Kamala Harris introduced her plan for the economic system, which incorporates many incentives and disincentives for the actual property trade. Lots of her factors are really designed to stimulate the actual property trade, which may benefit traders (though trigger some unintended penalties as well). For others, we’re within the crosshairs.

Let’s take a take a look at every one individually and the way they’ll have an effect on the economic system, significantly the actual property trade. We’ll ignore proposals that don’t relate to actual property—for instance, a “price-gouging ban” or limiting taxes on ideas—and simply deal with our trade.

Serving to First-Time Homebuyers

Harris’s plan is to supply “…first-time homebuyers with $25,000 to assist with the down fee on a brand new residence.” This could be probably the most important down fee help the federal government has ever provided and dwarves the $8,000 First-Time Homebuyer Tax Credit score that was in place between 2008 and 2010. That additionally occurred whereas we had been in the midst of a deep recession and credit score crunch, in contrast to right this moment.

In 2020, there have been 1,782,500 first-time homebuyers within the nation. Had all of them used such an incentive, that might have price the taxpayer a cool $44.6 billion.

In fact, not each first-time homebuyer would use it. However then once more, with such an incentive in place, demand for first-time homebuyers would seemingly skyrocket.

FHA loans already solely require 3.5% down to buy a house. And Fannie Mae dropped its required down fee for multifamily properties the place the proprietor lives in a single unit to simply 5% final November.

Certainly, with a 3.5% down fee, a home that prices $714,286 would conceivably have the down fee utterly lined by this program. (And this ignores vendor credit, which are generally provided to homebuyers throughout negotiations.)

Affording the down fee is a matter for potential homebuyers, however not the primary one. One current survey discovered 40% of non-homeowners mentioned that their lack of ability to afford a down fee was their fundamental impediment. However extra (46%) cited inadequate revenue. Particularly exterior costly coastal cities with virtually comically bloated housing costs, the most important concern for homebuyers isn’t the down fee—it’s affording the month-to-month mortgage funds, particularly with rates of interest the place they’re.

By throwing cash on the demand aspect with out addressing the availability aspect, the almost certainly result’s simply to extend the worth of properties all of the extra, as potential homebuyers with $25,000 in authorities cash behind them bid up costs in opposition to one another. This will make the mortgage funds even much less inexpensive. This program might actually be helpful for home hackers, however on a coverage stage, it’s seemingly throwing good cash after dangerous.

Increasing Reasonably priced Housing

To provide Harris credit score, she acknowledges the first-time homebuyer tax credit score is barely a stopgap “whereas we work on the housing scarcity.” As I’ve mentioned repeatedly, the solely method to actually alleviate the nation’s housing points is to construct extra.

Harris desires to deal with increasing inexpensive housing. As The Hill describes:

“Harris’s plan pushes for the development of 3 million new housing items over the subsequent 4 years, together with what it described because the ’first-ever’ tax incentive for constructing starter houses for first-time homebuyers.

“The plan requires an growth to an current tax credit score for companies that construct inexpensive rental housing, in addition to a $40 billion federal fund to assist enhance building. The plan additionally particulars a proposal to make some ‘federal lands eligible to be repurposed’ for brand spanking new and inexpensive housing developments.”

Sadly, inexpensive housing doesn’t all the time transform inexpensive. One examine by Michael Eriksen discovered that the Low-Revenue Housing Tax Credit score (LITHC) program “encourages builders to assemble housing items which are an estimated 20% dearer per sq. foot than common trade estimates.”

On the plus aspect, Harris’s plan to supply tax credit for companies constructing inexpensive rental housing might be a main alternative for builders. This is very true, as such incentives might alleviate among the regulatory prices that make it so tough to construct housing for lower-income residents. (One examine discovered regulatory prices amounted to $93,870 for every home in-built 2021, virtually 1 / 4 of the full.)

That mentioned, single-family begins had been already at an annualized charge of 1.46 million in December 2023. That will quantity to virtually double the three million new housing items Harris’s administration desires to construct over the subsequent 4 years and doesn’t even embrace multifamily. Authorities spending tends to crowd out non-public funding until in an financial stoop (which housing growth isn’t), so this may increasingly simply find yourself costing the taxpayer extra and getting the buyer much less. (Such authorities packages additionally have a tendency to be ripe for corruption.)

Lastly, the U.S. has had near-record ranges of immigration over the course of the Biden-Harris administration. Whereas this can be a politically fraught concern, it could be a superb time to gradual that down till the housing scarcity is alleviated with the intention to cool off demand within the housing market. This is one thing a Harris administration is very unlikely to do.

Stopping “Predatory Buyers”

Harris additionally desires to cease Wall Road from shopping for up single-family houses with a “Cease Predatory Investing Act.” The invoice is slightly easy. Right here it’s in its entirety:

“This invoice denies taxpayers proudly owning 50 or extra single-family properties any tax deduction for curiosity paid or accrued in reference to any single-family residential rental property. It additionally disallows depreciation of residential rental property owned by such taxpayers.”

The mortgage curiosity deduction is not practically as necessary as many assume, however prohibiting depreciation might have extreme penalties for actual property traders. This deduction permits actual property traders to deduct constructing depreciation (the IRS considers a residential property to depreciate to zero over 27.5 years) from internet revenue to scale back their revenue tax legal responsibility. It’s a key benefit of actual property investing and given how cash-intensive actual property is, eradicating it might be significantly damaging.

