Russia’s central financial institution bucked expectations of one other rate of interest improve and as an alternative held its benchmark fee at 21 per cent within the face of criticism from highly effective Kremlin-linked figures sad with its aggressive makes an attempt to tame inflation via greater borrowing prices.

Elvira Nabiullina, the central financial institution governor, stated the financial institution had determined to pause a collection of fee rises, regardless of widespread expectations amongst buyers and economists it could elevate borrowing prices to 23 per cent — and even greater.

The shock determination comes amid expectations of double-digit inflation and a pointy fall within the rouble’s worth, as President Vladimir Putin struggles to manage what even he has described as an “overheating” conflict economic system.

Rates of interest have risen sharply since July and are actually greater than within the speedy aftermath of Russia’s invasion of Ukraine in February 2022, prompting an more and more loud refrain of criticism from officers and oligarchs.

“Holding charges is an surprising determination for the market and, evidently, the central financial institution itself,” stated Alexandra Prokopenko, a fellow on the Carnegie Russia Eurasia Middle in Berlin. “There’s no different option to clarify it aside from the mounting political stress.”

Nabiullina’s wrestle to rein in inflation, even amid the file fee rises, highlights how policymakers have didn’t steadiness irresolvable priorities through the conflict, in line with senior Russian businessmen and economists.

“Both you’ve got monumental spending, or a secure international change fee and a market economic system,” a former senior vitality government stated. “You must sacrifice a type of. You may’t have it abruptly.”

Demand is persistently outpacing provide, and the central financial institution has a restricted toolkit past excessive rates of interest to deal with inflation amid low unemployment and weak productiveness.

Many economists forecast inflation as excessive as 10 per cent by the top of 2024, pushed by the splurge on defence spending and a corresponding growth within the client sector. The central financial institution estimates annual inflation at 9.5 per cent proper now, far past its goal of 4 per cent.

The rouble has slid about 20 per cent since summer time lows to commerce at about 103 to the greenback, hit by sanctions limiting Russia’s vitality exports and talent to transact internationally. Unemployment is hovering round simply 2.3 per cent as defence producers work in three shifts across the clock, paid by ever-growing funds spending, and the civilian sector struggles to maintain up.

The economic system was receiving “far more cash than it may well ‘digest’”, the CBR acknowledged in its newest report from early December.

The CBR’s rate of interest rises from 16 per cent in July have drawn a number of distinguished critics out into the open in latest months, together with longtime Putin associates akin to Igor Sechin, the pinnacle of oil firm Rosneft, and Sergei Chemezov, who runs defence producer Rostec. On Wednesday, Sergei Mironov, the pinnacle of a Kremlin-run opposition get together, accused Nabiullina of “sabotage” and stated her fee rises had made inflation worse.

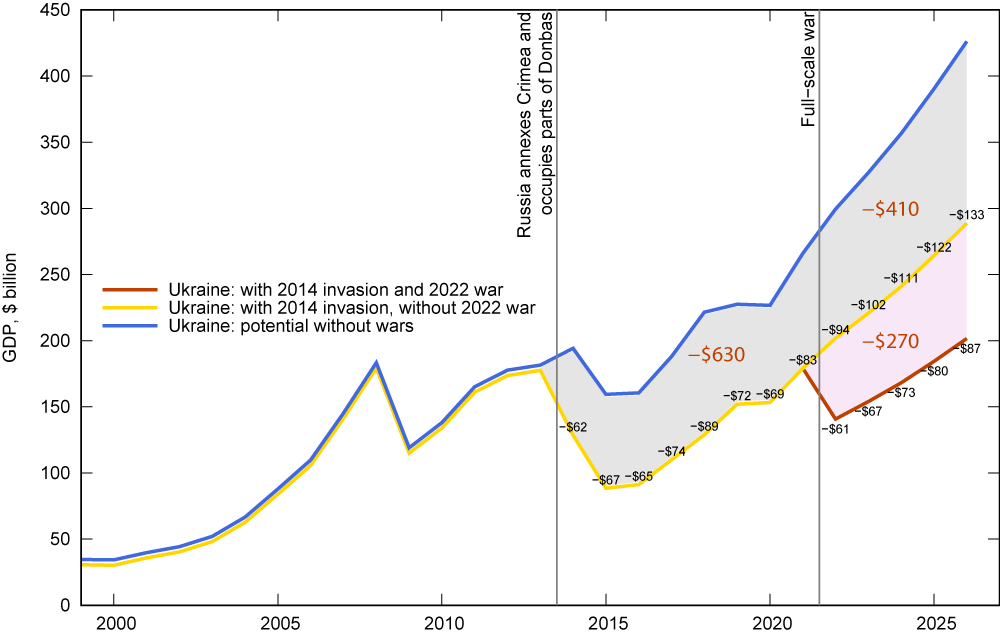

Nabiullina has steered Russia via a number of financial crises since she took over in 2013, together with the 2014 monetary disaster that adopted Putin’s annexation of Crimea and the aftermath of the 2022 full-scale invasion of Ukraine.

