Revealed on December twenty third, 2024 by Bob Ciura

The fantastic thing about purchase and maintain eternally dividend development investing is that:

- It takes little or no work to take care of a portfolio

- Your passive revenue is more likely to improve considerably over time

Only a few constructive issues in life have the above mixture.

Top quality dividend development shares are inclined to pay rising dividends year-after-year. This implies a elevate for traders yearly. However the investor must do virtually nothing to get their annual elevate.

The one “work” required is to carry your dividend development shares as long as they proceed to develop your revenue.

With this in thoughts, we created a downloadable record of over 130 Dividend Champions.

You’ll be able to obtain your free copy of the Dividend Champions record, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink under:

The Dividend Champions have raised their dividends for at the least 25 years in a row. Consequently, they’re the most effective candidates for traders seeking to get raises for doing nothing.

This text will talk about the our high 10 Dividend Champions to get raises for doing nothing. We are going to record the ten Dividend Champions within the Certain Evaluation Analysis Database with the very best 5-year dividend development charges.

Desk of Contents

You’ll be able to immediately soar to any particular part of the article by clicking on the hyperlinks under:

Excessive-Development Dividend Champion #10: Gorman-Rupp Co. (GRC)

- 5-year dividend development charge: 9.0%

Gorman-Rupp started manufacturing pumps and pumping programs again in 1933. Since that point, it has grown into an trade chief with annual gross sales of practically $700 million and a market capitalization of $1 billion.

At present, Gorman-Rupp is a targeted, area of interest producer of crucial programs that many industrial purchasers rely on for their very own success.

Gorman Rupp generates about one-third of its complete income from outdoors of the U.S.

Supply: Investor Presentation

Gorman-Rupp posted third quarter earnings on October twenty fifth, 2024. Outcomes had been weaker than the analysts’ estimates however nonetheless they mirrored sturdy development over the prior yr.

Income grew marginally (0.4%), from $167.5 million to $168.2 million, as value hikes offset a lower in volumes.

Adjusted earnings-per-share of $0.49 missed the analysts’ consensus by $0.06, however they had been 44% larger than these within the prior yr’s interval. The sturdy efficiency resulted primarily from value hikes and decrease enter prices.

Click on right here to obtain our most up-to-date Certain Evaluation report on GRC (preview of web page 1 of three proven under):

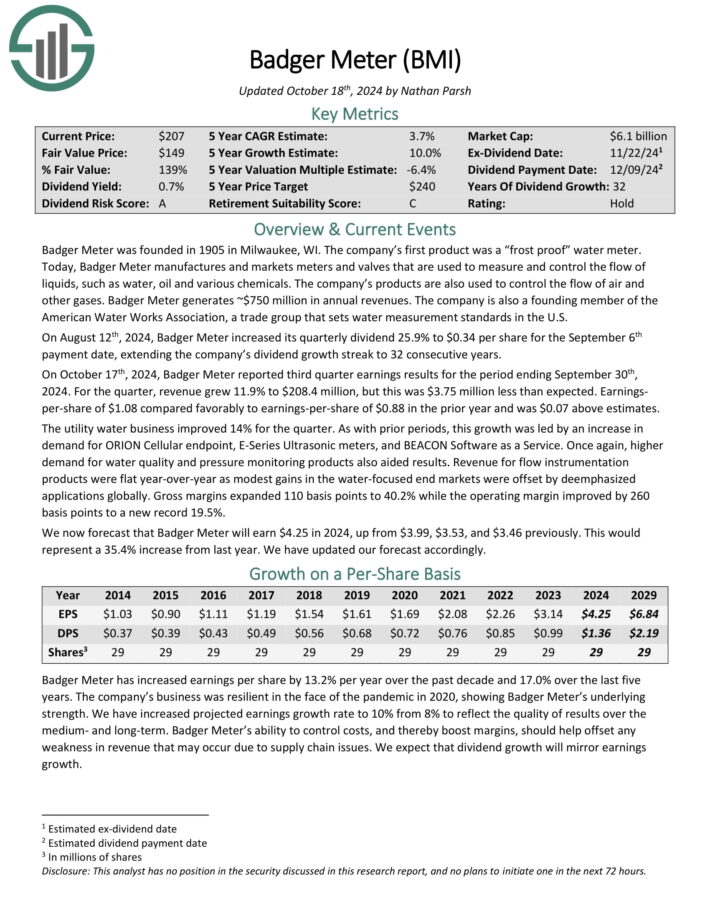

Excessive-Development Dividend Champion #9: Badge Meter Inc. (BMI)

- 5-year dividend development charge: 10.0%

Badger Meter was based in 1905 in Milwaukee, WI. The corporate’s first product was a “frost proof” water meter.

At present, Badger Meter manufactures and markets meters and valves which are used to measure and management the circulate of liquids, corresponding to water, oil and numerous chemical substances. The corporate’s merchandise are additionally used to manage the circulate of air and different gases. Badger Meter generates ~$750 million in annual revenues.

