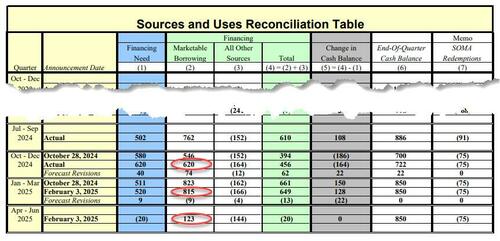

Forward of Wednesday’s Quarterly Refunding Announcement, at 3pm ET the Treasury printed its newest debt sources and makes use of forecast for the present and coming quarters, and it confirmed that the Treasury once more marginally trimmed its estimate for borrowing for the present quarter ($815BN vs $822BN estimated beforehand), whereas elevating materially extra debt than it beforehand anticipated within the quarter ended Dec 31 ($620BN vs $546BN estimated beforehand).

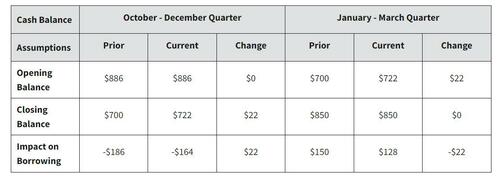

The Treasury additionally revealed that its year-end money stability was $722 billion, greater than the $700 billion forecast, which as reported beforehand, is simply earlier than the federal debt ceiling kicked again in.

Wanting forward, the Treasury expects to lift simply $123 billion in new debt within the second calendar quarter of 2025 ending June 30; in keeping with the Treasury each the end-of-March and end-of-June money stability of $850 billion assumes enactment of a debt restrict suspension or enhance. That mentioned, if the Treasury’s money stability for the top of both quarter is decrease than assumed, and assuming no modifications within the forecast of fiscal exercise, Treasury would anticipate that borrowing can be decrease by the corresponding quantity.

Listed here are the small print from the Treasury assertion

- Throughout the October – December 2024 quarter, Treasury borrowed $620 billion in privately-held internet marketable debt and ended the quarter with a money stability of $722 billion. In October 2024, Treasury estimated borrowing of $546 billion and assumed an end-of-December money stability of $700 billion. Privately-held internet marketable borrowing was $74 billion greater largely due to decrease internet money flows and the next ending money stability.

- Throughout the January – March 2025 quarter, Treasury expects to borrow $815 billion in privately-held internet marketable debt, assuming an end-of-March money stability of $850 billion. The borrowing estimate is $9 billion decrease than introduced in October 2024, largely because of the next beginning-of-quarter money stability, partially offset by decrease internet money flows.

- Throughout the April – June 2025 quarter, Treasury expects to borrow $123 billion in privately-held internet marketable debt, assuming an end-of-June money stability of $850 billion. As famous above, the end-of-March and end-of-June money balances assume enactment of a debt restrict suspension or enhance.

- Treasury’s money stability could also be decrease than assumed relying on a number of components, together with constraints associated to the debt restrict.

- If Treasury’s money stability for the top of both quarter is decrease than assumed, and assuming no modifications within the forecast of fiscal exercise, Treasury would anticipate that borrowing can be decrease by the corresponding quantity

Right here is the debt schedule in desk format:

The Treasury’s money stability stood at about $826 billion as of Thursday, or roughly the place the Treasury hopes will probably be on the finish of the quarter. As reported two weeks in the past, the US federal debt ceiling cap kicked again simply days earlier than Trump’s inauguration. Any drawn-out episode in Congress over elevating or suspending the restrict will power the Treasury to slash invoice issuance and spend down its money buffer.

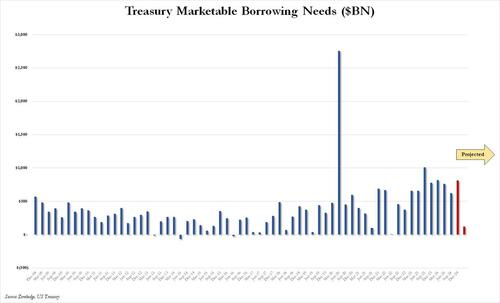

In the meantime, the projected $815 billion borrowing want in Q1 2025 would nonetheless be tied for the best for the reason that Sept 2023 quarter.

As Bloomberg notes, some Treasury watchers have flagged the potential for the division to shift towards sustaining a smaller money stockpile over time, although Monday’s estimates don’t replicate any such consideration; it will be the newest reversal by Trump’s Treasury Secretary Scott Bessent who initially pushed again towards tariffs solely to apparently concede that these are, in reality, wanted potential inflation however.

Wrightson ICAP economist Lou Crandall is amongst those that have talked about the potential of a small money hoard. Forward of Monday’s assertion, he estimated $820 billion in borrowing for the present quarter, with an end-of-period money stability of $850 billion. Anshul Pradhan, head of US charges technique at Barclays, forecast that the January-through-March borrowing determine can be $800 billion, with the money stability goal set at $850 billion. Each of them obtained the quarter-end money stability proper.

On Wednesday, the Treasury division will announce its newest refunding plans plans (i.e. detailed debt issuance planes for over the approaching months) which sellers extensively see as staying unchanged. But, given outsize US fiscal deficits, sellers see elevated gross sales of longer maturities is inevitable sooner or later; these in flip might push yields sharply greater.