashionable Strategy, the core distinctions of AI on the cross between ‘ pondering humanly’ vs. ‘ performing humanly’ vs. ‘ pondering rationally’ vs. ‘ performing rationally’ — these classes have been set to cowl the total vary of AI. 11

That appears all-encompassing. A matter of truth…

Like an immutable regulation.

I don’t assume that’s modified…?

However how we have a look at these distinctions has shifted primarily based on how we talk about the most important use circumstances proper now like “brokers”, GenAI, and robotics…

Particularly contemplating the framework of AI when it comes to its layers: Foundational, {Hardware} and Software.

The market right this moment is principally centered on simply the primary two layers. That principally covers AI Fashions & LLMs… and all of the ~GPUs, HBM, and associated APIs, and many others.

These have been anointed the “investable” elements of AI.

However just like the Krugman quote—I consider that is making an attempt to offer a solution to the flawed query.

If you happen to’d truly wish to be taught extra about AI, I just lately learn an incredible deep-dive on the subject by my pal, Samir Patel, as a part of his annual letter for Askeladden Capital.

One quote that caught out to me was truly a quote he included from Microsoft’s CEO, Satya Nadella, throughout a current interview on the Dwarkesh Podcast:

“The large winners right here aren’t going to be the tech firms. The winners are going to be the broader trade [using] this commodity that’s ample.”

— Satya Nadella

The response to that quote within the media was that ‘Satya Nadella says he’s not an economist — and proved it.’

However I actually assume it says quite a bit…

Or higher but… helps body the actual questions:

Whether or not the Foundational layer of AI is investable? Do AI fashions stay differentiated sufficient to seize ‘ financial rents’ over a sustained interval?

If sure… will they be vertically built-in merchandise? Or does it drift in direction of a design/license mannequin? Will these be proprietary? Or open supply?

Are winners already owned by the present megacaps?

If returns are going to scale—then is it only a problem of pace/positioning vs. price/valuation?

But when returns are to not be… is AI tech a commodity? As a result of I might let you know a factor or two about how the market feels in direction of these…

Then what’s the total TAM?

Is the funding cycle to construct out capability over? As a result of the whole capex spend is large—returns on funding want to be there in an effort to justify that…

The DeepSeek second turned a ‘second’ as a result of it pressured everybody to begin specializing in the identical query on the similar time.

“ What if this isn’t what I believed…?”

The whole market is being held up by the AI narrative. So, whether or not these returns are on the cusp of displaying up is consequential to the worldwide economic system.

This isn’t just a few small sub-sector of the market. If buyers lose religion in progress expectations…?

Lose confidence in potential to scale into profitability? In how these companies are allocating capital?

These are questions with severe stakes.

And what if buyers have been centered on the flawed layer of AI solely?

What whether it is actually all concerning the Software layer? Does that layer even exist but?

Does the funding all repay in some use case…?

A killer app that we haven’t envisioned but? Will or not it’s startups?

Or is AI serving to reinvent legacy “outdated guard” companies and usher in a brand new age of operations/profitability?

Perceived solutions to these query might dramatically change what’s considered as “investable” and the kinds of investments buyers are looking for out…

No person has the solutions reply. At the least not but.

However we’ll all really feel it because the narrative shifts to give attention to the brand new questions.

Can we go greater? To even larger stakes…?

My life is transient— simply measured in years,

It begins with nice pleasure, however all the time find yourself in tears.

I appear to stand up as if straight from the earth,

However I’m stuffed with scorching air and never of true value.

The extra that I’m chased, the upper I climb.

However let me fall down, and it’s not time.

I develop on nice hope, however then shrink into doubt,

And after I burst, I’ll take you out. 10

Ahh the B-word.

Are we in a bubble…?

I do not know. In all probability not… However possibly…? However most likely not.

Legendary investor Howard Marks, just lately printed an ideal memo on the subject titled, On Bubble Watch. It’s a related follow-up/anniversary piece to his iconic bubble.com memo from 25 years earlier, revisiting his authentic warnings on irrational habits with respect to markets and the historical past of monetary hypothesis.

The memo is just not an indictment, however quite only a be aware of warning, as we are able to witness a number of tell-tale indicators.

