(Bloomberg) — US mortgage charges dropped final week to the bottom stage this yr, however not sufficient to spur a rebound lending exercise.

The contract price on a 30-year mortgage declined 5 foundation factors to six.88% within the week ended Feb. 21, in keeping with Mortgage Bankers Affiliation knowledge launched Wednesday.

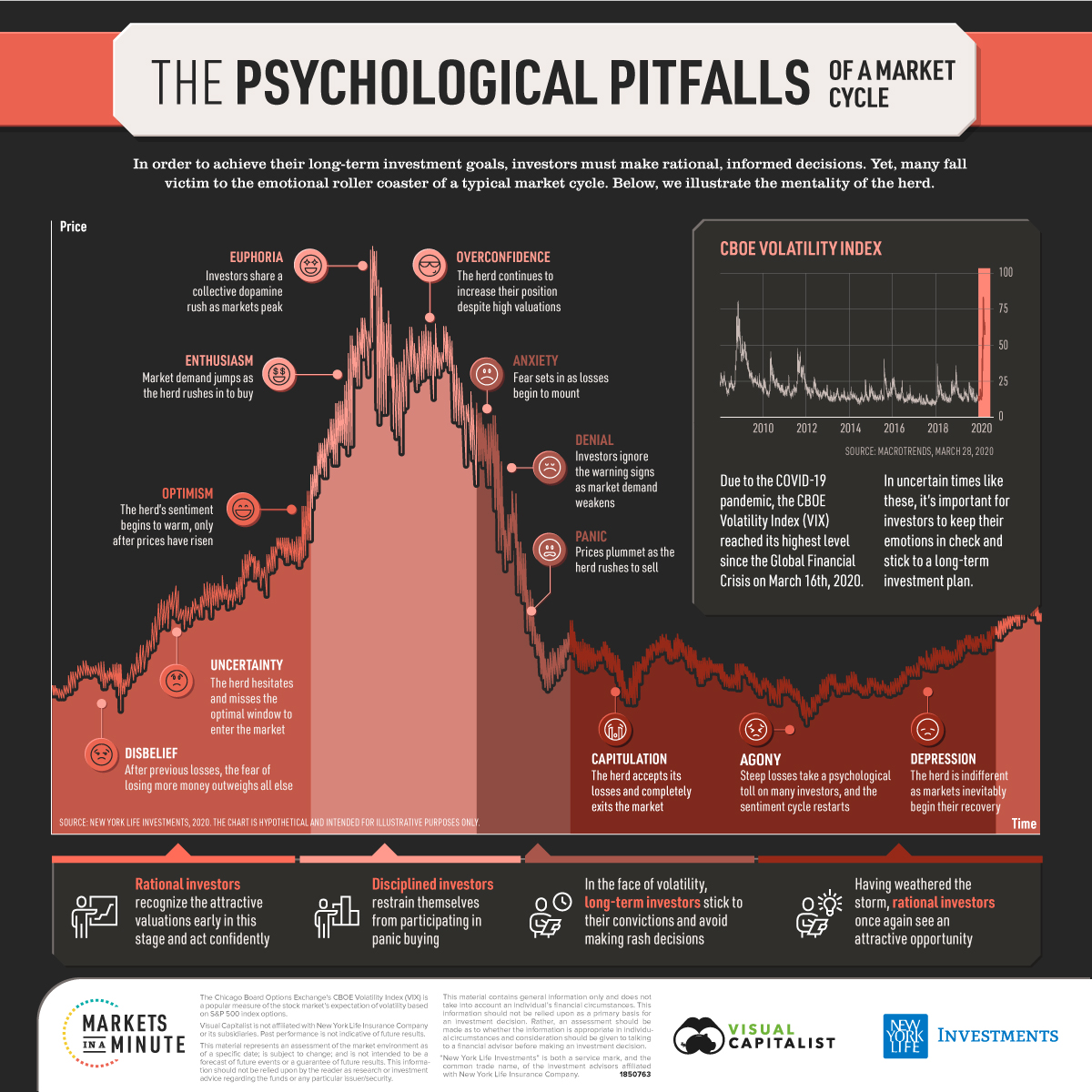

Mortgage charges observe Treasury yields, which have fallen previously week as buyers search secure havens amid a selloff in shares and oil markets. Financial knowledge have additionally contributed to the current drop in yields, together with weak January retail gross sales and an uptick in shoppers’ long-run inflation views to the very best since 1995.

Even so, borrowing prices are nonetheless elevated — as are residence costs — and weighing on lending exercise. MBA’s gauge of refinancings fell 3.6%, whereas its index purposes for residence purchases barely rose.

The MBA survey, which has been performed weekly since 1990, makes use of responses from mortgage bankers, industrial banks and thrifts. The information cowl greater than 75% of all retail residential mortgage purposes within the US.

The federal government will launch January knowledge on new-home gross sales later Wednesday.

–With help from Liz Capo McCormick.

(Provides graphic)

Extra tales like this can be found on bloomberg.com

©2025 Bloomberg L.P.