Key Takeaways

- Frax Finance is an on-chain protocol that mints and manages the FRAX stablecoin.

- FRAX maintains its peg via a twin collateral-backed and algorithmic mechanism, making it extra scalable and capital environment friendly than overcollateralized stablecoins.

- Frax additionally makes use of Algorithmic Market Operations to generate income and make sure the protocol is safer and strong.

Share this text

Frax Finance is a decentralized protocol that may be regarded as a completely autonomous, on-chain central financial institution issuing and controlling the financial coverage of a fractional-algorithmic stablecoin known as FRAX. Discovered within the candy spot between fully-collateralized and uncollateralized stablecoins, FRAX is the primary decentralized stablecoin that makes use of a dynamically adjusting collateral ratio to efficiently preserve peg stability.

The Present Stablecoin Panorama

Frax is a decentralized, totally autonomous on-chain protocol managing a flagship fractional-algorithmic stablecoin that’s backed partly by exterior and partly by internally-generated collateral.

To know Frax’s worth proposition and its standing amongst different stablecoins, it’s first essential to summarize the present stablecoin panorama. For the uninitiated, stablecoins are crypto-assets pegged, in a method or one other, to a specific fiat foreign money—usually the U.S. greenback. Extra broadly, they are often categorized into two sorts: centralized and decentralized. Centralized stablecoins symbolize fully-backed, fiat-collateralized digital property issued and managed by centralized firms or custodians. These embody Tether’s USDT, Circle’s USDC, and Binance’s BUSD and occupy by far the largest market share.

Centralized stablecoins are the only of the asset class. Centralized issuers mint them in alternate for {dollars} and redeem them to obtain {dollars} again at an alternate ratio of one-to-one. This implies the issuers have to be trusted to at all times have an equal or better provide of {dollars} or different highly-liquid, low-risk property like industrial paper or treasuries on their steadiness sheets to honor these redemptions. Whereas the market typically deems them safer, centralized stablecoins nonetheless carry appreciable custodial and censorship dangers.

Decentralized stablecoins, alternatively, usually fall into two classes: over-collateralized and non-collateralized. Probably the most notable instance of the previous is the Maker protocol, which permits customers to mint the DAI stablecoin by locking exterior crypto collateral in good contracts as collateralized debt positions. The CDPs have to be over-collateralized, which means the whole property locked in Maker should at all times exceed the mixture worth of DAI’s circulating provide. Whereas this makes DAI comparatively protected and dependable when it comes to peg resilience, it additionally makes it capital-inefficient and troublesome to scale as it could solely develop with the demand for leverage.

There have been many makes an attempt to create extra scalable and capital-efficient stablecoins, however by far probably the most notable is Terraform Labs’ not too long ago collapsed UST. Earlier than it finally failed, UST was briefly the third-largest stablecoin available on the market, with a capitalization of round $18.6 billion at its highs. As a non-collateralized or “algorithmic” stablecoin, UST maintained value stability via an arbitrage swapping course of with Terra’s native governance token, LUNA. When UST traded under $1, arbitrageurs may burn it for $1 value of LUNA to revenue on the distinction. Likewise, when it traded above $1, arbitrageurs may mint it utilizing $1 value of LUNA after which promote it on the open marketplace for revenue, growing its provide and finally bringing its value again to its desired peg.

Regardless of its non permanent success, UST finally imploded in a catastrophic $40 billion demise spiral occasion that introduced Terra’s total ecosystem down with it. Attributable to being fully depending on internally-generated LUNA collateral, the system proved gravely weak to the chance of a financial institution run. Finally, it ended up in the identical graveyard as all beforehand tried-and-failed algorithmic stablecoin experiments.

Nonetheless, between over-collateralized stablecoins like DAI and non-collateralized or totally algorithmic stablecoins like UST, there appears to be a candy spot that leverages the strengths of each programs whereas minimizing their faults. Crypto Briefing linked with Frax Finance founder Sam Kazemian to be taught extra concerning the protocol, and he mentioned that that is exactly the area FRAX has been occupying for the final 16 months because it launched in December 2020. “I feel we have now the perfect of each worlds and that lots of people are realizing that,” he defined. “I additionally assume that FRAX is a extremely massive innovation; we appear to have developed a extra capital environment friendly however simply as protected stablecoin as Maker. To this point, we’re the one ones left standing alongside them.”

Frax Finance Defined

Frax Finance is a permissionless, open-source, and fully on-chain stablecoin protocol that gives and autonomously manages a extremely scalable decentralized stablecoin known as FRAX. The identify FRAX is an abbreviation of “fractional-algorithmic,” which describes the mechanism the protocol leverages to take care of its peg to the U.S. greenback.