On August twelfth, 2024, Badger Meter elevated its quarterly dividend 25.9% to $0.34 per share for the September sixth fee date, extending the corporate’s dividend development streak to 32 consecutive years.

On October seventeenth, 2024, Badger Meter reported third quarter earnings outcomes for the interval ending September thirtieth, 2024. For the quarter, income grew 11.9% to $208.4 million, however this was $3.75 million lower than anticipated.

Earnings-per-share of $1.08 in contrast favorably to earnings-per-share of $0.88 within the prior yr and was $0.07 above estimates.

Click on right here to obtain our most up-to-date Certain Evaluation report on BMI (preview of web page 1 of three proven under):

Excessive-Development Dividend Champion #8: Roper Applied sciences (ROP)

- 5-year dividend development charge: 10.0%

Roper Applied sciences is a specialised industrial firm that manufactures merchandise corresponding to medical and scientific imaging gear, pumps, and materials evaluation gear.

Roper Applied sciences additionally develops software program options for the healthcare, transportation, meals, power, and water industries. The corporate was based in 1981, generates round $5.4 billion in annual revenues, and is predicated in Sarasota, Florida.

On October twenty third, 2024, Roper posted its Q3 outcomes for the interval ending September thirtieth, 2024. Quarterly revenues and adjusted EPS had been $1.76 billion and $4.62, indicating a year-over-year improve of 13% and seven%, respectively.

The corporate’s momentum through the quarter remained sturdy, with natural development coming in at 4% and acquisitions additional boosting top-line development.

Natural development was as soon as once more pushed by broad-based energy throughout its portfolio of niche-leading companies.

Click on right here to obtain our most up-to-date Certain Evaluation report on ROP (preview of web page 1 of three proven under):