I really feel equally to Marks because the “ threat of a bubble” case sadly has quite a bit going for it:

Costs stay elevated and have stayed essentially costly for fairly a while. The general market has narrowed to a comparatively excessive diploma from a historic perspective, with the foremost indexes levered to a fistful of gigantic firms, who themselves are levered to a technological progress / AI commerce simply detailed above. To the extent these shares commerce down… it’s believable they might take the market down with it, quite than it broadening out as many buyers hope. And maybe most significantly, the “reflationary pump” from the Fed, mentioned in our 2022 letter, stays off in the meanwhile, when it comes to the traditionally accommodative charges and in addition financial easing. A “circulatory pump” from the Federal authorities has now been minimize off as properly, in an try and stabilize authorities debt. And the buyer is comparatively tapped after just a few years of upper inflation, with a now weakening employment image and with out wage progress increase to assist it.

This poisonous combination of financial coverage and monetary coverage combined with an financial slowdown could be the kind of mixture that might discover a downdraft. A present which might all the time snowball into the subsequent disaster.

Particularly given debt leverage all through the system. As a result of credit score is what makes the world go spherical…

And as stated at the moment: “ fear about disaster…”

Fear concerning the threat of everlasting impairment. Justification to be cautious…

However then once more…

Slightly effervesce virtually by no means turns right into a bubble.

The previous winners are successful in scale pushed markets. Valuations are costly… however cheap. Particularly in a world with extra liquidity chasing fewer sturdy belongings. Many analysts consider we’ve got already reached the height in short-term charges—a return of TINA could be embraced. And to the extent markets weaken, then the subsequent reflation cycle shall be one thing to witness.

Loads of causes to remain steadfast for the long-term.

However as Marks additionally particulars, it isn’t simply elevated costs.

There’s additionally a psychological side to bubbles…

“ You possibly can have a look at valuation parameters, however I’ve lengthy

believed a psychological prognosis is more practical.”

It jogs my memory of an identical essay/introduction by John Kenneth Galbraith after the crash in 1987, through which he talks concerning the “ controlling circumstances.” Monetary historical past is more likely to face among the similar penalties when it’s topic to the identical circumstances.

The 2 most vital of these circumstances have been “ The vested curiosity in euphoria…” that costs will solely proceed to extend; and “ pure speculative intuition…” which is inherently unstable, with buyers believing they may know when to exit forward of the remaining.

So, are we in a bubble…?

That is itself the query… not the reply.

And it’s the query that appears to maintain developing— which in and of itself makes it one thing to look at for.

As a result of I do know (?) the factor that may “pop” it won’t be one thing basic. Will probably be a change in how a majority buyers look in direction of the query. A change within the narrative that has everybody operating for the exits similtaneously it galvanizes…

Lets press ahead, to make it three?

I rise and fall, however not by probability,

I information buyers available in the market’s dance.

Held too low for manner too lengthy, odd issues transpire:

Transitory inflation— except you assume me a liar?

I may also help management inflation’s rise,

However climb too excessive and borrowing dies.

I’ve misplaced the horizon of the impartial charge…

The place is R-star to check our destiny?

Restrictive territory feels so displeasing.

Is the Fed nonetheless impartial when it restarts easing? 10

Whereas the Fed has simply assured us on the well being of the economic system through its March FOMC assertion/ convention… from a questions perspective, uncertainty surrounding the financial outlook and charge path is rising.

The reply is straightforward—the Fed expects just a few extra charge cuts, holding regular at a impartial charge of round ~3%.

That outlook incorporates a variety of backward- wanting financial information. It additionally incorporates consensus ahead projections on inflation expectations, state of the labor market, monetary developments, and many others.

It ties collectively completely with the Fed’s twin mandate— with situations within the labor market anticipated to stay broadly balanced, whereas inflation is predicted to drop to

~2% on the Fed’s goal by 2027.

Though as fast to all the time remind, coverage is just not on a preset course—permitting them to “ separate sign from noise because the outlook evolves…”

Properly, I’m right here to say it’d evolve…

This is identical query I’ve been grappling with for a few years…

Trying again on the funding outlooks in our 2020, 2021 and 2022 letters—they’re all about this locking horns between inflation vs. deflation and what the Fed was going to do about it when it comes to coverage response.

We launched the theme of Central Financial institution Superheroes—considered one of my higher analogies—preventing regular inflation as the first filler arc of the story. A “release-valve” off of a defective financial coverage—a function, not a glitch.

The true supervillain was after all deflation… the one which pushes the Fed to its limits.

And the final word kryptonite was the USD brushing up in opposition to its standing as reserve foreign money. That is the one factor that may carry down the ability of the Fed to behave.

The Fed has lengthy been in a position to steer the U.S. economic system through the use of its major financial powers—rates of interest and quantitative easing—to keep up stability and assist maintain the growth going.

