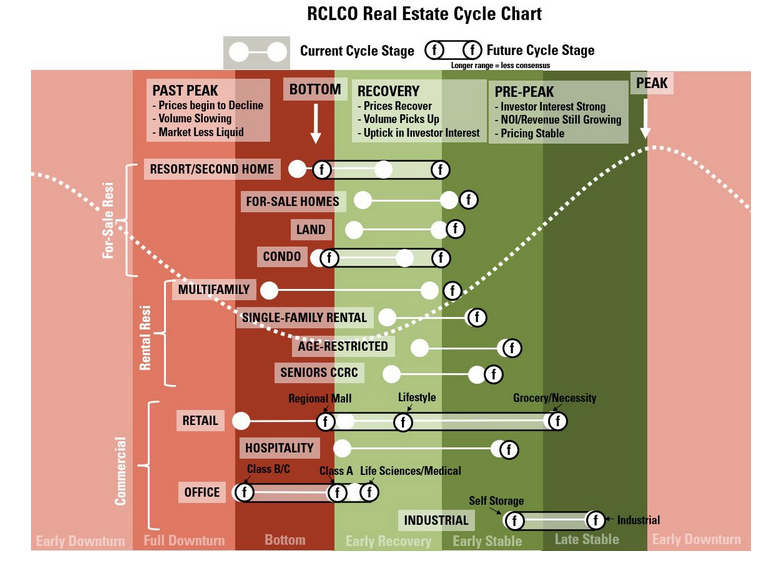

Industrial actual property funding sentiment has risen convincingly within the second half of the 12 months, in accordance with RCLCO’s actual property market index, which registered a 25 p.c improve.

After sputtering for the previous few years, it’s now at 65, solidly into restoration territory. An RMI above 60 is usually indicative of constructive or enhancing market circumstances.

Some 68 p.c of this survey of extremely skilled actual property professionals from throughout the nation and the trade have labored in the actual property trade for 20 years or extra, with a mean respondent tenure of roughly 25 years; and 82 p.c of respondents are C-suite or senior executives of their organizations.

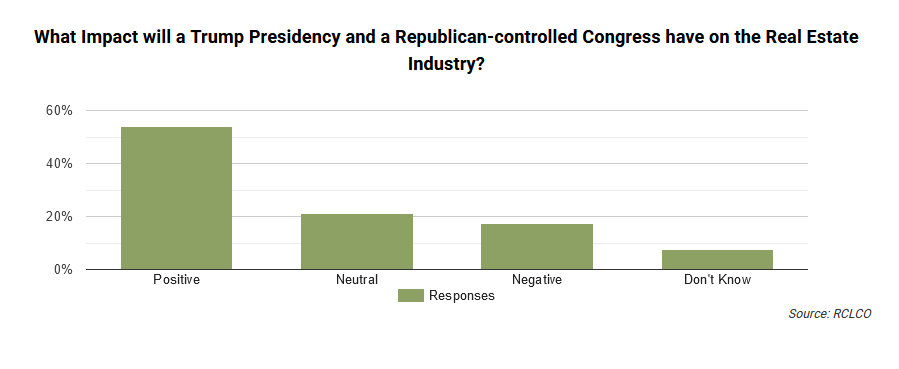

Much more, the RMI is forecast to extend to 82 over the following 12 months. Greater than half (54 p.c) credit score the incoming Trump Administration for his or her favorable view.

Area of interest sectors—reminiscent of self storage, industrial, grocery/necessity retail—are prone to present resilience, having overcome downturn circumstances this cycle.

“A renewed sense of optimism is clear throughout all points of economic actual property, together with multifamily, industrial, retail and workplace,” Michael Romer, co-founding companion, Romer Debbas, instructed Industrial Property Govt.

“You may truly see the grins once more at vacation events. There’s optimism for 2025.”

America was constructed on huge goals and self-belief, and that has returned, in accordance with Kyle Gulock, founder & managing companion at Century Companions.

“As soon as the brand new coverage is in place, we count on a swift uptick in general funding [at least] till the center a part of the 12 months,” he stated.

Trump insurance policies are ‘a wild card’

President-elect Trump’s second time period throws a possible wild card into the outlook, in accordance with Kevin Thorpe, world chief economist, Cushman & Wakefield.

“The coverage modifications embody a variety of macroeconomic influences, together with regulatory circumstances, fiscal insurance policies reminiscent of taxation and authorities spending, commerce insurance policies and immigration insurance policies,” Thorpe stated.

Many insurance policies the Trump administration is pursuing in his second time period—reminiscent of restrictive immigration, tariffs and tax cuts—mirror the identical pursued throughout his first time period and, regardless of the whipsaw in coverage, the U.S. property sector carried out effectively, Thorpe noticed.

READ ALSO: Is This the Begin of CRE’s New Progress Cycle?

He added that a few of these insurance policies may have a extra quick impression, for instance, on the monetary markets. Others have a extra lagged impression on the financial system and monetary markets and are, due to this fact, extra prone to affect leasing fundamentals and the capital markets down the street.

“Though lots of the modifications to coverage may very well be important, in addition they have the potential to exert offsetting forces to financial progress and inflation,” Thorpe stated. “Our baseline assumes that the anticipated modifications in coverage won’t considerably alter the trajectory of the financial system or the property sectors’ efficiency in 2025.”

The Federal Reserve’s 50-basis-point price minimize in September 2024 spurred transaction exercise in the actual property sector, Robert Martinek, director at EisnerAmper, instructed CPE.

“Many felt this confidence has continued with further 25-basis-point cuts in November and December,” he stated. “Many market individuals really feel that Trump has ‘business-first’ insurance policies and he’ll minimize pink tape and broaden enterprise alternatives.

“For wholesome sectors of the market (multifamily and industrial), many of the new development that entered the market has been absorbed. With new and deliberate growth anticipated to gradual, emptiness charges will transfer decrease whereas rental charges ought to improve.”

Outlook for 2025

Trying to subsequent 12 months, concerning retail, rising insurance coverage prices, development pricing, debt and fairness, and the financing and refinancing landscapes have an effect on the buying and selling quantity, in accordance with Meghann Martindale, principal & director, market intelligence, retail at Avison Younger.

“Renewed port negotiations or strikes might additionally impression the motion of products, costs and retailer operations. And it’s but to be seen whether or not shopper spending can stay resilient—though tariffs might set off renewed inflation stress, U.S. shoppers haven’t stopped spending by way of current inflation and rising rates of interest, so tariffs might not deter spending to the degrees some are fearing.”

As for vitality, Howard Huang, analyst, market intelligence, information facilities at Avison Younger, instructed CPE that the incoming administration has expressed assist for nuclear vitality growth. “If realized, this coverage might considerably improve vitality availability within the U.S., benefiting the expansion of knowledge facilities and different industries reliant on secure energy infrastructure.”

Throughout workplace, industrial and retail, Garett Bjorkman, co-chief govt officer at PEG Cos., stated he anticipates constructive tendencies and continued flight to high quality for brand spanking new workplace leasing, and older classic product being transformed to different makes use of reminiscent of residential and hospitality.

“Given the power of shopper spending, we count on retail to proceed enhancing, which is able to, in flip, result in extra industrial and logistics demand,” Bjorkman stated.