MicroStockHub/iStock through Getty Photographs

Written by Nick Ackerman, co-produced by Stanford Chemist

We final coated the Clough International Alternatives Fund (NYSE:GLO) earlier this 12 months. It is a hybrid closed-end fund that actually has restricted constraints in making an attempt to pursue its funding targets. That features investing across the globe, throughout all asset courses, sectors and market cap sizes and even shorting securities.

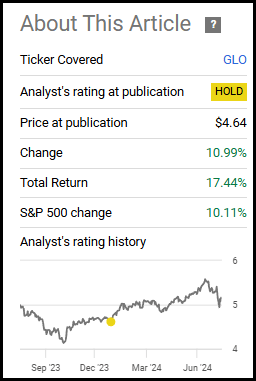

Throughout our earlier replace, I had made the case that it was value a speculative place for buyers on the lookout for a high-yield fund. The deep low cost was one of many major driving elements, however with total robust market efficiency, that helped elevate this fund increased. The low cost did slim to some extent since our prior replace, but it surely stays at a degree the place I consider it’s nonetheless worthwhile holding a place. On the present tempo, the fund appears to be like like it will likely be set to lift its distribution for subsequent 12 months as effectively, based mostly on its managed distribution coverage.

GLO Fundamentals

- 1-Yr Z-score: 1.95

- Low cost/Premium: -14.86%

- Distribution Yield: 11.18%

- Expense Ratio: 1.86%

- Leverage: 13.73%

- Managed Property: $380.6 million

- Construction: Perpetual

GLO’s funding goal is “to offer a excessive degree of whole return.” The fund makes an attempt to realize this by “making use of a basic research-driven funding course of and can put money into fairness and equity-related securities in addition to fixed-income securities, together with each company and sovereign debt.” In addition they embody that the fund will “put money into each U.S. and non-U.S. markets.”

Low cost Continues To Have Attraction For These Wanting To Gamble

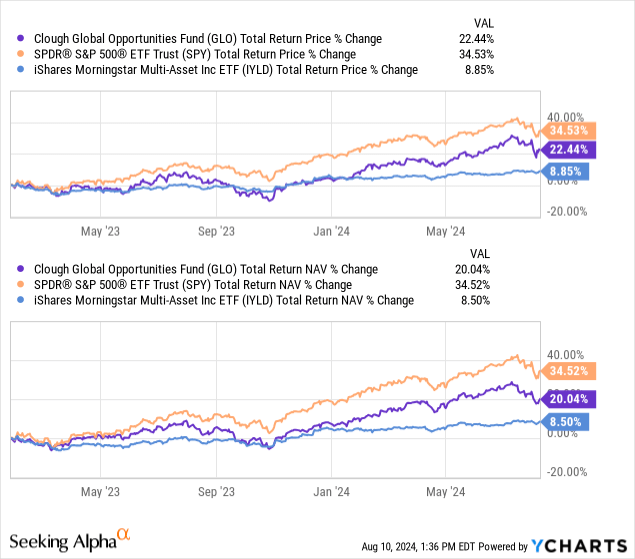

Since our final replace, the fund has been capable of outpace the S&P 500 Index.

GLO Efficiency Since Prior Replace (In search of Alpha)

Which isn’t a daily prevalence for this fund, and I am undecided that is going to be establishing a brand new pattern to alter that over the long run. For me, it stays a speculative place, so I would proceed to price it a ‘Maintain.’ The market was lately flirting with close to all-time highs, and we aren’t too far off of these ranges. This fund will want the market to proceed to carry out effectively for itself to additionally carry out effectively. They brief some securities, so it’s considerably hedged, however total, they’re web lengthy.

