Key Takeaways

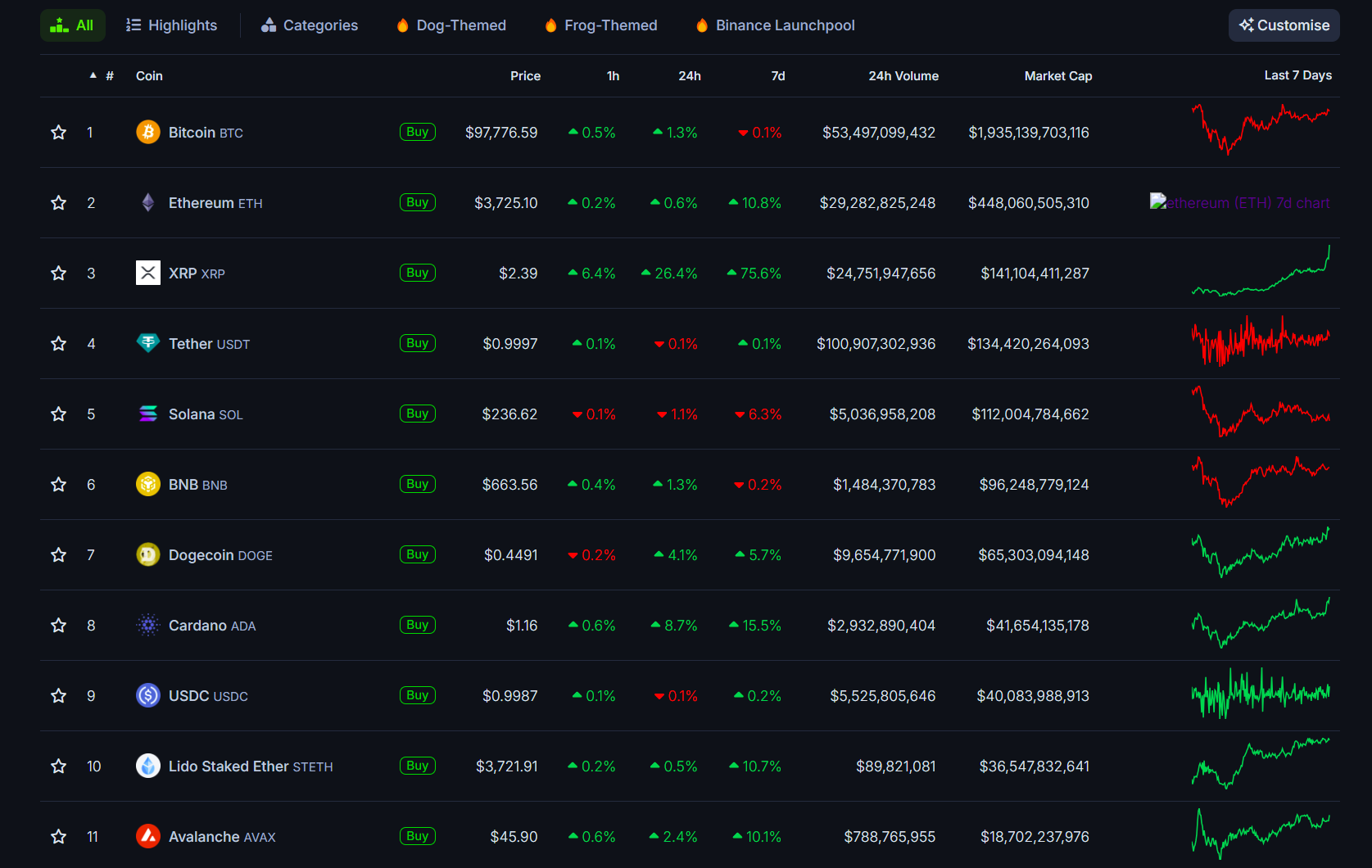

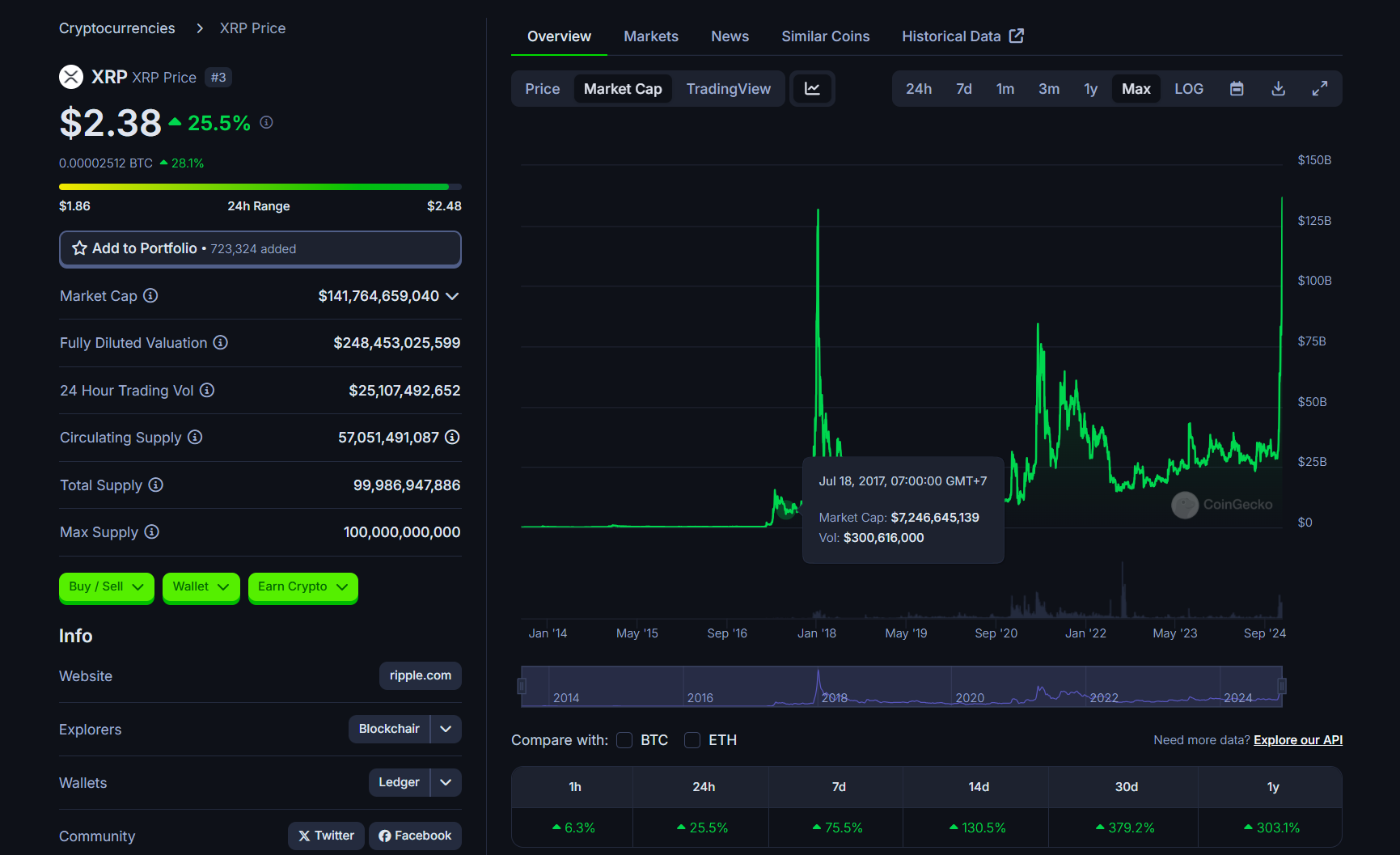

- Ripple’s XRP market cap has surged to $140 billion, inserting it because the third Most worthy crypto asset.

- The token’s rise follows constructive sentiments from political adjustments and ongoing regulatory developments.

Share this text

XRP’s market capitalization has reached a brand new all-time excessive of over $140 billion, surpassing Tether and Solana to change into the third-largest crypto asset by market worth, CoinGecko information reveals.

XRP has exploded in worth over the previous month, skyrocketing practically 400% and outpacing most main crypto property. It’s now buying and selling at round $2.3, up 26% within the final 24 hours.

The achievement brings Ripple’s native crypto nearer to its pre-SEC lawsuit glory days. The crypto asset had suffered a pointy decline following the SEC’s lawsuit in December 2020.

At the moment, XRP’s value dropped from $0.5 to $0.17, with roughly $15 billion worn out. It took nearly 4 years for XRP to reestablish its place among the many high 7 crypto property, and it’s now climbing greater.

XRP is 27% away from its all-time excessive of $3.4 set in January 2018. It now trails solely Bitcoin and Ethereum within the crypto asset rankings. Bitcoin maintains its high spot with a market cap of practically $2 trillion, whereas Ethereum follows with a $448 billion valuation.

XRP’s upward trajectory started following Donald Trump’s presidential victory, together with his pro-crypto stance boosting market sentiment. But, XRP’s main good points are probably linked to SEC Chair Gary Gensler’s resignation.

The token broke previous $1 for the primary time since November 2021 after Gensler hinted at stepping down, adopted by a 25% surge to $1.4 when he formally introduced his resignation.

Market observers view Gensler’s departure as a possible catalyst for resolving Ripple’s authorized challenges, with consultants suggesting that ongoing SEC circumstances towards crypto firms is likely to be dismissed or settled.

XRP’s value appreciation can also be supported by constructive information like Ripple’s stablecoin improvement, enterprise enlargement, and rising institutional curiosity.

Asset administration companies together with Bitwise and Canary Capital are searching for SEC approval for XRP ETFs, whereas Ripple is pursuing approval from the New York Division of Monetary Providers to launch its RLUSD stablecoin.

Share this text