JHVEPhoto

Introduction

One of many attention-grabbing parts of most well-liked shares in Canada is that a few of the points (after which predominantly most well-liked fairness issued by bigger firms) have a conversion element. Inside the popular safety spectrum, you usually have two forms of most well-liked shares: Mounted fee and floating fee most well-liked shares. In Canada, even the floating fee most well-liked shares usually see most well-liked dividend charges being locked in for 5 yr stints (i.e. each 5 years the popular dividend fee will get reset, normally based mostly on a five-year authorities bond plus a mark-up). Nonetheless, in some circumstances, most well-liked shareholders get the choice to transform the five-year lock-in for a “actual” floating fee most well-liked safety with a quarterly dividend that fluctuates together with the short-term rates of interest. That’s what occurred at Enbridge, which not too long ago issued a brand new collection of most well-liked inventory with a quarterly most well-liked dividend cost based mostly on the three-month authorities bond fee.

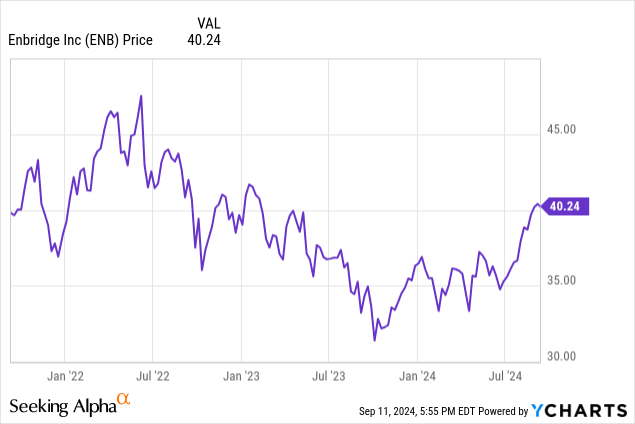

On this article I’ll deal with the newly issued Sequence 4 most well-liked shares of Enbridge (NYSE:ENB) which began buying and selling just some days in the past. From a basic perspective, nothing has modified since my earlier article was revealed in August, and I’d wish to refer you to that article to learn up on the dividend protection ratio and asset protection ratio of Enbridge’s most well-liked inventory.

Introducing the brand new Sequence 4 most well-liked shares

Firstly of August, when Enbridge introduced it wasn’t planning on redeeming its Sequence 3 most well-liked shares, it opened up the likelihood for Sequence 3 most well-liked shareholders to transform their most well-liked securities in a newly created Sequence 4 most well-liked safety. The brink to make the conversion occur was 1 million shares: If lower than 1 million of the 24 million Sequence 3 most well-liked shares needed to transform into Sequence 4, no new class can be created.

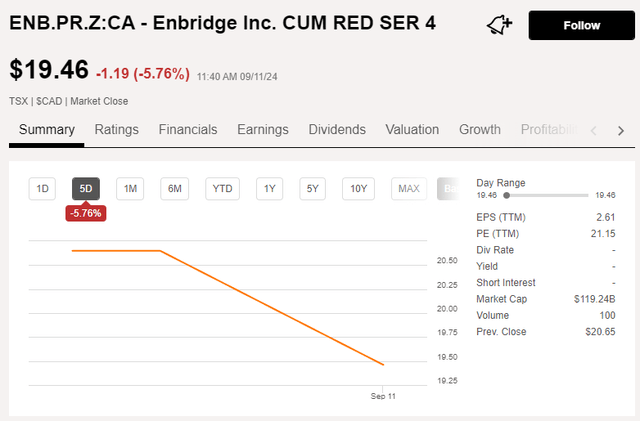

Surprisingly, the corporate obtained functions from simply over 1.5 million Sequence 3 most well-liked shares to transform the inventory into Sequence 4 most well-liked shares, in order per the phrases of the prospectus, Enbridge now has to transform these 1.5 million Sequence 3 into Sequence 4 inventory. This implies there are actually roughly 22.5M shares of the Sequence 3 excellent and roughly 1.5 million shares of the newly created Sequence 4. That new collection of most well-liked shares began buying and selling with ( TSX:ENB.PR.Z:CA) because the ticker image. Take note buying and selling volumes are at the moment fairly gentle however I anticipate the amount to select up as soon as all shares have been deposited within the respective accounts (there typically are delays). Moreover, as market contributors change into conscious of a brand new quarterly floating problem, I anticipate the curiosity within the new Sequence 4 to select up.

Looking for Alpha

The newly issued collection of most well-liked inventory is buying and selling at C$19.46, and the corporate introduced the primary floating fee dividend can be 42.206 Canadian Greenback cents per share. This represents an annualized dividend yield of roughly 6.75% per share based mostly on the par worth of the safety.

