marinzolich/iStock through Getty Photos

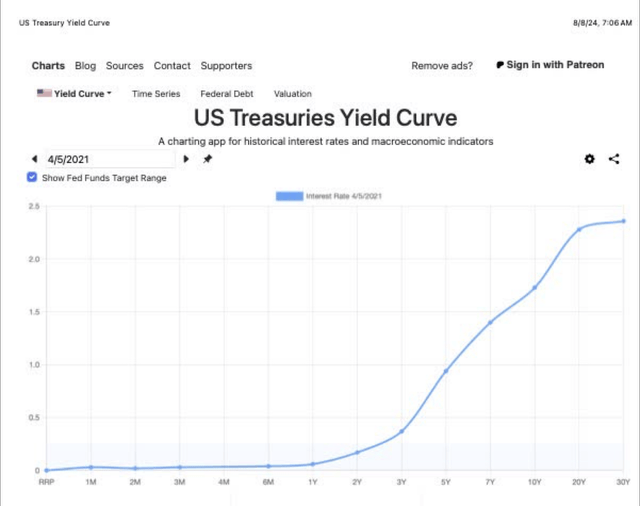

AGNC Funding Corp. (NASDAQ:AGNC) reported its 2nd quarter outcomes, saying anticipated numbers amidst the bouncing and noisy monetary markets. Within the report, the corporate famous that NAV, web asset worth, dropped as soon as once more from the virtually predictable noise skilled throughout the quarter, falling from $8.85 to $8.40. Clearly, the bond markets have not been secure within the final three years, experiencing extra excessive noise from inflation signaling excessive charges than adopted by weak spot signaling decrease charges. Up to now a number of quarters, with the sort of announcement, the inventory value would even have plummeted. It did not. This continues our protection of AGNC, the final being, AGNC’s Q1 Earnings Mannequin Suggests A Protected Dividend Going Ahead. Asking of why appears apparent, but extra element is so as. The market is predicting future positives, supporting the worth even with uncertainty. Lets go discover extra?

The Market Revisited

In our article, Defending AGNC’s Dividend, we included a brief watch checklist of parameters administration considers important in figuring out efficiency. On this article, we revisit the checklist, together with up to date numbers.

- Yield curve.

- Company MBS spreads.

- Bloomberg Lengthy Treasury Bond Index.

- Extremely rated company debt.

