Summary Aerial Artwork/DigitalVision through Getty Pictures

Funding Thesis

Inside an more and more unstable world, The Greenbrier Firms, Inc. (NYSE:GBX), as a part of the worldwide rail business is well-placed to make the most of efforts to deliver native or regional stability. Rail transport has grow to be an more and more necessary capability to have, as transport lanes are closed or threatened, or pipelines are attacked or impeded from delivering oil throughout borders. Throughout the context of what’s arguably an more and more energy-poor world, rail transport additionally helps to deal with the necessity to minimize down on power use in transport, in addition to serving to to chop emissions. Greenbrier’s monetary outcomes have been respectable and regular prior to now few years. The outlook is promising for the long run as a consequence of favorable exterior elements. I’m trying to purchase sizable dips on this inventory.

From a maintain, trying to promote within the Spring, to a maintain, trying to purchase towards the top of the 12 months

As I identified in an article within the Spring, when Greenbrier’s inventory was buying and selling within the low $50s/share, I used to be able to take earnings. In different phrases, I had it as a maintain, however I used to be leaning towards promoting. I ended up promoting my whole place, as I noticed the danger/reward potential at that value degree as being unfavorable. Now that its share value moved into the mid $40s/share vary, I nonetheless have it as a maintain, however now I’m taking a look at a positive entry level, in different phrases, I’m a maintain for now, however I’m leaning towards beginning to purchase in response to a positive shopping for alternative. As I shall clarify within the article, this modification has much less to do with Greenbrier’s efficiency, however reasonably with exterior elements.

Greenbrier’s newest quarterly outcomes reinforce a gentle efficiency monitor file

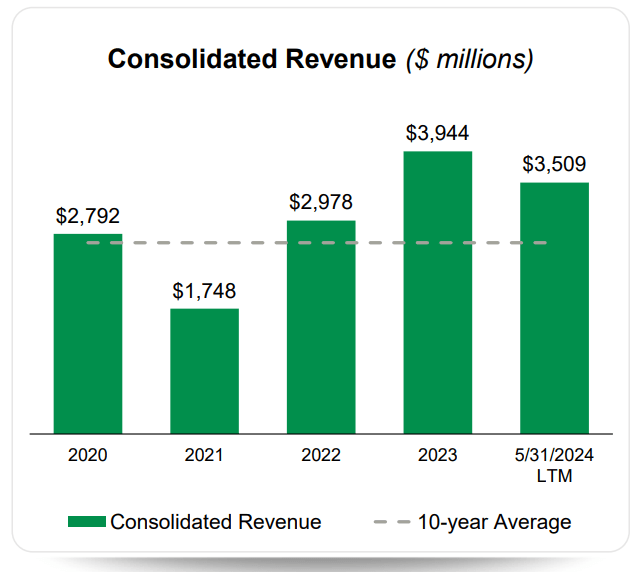

For the final quarter ending in Could, Greenbrier reported a income decline of virtually 5% from $862.7 million to $820.2 million. Revenues are set to drop for the fiscal 12 months in contrast with 2023, primarily based on the corporate’s outlook.

Greenbrier

Internet earnings elevated by about 1% to $33.9 million for the quarter in contrast with the identical interval. The revenue margin is reasonably skinny at about 4% of revenues, which I highlighted prior to now about this firm. It means that there’s little or no room to work with, when it comes to discounting to stave off competitors, or to maintain gross sales going throughout arduous financial instances. Deliveries declined for the interval from 5,600 carts to five,400. The order backlog grew simply barely by about 2%, to 29,400 models.