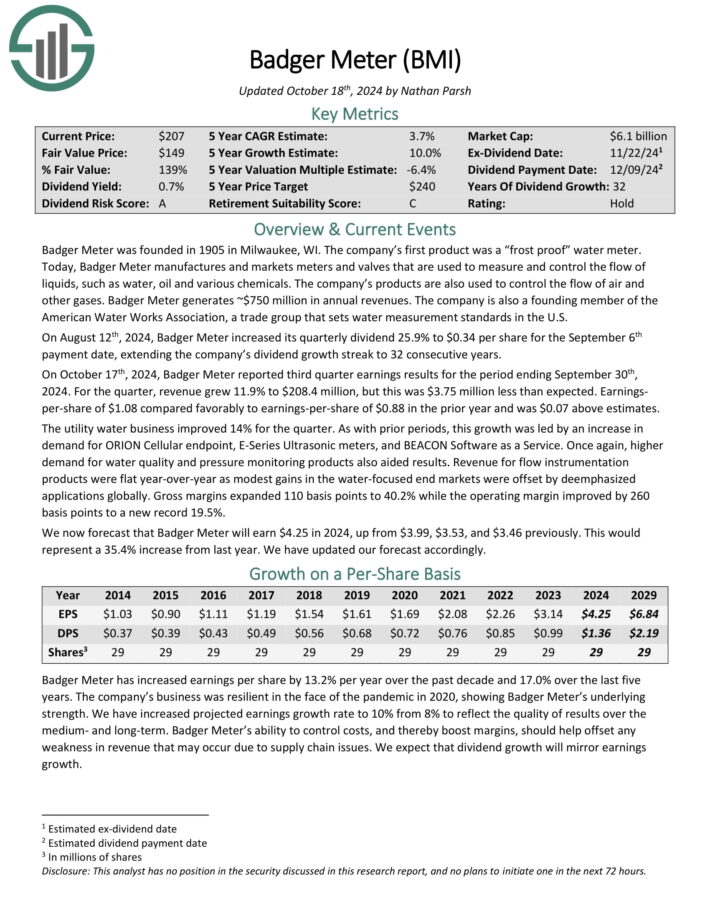

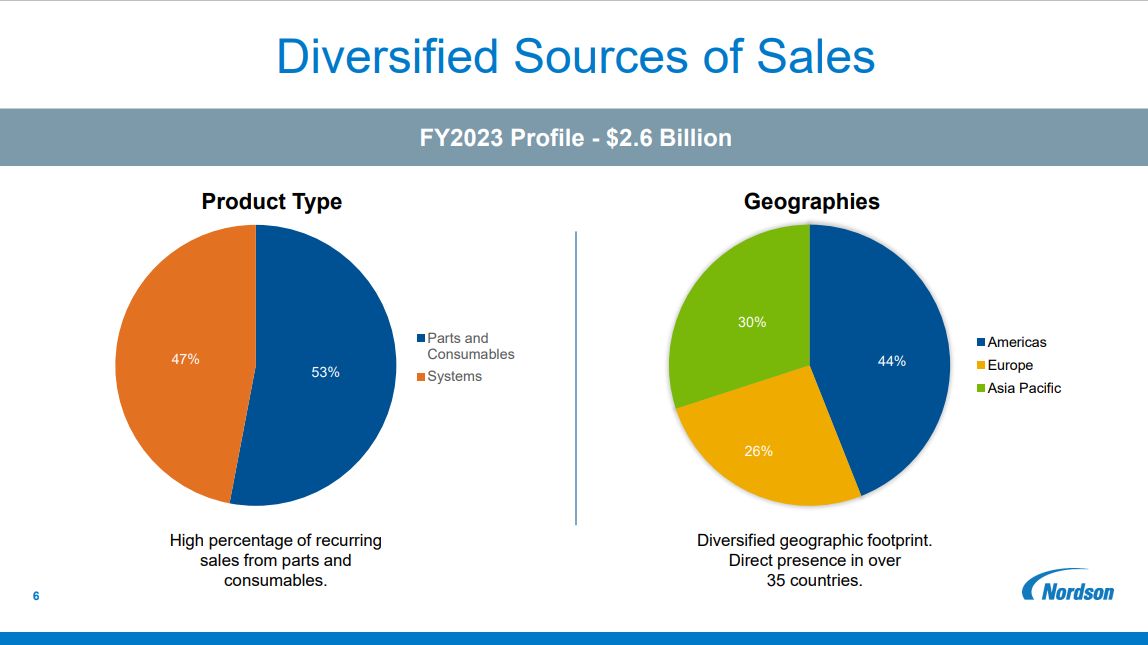

Excessive-Development Dividend Champion #7: Nordson Corp. (NDSN)

- 5-year dividend development charge: 10.0%

Nordson was based in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, however the firm can hint its roots again to 1909 with the U.S. Computerized Firm.

At present the corporate has operations in over 35 nations and engineers, manufactures, and markets merchandise used for shelling out adhesives, coatings, sealants, biomaterials, plastics, and different supplies, with functions starting from diapers and straws to cell telephones and aerospace.

Supply: Investor Presentation

On August 14th, 2024, Nordson elevated its dividend by 15% to $0.78 per share quarterly, marking 61 years of will increase.

On August twenty first, 2024, Nordson reported third quarter outcomes for the interval ending July thirty first, 2024. (Nordson’s fiscal yr ends October thirty first.) For the quarter, the corporate reported gross sales of $662 million, 2% larger in comparison with $649 million in Q3 2023, which was pushed by a constructive acquisition impression, and offset by natural lower of 1%.

The Industrial Precision noticed gross sales improve by 9.6%, whereas the Medical and Fluid Options and Superior Expertise Options section had gross sales declines of (2.4%) and (10.9%), respectively.

The corporate generated adjusted earnings per share of $2.41, a 6% lower in comparison with the identical prior yr interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on NDSN (preview of web page 1 of three proven under):