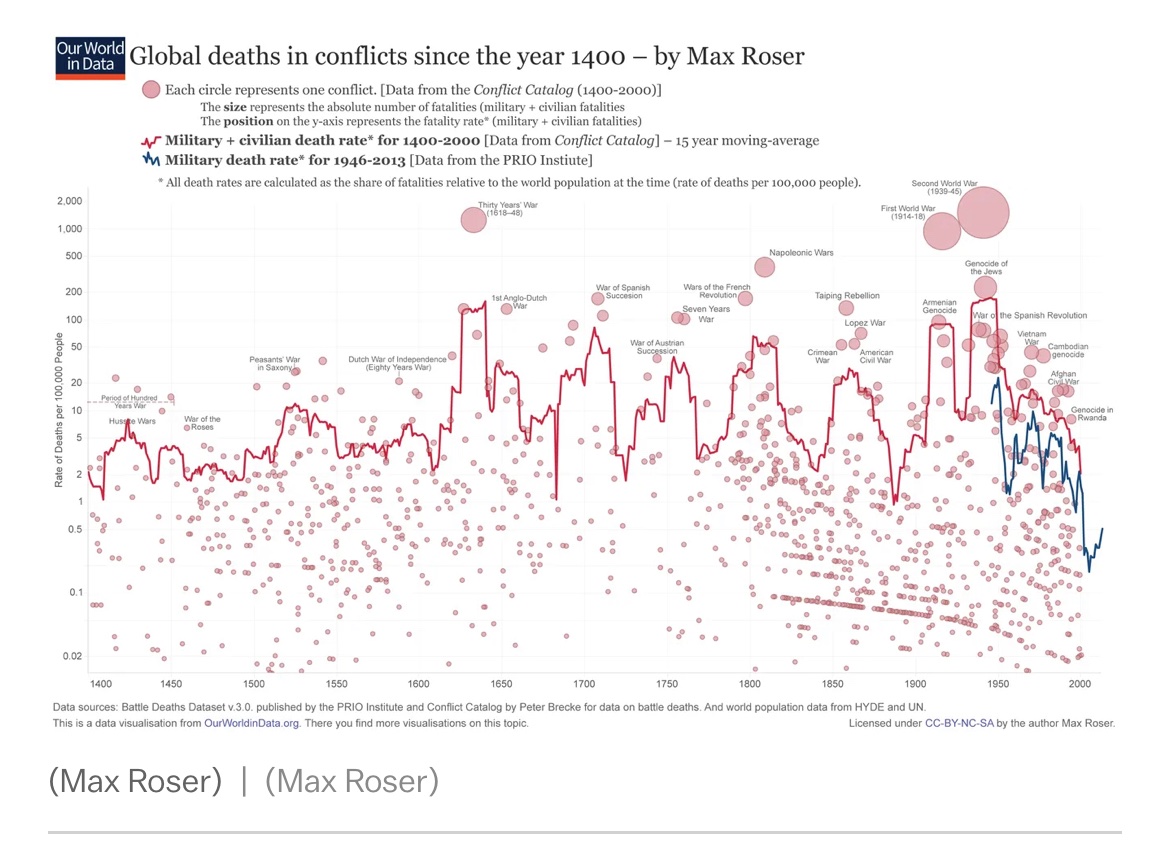

We start with the US Treasury Curve graph. The primary is probably the most present.

US Treasury

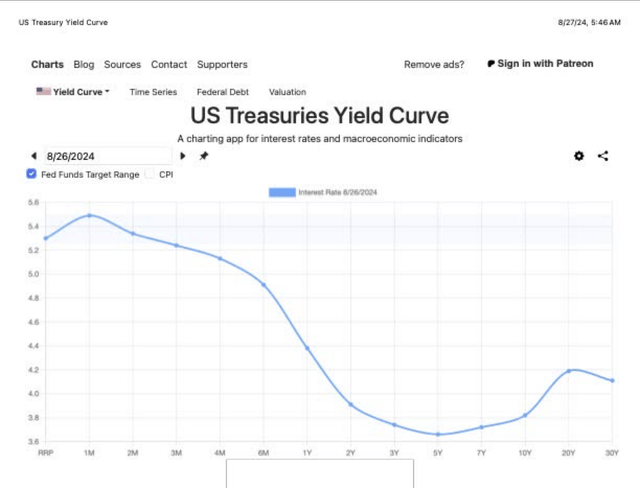

The second is the curve created in December.

US Treasury

As compared, the center of the curve elevated, however the basic form stays the identical.

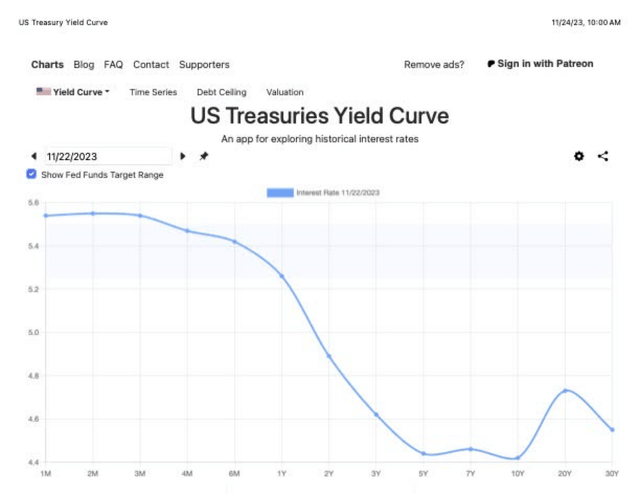

For comparability, an instance of the curve profile shortly earlier than the rate of interest hikes started follows.

US Treasury

It’s clear that charge cuts results have not but appeared, however modifications are coming.

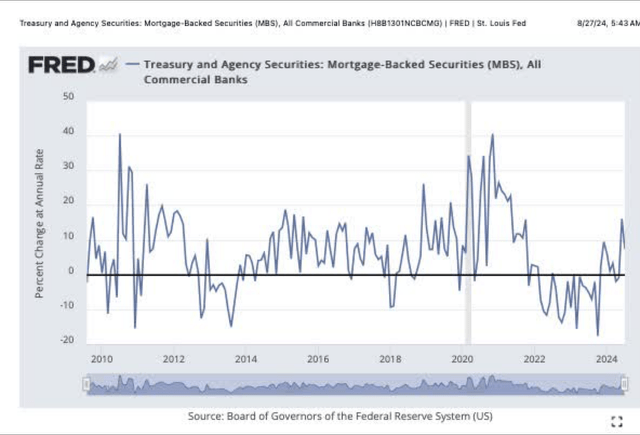

Subsequent is a graph of Company MBS.

FRED

Discover the bullish constructive separation showing. Many of the change occurred after the June quarter. We ask, will this bullish stance flip the greenback roll earnings round? In time, we will know.

From our article, “For individuals who have entry to Bloomberg’s Lengthy Treasury Bond Index, this hyperlink opens a graph.” The image is LUTLTRUU:IND. The present worth equals 3,408.”

