Krzysztof12/iStock Editorial through Getty Photos

Expensive readers/followers,

I am all the time completely satisfied to see high quality be undervalued. And whereas I can not argue that Jeronimo Martins (OTCPK:JRONY) (OTCPK:JRONF) is “the perfect” grocer in Europe, as a result of margins, combine, and earnings say in any other case, I do consider it is nonetheless a strong play right here, and one which’s getting higher and even simply at a conservative PT, with a excessive potential annualized upside.

Additionally, at this explicit time, the corporate is definitely yielding over 4% well-covered dividend yield, with a dividend that’s set to enhance and rise for the subsequent fiscal. So at a worth of beneath €16.5, the corporate is just not solely interesting, it is very interesting, not less than insofar as I see issues.

On this article, I am going to present you why precisely I do take into account it interesting, and what I see potential for the corporate each now and within the near-term future. I am one of many few analysts masking this firm, and yow will discover my earlier article on Jeronimo Martins right here.

Since that piece, my funding is down about 10% together with dividend and FX, underperforming the market by about 16%. Is that this a superb efficiency? In fact not. I am trying to make investments extra right here, because it’s extra undervalued, to take pleasure in a greater upside. There are some causes for the decline which we’ll go into right here, and likewise take a look at a few of the particular challenges that this firm sadly faces.

Jeronimo Martins – Challenges stay, however there are indicators of upside and restoration.

So let me be clear that it appears doubtless that 2024 goes to be a “down” 12 months for the enterprise by way of earnings. That is what we’re seeing mirrored within the share worth as properly, which noticed a decline after the 1H outcomes had been revealed final month on the twenty fifth. The corporate calls it a difficult context, given much less shopper demand, decrease meals inflation, and hovering value inflation. This has in flip led to very intense competitors amongst firms in these markets, in addition to the corporate’s varied working geographies.

This has pressured the corporate’s already sector-low margin additional, to the place it now stands at 6.4% EBITDA, with €1B generated (which is up 3.5%, however up because of quantity/combine not because of margin enhancements). The corporate has opened 140 new shops, which additionally explains the expansion, however the different developments aren’t optimistic. We’re destructive OCF at nearly destructive €400M in money move, and internet debt is now at over €3B.

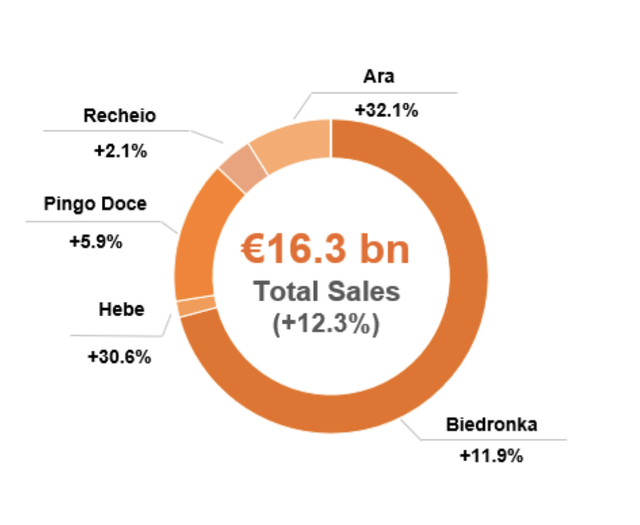

Right here is the gross sales combine for the Half-year interval.

Jeronimo Martins IR (Jeronimo Martins IR)

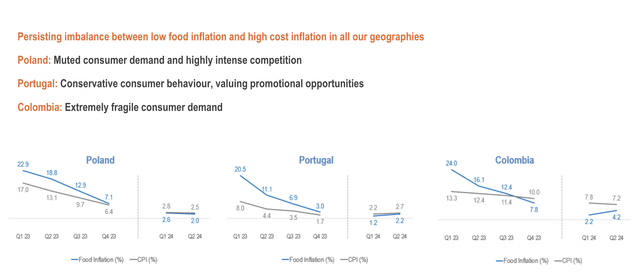

…and the “context” given for the corporate by these outcomes and the way it’s going additionally.

Jeronimo Martins IR (Jeronimo Martins IR)

There’s one thing to be stated for the corporate’s working geographies right here. The very fact is as a result of the corporate operates in rather more risky areas than we usually see for a few of these gamers, there are additionally more likely to be extra ups and downs with regard to outcomes, inflation, and CPI. That is what we’re seeing right here, and that is what’s inflicting the corporate to make use of wording like “Extraordinarily fragile demand”. In most of the firm’s geographies, we’re speaking about nations or areas that aren’t as developed or as mature of their operations as we see in NA or Western Europe. Portugal is the exception right here, and even on this section, we’re seeing stress.