Fractional-algorithmic signifies that a fraction of the stablecoin is backed by exterior collateral—primarily USDC—and half is algorithmically backed with the protocol’s native governance token FXS, which accrues charges, seigniorage income, and income from the protocol’s open market operations. The protocol decides the exact ratio between the exterior and inside backing utilizing a PID controller, which adjusts the collateral ratio based mostly on demand for the FRAX stablecoin and exterior market circumstances. Whereas that will sound difficult, the logic behind the mechanism is de facto fairly easy.

Utilizing the PID Controller, the protocol autonomously adjusts the exterior to inside collateral ratio essential to mint or redeem FRAX based mostly on direct data from the market. Throughout sustained durations of FRAX growth, the protocol lowers the collateral ratio in order that much less exterior collateral and extra FXS are wanted to mint or redeem the stablecoin. The reasoning is that in expansionary durations, the market successfully indicators belief within the inside collateral backing FRAX, indicating to the protocol that it ought to decrease the collateral ratio to accommodate this perception and higher facilitate progress.

Extra particularly, the protocol lowers the collateral ratio in order that much less USDC and extra FXS again FRAX each time its value exceeds the focused peg of $1. Conversely, when FRAX falls under $1, the protocol raises the collateral ratio to extend market confidence in FRAX by growing its backing from an exterior or “extra sound” supply. To maintain issues clear, the collateral ratio is at all times explicitly proven on Frax Finance’s entrance web page. As an example, at press time, the collateral ratio is 89.50%, which means that minting 100 FRAX requires depositing 89.5 USDC and burning $10.5 value of FXS.

To color a clearer image, a collateral ratio of 0% would imply that the market fully trusts the inner FXS backing and has no want to redeem FRAX for the rest. A 100% ratio would imply that the market has no religion within the inside collateral and prefers that FRAX be totally backed by sounder or extra trusted collateral like USDC.

The power to dynamically modify the collateral ratio based mostly on real-time market circumstances offers Frax a big benefit in scalability and capital effectivity over a protocol like Maker, which has a hard and fast collateralization ratio of 150% for risky property like Ethereum. Increasing extra on this distinctive characteristic of FRAX, Kazemian introduced up an fascinating level about what is supposed by “capital effectivity”:

“Normally, it means […] minting or buying the stablecoin is less complicated. There are extra methods for it to come back into existence than simply overcollateralized loans. One of many essential and solely methods to mint DAI, aside from depositing USDC, is to place much more Ethereum to mint it. With Frax, you may ship a greenback value of Ethereum into its protocol-controlled liquidity pool and get a greenback’s value of FRAX.”

“In Maker,” Kazemian highlighted, “DAI is debt of the customers—not the protocol.” In distinction, in a fractional reserve system like Frax, FRAX is debt of the protocol as a result of it’s the protocol that has to honor redemptions by ensuring it at all times has sufficient collateral. “Within the over-collateralized mannequin, the one strategy to create stablecoins is by customers taking out loans or going into debt—versus the fractional mannequin the place the protocol can simply print cash just like the Fed,” he defined.

The opposite important factor of Frax’s capital effectivity benefit, based on Kazemian, is that the protocol is rather more worthwhile exactly as a result of it could print cash. Increasing on this level, he mentioned:

“Frax has an annual income of about $150 million even with a $2.6 billion provide, whereas Maker has a considerably better provide however has an annual income of about $80 million. Clearly, FRAX is riskier than DAI—that’s one of many essential drawbacks whenever you print cash. In Fed’s case, there’s inflation, whereas in our case, there’s the chance of breaking the peg, nevertheless it’s additionally extra worthwhile.”

Talking of dangers to peg stability, one of many essential methods stablecoin protocols typically make sure the robustness of their peg is by securing deep liquidity for his or her stablecoin on numerous decentralized exchanges throughout DeFi. Understanding this very early on, Frax put in a number of totally different mechanisms to assist it supply and safe liquidity throughout decentralized exchanges as effectively as attainable.

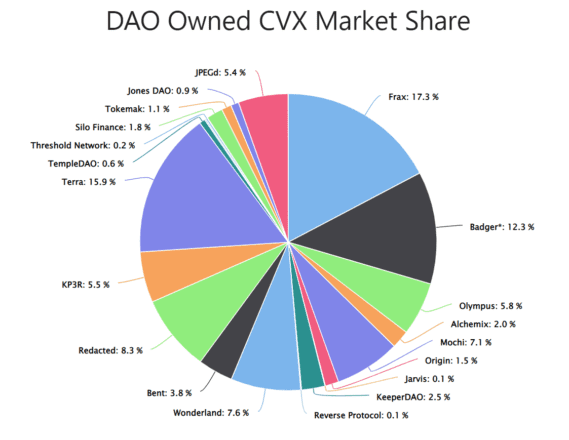

As an example, Frax is the largest holder of Convex’s CVX governance token, holding roughly 16.7% of the token’s provide at press time. This offers it substantial governance energy over Convex, which in flip is a proxy for controlling CRV rewards on the biggest decentralized alternate for stablecoins, Curve. This permits Frax to inexpensively incentivize liquidity provisioning for the FRAX3CRV liquidity pool, which holds roughly $1.46 billion in liquidity, permitting extremely environment friendly buying and selling between FRAX and DAI, USDC, and USDT.

