Every little thing is larger in Texas—together with the expansion of a few of its most under-the-radar cities. Based on the newest U.S. Census Bureau figures, between July 2022 and July 2023, eight of the 15 fastest-growing cities in the nation have been in Texas.

The unassuming Dallas suburb of Celina noticed meteoric progress of 26.6%, greater than 53 instances the nation’s common progress charge of 0.5%. Following Celina have been a number of smaller, much less well-known Texas cities:

- Fulshear: 25.6% enhance

- Princeton: 22.3% enhance

- Anna: 16.9% enhance

- Georgetown: 10.6% enhance

- Prosper: 10.5% enhance

- Forney: 10.4% enhance

- Kyle: 9% enhance

Bigger Texas cities fared properly, too. Houston is at present the fourth-largest U.S. metropolis, gaining on third-place Chicago.

Why Texas?

Favorable taxes, jobs, lower-priced housing, a heat local weather, and high-quality residing have all pushed the inhabitants surge from colder, high-priced Northern cities. Nonetheless, the dramatic inhabitants enhance in smaller cities may be extra easy than that.

“The checklist of fastest-growing cities contains loads of smaller cities that aren’t more likely to be on many individuals’s radar,” stated Danielle Hale, chief economist of Realtor.com, in a press launch. “Smaller areas typically high these lists as a result of their smaller dimension makes it simpler for them to see giant % adjustments.

How Inexpensive Are the High Small Cities in Texas?

Based on Realtor.com knowledge, affordability isn’t all the time on the high of the checklist when selecting a spot to reside. Celina’s median residence value of $679,999 is method above the nationwide common. Reasonably, it’s coveted for its good colleges and low crime charge. The hour-long commute to Dallas can be a plus.

Equally, Fulshear, additionally excessive on the checklist, has a median residence value of $519,000 and is just an hour away from Houston.

Texas Money Flows, Too

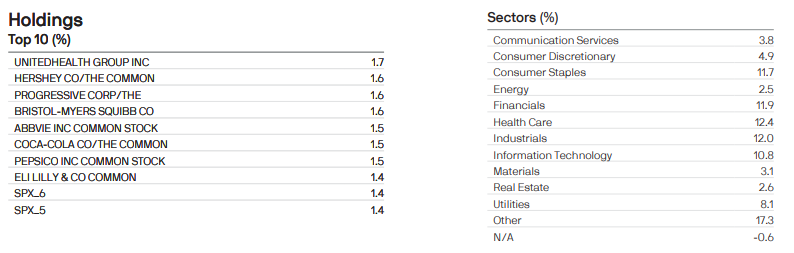

Whereas a few of the fastest-growing cities in Texas comprised dear single-family houses, inexpensive housing within the state additionally dominates the nation’s money move markets, too. Texas occupied six of the ten most cash-flowing markets within the U.S., in keeping with BiggerPockets knowledge.

Why Southern Texas is a Nice Place to Make investments

McAllen, Texas, has been an investor favourite for years. Based on BiggerPockets knowledge, the town has a rent-to-price ratio of 0.84%, a median “owner-occupied” gross sales value of underneath $100,000, and a median hire value of round $800. Low-cost housing and rents imply that many traders can scale rapidly.

Though Realtor.com knowledge tells a barely completely different story, with the median residence value offered being $285,300, that is seemingly because of the huge unfold of home costs between decrease and better within the metropolis, which gives a number of kinds of employment, from consulting companies, monetary companies, medical, and schooling. Properties valued at round $150,000 in 2023 skilled an 80% enhance in market worth over the previous 5 years. Different areas noticed costs enhance by over 100% in the identical interval as residents from California and elsewhere relocated throughout the pandemic amid the distant working growth.

BiggerPockets knowledge reveals that the opposite southern Texas cities of Odessa, Corpus Christi, and El Paso additionally dominate the best money move cities within the nation attributable to affordability. The border cities and Gulf areas provide a number of kinds of employment, from navy bases to medical, e-commerce achievement facilities, meals processing, and vitality. In an age of excessive rates of interest, these inexpensive Texan cities with sturdy employment make them nice locations to take a position, both as an all-cash purchaser or with a bigger down fee, to refinance as soon as charges fall.

Watch out for Rising Property Taxes

Although many components of Texas provide inexpensive housing, pricier cities which have appreciated considerably in recent times have seen property taxes soar, making them among the most costly within the nation.

Based on a latest evaluation by Axios, median property taxes on Texas single-family houses grew by 26% between 2019 and 2023 with out accounting for inflation. Lawmakers have been attempting to stem the will increase and have had some success. Many property house owners throughout the state noticed their taxes fall by 28% in 2023.

“The underside line is that it’s a way more taxpayer-friendly surroundings, significantly for owners, than it was earlier than 2019, and much more so after final yr’s enhance within the homestead exemption,” Lynn Krebs, a analysis economist on the Texas Actual Property Analysis Middle at Texas A&M College, informed Texastribune.org. Earlier than the cuts, some residents noticed their tax invoice enhance by as a lot as 31% between 2018 and 2023.

Ultimate Ideas

The problem of property taxes is contentious. Allotting with taxes that would in any other case have been used for college district upkeep is a troublesome promote past what has already been achieved. Lieutenant Governor Dan Patrick informed the Texas Public Coverage Basis final yr that the state would wish roughly $55 billion to offset the price of college district upkeep for 2024-2025, amounting to virtually two-fifths of the state’s $144.1 billion common fund finances.

Ought to taxes proceed to extend with out the reduction of decrease rates of interest, traders would wish to look intently at their bottom-line money move numbers and select to take a position with giant down funds or as all-cash consumers. Those that invested over a decade in the past have loved some golden years in appreciation and money move.

Nonetheless, that doesn’t imply one other halcyon period of Texas investing doesn’t lie forward. With companies relocating and cities attracting new residents, Texas stays an important place to deploy your money. Nonetheless, except you’re able to put down a big amount of cash, have a look at least for appreciation quite than money move.

Prepared to reach actual property investing? Create a free BiggerPockets account to find out about funding methods; ask questions and get solutions from our neighborhood of +2 million members; join with investor-friendly brokers; and a lot extra.

Be aware By BiggerPockets: These are opinions written by the writer and don’t essentially signify the opinions of BiggerPockets.