One other problem is that the corporate is trying to execute a really bold funding and CapEx plan whereas that is occurring. You possibly can see the ramp up relating to quite a lot of shops, in addition to renovations, and the outlook for this 12 months requires the corporate to complete up over 300 new shops throughout its section, in addition to revamping one other 300. So there are plenty of investments to be made right here.

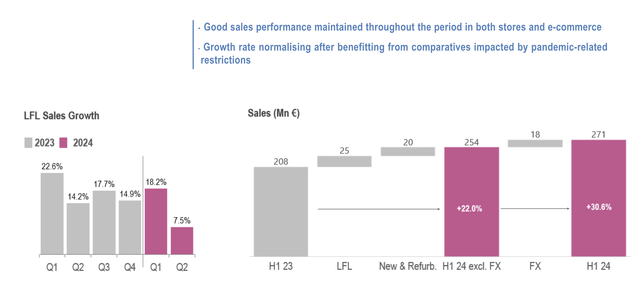

Gross sales efficiency whereas that is occurring is just not nice. The corporate is seeing a like-for-like gross sales progress that is turned destructive for 2Q24. That is the primary time in years that it has carried out so. That is regardless of all segments contributing fairly a bit to gross sales. There is a little bit of a destructive calendar impact to this improvement for 2Q (as I’ve stated for different meals firms as properly).

A few of the segments deserve particular person highlighting for the half-year interval. This consists of Poland, which is seeing good ends in Biedronka with enchancment in gross sales regardless of some destructive LFL progress, and likewise Hebe.

Jeronimo Martins IR (Jeronimo Martins IR)

Pingo Doce additionally did properly, and the gross sales progress of LFL right here is optimistic. What’s as an alternative occurring right here, if we take a look at why issues are usually not wanting so nice, is that the EBITDA and earnings mirror pricing and funding pressures. These are ongoing throughout your complete market, together with the Western and NA markets. However they’re worse right here, as a result of this firm is seeing “worse developments” than the others, because of being in troublesome geographies. Margin stress is actual, because of basket deflation, value inflation, in addition to investments. Out of 5 segments, solely 2 have improved their EBITDA margins – all others are going into the destructive.

Jeronimo Martins’ response to this has been an additional deal with pricing, and on worth propositions. The corporate hopes that this might be sufficient to ultimately drive robust quantity will increase. This makes the outlook, expectations, and forecasts vital after we take a look at the corporate.

Jeronimo’s plans are to proceed to try to develop firm volumes by means of pricing whereas working effectively. I translate and interpret this that the corporate will proceed to sacrifice margin for quantity, with a view to preserve market place. We should always subsequently count on margins to both keep on the decrease state, or on the very least not count on them to extend right here. The corporate itself in truth guides for an elevated quantity/funding of working capital. It’s because, throughout a deflationary interval, the corporate has so as to add allowances for not solely rates of interest, however progress slowdown and credit score constraints – which in flip will have an effect on the corporate’s companions as a result of the corporate might determine to shorten fee intervals, significantly for the private-label companions.

So there are various shifting elements right here which might be working to cut back the corporate’s attraction by way of margin and potential upside. The corporate can be clear that the corporate’s varied segments and operations are seeing their very own challenges, quantity points, and margin points. Particularly Colombia-based Ara, the place the corporate is evident that the enterprise will pursue its worth management (which on this interval means sacrificing margins for quantity in decreasing worth).

In brief, we should not count on good outcomes for 2024. I’ve lowered my expectations for this 12 months, and I consider you need to do the identical. I now count on a decline in EPS of not less than 15%, right down to round €1.1/share. Whereas this can little doubt recuperate as the corporate’s investments come on-line, and as margins slowly recuperate, I consider the corporate will stay on the decrease finish of the margin scale in its peer group – and this implies the corporate must be correctly discounted for such a “lack”.

Let us take a look at the valuation that will grow to be attention-grabbing.

Jeronimo Martins – I do wish to personal the corporate right here

The corporate’s common P/E stays at an 18-20x P/E. However I now not consider the corporate has the “proper” to commerce right here, given the margin pressures it is below. In my article the place I lined the corporate the final time round, I specified that I solely forecast at 15.5x – and I do not change this stance right here. The corporate, as I see it, is just not value greater than that.