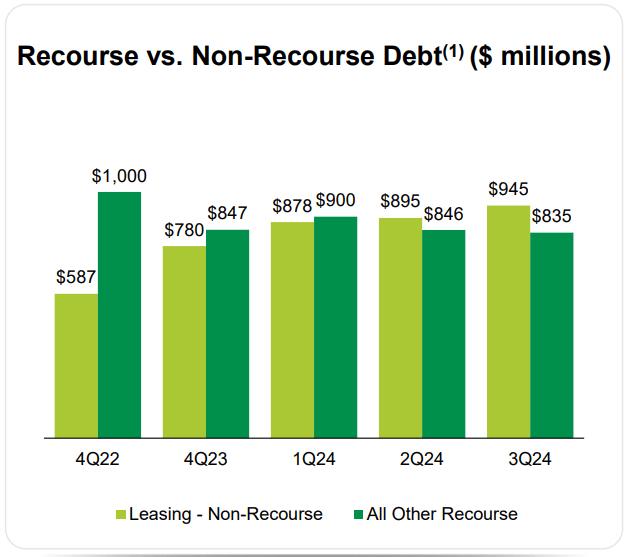

Its debt state of affairs is general regular. Curiosity on debt was just like the earlier quarter, coming in at $24.7 million. That’s about 3% of complete income. I fear when curiosity prices steadily stay above 5% of revenues for many firms. Its complete debt, together with leasing non-recourse debt, is $1.76 billion. That could be a bit excessive for my liking, however its non-leasing-related debt is $835 million. That is the same as a few quarter’s price of revenues.

Greenbrier

Throughout the context of upper rates of interest which have persevered because the post-COVID restoration, taking a look at an organization’s general debt state of affairs is now extra necessary than it has been through the low rate of interest period of 2008-2021. Greenbrier appears to be managing the debt and curiosity price state of affairs competently, conserving it sustainable.

Greenbrier is well-placed to make the most of a shifting world

With world commerce frictions, geopolitical massive energy competitors, conflicts, and political developments, such because the inexperienced motion that’s serving to to shift the way in which we method nearly all financial actions, the necessity for brand spanking new diversifications arises. Maybe the least talked about issue that requires severe adaptation to modifications is what I’ve been heralding these days as an important financial issue to look at, which is the rising proof that implies we could also be coming into an period of world shortage, particularly with regards to crude oil. All these main elements of change appear to be aligning in favor of a bullish long-term thesis for the rail transport business.

-

The inexperienced push & the power shortage challenge

Whereas it isn’t common worldwide, when it comes to insurance policies and energy degree, there’s a broad push to cut back emissions from our financial actions in most main economies worldwide. Some economies, such because the EU already achieved important reductions and want to preserve the progress going. Changing truck freight with rail transport can scale back emissions per ton of products transported by about eight-fold by some estimates.

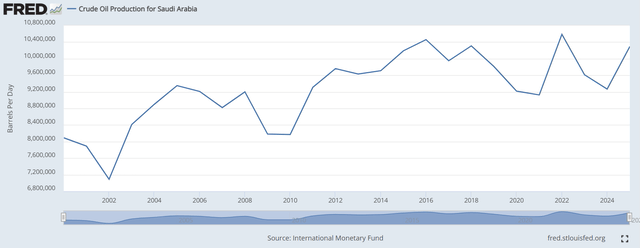

Considerably associated, is the a lot much less talked about effort to cut back transport gas consumption, as a consequence of impending shortages. Somewhat-known truth concerning the world state of the crude oil provide state of affairs is that we reached a month-to-month peak in manufacturing within the fall of 2018 at 84.6 mb/d. As of March of this 12 months, the world was producing 82.5 mb/d primarily based on the EIA’s world knowledge. A major issue that contributed to the height in world crude oil manufacturing for the interval was performed by the OPEC + efforts to cut back provide, which totals an quantity of 5.9 mb/d.

It needs to be famous that there isn’t a assure that OPEC + may add 5.9 mb/d in manufacturing if known as upon for the time being. We simply assume that they’ve the capability to take action, despite the fact that a number of members are producing most of their oil from very outdated fields which might be vulnerable to depletion-related declines. My take is that behind these official cuts, there are very actual declines in manufacturing capability hiding from public view. Notably, Saudi Arabia claims to have the capability to provide 12.5 mb/d, whereas thus far this century, it by no means proved able to producing greater than 10.5 mb/d on a sustained foundation. Even these intervals of manufacturing that surpassed 10 mb/d have been considerably transient.