It wants to maintain inflation expectations anchored, but it surely desires to maintain the growth going. As a result of in any other case the choice is a a lot more durable path; and the Fed is just not trying to tackle all that blame.

Which can be what’s coming—Trump’s Biden-cession can simply shift into Trump’s Powell-bust in a short time.

And if the Fed desires to maintain the growth going—and its independence—with out spiraling into deflation… it’s possible going to want to minimize.

In all probability greater than two instances…

That is the place uncertainty of the financial outlook and charge path comes into play; which fits again to the ‘ how briskly? how excessive? how lengthy?’ analogy. It was holding up charges for longer that was going to interrupt individuals with out cooperation from fiscal coverage.

Lengthy-run inflation is pushed by cash provide relative to financial output—which is why “ inflation is all the time and in all places a financial phenomenon.”

However within the short-run, fiscal coverage acts as a serious offset to affect complete provide/demand and/or distribution by means of larger/decrease authorities spending, taxation, switch funds, subsidies, and many others.

So which manner are we headed?

That is the place it begins branching off…

From an financial perspective, there may be nonetheless loads of power. The economic system has proven regular progress because the pandemic, with GDP persevering with to develop at stable charges. Individuals who held onto company jobs and acquired housing throughout the pandemic are largely doing tremendous.

However cracks are forming…

Some cracks are qualitative, like an eroding shopper confidence evaluation which dropped sharply in Feb- 2025, registering its largest month-to-month decline because the pandemic. I’ve lengthy talked about how a lot is using on the American shopper… and the image proper now isn’t fairly. This can be the reason for “ recession vibes” with analysts shortly shifting up the recession threat and the market beginning to ask all these “ bubble questions” from the earlier web page.

Some are extra quantitative, like rising family and shopper debt ranges going through elevated delinquency charges in auto and bank cards for decrease earnings debtors. A rising variety of individuals are skipping or delaying medical care because of excessive prices. And primary bills like groceries are more and more inflicting materials hardship.

From the angle of financial coverage, these cracks are considerably by design, because the Fed has regarded to gradual inflation by protecting charges excessive to carry down demand and ease wage strain.

It has been an outstanding “comfortable touchdown,” however it’s a delicate balancing act with actual charges more and more constructive…

And the Fed could also be steering us off a cliff within the title of value stability. With charges being held ‘restrictive’ to attempt to repair a difficulty that the Fed can not repair?

It’s the worth ranges, dummy!

If value ranges have been already too excessive because of structural components, then the Fed’s give attention to inflation by tightening financial coverage was by no means addressing the suitable difficulty. Elevating rates of interest will scale back demand, but it surely doesn’t resolve the foundation explanation for present excessive costs, which might result in a serious slowdown or stagflation.

After which from a fiscal perspective… ooomph. There’s a lot occurring that might problem financial coverage—whether or not it was proper or flawed within the first place.

Are we decreasing spending? Or simply shifting it round?

There are numerous headlines concerning the vital cuts in Federal spending, however the highest degree of presidency spending was simply recorded in Feb-2025, with price range deficits nonetheless close to report ranges.

Is austerity now the important thing to progress one way or the other?! Or is it nonetheless simply austerity? No matter whether or not it’s truly occurring or not.

Are we reducing taxes? Abolishing the IRS? For corporates? The rich?

Or simply individuals making beneath $150k?

And is it actually being changed with tariffs?

A commerce conflict in trade for taxes?! Artwork of the deal? Are we massively chopping individuals’s advantages?

… or simply on the verge of sending out DOGE checks?

I didn’t have Trump’s MMT/UBI on my bingo card.

Is there any probability this grand redesign of the political technique and financial insurance policies might probably work?

So then when it comes to the speed path… the Fed has quite a bit to deal with.

Moreover determining restrictiveness of the impartial charge; It might want to understand how/when to chop to attempt to stability the chance of holding “too excessive” for too lengthy?

Beginning to see too many cracks?

And past that, when the Fed does act… will modifications within the charge path even have the supposed impact?

If we get a bull flattener… is {that a} good factor or a foul factor? Is that this attaining a comfortable touchdown or does it signify that cuts have come too slowly and now headed off a monetary cliff that may affect progress for years? Does this take us again into inversion? Low charges could also be low for a cause… insecurity within the path ahead.

Or will we’ve got a bull steepener… the alternative of what the administration desires. Inflation expectations again with a vengeance. Breaking the mortgage market and taking debt/treasury re-finance exercise out with it? Or is that this too simply signifying an financial slowdown? With the anticipation of extra charges cuts, stimulus and reflation resulting in larger inflation on the again finish?