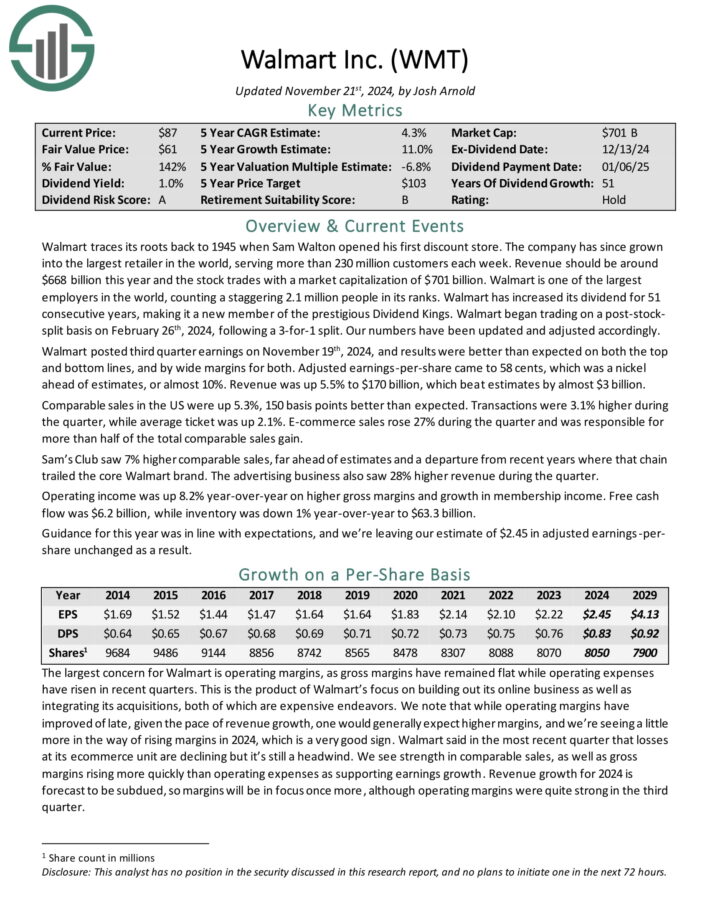

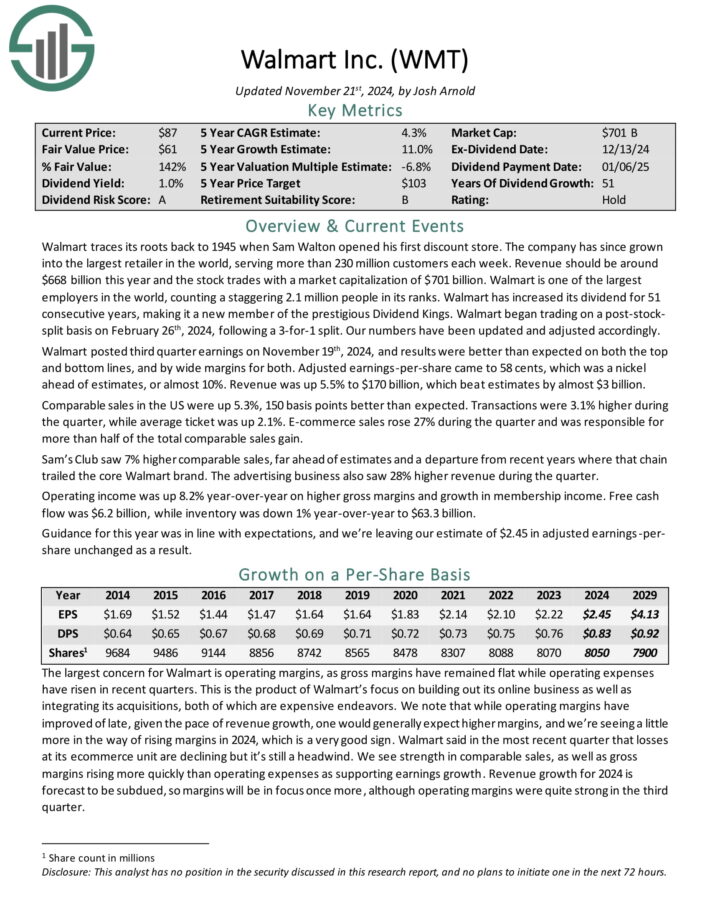

Excessive-Development Dividend Champion #6: Walmart Inc. (WMT)

- 5-year dividend development charge: 11.0%

Walmart traces its roots again to 1945 when Sam Walton opened his first low cost retailer. The corporate has since grown into one of many largest retailers on the planet, serving over 230 million clients every week. Income will doubtless be round $600 billion this yr.

Walmart posted second quarter earnings on August fifteenth, 2024, and outcomes had been wonderful, sending the inventory hovering. Adjusted earnings-per-share beat estimates by two cents at 67 cents. Income was up virtually 5% year-over-year to $169.3 billion, and beat estimates by virtually $2 billion.

Walmart posted third quarter earnings on November nineteenth, 2024, and outcomes had been higher than anticipated on each the highest and backside traces, and by huge margins for each.

Adjusted earnings-per-share got here to 58 cents, which was a nickel forward of estimates, or virtually 10%. Income was up 5.5% to $170 billion, which beat estimates by virtually $3 billion.

Comparable gross sales within the US had been up 5.3%, 150 foundation factors higher than anticipated. Transactions had been 3.1% larger through the quarter, whereas common ticket was up 2.1%.

E-commerce gross sales rose 27% through the quarter and was answerable for greater than half of the entire comparable gross sales achieve.

Click on right here to obtain our most up-to-date Certain Evaluation report on Walmart (preview of web page 1 of three proven under):