Buyers make investments a considerable quantity in lower-income neighborhoods, the place there are comparatively fewer owners, and such a tax change would seemingly trigger a flight of capital from neighborhoods that want it probably the most.

It’s additionally distressing that Harris describes “taxpayers proudly owning 50 or extra single-family properties” as “institutional traders.” Most traders who personal that many properties (like us) are a lot nearer to being small companies than “institutional traders.” Belief me, we’re nothing near BlackRock.

The concept Wall Road is shopping for Essential Road is generally a delusion. As I famous in a earlier article:

“…What seems to be a skyrocketing quantity of homes being purchased by institutional traders solely modified the proportion they bought from about 0.5% to 2.5%, not precisely what I’d name a ‘important chunk…’ The proportion of houses being purchased by all traders had really been lowering from 2013 till the tip of 2020; from 29% of all purchases to twenty.5%.”

If Harris is elected, this proposal would hopefully be amended or scrapped.

Who’s Paying For All This?

For all the extreme political rhetoric flying backwards and forwards between Kamala Harris and Donald Trump, Individuals ought to search for commonalities to bridge what seem like our implacable variations. And one level of obvious bipartisan settlement is to spend like a drunken sailor with a stolen bank card.

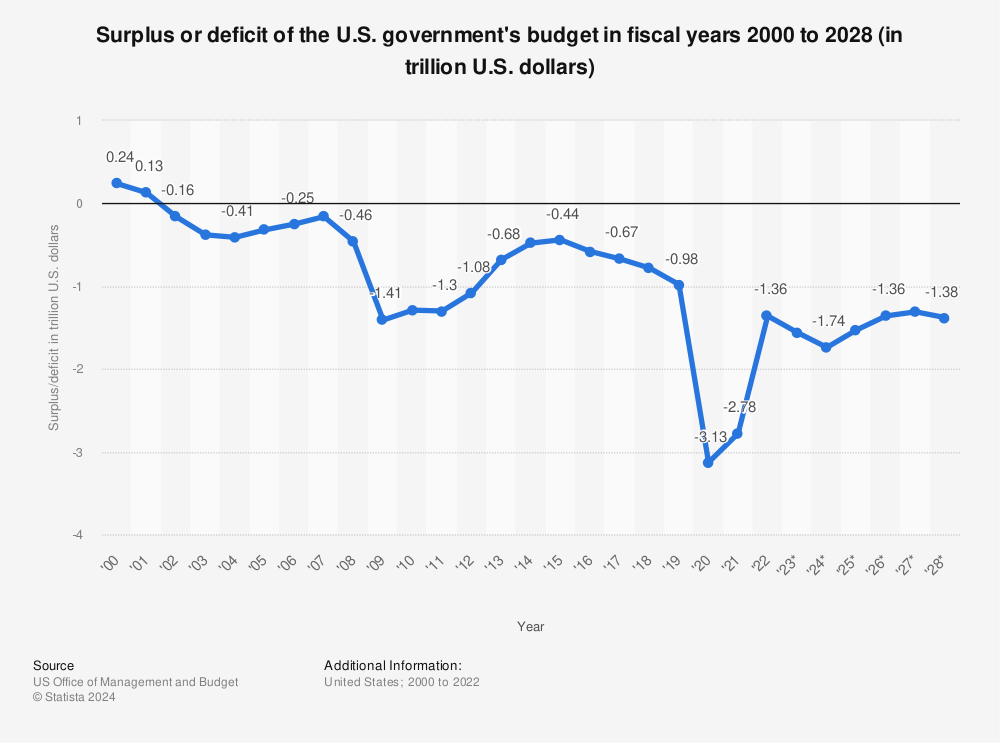

Certainly, regardless of the COVID-19 pandemic being over and the U.S. not (not less than formally) being at warfare, america is working deficits of over $1.5 trillion a 12 months. Trump can’t make a lot of a difficulty of this, although, as in 2019, the 12 months earlier than COVID hit, he had a “peacetime” deficit of $0.98 trillion. Personally, I don’t assume saying, “I didn’t even technically have a trillion-dollar deficit earlier than COVID,” is a very convincing marketing campaign slogan.

Discover extra statistics at Statista

The Harris marketing campaign is promising a number of new spending (to be truthful, so is Trump). Whereas there might be some new taxes, such taxes clearly have a price to the economic system and gained’t come near protecting the shortfall.

Subsequent 12 months, for the primary time ever, america will spend extra on debt service than its navy. And it’ll get a lot worse within the years to return.

I, for one, am in favor of reducing the navy price range considerably, however that’s a bit inappropriate right here. As historian Niall Ferguson factors out in Bloomberg:

“Any nice energy that spends extra on debt service (curiosity funds on the nationwide debt) than on protection won’t keep nice for very lengthy. True of Hapsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire, this legislation is about to be put to the check by the U.S. starting this very 12 months.”

Sadly, the piper might come calling prior to all of us would have hoped. New spending packages (and tax cuts, for that matter) are prone to exacerbate this drawback all of the extra, which may have important ramifications for not simply the actual property trade however the economic system as a complete.

Neither Harris nor Trump appear to be taking this concern severely.

Discover the Hottest Offers of 2024!

Uncover prime offers in right this moment’s market with the model new Deal Finder created only for traders such as you! Snag nice offers FAST with customized purchase bins, complete property insights, and property projections.

Be aware By BiggerPockets: These are opinions written by the creator and don’t essentially symbolize the opinions of BiggerPockets.