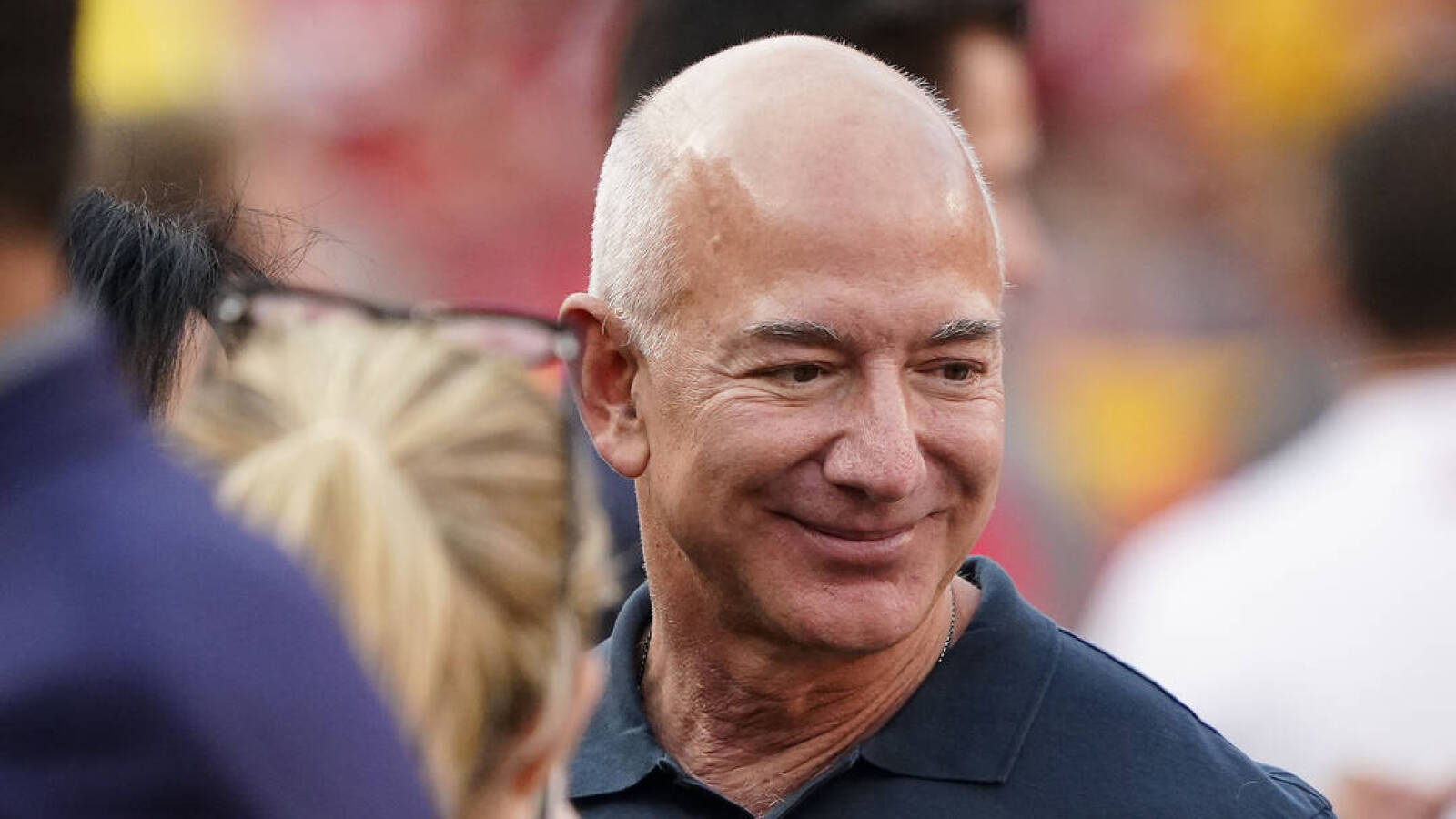

I solely purchase sturdy companies. I solely purchase them after they’re low-cost. Backgrounds in economics, philosophy, authorities, knowledge. I began my investing journey with a reasonably concentrated portfolio of Canadian dividend payers within the telecom, pipeline and banking industries. I’ve moved ahead by means of totally different industries together with funds, US regional banking, Chinese language and Brazilian equities, REITs, expertise corporations and some different rising market alternatives, in addition to microcap by means of to megacap vary. I presently am targeted on holding the best high quality companies and persevering with to develop my data of their benefits. I believe there’s a lot one can be taught listening to Warren Buffett, Charlie Munger, Monish Pabrai, Terry Smith, Li Lu, Invoice Ackman, Man Spier and maybe most significantly, the CEOs: Jensen Huang, Mark Zuckerberg, Jeff Bezos and others.I’m principally targeted on massive tech corporations with billions of customers and increasing libraries of content material. I believe the probabilities of cross-selling when you could have such massive bases are underappreciated. I choose to worth corporations on the EBIT+R&D stage due to the potential in sure R&D investments I imagine in. I’ve no skilled affiliations. My annual return from February 2019 to October 2024 was 11.4% CAGR (a 1.82x), considerably underperforming the market’s 15.18% CAGR (a 2x). However I imagine my expanded data since 2019, particularly in the previous couple of years, has supplied me with the instruments required to outperform the market into the long run. I imagine the rules I’ve realized will preserve portfolio turnover to a minimal going ahead and that a lot of the cash to be made can be made not promoting the businesses I already personal.Lastly, I do not imagine in “Purchase” and “Promote” suggestions. We have now a number of 50,000 shares worldwide, all with various costs. In case your focus is whole return, and you might be searching for really distinctive companies at greater than truthful costs, then the edge for allocating capital ought to solely be titled “Robust Purchase”, with every thing else a “Robust Promote” to generate money for the subsequent “Robust Purchase”. I’ll provoke a “Maintain” on a few of these nice companies if the pricing is not favorable.

Analyst’s Disclosure: I/we’ve a helpful lengthy place within the shares of MSCI, INTU, ELV both by means of inventory possession, choices, or different derivatives. I wrote this text myself, and it expresses my very own opinions. I’m not receiving compensation for it (aside from from In search of Alpha). I’ve no enterprise relationship with any firm whose inventory is talked about on this article.

In search of Alpha’s Disclosure: Previous efficiency isn’t any assure of future outcomes. No suggestion or recommendation is being given as as to if any funding is appropriate for a specific investor. Any views or opinions expressed above might not replicate these of In search of Alpha as a complete. In search of Alpha just isn’t a licensed securities vendor, dealer or US funding adviser or funding financial institution. Our analysts are third social gathering authors that embody each skilled buyers and particular person buyers who might not be licensed or licensed by any institute or regulatory physique.