Readers are cautioned the popular dividend on the Sequence 4 most well-liked shares can be reset each quarter, based mostly on the three-month Canada Authorities Treasury invoice plus a mark-up of 238 bps.

Because the share value chart above reveals, the share value is now buying and selling at slightly below C$19.5, which implies the present yield on value is roughly 8.65% based mostly on the popular dividend for the present quarter (payable on Dec. 1).

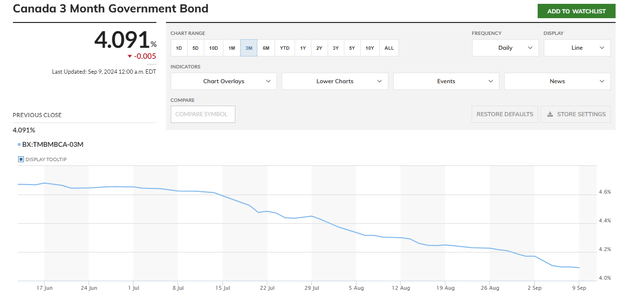

Sounds nice, however have in mind the popular dividend will fluctuate each quarter. And the three-month authorities bond yield has been steadily lowering prior to now few months (the Financial institution of Canada has been strolling down its benchmark rate of interest, and this clearly had a unfavorable impression on the short-term rates of interest on the monetary market). As you possibly can see under, the three-month yield has misplaced about 60 bps prior to now three months.

Marketwatch.com

So whereas the popular dividend for the present quarter is fairly interesting, odds are the following few quarterly dividends can be decrease. If I’d use the present three-month authorities bond fee of 4.09% and add the 238 bps mark-up, the quarterly most well-liked dividend can be C$0.404/share for a yield of 8.3%.

That’s nonetheless good. However between now and the tip of this yr there are two extra coverage rankings. A further two conferences are scheduled to be held within the first quarter of subsequent yr. So the chances of seeing not less than two extra fee cuts introduced between now and the tip of March subsequent yr is fairly practical.

So let’s assume the three-month authorities bond yield drops to three.50%. In that case, the quarterly most well-liked dividend would drop to C$0.3675 per quarter for a present yield of seven.55%.

I can even have a look at the Sequence 4 most well-liked shares from one other perspective. The Sequence 3 most well-liked shares reset to a 5.288% yield and contemplating the share value of the Sequence 3 is at the moment C$18.12 (proven under), the present yield is roughly 7.3%.

If that’s what the market likes to see for a five-year lock-in, I can now use this quantity to determine what the minimal required three-month authorities bond yield is to generate an identical return on the Sequence 4.

7.3% * C$19.46 = C$1.42 is what’s wanted to make the Sequence 4 preferreds yield 7.3%. This represents a yield of 5.68% based mostly on the C$25 principal worth, and after deducting the 238 bps mark-up, the three-month Canada authorities bond yield needs to be 3.3% (on common all through the following 5 years) for the Sequence 4 to supply the identical yield because the Sequence 3.

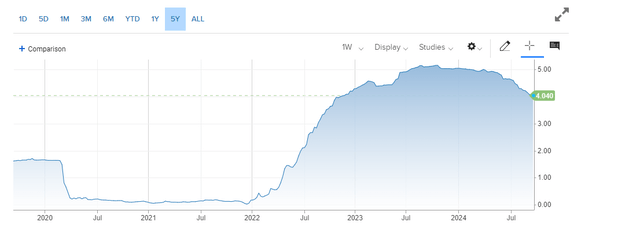

Whereas the 3M yield is at the moment 79 bps greater than the required 3.3% threshold, I wouldn’t financial institution on the present advantageous state of affairs to proceed. The query now clearly is “by how a lot will rates of interest on the monetary markets lower” and I want I had a solution.

CNBC.com

I don’t suppose we’re going again to a zero rate of interest coverage. However even earlier than the 2020 pandemic associated fee cuts occurred, the 3M Canada bond yield was buying and selling round 1.75%, through which case the yield on the Sequence 4 would drop to simply 5.3% based mostly on the present share value.

Funding thesis

Whereas the Sequence 4 most well-liked shares of Enbridge are an ideal car to take a position on the three-month Canada authorities bond yield staying “greater for longer,” I am passing on shopping for inventory on the present ranges. I’d reasonably want the visibility and certainty supplied by the Sequence 3 the place the brand new most well-liked dividend has been locked in for the following 5 years reasonably than speculating on the short-term rates of interest.

Sequence 4 may very well be a “speculative purchase” for anybody in search of publicity to those short-term rates of interest, however I am not on the present value ranges. Maybe I’ll have one other look after we are nearing the tip of the tip of the speed minimize cycle.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.