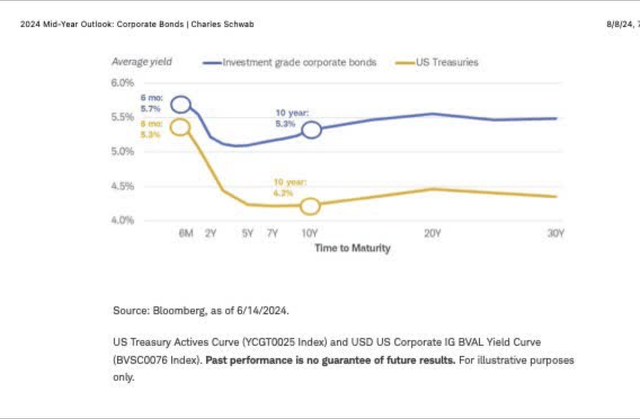

Lastly, a graph from Schwab of Funding Grade Corp. Bonds follows.

Schwab

For evaluating this to our former chart, we embrace the graph from Schwab of Funding Grade Corp. Bonds posted prior.

Schwab

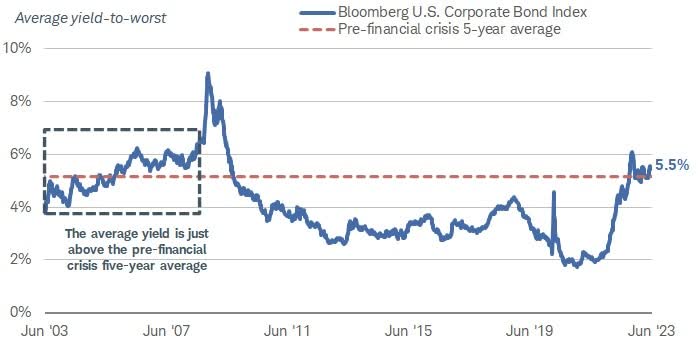

The yields stay within the 5.5% vary unchanged. The revisited market reveals buyers that crucial efficiency figuring out parameters are actually within the very early stage of restore, specifically the actual constructive enchancment within the MBS worth. The treasure curve stays comparatively unchanged.

The Future

Now, a glance ahead into the way forward for rates of interest is greater than so as. From Reuters,

“The August 2024 SOFR futures have factored within the chance that the Fed will reduce rates of interest by a minimum of 25 foundation factors (BPS) this month. The September futures, however, have priced in a 100% likelihood of a minimum of a 50-bps charge discount.

A weak jobs report and different indicators, manufacturing index, (ISM) turned unfavorable in June, printing a 46 in July.

The current feedback of Fed Chairman, Jerome Powell at Jackson Gap, By confirmed the change in posture; decrease charges are coming.

The Outcomes

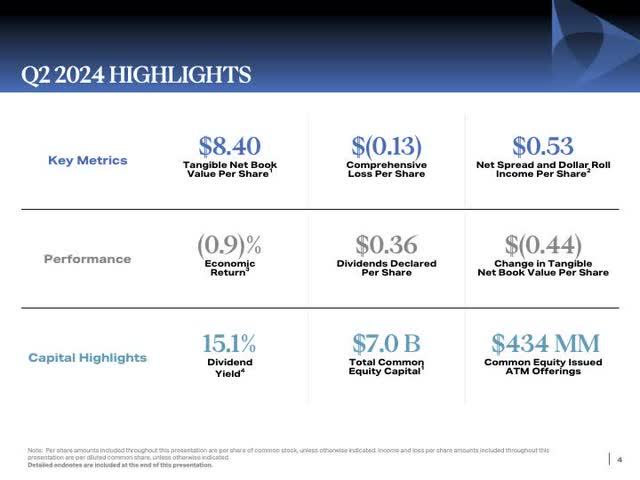

The outcomes for the quarter together with a a number of quarter summaries are proven within the subsequent few slides, first the quarter.

AGNC 2nd Quarter

Subsequent, the historical past slide follows.

AGNC 2nd Quarter

Discover the continued downward drift within the Web Unfold and TBA Greenback Roll. We had been anticipating this drop for a interval with the weak Company MBS vs. Treasuries chart included above. That chart began to perk up within the final a number of weeks in anticipation of a September charge reduce. Administration famous,

“Web unfold and greenback roll earnings for the quarter remained nicely above our dividend at $0.53 per share. The $0.05 per share decline for the quarter was because of a lower in our web rate of interest unfold of roughly 30 foundation factors to simply beneath 270 foundation factors for the quarter, as increased swap prices greater than offset the rise within the common yield on our asset portfolio.”

