AzmanL/E+ by way of Getty Photos

Abstract

A short replace from my final protection (11th July): I gave Cellebrite (NASDAQ:CLBT) a purchase score because the enterprise’s sturdy aggressive benefit, mission-critical operate, and nice execution satisfied me that it will probably proceed to develop at 20%. In this replace, I’m revising my score from purchase to carry as a result of valuation has caught up, which makes the upside a lot much less engaging at this time regardless of a greater basic outlook.

2Q24 outcomes carry out even higher than I anticipated.

Within the newest quarter (2Q24) reported two weeks in the past, whole income got here in stable, rising by 25% y/y to $95.7 million, which beat the consensus estimate of 4.1% and my FY24 progress expectation of 20%. Particularly, subscription software program income grew 27% y/y. Revenue metrics had been additionally stable, with EBIT coming in at ~$20 million and adj. EBITDA at $21.6 million. By margin, EBIT margin improved by 300bps sequentially and ~840bps yearly, whereas adj EBITDA margin expanded by 290bps and 810bps yearly. With the stable efficiency, administration has revised its steerage, now anticipating $390 to $398 million (implying 20% to 22% progress) and EBITDA of $90 to $95 million.

A number of metrics and initiatives progressing nicely

The 2Q24 outcomes ought to additional persuade traders that CLBT can proceed to develop at >20% for the foreseeable future, particularly with all of the optimistic progress seen. To begin, the main progress indicator—annual recurring income [ARR]—grew even quicker than whole income at 26% y/y to $345.9 million. The important thing driving drive within the ARR progress equation is that cloud and SaaS-based options have virtually doubled over the previous 12 months and are actually producing a low-teens share of ARR. We all know that subscription software program income is rising at 27% y/y, which suggests ARR progress can doubtlessly speed up from right here as cloud and SaaS-based options grow to be a bigger mixture of the pie. Qualitatively, feedback round Guardian and Pathfinder proceed to point strong progress forward. As an example, Guardian clients proceed to develop, with the variety of customers (each examiners and investigators) and knowledge storage having doubled within the final 5 months. Pathfinder footprint continues to develop and may regularly speed up as Pathfinder turns into absolutely cloud-enabled.

Talked about within the 2Q24 earnings name: We’re happy to see rising traction for Guardian, our SaaS-based case and proof administration answer. The variety of Guardian clients has continued to develop, together with the variety of customers by way of each examiners and investigators, and knowledge storage volumes have doubled up to now 5 months alone to over two petabytes.

We continued to develop our Pathfinder footprint with IUs in the course of the second quarter, and I can say that we’re enthusiastic about our potential to speed up penetration into the IUs as Pathfinder turns into absolutely cloud-enabled over the approaching quarters.

Secondly, the upgrading of CLBT’s put in base to Inseyets is progressing rather well, which is able to function one other sturdy progress driver within the close to time period. To place issues into perspective, CLBT at the moment maintains an put in base of ~32,000 private and non-private digital forensic software program licenses, and the anticipated timeline of completion (for the improve) is over 3 years. To this point, the conversion charges have been very wholesome, a lot in order that administration raised expectations for conversion in 2024 from 10% to fifteen% of its put in base. As I famous beforehand, this conversion represents a 20–25% pricing uplift, so it was very encouraging to see the conversion progressing higher than anticipated.

Talked about within the 1Q24 earnings name: And there’s additionally the investigative models, we’re augmenting our continued progress within the digital forensic models by accelerating our enterprise within the investigative models of our clients, possibly extra particularly that digital proof captured by Inseyets, open up cross promote and upsell alternatives for proof administration and analytic options.

Now, as we advance these initiatives to capitalize to our improve, upsell and cross promote alternatives inside our put in public sector buyer base, we’ll see our know-how deployed extra pervasively as we lengthen our attain into new models, new departments and new shopping for facilities, what we contemplate to be new sub-logos inside the logos we have already captured.