That has given her broad leeway from Putin, who has acknowledged the criticism however continues to again her in personal, in line with individuals who know them.

At his annual press convention on Thursday, Putin acknowledged that “inflation” and “a sure overheating of the economic system”, however stated “the federal government and the central financial institution are already tasked with bringing the tempo down”.

Rates of interest are unlikely to fall any time quickly.

Nabiullina hinted on Friday that charges may stay the place they’re within the new 12 months too, saying solely that rate-setters would “assess” borrowing prices once more on the subsequent assembly in February — an easing of its earlier steering that borrowing prices would want to rise once more.

Putin’s bravado whereas Russia maintains an higher hand on the Ukrainian battlefield masks a rising concern about how lengthy the Kremlin can maintain the conflict effort, in line with a former senior Russian official. “He can cling on for 2 or three years like this. However he is aware of the economic system can’t develop with these rates of interest. It’s a catastrophe.”

The gloomy financial outlook would possibly spur Putin to strike a deal to finish the conflict in some unspecified time in the future subsequent 12 months, they added. “He is aware of the USSR collapsed due to the arms race and financial mismanagement. He retains saying we will’t repeat the USSR errors. He must cease the conflict,” the previous senior official stated.

A number of indicators level to deep issues within the economic system that the spending growth is more and more struggling to masks, economists say.

One is wage progress for unskilled employees prompted by a hiring spree within the defence sector. Some salaries rose by as a lot as 45 per cent within the first half of this 12 months, in line with Russian classifieds website Headhunter.

“Your welder was lured over to the defence manufacturing unit for an enormous wage,” the previous senior vitality government stated. “Now both there’s no person to rent or you need to hike salaries, and the way are you going to generate income? Rates of interest are so excessive that you may’t entice cash and development grinds to a halt.”

Elina Ribakova, a senior fellow on the Peterson Institute for Worldwide Economics, stated the hiring spree was merely aiming “to throw folks on the entrance strains and to provide Kalashnikovs. That’s not productiveness progress.”

Expert employees are additionally briefly provide. Russia faces a scarcity of 1.5mn extremely expert employees, notably in development, transport and utilities, deputy prime minister Alexander Novak stated earlier this month.

The rouble’s latest slide additionally factors to how the Russian economic system is coming below better pressure as western sanctions goal Moscow in additional artistic methods.

Final month, the US blacklisted Gazprombank, Russia’s predominant conduit for vitality exports and one of many few lenders not already below western sanctions. The itemizing closed one in all Russia’s few open home windows to the worldwide economic system and the Swift fee system, forcing importers and exporters into more and more complicated and costly workarounds to transact internationally.

The economic system was “overheated as a result of big commissions for middlemen” concerned in these transactions had been rising the value of “every part”, stated an individual concerned in worldwide funds. “There’s nothing you are able to do about it, and it’s an enormous drawback for the economic system.”

Atypical Russians are those who’ve felt the best monetary pressure. Throughout the nation, the value per sq. metre of housing has soared for the reason that begin of the conflict by 30 per cent, in line with SberIndex, a knowledge set compiled by Russia’s largest state-owned financial institution.

This, mixed with hovering mortgage charges and a halt of subsidised lending, has made the dream of proudly owning a house unattainable for a lot of.

“I remorse a lot not taking out a mortgage when charges had been low. Now it appears we’ll by no means be capable of afford it — not less than not on this nation,” stated Arina, a single mom in her 30s from Moscow.

Unable to purchase a flat, Russians rushed to lease. In Moscow, renting a one-bedroom flat now requires practically 74 per cent of the town’s common wage — up from 63 per cent simply two years in the past, in line with RBC Actual Property information.

The realities of working a wartime economic system meant Nabiullina had few choices, Ribakova stated.

“She may attempt to intervene into subsidised loans for the military-industrial complicated. No person’s going to permit her to do this,” she stated. “That’s not the precedence. The precedence is stronger output progress and the military-industrial complicated, so inflation is secondary.”