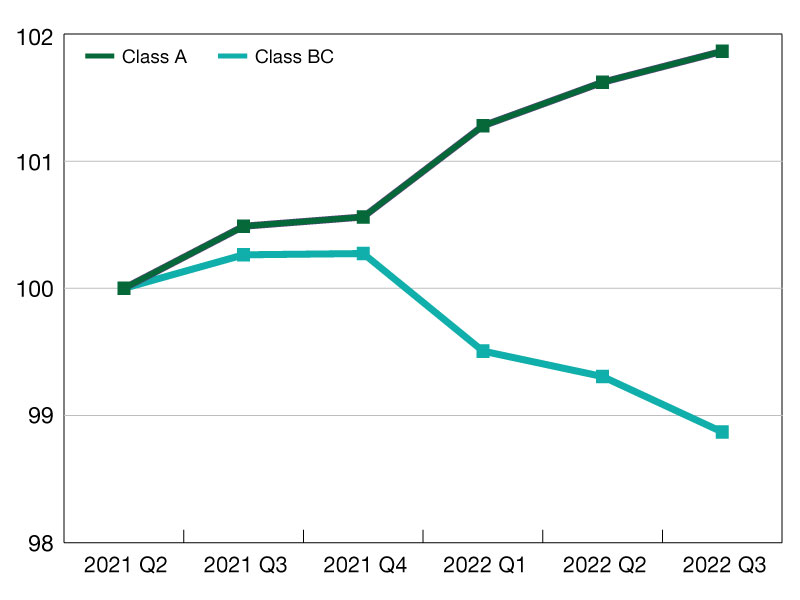

Investing.com– Qualcomm Included (NASDAQ:) is reconsidering its curiosity in pursuing a takeover of beleaguered chipmaker Intel Company (NASDAQ:), Bloomberg reported on Monday, amid issues over the complexities of a possible deal.

Studies earlier this yr recommended Qualcomm was contemplating a bid for Intel, particularly after the latter’s shares fell sharply in worth because it flagged elevated headwinds. Any potential deal would have been one of many largest tech mergers ever seen, however would have additionally been topic to excessive ranges of regulatory scrutiny.

Bloomberg reported on Monday that the complexities related to a possible acquisition had dulled Qualcomm’s curiosity in a deal.

The Bloomberg report follows a New York Occasions (NYSE:) report that the U.S. authorities had determined to chop its grant for Intel underneath the CHIPs Act to lower than $8 billion from $8.5 billion.

The minimize got here after Intel delayed plans to construct a chip facility in Ohio to the tip of the last decade from preliminary plans of 2025. The chipmaker- as soon as the most important within the world- is grappling with dwindling funds, because it lags rivals corresponding to TSMC (NYSE:) and NVIDIA Company (NASDAQ:) in capitalizing on the unreal intelligence growth.

Intel not too long ago clocked a record-high quarterly loss and mentioned it was quickly dropping money.