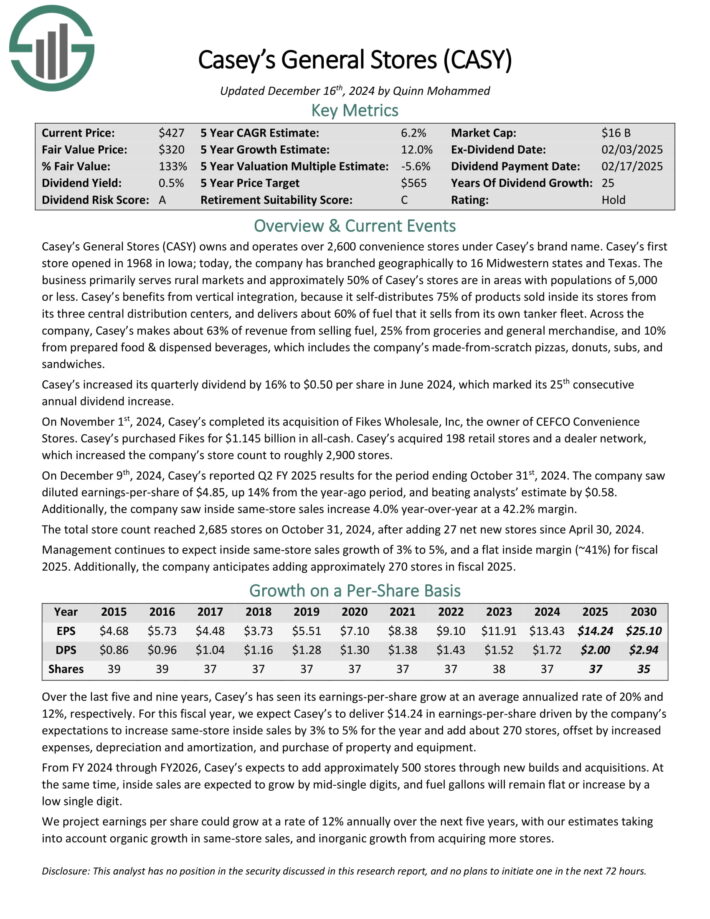

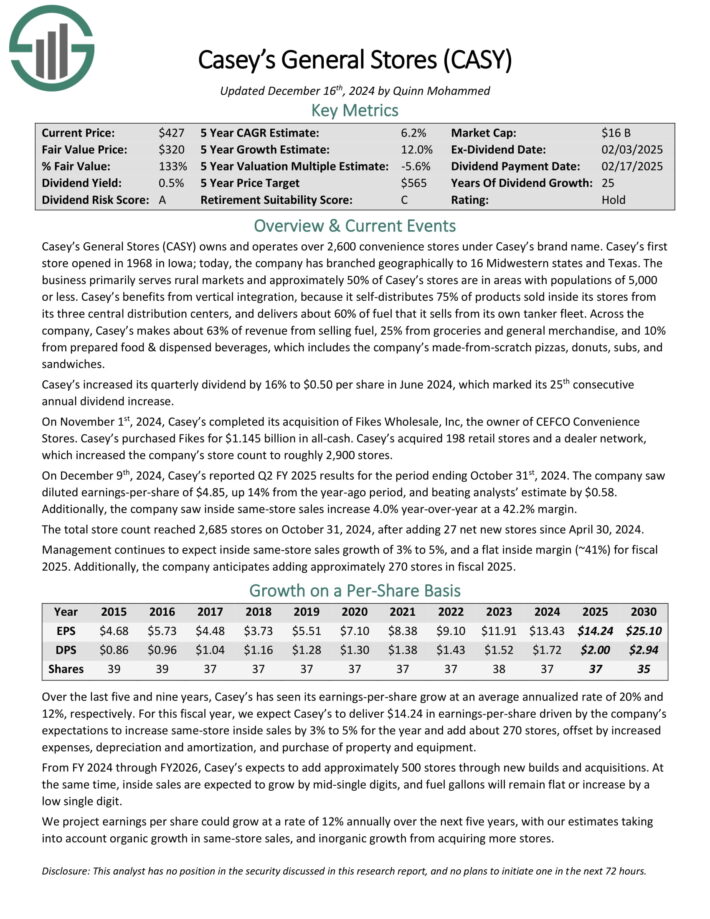

Excessive-Development Dividend Champion #5: Casey’s Common Shops (CASY)

- 5-year dividend development charge: 12.0%

Casey’s Common Shops owns and operates over 2,600 comfort shops below Casey’s model identify. The enterprise primarily serves rural markets and roughly 50% of Casey’s shops are in areas with populations of 5,000 or much less.

Throughout the corporate, Casey’s makes about 63% of income from promoting gas, 25% from groceries and normal merchandise, and 10% from ready meals & distributed drinks, which incorporates the corporate’s made-from-scratch pizzas, donuts, subs, and sandwiches.

Casey’s elevated its quarterly dividend by 16% to $0.50 per share in June 2024, which marked its twenty fifth consecutive annual dividend improve.

On November 1st, 2024, Casey’s accomplished its acquisition of Fikes Wholesale, Inc, the proprietor of CEFCO Comfort Shops. Casey’s bought Fikes for $1.145 billion in all-cash. Casey’s acquired 198 retail shops and a supplier community, which elevated the corporate’s retailer depend to roughly 2,900 shops.

On December ninth, 2024, Casey’s reported Q2 FY 2025 outcomes for the interval ending October thirty first, 2024. The corporate noticed diluted earnings-per-share of $4.85, up 14% from the year-ago interval, and beating analysts’ estimate by $0.58.