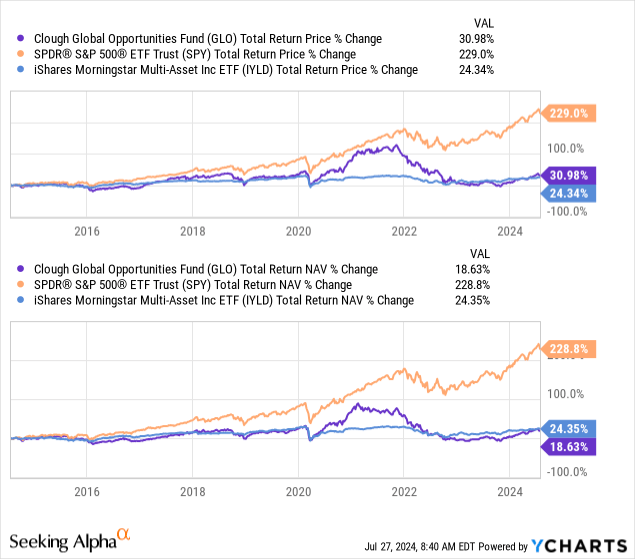

Over the long run, the fund had didn’t outperform the non-leveraged iShares Morningstar Multi-Asset Earnings ETF (IYLD) as effectively. Which may be extra of an applicable benchmark contemplating that GLO also can put money into fixed-income. IYLD additionally invests across the globe.

Ycharts

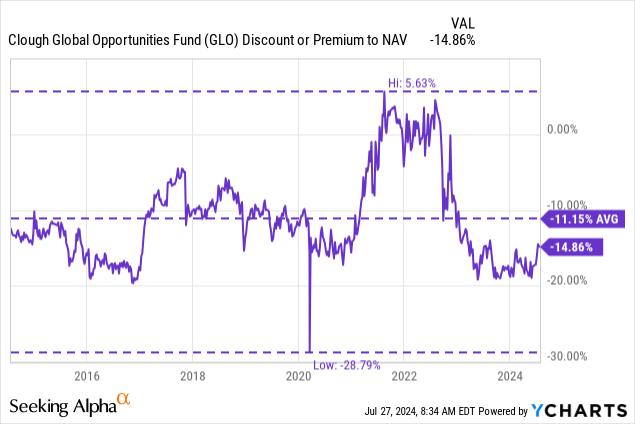

The fund’s low cost did slim since our prior replace, which helped to drive these higher total whole returns. That mentioned, the underlying portfolio additionally contributed probably the most to those outcomes, because the fund’s low cost stays fairly enticing at present ranges. The fund continues to be buying and selling under its long-term common low cost degree.

Nonetheless, this was additionally skewed increased, because of a interval the place the fund reached premium ranges earlier than crashing again down. It got here crashing down after 2022 when the fund carried out fairly horribly because it declined on a complete NAV return foundation by practically 40%.

That noticed the distribution slashed the next 12 months, and CEF buyers who liked that prime yield stopped loving that prime yield when it was adjusted based mostly on the managed distribution coverage. Subsequently, it despatched the fund from buying and selling at a premium to dropping to an almost 20% low cost.

Ycharts

With the potential for the low cost narrowing farther from right here, GLO could possibly be set to outperform—assuming the underside would not fall out of the market. Although it also needs to be thought-about that the fund was extremely leveraged beforehand.

They’ve taken that leverage ratio down considerably to 13.73% as of their newest truth sheet. For perspective, heading into 2022, the fund’s efficient leverage ratio was pushing close to 40%. That is what we famous beforehand as effectively, which ought to imply that the varieties of losses we noticed throughout 2022 could possibly be extra restricted within the subsequent market crash.

As a substitute, they’re now ready the place if we see a market crash, they’ve an enormous buffer earlier than potential compelled deleveraging—or, extra ideally, the capability so as to add extra leverage when the market has crashed to rebound tougher on the opposite aspect.

Excessive Distribution Yield

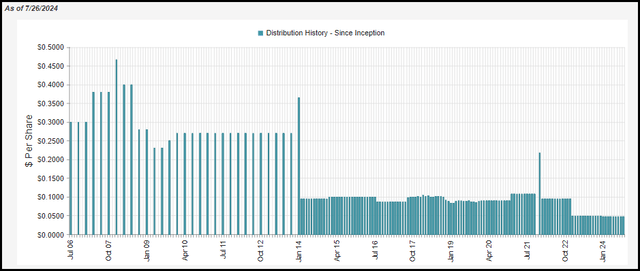

One profit for some buyers on this fund is that it’s going to at all times pay a excessive distribution yield; it’s because the fund has a managed distribution coverage based mostly on 10% of the calendar year-end NAV. In fact, that additionally comes with the draw back of when the fund has such a tricky 12 months like 2022, the month-to-month payout will get completely slashed.