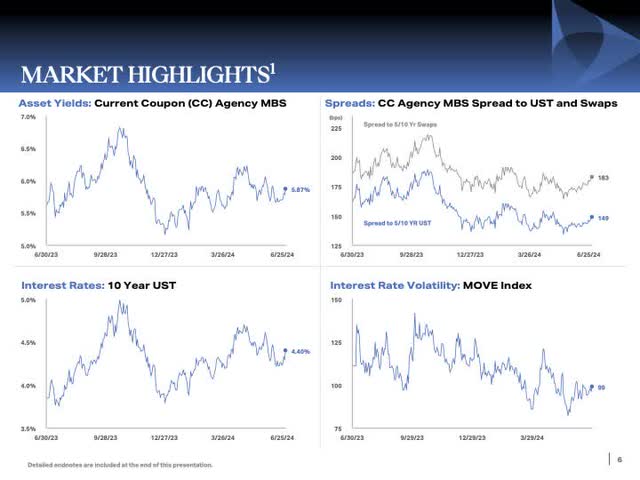

The following slide illustrates for buyers some key parameter traits for the final a number of quarters.

AGNC 2nd Quarter

Within the decrease proper, the corporate included a chart of the MOVE Index, the VIX for bonds. Of significance to AGNC, this index is slowly trending decrease, a path which is extremely essential to the efficiency of the corporate. Risky bond actions grant administration migraines in trying to handle the enterprise.

Administration additionally offered extra inventory. Of this promote, administration commented,

“Lastly, within the second quarter, we issued $434 million of frequent fairness via our aftermarket providing program. Our capital administration framework supplies us the flexibility to opportunistically create incremental worth for present stockholders via e-book worth and earnings accretion. Within the second quarter, we issued inventory at a considerable price-to-book premium and invested these proceeds in attractively priced belongings.”

This bothers us deeply, to be trustworthy, and is one thing we proceed to observe. Is the corporate promoting inventory in actuality to pay the dividend?

Dividend

We proceed with the at all times important dialogue on the dividend. An announcement just like this appears to look in each name. When requested by Douglas Harter of UBS, Peter Federico, CEO, answered,

“From a complete value of capital, for instance, while you take the price of our frequent dividend, for instance, within the second quarter, the price of our most popular dividend and our working prices annualized these, as I did and divide it by our whole capital place, you may get a quantity one thing round 16.3% or, name it, 16.5%. In order that’s the quantity of return that we have to earn to cowl all of these prices in our enterprise. Should you evaluate that to what are the economics of our enterprise at present valuation ranges. . .. I believe our dividend and our whole value of capital are fairly nicely aligned with the economics of the place mortgage-backed securities are leveraged and hedged the way in which we had them and leverage them at this time.”

Administration made it clear that the dividend is not in danger anytime quickly.

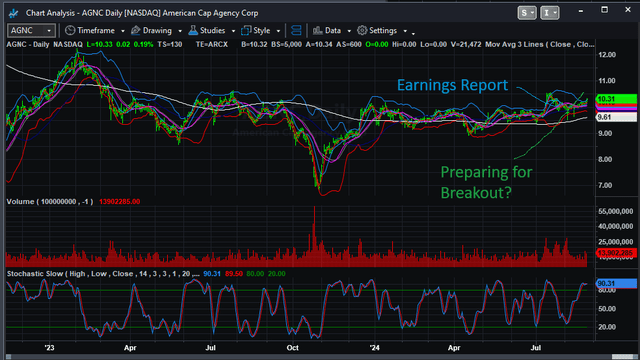

The Chart

Subsequent, we embrace a chart from TradeStation Securities of AGNC.

TradeStation Securities

The quarter announcement, labeled within the chart reveals, how benign the worth motion was on the next day. This can be a divergence from the previous. It’s concerning the future. The FRED chart proven above illustrates a change to a extra constructive earnings energy is turning into. Additionally, with decrease charges, the corporate can begin to buy extra interest-bearing securities from each money readily available $5 billion plus and thru reducing the leverage. The market senses this and is reacting positively.

Threat

The primary threat appears to be at all times concerning the financial system. Is a recession coming, or is it right here? JPMorgan Chase CEO Jamie Dimon mentioned he nonetheless believes that the chances of a “gentle touchdown” for the U.S. financial system are round 35% to 40%, making recession the almost certainly state of affairs in his thoughts. One other threat, rebalancing short-term entities, can be a money drain. On this topic, Federico added,

“Now what’s essential to level out, what that does not embrace once I try this calculation, it does not embrace the price of ongoing rebalancing, which might be a drag. In order that’s one thing you need to think about over time. However on the identical time, what it additionally doesn’t embrace is the constructive profit we get, which is about 2%, for instance, on our most popular inventory place. So, it is not probably the most full measure, however it’s actually a very good indication.”

On the corporate’s coverage of continuous to promote inventory, a follow we aren’t in favor of, we may promote our lion’s share after charge cuts start within the $12 area. However till then, we proceed our purchase ranking, with the mannequin producing returns to help the dividend. We, additionally, perceive that the dividend shall be paid regardless, a follow that helps the worth. The market strongly senses constructive modifications going ahead and acts accordingly.