Federal Reserve Financial institution of St. Louis

If my thesis is right and there’s a extreme shortage challenge on the horizon, then making the worldwide economic system much less depending on truck transport for hauling items is an effective long-term adaptation, that may defend economies all over the world from value spikes and outright shortages. Investing in rail transport is subsequently a logical coverage on the authorities degree, in addition to when it comes to non-public enterprise funding.

-

Deglobalization could result in elevated regional transport wants as world provide chains are disrupted by commerce frictions and battle

There isn’t a clear time limit that we will pinpoint as the start of the halting after which reversing of the globalization of the economic system, and it was not a single-factor pivot. For my part, it occurred final decade, with the beginning of the battle in Ukraine in 2013-2014, then the US-China commerce frictions that began underneath the Trump administration’s commerce & tariff insurance policies. The COVID disaster bolstered the worldwide notion that an over-dependence on the worldwide provide chain is a vulnerability.

This decade we noticed an acceleration within the strategy of the world reducing outdated financial and transport ties. The Ukraine struggle went into full battle mode in 2022, and so did the Russia-Western World financial confrontation. Transport within the Black Sea has been disrupted, the Nord Stream pipelines transporting pure fuel from Russia to Germany have been blown up, and Ukraine lately partially halted pipeline transport from Russia to EU nations by its territory. The battle within the ME area, beginning with the Hamas assault on Israel final fall can be inflicting world provide disruptions not directly, because the Yemen Houthi militia is attacking transport by the Crimson Sea. The tech struggle with China on the one hand and the US & the EU on the opposite can be intensifying, resulting in different financial ties being minimize.

Since world transport & commerce are more and more coming underneath disruptive stress, as a consequence of varied elements converging towards the identical end result, it’s logical to conclude that a lot of these outdated provide flows are set to get replaced by new regional or nationwide ones. It is a potential long-term profit for the rail transport business.

-

Proof of a rising shift to reliance on extra rail transport, and Greenbrier’s potential to profit from it

Maybe the obvious instance of how the present world financial and geopolitical state of affairs is creating increased demand for rail transport is the instance of Ukraine’s have to shift its transport of exports from its Black Sea ports to land-based transport as a consequence of full-blown hostilities breaking out with Russia. Russia both conquered or blockaded some ports, giving rise to a necessity to move Ukraine’s grains and different exports and lots of imports by rail. Neighboring nations corresponding to Hungary & Romania needed to spend money on additional capacities or revive outdated rail transport capacities to fulfill the brand new demand.

Greenbrier is well-positioned to make the most of this explicit, geopolitically triggered alternative. It has manufacturing, refurbishment, and restore services for railcars in Romania & Poland. The magnitude of demand that’s set to materialize for the long run within the area because of ongoing occasions is unclear, on condition that the struggle is ongoing and the form of an eventual peace is but to be revealed, however there’s important demand progress already occurring, as evidenced by investments which might be already being made within the area in increasing rail transport capacities.

The EU is a rising marketplace for firms concerned within the rail transport business, not solely as a consequence of geopolitical occasions but in addition due to different issues, such because the objectives for emissions cuts, in addition to the truth that the EU doesn’t have very important petroleum reserves and manufacturing. Due to this fact, it’s reliant on imports, which is an additional stimulant towards extra effectivity in freight in addition to public transport.

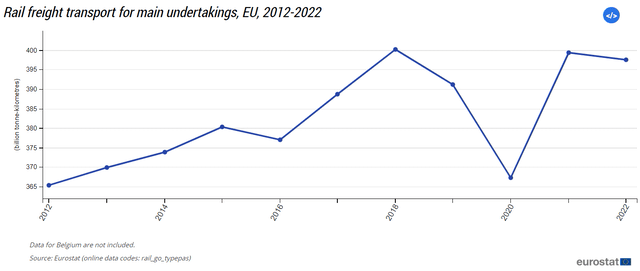

Eurostat

As we will see, the EU has seen regular and important progress in rail transport over the previous decade. It’s a completely different image from what we’re seeing within the US.