Click on right here to obtain our most up-to-date Certain Evaluation report on CASY (preview of web page 1 of three proven under):

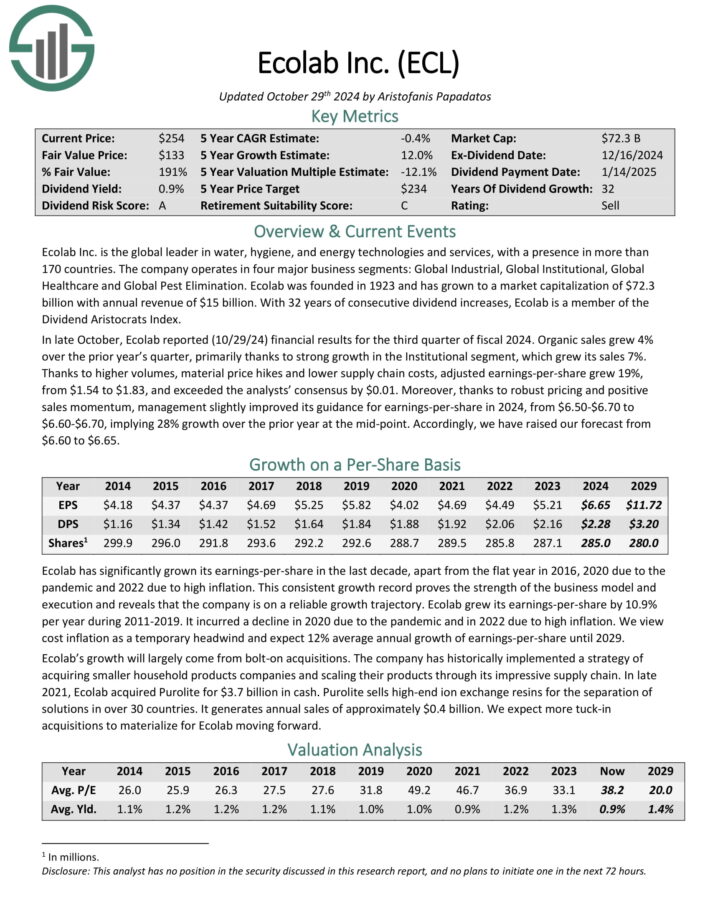

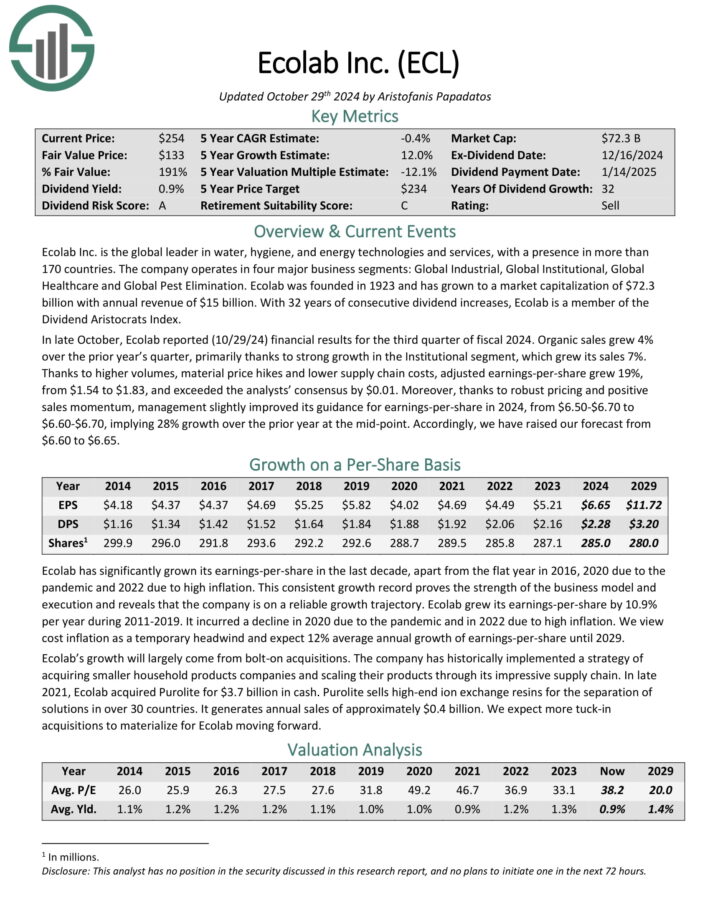

Excessive-Development Dividend Champion #4: Ecolab, Inc. (ECL)

- 5-year dividend development charge: 12.0%

Ecolab Inc. is the worldwide chief in water, hygiene, and power applied sciences and providers, with a presence in additional than 170 nations.

The corporate operates in 4 main enterprise segments: World Industrial, World Institutional, World Healthcare and World Pest Elimination.

In late October, Ecolab reported (10/29/24) monetary outcomes for the third quarter of fiscal 2024. Natural gross sales grew 4% over the prior yr’s quarter, primarily due to sturdy development within the Institutional section, which grew its gross sales 7%.

Due to larger volumes, materials value hikes and decrease provide chain prices, adjusted earnings-per-share grew 19%, from $1.54 to $1.83, and exceeded the analysts’ consensus by $0.01.

Furthermore, due to strong pricing and constructive gross sales momentum, administration barely improved its steering for earnings-per-share in 2024, from $6.50-$6.70 to $6.60-$6.70, implying 28% development over the prior yr on the mid-point.