Nonetheless, we have now reached a stage of valuation the place the corporate’s share worth is just €16.28, that even forecasting at 15x, beneath 15.5, the upside remains to be 15% annualized with a yield of 4%+ (Supply: F.A.S.T graphs Paywalled Hyperlink).

This firm is much much less sure about its forecastability than its friends are. The analysts following the corporate have a 50% destructive forecast accuracy on a 1-year foundation even with a ten% margin of error, which suggests a excessive price of near-term uncertainty. This makes it doubly vital to get the enterprise at a gorgeous worth.

However that’s one thing I consider we’re getting right here. You are shopping for the corporate, even on the decrease forecast charges and EPS, at a a number of of 14x to earnings. That is properly beneath the corporate’s long-term and short-term common, and even within the case of comparatively flat or below-average improvement, say forecasted to 12x P/E, the corporate nonetheless generates optimistic RoR. Within the 12x P/E case we’re speaking about 5.35%. Not market-beating, however you are not dropping cash, even when this firm was to carry out very poorly.

That is what I prefer to view as “security” by way of investments right here, and why I feel there is a optimistic funding potential to be made right here.

Different analysts agree. The present common PT for this firm has not moved from my very own PT of €22, even barely above it. 22 analysts observe the inventory with a lowest worth goal of €16/share, and a highest of €28/share, with a mean of €22.33. Out of twenty-two analysts, 17 name the corporate a “Purchase” or “outperform” right here, and I’d agree with that.

I don’t transfer from my present PT, and I say that Jeronimo Martins is value shopping for right here. JRONY is my ADR of alternative, and it’sas an ORD x2 ADR, which means one ADR is 2 native shares. My goal for the ADR is subsequently $48/share at this explicit time, and I view JRONY as liquid sufficient to warrant investing right here.

Dangers for the corporate are as follows.

Dangers

The dangers to this firm do exist. Jeronimo Martins is likely one of the lower-margin shopper staples firms seen to its friends that I put money into. That is additionally why I give it decrease multiples. It has publicity to downright dangerous geographies, equivalent to Colombia. Neither Poland nor Portugal are extraordinarily steady right here, however see from a European context, increased quantities of income attrition and margin stress as properly, and function in weaker shopper segments than different Western European gamers right here.

However in the long run, they’re shopper staples and a grocery enterprise. Folks must eat – and when you can argue that the corporate faces challenges, you actually cannot argue that this firm faces points to the diploma the place it threatens their survival. As a substitute, present developments are targeted on investments – and as soon as these materialize, we must always see enhancements. So whereas dangers exist – each operational, nationwide, and macro – I consider the upside and above all of the valuation make up for these at this worth.

If the corporate had been to rise above €20/share, then it may be argued that they nonetheless make up for it. However for now, I view issues as being “advantageous” right here for purchasing the corporate.

Thus, my thesis for the corporate is as follows.

Thesis

- Jerónimo Martins is an organization I do wish to personal, and now personal – and I managed to get in at €19-€20/share. The upper-than-average forecast uncertainty at the moment stays, however I do consider that at round €16-17/share, you should buy this with a double-digit upside because of the potential premium, but in addition to a normalized P/E of 15x. The corporate has loads of positives right here.

- I need 15% or above out of the investments that I put my cash in, on an annual foundation. It is now excessive sufficient, and even increased, with a premiumized return of over 20% per 12 months.

- I stick with my PT of €22/share and a “BUY” ranking right here. I, subsequently, stick with my ranking by way of a optimistic stance. I’d name the corporate “low-cost” beneath €20/share, which implies that as I’m writing the article, I take into account the corporate low-cost because it trades near €16/share.

Bear in mind, I am all about:

- Shopping for undervalued – even when that undervaluation is slight and never mind-numbingly large – firms at a reduction, permitting them to normalize over time and harvesting capital features and dividends within the meantime.

- If the corporate goes properly past normalization and goes into overvaluation, I harvest features and rotate my place into different undervalued shares, repeating #1.

- If the corporate does not go into overvaluation however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

- I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (italicized).

- This firm is general qualitative.

- This firm is essentially secure/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is at the moment low-cost.

- This firm has a practical upside that’s excessive sufficient, primarily based on earnings progress or a number of enlargement/reversion.

The corporate fulfills each single one in all my standards right here, and I view the corporate as a “BUY” right here.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.