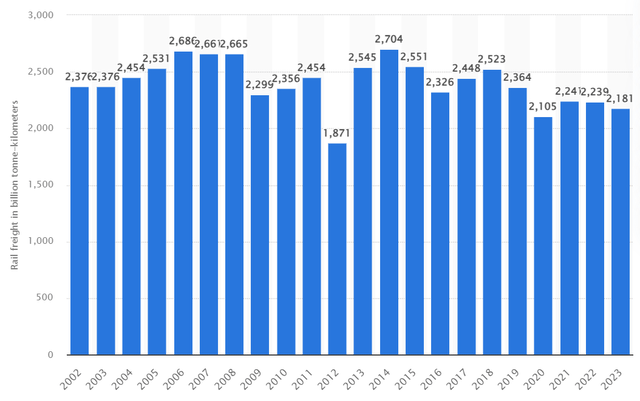

US rail freight transport quantity (Statista)

The distinction prior to now efficiency of rail transport within the EU versus the US comes down principally to environmental insurance policies, which in my opinion are bolstered by a long-term coverage of fostering effectivity as a consequence of useful resource scarcities, in addition to geopolitical developments, such because the battle with Russia. We might even see an identical development develop within the US as in Europe, because the reshoring of producing actions and different developments can provide rise to increased inner transport must facilitate the ensuing enlargement within the home provide chains.

Funding implications:

-

A European financial implosion stays the best potential threat for Greenbrier

Greenbrier inventory value and different metrics (Searching for Alpha)

With a ahead P/E of just below 11, Greenbrier’s valuation appears low cost inside the context of the broader market, the place the S&P 500 is at the moment buying and selling at round 28. In contrast with most industrial friends, it’s buying and selling at a way more modest low cost. Bombardier Inc. (OTCQX:BDRBF) as an illustration, additionally produces among the identical merchandise, and it’s at the moment buying and selling at a ahead P/E ratio of just below 15.

The one nice threat issue, other than the truth that Bombardier has a extra various product profile, that maybe justifies a decrease P/E ratio for Greenbrier, stays its deep reliance on the European marketplace for each manufacturing and gross sales. The long-term outlook for Europe’s economic system stays bleak in my opinion. The inexperienced agenda continues to be a drag on its industrial capability, and the financial divorce from Russia leaves it susceptible to power shortage shocks. It is usually falling behind technologically in contrast with main friends such because the US, China, and others all over the world.

The mixed impact of all of the detrimental elements quantities to a threat of the EU going into an financial tailspin sooner or later. It would maybe be triggered by an power value shock or by one other eurozone disaster. Regardless, when the following disaster comes, it will likely be met by an already weakening EU economic system, which for the primary half of this decade hardly managed to provide any financial progress. A European financial disaster may translate right into a disaster for Greenbrier as nicely, for my part. Its gross sales and maybe its manufacturing services can doubtlessly plunge.

-

In search of a shopping for alternative underneath $40/share

Maintaining in thoughts the dangers, in addition to the potential long-term exterior developments which might be helpful for the rail transport business, thus for Greenbrier, I see as a maintain between $40-$50/share. If it declines together with the broader market underneath $40/share, I see it as a shopping for alternative, assuming that the general constructive exterior thesis stays intact. It got here near going underneath $40/share this summer time on two completely different events, however it held above that value. Given the broader market volatility we noticed prior to now few months, I imagine that there’s a good likelihood that the shopping for alternative I’m searching for will happen. At that time, I intend to purchase incrementally on the way in which down. Its strong monetary efficiency mixed with favorable exterior market elements makes it candidate to purchase its inventory at a cut price value, after which look forward to a restoration to happen.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.