Click on right here to obtain our most up-to-date Certain Evaluation report on ECL (preview of web page 1 of three proven under):

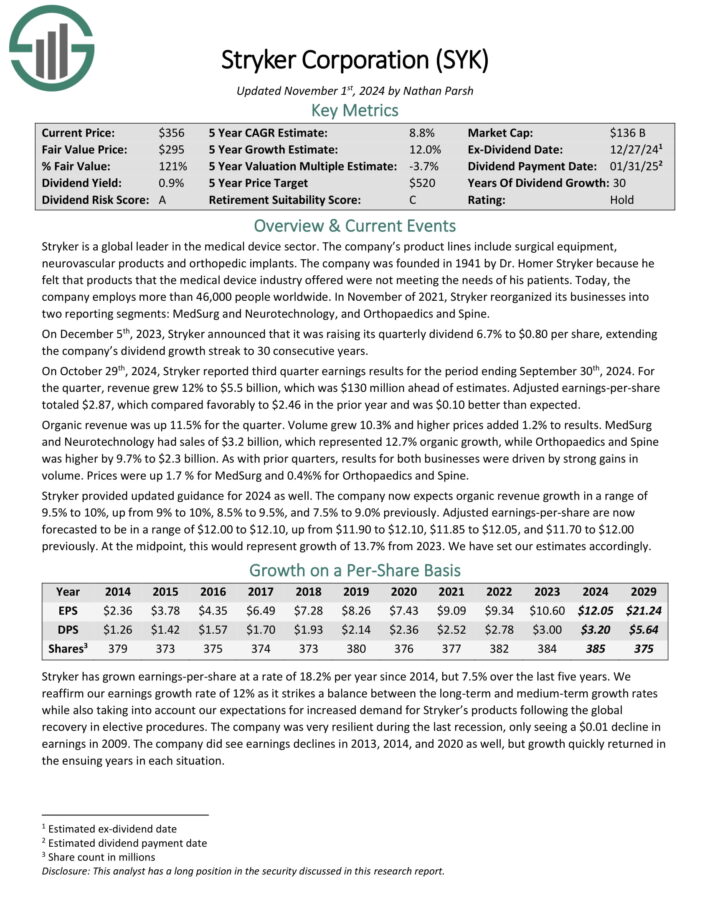

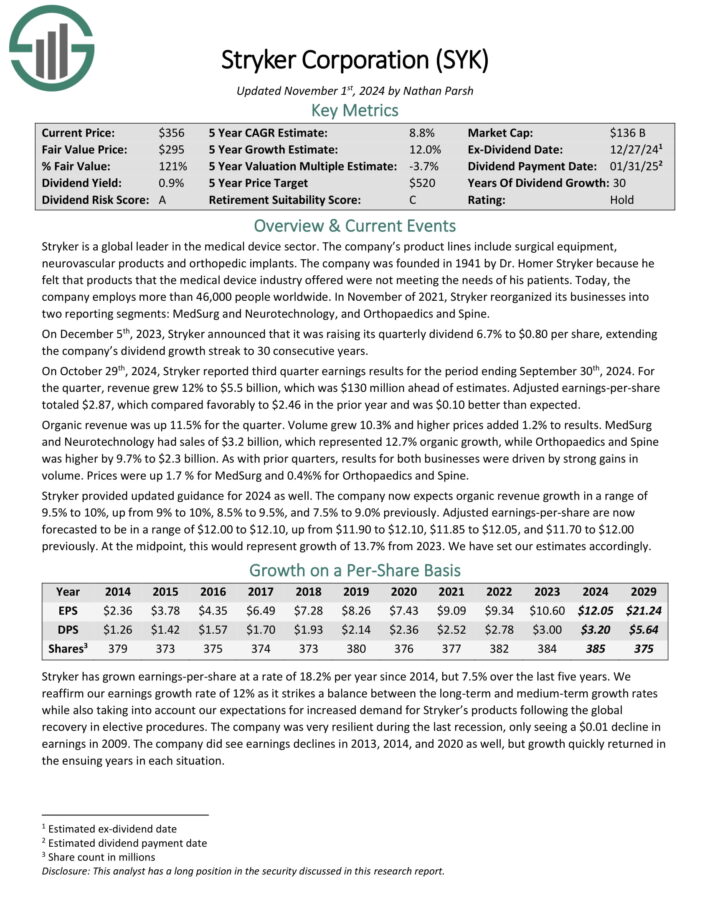

Excessive-Development Dividend Champion #3: Stryker Corp. (SYK)

- 5-year dividend development charge: 12.0%

Stryker is a worldwide chief within the medical gadget sector. Product traces embrace surgical gear, neurovascular merchandise and orthopedic implants.

At present, the corporate employs greater than 46,000 individuals worldwide. In November of 2021, Stryker reorganized its companies into two reporting segments: MedSurg and Neurotechnology, and Orthopaedics and Backbone.

On October twenty ninth, 2024, Stryker reported third quarter earnings outcomes for the interval ending September thirtieth, 2024. For the quarter, income grew 12% to $5.5 billion, which was $130 million forward of estimates.

