Alvin Man/iStock Editorial through Getty Pictures

Lately, IATA estimated that 2022 losses would cut to $9.7 billion which is a $2 billion enchancment from the estimate supplied in October 2021. North American airways are anticipated to steer the pack being the optimistic outlier with an estimated $8.8 billion in income. Air Canada (OTCQX:ACDVF) could possibly be a kind of airways benefiting from robust pent-up demand being launched to the market. On this report, I take a look at Air Canada’s first quarter outcomes.

Values on this report are denoted in Canadian {dollars} until talked about in any other case.

Air Canada Loss Tapers

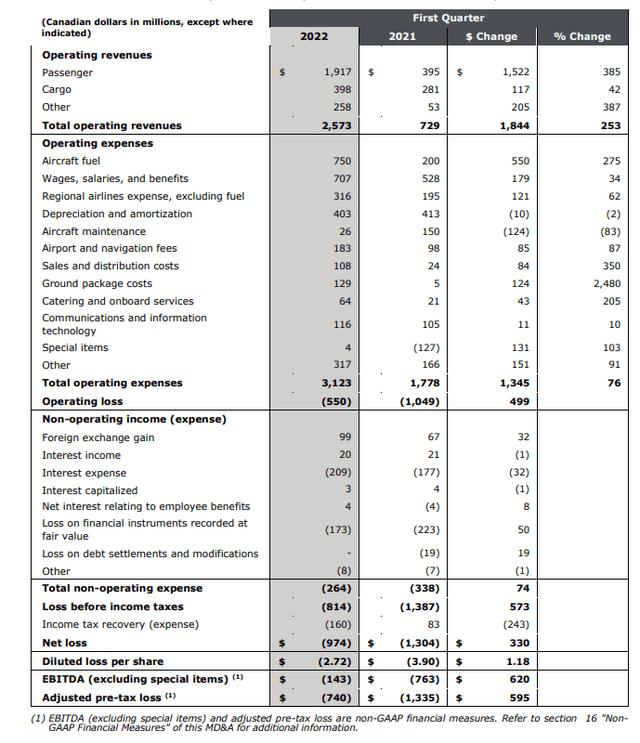

Air Canada Q1 2022 outcomes (Air Canada)

Throughout the first quarter, revenues elevated by $1.8 billion which was primarily pushed by a 385% surge in passenger revenues. This was clearly the results of pent-up demand being launched to the market offset by Omicron pressures whereas cargo revenues grew as Air Canada has been increasing its cargo capability and cargo charges remained robust. On the fee finish, Air Canada noticed a 76% improve or $1.35 billion. So, regardless of a 55% surge in gas costs and flight quantity associated price will increase Air Canada narrowed its working loss helped by a 6.6% sequential lower in adjusted unit prices and a 43% year-over-year improve in unit income.

Yr-over-year figures present some perception into how issues did develop, however it’s exhausting to get an excellent view of the restoration as a result of we’re evaluating two totally different market environments and the 2021 numbers present a low comparability foundation. A comparability with Q1 2019, offers higher insights into the restoration. In Q1 2022, revenues have been 58% recovered. Passenger capability was 55% recovered with revenues down 50% and visitors down 55%. This implies that there nonetheless is lots of area to extend capability to learn from pent-up demand and drive down unit prices excluding gas.

In March, bookings have been already 90% recovered from 2019 ranges whereas advance ticket gross sales have been exceeding the March 2019 ranges by $200 million. This reveals a robust base to extend capability going ahead.

Air Canada: Path of Prudent Capability Enlargement

Air Canada Boeing 737 MAX (Boeing)

What I notably like about Air Canada is their consciousness of being in a pent-up demand surroundings, which implies that the corporate isn’t throwing capability available on the market on the quickest fee because the airline retains in thoughts that the pent-up demand would possibly cool during which case capability is being delivered to the market enabling some unit prices benefits however total deliver increased complete prices that may not be offset by the topline development.

Air Canada expects to get well 73% of its 2019 capability within the second quarter and have summer time capability of 80% of pre-pandemic ranges. In North America the place pent-up demand possible is strongest, the capability will already be 90% recovered in summer time and 70% recovered by September/October and 90% recovered for Atlantic within the second half of the yr. So, there’s lots of energy in North America and the Atlantic bringing capability very near pre-pandemic ranges and Air Canada expects to be totally recovered by 2024 which is according to the trade outlook.

Company demand is evolving in a optimistic route nearly weekly and Air Canada is also seeing increased demand for premium merchandise from its leisure vacationers.

So, total there’s lots of enchancment going to materialize within the second quarter partially offset by a excessive jet gas value surroundings. Nonetheless, the Canadian provider does anticipate that EBITDA margin will attain 8 to 11 p.c in 2022 with adjusted CASM being 13 to fifteen p.c increased in comparison with 2019. Air Canada additionally identified that it sees robust demand this yr, however its passenger revenues wouldn’t exceed pre-pandemic ranges till someplace subsequent yr.

