krblokhin

AMZN inventory: earlier thesis and new developments

I final wrote on Amazon inventory (NASDAQ:AMZN) a bit greater than a month in the past, shortly after the discharge of its Q2 earnings report (“ER”). As you possibly can see from the screenshot beneath, that article was titled “Amazon Q2: Be Grasping When Others Are Fearful”. Because the title already gave away, the article was a evaluation of its ER and argued for a purchase ranking amid the selloff following its ER. Quote:

The market’s concern over a possible AI bubble actually has good causes. Nonetheless, the concern is overblown within the case of Amazon.com, Inc. judging by its Q2 outcomes. In Q2, Amazon continued to indicate the prevalence of its e-commerce, well-balanced income sources, and differentiating providers/merchandise. The latest selloff has supplied a large margin of security to purchase Amazon shares.

In search of Alpha

Since that writing, in addition to the inventory value modifications (greater than 14%), there have been just a few new developments surrounding the corporate. An important one in my opinion was the strategic partnership AMZN and Oracle (NYSE:ORCL) collectively introduced just a few days in the past. Extra particularly,

Oracle and Amazon Internet Providers, Inc. (AWS) introduced on September 9, 2024, the launch of Oracle Database@AWS, a brand new providing that permits clients to entry Oracle Autonomous Database on devoted infrastructure and Oracle Exadata Database Service inside AWS. Oracle Database@AWS will present clients with a unified expertise between Oracle Cloud Infrastructure (OCI) and AWS, providing simplified database administration, billing, and unified buyer assist. As well as, clients can have the power to seamlessly join enterprise knowledge of their Oracle Database to functions working on Amazon Elastic Compute Cloud (Amazon EC2), AWS Analytics providers, or AWS’s superior synthetic intelligence (AI) and machine studying (ML) providers, together with Amazon Bedrock.

Within the the rest of this text, I’ll argue that this partnership highlights the management place of AWS within the burgeoning cloud house, a place that permits AMZN to not solely develop its EPS at a fast tempo however extra importantly additionally to broaden its revenue margins significantly.

AMZN inventory: EPS progress outlook

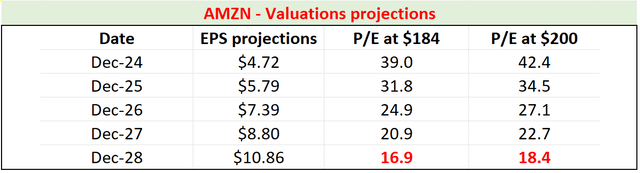

First, let’s take a look at EPS progress potential. As you possibly can see from the next consensus estimates, the market expects its EPS to quickly develop from $4.72 in FY 2024 to $10.86 in 5 years. Such progress interprets into an annual progress price of over 18% CAGR.

Due to its AWS (along with different catalysts as to be detailed later), I contemplate such a projection extremely believable. In latest quarters, ASW section income has been rising at comparable charges. AWS has maintained its market-leading share, because of customized silicon options, extremely sought developer providers (led by Sagemaker), AI and machine studying capabilities, giant partnerships, and trusted safety. The above partnership with ORCL simply added one other testomony – a really sizable one – to those strategic strengths.

Additionally notice that below this progress state of affairs, the implied P/E ratio could be solely about 16.9x in 5 years on the present inventory costs ($184 as of this writing). Even at its 52-week peak value of round $200, the implied P/E continues to be solely about 18.4x. Lastly, I don’t suggest traders rely solely on accounting P/E ratios for the analysis of high-growth firms. These firms make investments closely in progress CAPEX and thus their true proprietor’s earnings are far greater than the accounting EPS.

Subsequent, I’ll argue that such EPS progress and P/E multiples understate the attractiveness of inventory as they don’t mirror the advance within the QUALITY of its earnings.

Supply: writer based mostly on In search of Alpha knowledge.

AMZN inventory: margin growth potential

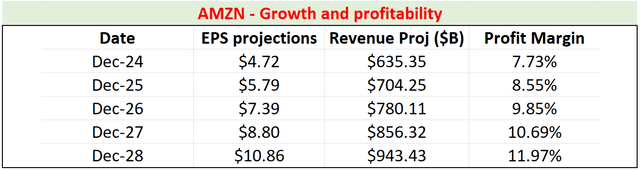

The following chart exhibits the consensus estimates for its topline progress. As seen, the market expects the revenues to develop from $635 billion in FY 2024 to $943 billion in FY 2028, translating into an annual progress price of 8.2% CAGR within the subsequent 5 years. That is considerably beneath the above-projected progress price for its EPS. The discrepancy implies that the margin is prone to broaden considerably. Certainly, below the idea of a set variety of excellent shares (taken to be 10.2 billion shares), I estimated the revenue margin implied by the consensus EPS and income forecasts. As seen within the final column, its revenue margin is projected to broaden from 7.73% to nearly 12% within the subsequent 5 years.

Supply: writer based mostly on In search of Alpha knowledge.

Just like my view on the EPS progress curve, I contemplate the margin growth to be additionally believable. To higher contextualize issues, the next chart exhibits its quarterly revenue margin over the long run. As seen, the corporate has change into worthwhile (in accounting phrases) round 2015~2016. Since then, its revenue margin has been on an total increasing pattern apart from the transient disruption by the pandemic. Presently, the revenue margin is about 9.11% as of the most recent quarterly, nearly totally recovered to the pre-pandemic stage.

Dissecting the info a bit nearer, the margin for its AWS section is much above the company-wide stage. My estimate for its AWS margin is above 35% for FY 2024 (and about 4.5% for its retail section, extra on this later). Given the AWS acceleration and AI alternative as highlighted by the ORCL partnership, I actually count on an rising function of AWS in its future revenue combine and consequently a better aggregated margin for the entire firm.

In search of Alpha

Different dangers and last ideas

By way of draw back dangers, the retail enterprise continues to face progress and profitability uncertainties in my opinion. In distinction to the fast progress of the AWS enterprise, I see extra demand points (i.e. slower client spending) which may overshadow the retail section. Though the corporate has invested closely to enhance its retail operations’ effectivity and profitability lately. These efforts have boosted profitability markedly and its retail working margins climbed to round 5.0% in latest quarters. Going ahead, I count on the corporate to maintain investing within the retail aspect to broaden its providers (reminiscent of same-day supply) and enhance operations, particularly abroad. I’m optimistic that these investments to bear fruit in the long run, however they might create drags for near-term profitability.

All advised, my verdict is that the positives far outweigh the negatives below the present circumstances. The highest constructive on my record is the potential for AWS acceleration and AI alternatives, as accentuated by the not too long ago introduced ORCL-AWS partnership. I count on these catalysts to not solely drive fast earnings progress but in addition enhance margins significantly within the subsequent few years.