GLO Distribution Historical past (CEFConnect)

With the NAV price at the moment at 9.50%, if the distribution was reset at the moment, we might see a rise. In fact, we nonetheless have loads of the buying and selling 12 months left, which implies loads of time for this to alter.

To fund the distribution, GLO would require principally capital good points because the fund’s web funding revenue is often destructive—it got here in precisely at $0.00 with the newest report. That is the results of the fund’s typically increased expense ratio, partially pushed by the added expense on their brief sleeve.

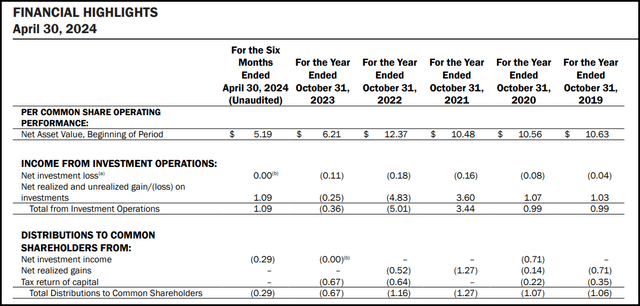

GLO Monetary Metrics (Clough)

Together with the fund’s lengthy/brief positioning to provide potential capital good points to distribute to buyers, the fund makes use of quite a lot of by-product methods as effectively. That features writing choices, whole return swaps and overseas forex transactions.

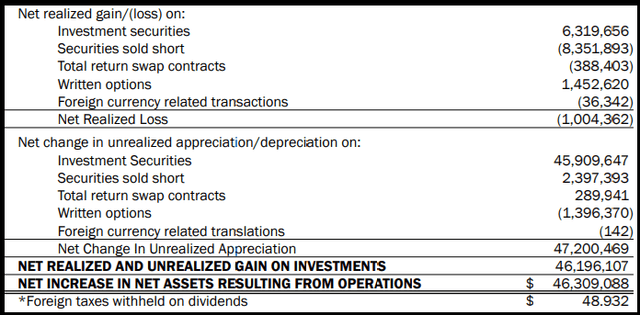

Within the newest semi-annual report, the success was quite combined—however web property elevated anyway, because of the sizeable unrealized appreciation within the underlying portfolio.

GLO Realized/Unrealized Good points/Losses (Clough)

Within the final 12 months, GLO’s distribution was labeled solely as return of capital distributions. As we famous beforehand, this may be the case for some time, even when the fund begins performing higher as a result of capital loss carryforwards the fund is sitting on. So the extra essential metric to observe right here is the path of the NAV per share over time.

GLO’s Portfolio

The turnover price on this fund is sort of excessive. The most recent semi-annual report put it at 60%, which, if continued for the remaining six months, would put it above the 115% seen final 12 months. Whereas 115% turnover is sort of uncommon and signifies a really lively administration staff, that was down from the 212% and 209% seen in fiscal 2022 and 2021. The truth is, going again to fiscal 2019, the fund’s turnover price was at a whopping 306%. Meaning they’d purchased and offered sufficient to recycle your entire whole managed property within the fund over 3x all year long.

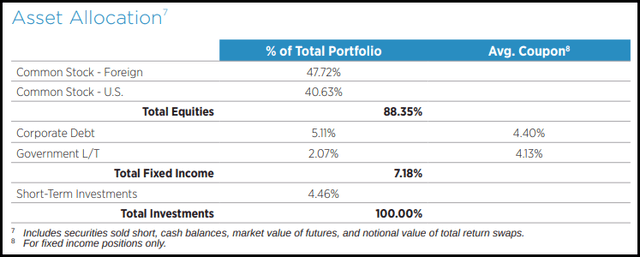

With that being mentioned, since our prior replace, the fund’s whole asset allocation hasn’t shifted an excessive amount of. The fund stays heavy in equities at simply over 88% and carries solely round 7% within the fixed-income sector. The weightings beforehand had been ~85% and ~11%, respectively.

GLO Asset Allocation (Clough)

Nonetheless, typically, the modifications could be drastic for this fund. For instance, in our late 2022 replace, the fund held round 46.5% in equities with 51.50% in fixed-income.

