At one level in February 2020, a single cruise ship — the Diamond Princess — accounted for greater than half of the world’s confirmed instances of Covid-19 exterior China. The three,700 passengers and crew endured a grim quarantine off Japan; seven died.

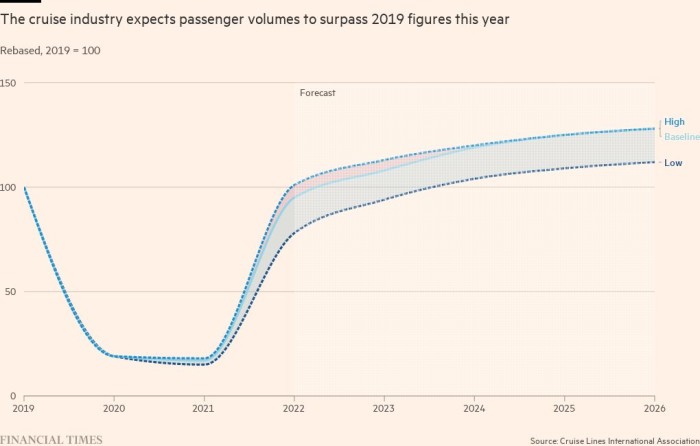

However Covid has not proved to be an existential risk for the business. Bookings have surged to pre-pandemic ranges. And earlier this month, after a complete refit and a number of other deep cleans beneath its proprietor Carnival, the Diamond Princess took to the seas for the primary time in additional than two years, sure for its new dwelling port of San Diego earlier than it returns to full service in September.

“Everyone you converse to on cruises these days says: ‘Gee, it’s good to be again dwelling, it’s good to be again on the seas once more,’” mentioned Mike Alcock, a 72-year-old retiree from Northamptonshire, who has taken six cruises alongside his spouse because the business returned from the pandemic and has three extra booked.

“You wouldn’t go to a resort that’s as spotlessly clear,” mentioned Alcock, who has a lot confidence within the business’s capability to rebound from the pandemic, he simply bought 500 extra Carnival shares. “Individuals are hooked on cruises . . . After all it’s going to bounce again.”

What may sink lots of the business’s greatest corporations is one thing else completely: enormous icebergs of debt. As cruise ships had been moored in docks through the pandemic, the businesses that owned them turned to the debt markets in a determined try to remain afloat.

The three main listed cruise corporations — which between them management four-fifths of the business — have all greater than doubled their gross debt over the previous two years. Consequently, the markets are viewing the businesses with warning, at the same time as prospects clamour to get again on board.

This week Carnival’s share worth plunged 14 per cent after Morgan Stanley downgraded the inventory, predicting — in a bear case — that its shares might be price nothing. “[Carnival’s] leverage seems to be unsustainably excessive,” its analysts warned.

Each Carnival and Royal Caribbean rank among the many prime 5 losers on the S&P 500 over the previous three months — one of many worst quarters for the index on file — having misplaced round half of their share worth. Norwegian is the thirteenth worst performing inventory over the identical interval.

“The worry available in the market is that the boat had sailed on the most effective a part of the post-Covid restoration earlier than the cruise traces had been again up and operating,” mentioned Chris Woronka, an analyst at Deutsche Financial institution. “Now we’re speaking a couple of potential client slowdown once they simply received restarted.”

Woronka added that the gradual restoration within the cruise business — due partly to extra onerous Covid-19 restrictions from the US Facilities for Illness Management and Prevention than are enforced on different journey operators — meant the businesses “by no means actually handled their stability sheet issues”, leaving them “on the mercy of an amazing quantity of debt”.

Royal Caribbean faces $8bn of debt — a 3rd of its whole — maturing within the subsequent 18 months. Carnival and Norwegian have $4.1bn and $1.8bn, respectively, coming due over the identical interval.

In Could, Carnival refinanced $1bn of debt by issuing an unsecured seven-year bond with an expensive 10.5 per cent coupon.

Jason Liberty, Royal Caribbean’s chief govt, advised the FT that the excessive yield “did spook some individuals”, including that such excessive coupons had been “definitely not what we had been anticipating or planning for”.

He acknowledged that Royal Caribbean was prone to should refinance debt at “the next stage of a coupon than we had anticipated” however pressured that it could not should refinance all $8bn of debt that’s coming due imminently.

Royal Caribbean’s subsequent problem is a $650mn bond issued in 2012, which can come due in November. Whereas the bond is buying and selling near face worth, suggesting buyers anticipate it to be repaid comfortably, it might be costly to refinance. Royal Caribbean’s longer-dated debt is buying and selling at yields in extra of 10 per cent.

Ash Nadershahi, a high-yield portfolio supervisor at Three Bridge Capital mentioned: “They’ll should refinance at the next yield . . . all the cruise business will perhaps have a repricing.”

However Liberty insisted a few of Royal Caribbean’s $8bn of money owed maturing earlier than the tip of 2023 might be paid down with the corporate’s “fairly wholesome” $3.8bn in money and revolving credit score services and that at the very least $2bn price of debt got here within the type of convertible bonds, which might be paid out as shares.

For the opposite pressures weighing on their stability sheets, the businesses have been capable of provide you with workarounds.

Royal Caribbean and Norwegian hedge on gasoline prices. For 2022, for example, Royal Caribbean is 56 per cent hedged at below-market charges. Gas usually includes simply above 10 per cent of Royal Caribbean’s price base, however that proportion has risen since Russia’s invasion of Ukraine. Carnival, nonetheless, doesn’t have a gasoline hedge, so is “far more uncovered” to hovering gasoline costs, based on Deutsche Financial institution’s Woronka.

Royal Caribbean can also be being “extra nimble” in response to inflation in meals prices, based on Liberty. The corporate now sources its bacon from Mexico, for instance, the place costs are far decrease than within the US. “We simply load up our ships in Mexico . . . and we simply grow to be our personal provide chain or transporter of bacon for our fleet.”

Regardless of fears of an financial slowdown or perhaps a recession, the businesses stay bullish.

“Whereas not recession-proof, our enterprise has confirmed to be recession-resilient repeatedly,” mentioned Arnold Donald, Carnival’s outgoing CEO on an earnings name final week. Liberty mentioned Royal Caribbean’s aggressive pricing would assist it climate a recession. “We commerce at a fairly important low cost to land-based holidays,” he pressured.

The expertise of the recession following the 2008-09 monetary disaster confirmed that “individuals will do rather a lot to keep away from giving up their cruise holidays”, based on Stewart Chiron, an impartial business marketing consultant.

“Cruisers are very loyal,” mentioned Chiron. “They’ll make sacrifices in different areas: they’ll eat out much less, they could get completely different automobiles, they’ll change their spending patterns.”

However buyers are unconvinced. “Traders have mainly mentioned I don’t actually care about one good yr wherein the sector recovers,” mentioned Alex Brignall, a journey and leisure analyst at Redburn. “A recession will simply make 2023 horrible.

“The profitability restoration [for cruise lines] has been horrible, stability sheets are very stretched, they’re very operationally levered corporations and so they have loads of debt to repay or refinance. So in a recession, they might be abysmal.”