By means of partnering with OlympusDAO, Frax has additionally acquired and controls a portion of its liquidity, which means it doesn’t need to pay out excessive incentives secured via dilution of its personal governance token to lease liquidity from third-party mercenary liquidity suppliers. On prime of that, via its so-called Liquidity AMO, Frax can put idle collateral to work by offering liquidity on Uniswap V3. It could additionally autonomously enter any place on Uniswap and mint FRAX in opposition to it, concurrently securing deep liquidity and producing income from buying and selling charges.

Algorithmic Market Operations

In early This autumn 2021, Frax expanded on the thought of turning into a decentralized central financial institution by launching Algorithmic Market Operations controllers. These “AMOs” symbolize good contracts that algorithmically execute totally different open market operations to generate income and make sure the protocol is safer and strong by placing its collateral to work.

Since Frax controls a big quantity of exterior collateral from FRAX minting, the AMOs generate substantial revenue for the protocol, which finally accrues to the FXS holders via buybacks and token burns. Every AMO, which Frax describes as a “central financial institution cash lego,” has 4 properties:

- Decollateralize: actions that decrease the collateral ratio

- Market Operations: actions that run in equilibrium and don’t change the collateral ratio

- Recollateralize: actions that enhance the collateral ratio

- FXS1559: formalized accounting of the steadiness sheet of the AMO that defines precisely how a lot FXS will be purchased and burned with income above the focused collateral ratio.

To this point, Frax has deployed 4 AMOs: Investor, Curve, Lending, and Liquidity.

To generate yield, the Investor AMO deploys the protocol’s collateral to battle-tested yield aggregator protocols and cash markets like Yearn, Aave, Compound, and OlympusDAO. This AMO by no means allocates funds to methods or vaults which have ready durations for withdrawals, in order that it could pull the collateral at any time to honor FRAX redemptions.

The Curve AMO deploys idle USDC and newly minted FRAX into the FRAX3CRV pool on the Curve alternate. In addition to incomes revenues from buying and selling, admin charges, and CRV incentives (which Frax can management via its substantial Convex holdings), this AMO additionally helps the protocol deepen FRAX liquidity to fortify its peg.

The Lending AMO mints FRAX straight into swimming pools on cash markets like Compound and CREAM, permitting customers to amass it via over-collateralized borrowing as an alternative of the usual minting mechanism. In addition to incomes revenues via the curiosity funds on the loans, this AMO makes FRAX extra accessible to customers, who can now mint it by posting collateral as they’d when minting DAI on Maker.

Lastly, the Liquidity AMO places FRAX and a part of the protocol’s collateral to work by offering liquidity in opposition to different stablecoins on Uniswap V3 to earn income from buying and selling charges and additional deepen FRAX’s liquidity. This AMO can enter any place on the alternate and mint FRAX in opposition to it, which means the protocol can develop its provide in a really capital environment friendly method. This offers customers the flexibility to amass FRAX on Uniswap in alternate for Ethereum, wBTC, or different stablecoins.

Closing Ideas

Whereas the Terra blow-up might have given all algorithmic, together with fractional-algorithmic stablecoins a nasty identify, it’s value noting that—regardless of sharing sure similarities—not all stablecoins are created equal. With this in thoughts, it’s value noting that since launching over 16 months in the past, FRAX’s value has remained reliably steady, with no extreme deviations past 1% of its focused peg. This means that its distinctive collateralization mechanism seems to be strong sufficient to face up to vital systemic shocks just like the Terra collapse.

With that mentioned, Frax is definitely not with out its faults. Its overreliance on USDC is one: relying an excessive amount of on a centralized stablecoin to mint and again a “decentralized” one is just not probably the most fascinating mannequin for any protocol that strives to be actually decentralized and censorship-resistant.

“Frax does endure from [overreliance on USDC,] transparently,” Kazemian admits, underscoring that nobody in crypto has discovered a “holy grail decentralized resolution with no connection to fiat cash.” At present, Frax has about 40% publicity to USDC, whereas Maker has about 60%, which Kazemian admits is rather a lot for each. Nonetheless, it’s additionally essential—at the least for now—to make sure enough stability for each stablecoins. “We’ll solely diversify out of fiat cash if there’s a transparent regulatory motive to try this—we received’t do it for enjoyable and depeg like Terra,” he harassed.

All issues thought of, Frax employs a easy and stylish resolution that appears to strike the right steadiness in stablecoin design: a protocol that’s decentralized and scalable whereas additionally being sufficiently safe and dependable.

Disclosure: On the time of writing, the writer of this piece owned ETH and several other different cryptocurrencies.