Particularly, on Inseyets, CLBT ought to see extra upsell alternatives as it’s at the moment upgrading the vast majority of its ~32,000 put in base of private and non-private digital forensic software program licenses to Inseyets over the subsequent three years. Execution has been sound to date in 1Q24, and administration is anticipating 2H24 and 2025 acceleration. Notably, adoption of Inseyets provides CLBT extra pricing energy because it supplies a greater worth proposition, which administration expects to see a 20 to 25% uplift.

Lastly, CLBT can also be progressing nicely to achieve the FedRAMP certification and is now anticipating full authorization by 1H25. I see this as one other progress accelerator, as it’s going to enable CLBT to deploy their cloud-based choices at a a lot quicker tempo.

Partnerships and acquisition to assist progress

CLBT’s GTM technique, which includes forming partnerships and buying different firms, can also be exhibiting nice course of. As an example:

- In late June, CLBT introduced that Endpoint Inspector SaaS is now obtainable on Amazon Net Companies [AWS] Market. Given the attain that AWS has to hundreds of end-users, this enormously improves CLBT’s distribution capability

- In mid-July, CLBT shaped Cellebrite Federal Options and bought Cyber Know-how Companies, Inc. In the long term, this improves CLBT’s distribution capabilities, permitting it to participate in a greater variety of federal packages and initiatives within the US. Word that this improvement additionally enhances to CLBT efforts in gaining FedRAMP authorization.

Warrants overhang gone

An necessary improvement within the 2Q24 earnings report was CLBT’s supply to redeem the excellent warrants to buy strange shares. These warrants embody 20 million public warrants and about 9.7 million personal warrants. The present expectation is for these warrants to be transformed into 8 to 9 million widespread shares. That is actually nice for shareholders as a result of it’s anticipated to be ~70% much less dilutive than if all the warrants had been exercised for money.

Valuation

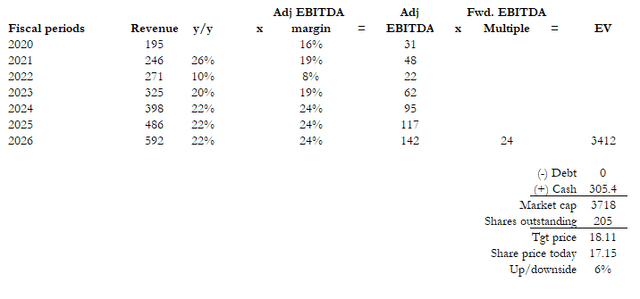

Supply: Writer’s calculation

In my present mannequin, I’ve revised my progress estimates up by 200bps, from 20%/12 months to 22%/12 months, and my adj EBITDA margin upwards from 20% to 24%, to mirror the sturdy 2Q24 efficiency and administration revised steerage. Given all of the optimistic progress made and powerful progress metrics, I imagine the steerage is definitely achievable and has the energy to be sustained over the close to time period.

Nonetheless, whereas I’m very optimistic in regards to the enterprise outlook, I feel CLBT’s valuation has already priced in all of the upside. Presently, the inventory is buying and selling at 31x ahead EBITDA, a big premium vs. its historic common of ~24x. Buyers hoping for extra upsides now should count on valuation to maintain at this stage, which is a dangerous maneuver in my view, as any underperformance is prone to ship the inventory down.

Primarily based on my conservative assumption on multiples, if CLBT trades again to its common of 24x, the obtainable upside based mostly on at this time’s worth is ~6%.

Conclusion

My downgrade from a purchase to carry score is as a result of the sturdy valuation appreciation has made the chance/reward scenario much less engaging at this time. Whereas I’m nonetheless optimistic in regards to the fundamentals, given the expansion trajectory and strategic initiatives, I’m not comfy to imagine valuation will maintain at 31x ahead EBITDA simply because progress is now 200bps larger (I now count on progress of twenty-two% vs. 20% beforehand).