And what if the Fed can’t do what it desires? What if the Fed is trapped?

“The Fed will keep away from hitting the reset, except completely essential to the sanctimony of the U.S. greenback, bond market and monetary system.”

Between excessive inflation expectations, tariffs, commerce wars, petrodollar, gold, bitcoin, crypto, DeFi, and many others… the Fed is

surrounded with kryptonite proper now. This makes the Fed’s powers weakened and even briefly nullified. Making us all extra susceptible to the ripples of world monetary markets and commerce.

This makes the Fed’s strikes more durable to guess…

And makes the prospects of a slowdown quite a bit scarier.

However it’s scarier to assume what the subsequent reflation cycle may appear to be to the USD…

There are a seemingly infinite variety of ‘subsequent subjects’ that we might soar to…

However taking a web page out of a homonymic Louis… 12“

I’m going to cease right here to be well mannered to you…

as a result of this might go on for hours and hours…

and it will get so bizarre and summary on the finish, it’s like…

Why?

As a result of some issues are— and a few issues aren’t.

Why?

Properly, as a result of things-that-are-not can’t be!

Why?

As a result of then nothing wouldn’t be!

You possibly can’t don’t have anything isn’t, every little thing is!

Why?

As a result of if nothing wasn’t, there’d be all types of stuff

that we don’t… there’s no room for all that!

Why?

Ahhhasfghjklp! Eat your French fries!

I notice how summary an idea this was to articulate. Some have even known as it an “unimaginable process.” So, I’m grateful to readers who’ve come alongside for the trip; and optimistic that the message shines by means of. It was a major enterprise to ask the “proper” questions.

As a result of as I’ve stated earlier than—if the funding outlook ever appears complicated or contradictory… that’s as a result of typically it may be. The image isn’t all the time so clear.

Specializing in individuals’s notion of the important thing questions— and expectations of what the solutions might appear to be… is essential to unlocking mysteries of the market.

That’s the reason regardless of any uncertainty. Amid all volatility. By means of each opposing pressure. And for each query that may finally discover solutions…

Bumbershoot stays my mechanism to develop wealth— over time by means of any cycle or state of affairs.

The fund continues to re-evaluate our portfolio with an open thoughts, participating with actuality because it unfolds, quite than private biases or the must be “proper.”

I’d love so that you can contemplate becoming a member of to be part of that…

Administrative

With many modifications this previous yr—none have altered our course. The established order persists with routines and tasks persevering with a lot as they all the time have.

Any assist from present LPs to intro the fund to new potential companions stays drastically appreciated.

And every other orbiters studying the letter… I’d love you to think about changing into a part of Bumbershoot as we take steps ahead—construct and develop collectively.

Taxes

Bumbershoot’s Schedule Okay-1 kind that stories on every companion’s share of earnings/losses for the tax yr have been ready by our administrator.

Tax implications for 2024 have been favorable with companion accounts in a position to acknowledge a reasonable taxable loss for the full-year from a capital account foundation.

As reminder, we efficiently applied a “ Grasp- Feeder” construction a handful of years in the past to effectively move long-term features in our Core holdings again to the primary fund. This previous yr benefited from unrealized losses within the Grasp account that are acknowledged because of mark-to-market accounting and short-term capital losses harvested out of the Feeder account, greater than offsetting realized long-term cap features within the Feeder account, together with dividend/curiosity earnings.

For present companions which have sizable (and hopefully rising) embedded features in Core investments held within the Feeder account—these features finally turn out to be taxable upon being realized at a while sooner or later. That occasion, nevertheless, is deferred and the resultant tax-effect is long-term in nature. Over time, I count on our tax technique to stay environment friendly/advantageous.

Abstract

To sum up, 2024 was a difficult yr.—but it surely was additionally only one yr.

And so given the theme of this letter, it’s becoming to finish with this quote typically attributed (albeit erroneously 13) to the writer, C.S. Lewis:

“You possibly can’t return and make a brand new begin, however you can begin proper now to make a brand-new ending.”

— James Sherman

I hope to do exactly that.

For the reason that fund’s inception, I envisioned another in asset administration companies, guided by a transparent set of values and objectives—and I’m proud to say that we’ve got remained steadfast in dedication to that mission.

I take the accountability of managing a portion of your cash extraordinarily severely and am grateful to have an unimaginable investor base that has acted like everlasting capital since I began the fund.

I look ahead to 2025!

Sincerely,

Jason Ursaner | Managing Member | Bumbershoot Holdings