Total, from the Air Canada plans we see that the corporate is extraordinarily prudent about offering step ups in capability and driving down the unit prices within the course of but in addition not overdoing that as pent-up demand might dry up offering a major price overhang. One other robust level is that whereas workers shortages have been main speaking factors with different airways, Air Canada sees completely no points on that finish that means that the airline can match its capability with demand ranges with out seeing different constraints. At this level, that is a really comfy place to be in.

Fleet planning

Air Canada expects a robust restoration this yr, but in addition is positioning itself for the long term as turns into obvious from its fleet.

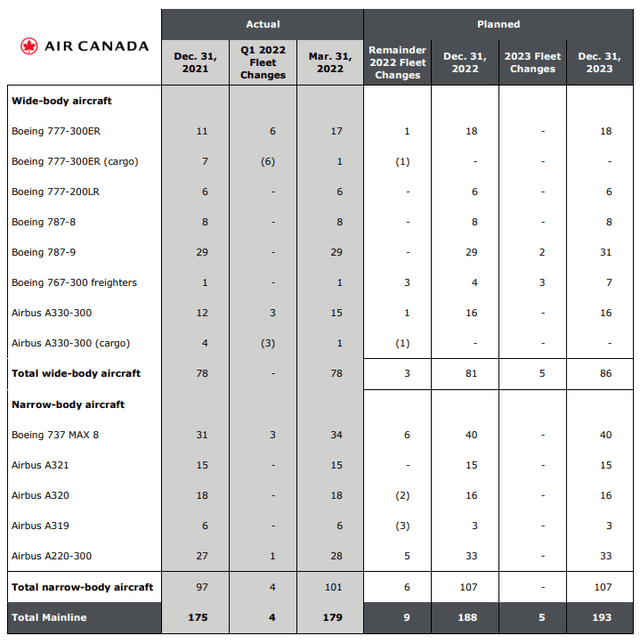

Air Canada fleet plan (Air Canada )

As Atlantic capability will get well to 90% in the course of the second half of the yr, Air Canada is bringing again some passenger plane used for cargo companies to passenger companies. Throughout Q1, six Boeing 777-300ERS and three Airbus A330-300s have been introduced again to passenger service. To offset the capability loss, Air Canada has taken supply of 1 Boeing 767-300 Freighter this yr and expects one other later this yr. Additionally attention-grabbing to notice is that Air Canada has no Boeing 787 deliveries deliberate this yr though deliveries are anticipated to recommence quickly.

Air Canada Airbus A321XLR (Air Canada )

Throughout the quarter, three Boeing 737 MAX plane have been added to the fleet and one other three are anticipated within the second quarter with the remaining three anticipated by year-end. Air Canada introduced in March 2022, that it might purchase 26 Airbus A32XLRs. Twenty will probably be obtained through lessors whereas six had been beforehand ordered by Air Canada however weren’t disclosed and 4 have been ordered in April 2022 by Air Canada based on knowledge analytics instruments from The Aerospace Discussion board. First deliveries are scheduled for 2024 and the airline has choices for 15 extra plane scheduled for supply between 2027 and 2030.

Throughout the pandemic, Air Canada backed off from the acquisition of 12 Airbus A220-300s however determined earlier this yr to take supply of all the jets. So, Air Canada isn’t totally recovered but however it already has a robust fleet plan in place to place itself for development in comparison with pre-pandemic ranges and that is good to see.

Conclusion

Air Canada revenues tapered within the first quarter of the yr in comparison with the earlier quarter partially as a result of Omicron. Nonetheless, the corporate has seen year-over-year prices losses taper and demand-driven capability enlargement will drive up revenues and scale back unit prices. Air Canada is being prudent on their capability enlargement retaining in thoughts the pent-up demand surroundings. Concurrently, the airline is assessing the way it can effectively take up elevated gas costs by its income drivers.

I might say that the airline is being very prudent in the fee and capability administration whereas workers shortages don’t appear to be a watch merchandise for Air Canada for the time being permitting the airline to develop again to 90% in some areas this yr already and be shut to completely recovered in 2024 and have passenger income exceed pre-pandemic ranges within the first half of subsequent yr.

I might say that Air Canada is the template airline of the restoration trajectory as anticipated by Boeing and varied aerospace intelligence corporations. What’s additionally compelling is that the airline is trying past 2024 and has fleet plans in place that permit the airline to develop in a cost-efficient approach and exceed pre-pandemic outcomes. My solely concern is Air Canada’s cargo section. With excessive expectations of e-commerce having a cargo section looks as if a no brainer, however we’re nonetheless in a cargo fee surroundings with very robust unit revenues and that has not at all times been the case. So, we have to see whether or not Air Canada can handle its cargo enterprise such that it stays an asset fairly than a legal responsibility.