Adjusted earnings-per-share totaled $2.87, which in contrast favorably to $2.46 within the prior yr and was $0.10 higher than anticipated.

Natural income was up 11.5% for the quarter. Quantity grew 10.3% and better costs added 1.2% to outcomes. MedSurg and Neurotechnology had gross sales of $3.2 billion, which represented 12.7% natural development, whereas Orthopaedics and Backbone was larger by 9.7% to $2.3 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on SYK (preview of web page 1 of three proven under):

Excessive-Development Dividend Champion #2: S&P World Inc. (SPGI)

- 5-year dividend development charge: 12.0%

S&P World is a worldwide supplier of economic providers and enterprise data and income of over $13 billion. By its numerous segments, it supplies credit score scores, benchmarks and indices, analytics, and different knowledge to commodity market members, capital markets, and automotive markets.

S&P World has paid dividends constantly since 1937 and has elevated its payout for 51 consecutive years.

S&P World posted third quarter earnings on October twenty fourth, 2024, and outcomes had been fairly sturdy as soon as once more. Adjusted earnings-per-share got here to $3.89, which was 25 cents forward of estimates. Earnings had been down from $4.04 in Q2, however a lot larger than $3.21 within the year-ago interval.

Income soared 16% larger year-on-year to $3.58 billion, which additionally beat estimates by $150 million. Development within the Scores and Indices section led the highest line larger in Q3, though energy was broad.

Click on right here to obtain our most up-to-date Certain Evaluation report on SPGI (preview of web page 1 of three proven under):

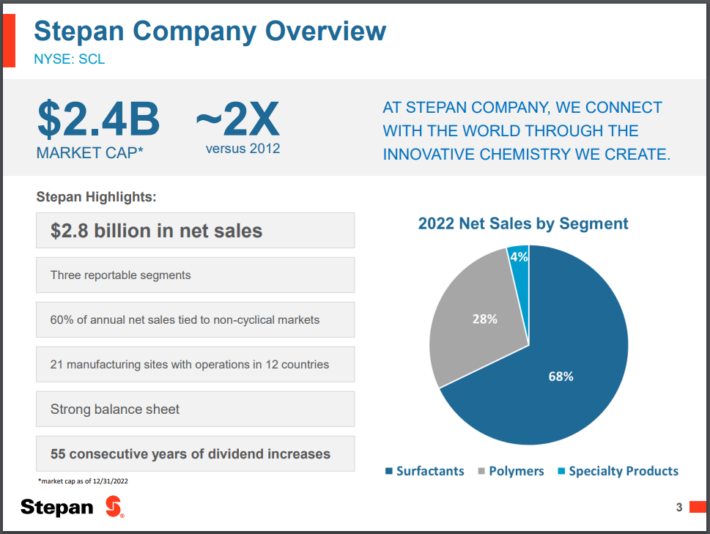

Excessive-Development Dividend Champion #1: Stepan Co. (SCL)

- 5-year dividend development charge: 15.0%

Stepan manufactures fundamental and intermediate chemical substances, together with surfactants, specialty merchandise, germicidal and material softening quaternaries, phthalic anhydride, polyurethane polyols and particular components for the meals, complement, and pharmaceutical markets.

It’s organized into three distinct enterprise traces: surfactants, polymers, and specialty merchandise. These companies serve all kinds of finish markets, which means that Stepan is just not beholden to only a handful of industries.

Supply: Investor presentation

The surfactants enterprise is Stepan’s largest by income, accounting for ~68% of complete gross sales in the latest quarter. A surfactant is an natural compound that accommodates each water-soluble and water-insoluble elements.

Stepan posted third quarter earnings on October thirtieth, 2024, and outcomes had been combined. Adjusted earnings-per-share got here in nicely forward of expectations at $1.03, which was 38 cents higher than anticipated. Income, nonetheless, was off virtually 3% year-over-year to $547 million, and missed estimates by over $30 million.

World gross sales quantity fell 1% year-over-year, as double-digit development in a number of of the corporate’s Surfactant finish markets had been totally offset by demand weak spot in Polymers.

Click on right here to obtain our most up-to-date Certain Evaluation report on SCL (preview of web page 1 of three proven under):

Last Ideas

The fantastic thing about dividend development shares is that they offer shareholders a pay elevate yearly, for doing virtually nothing. This is the reason we advocate high quality dividend development shares, such because the Dividend Champions.

To ensure that an organization to lift its dividend for at the least 25 years, it will need to have sturdy aggressive benefits, extremely worthwhile companies, and management positions of their respective industries.

Additionally they have long-term development potential and the power to navigate recessions whereas persevering with to lift their dividends.

The highest 10 Dividend Champions on this article have lengthy histories of dividend development, and the power to lift their dividends at a excessive charge going ahead.

The Dividend Champions record is just not the one method to shortly display screen for shares that usually pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].