Inside the comparatively small sleeve of fixed-income publicity, it’s principally geared towards increased high quality, above-investment-grade debt securities. That contains simply over 60% of the fund’s publicity, with the rest being BB-rated.

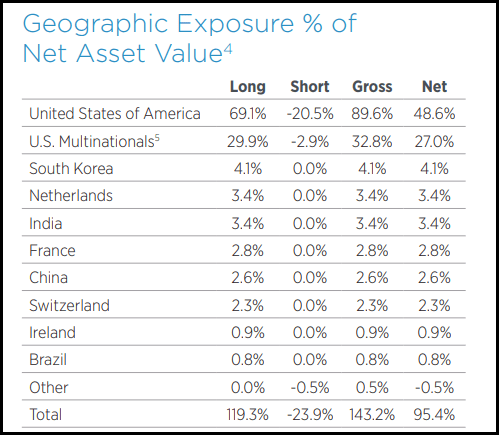

Geographically, the most important publicity to the fund is to the U.S., which tends to be the case with most CEF fairness funds, even these with a world focus. Nonetheless, by shorting a sizeable sleeve of its U.S. publicity, it really reduces the online publicity to simply below 50% with the newest reporting supplied. Since our prior replace, there hasn’t been an enormous shift right here in publicity, both. There was a little bit of a rise within the U.S. lengthy sleeve but additionally a rise within the brief publicity to provide an identical web publicity total.

GLO Geographic Allocation (Clough)

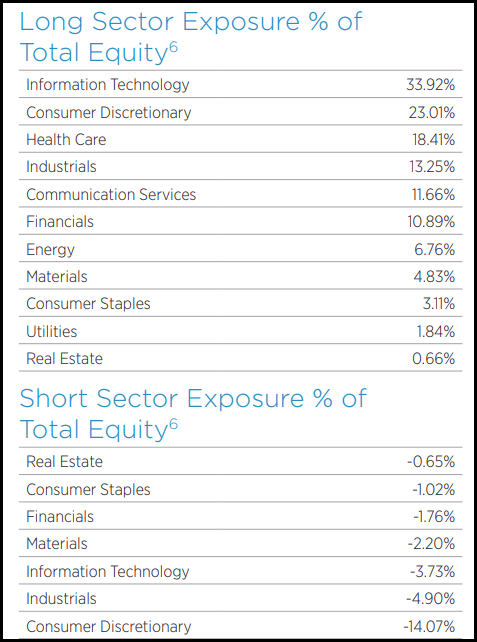

Trying on the sector that’s the most shorted by GLO, now we have the buyer discretionary sector as the vast majority of the brief sleeve.

GLO Lengthy/Brief Sector Breakdown (Clough)

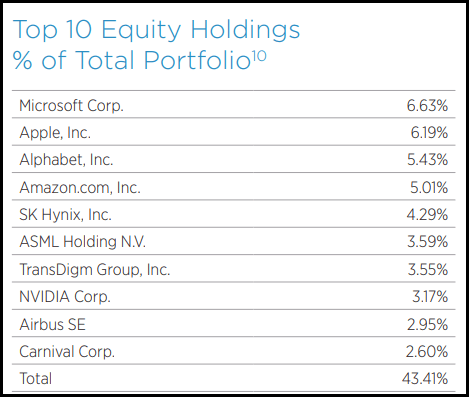

Data tech is the most important allocation, adopted by shopper discretionary, which is smart trying on the fund’s high ten holdings.

When trying on the fund’s high holdings total, Microsoft (MSFT), Apple (AAPL), Alphabet (GOOG) and Amazon (AMZN) dominate the highest positions—Nvidia (NVDA) can also be a holding however is available in on the quantity 8 spot. These are the mega-cap development names which have been driving the market principally increased this 12 months, which helps to see why GLO has additionally been having fairly a profitable run this 12 months. General, the highest ten account for a sizeable 43.41%, indicating that the fund is sort of concentrated.

GLO High Ten Holdings (Clough)

Conclusion

GLO is delivering some strong efficiency this 12 months, however nonetheless hasn’t garnered investor curiosity because it languishes at a deep low cost. The sentiment right here is not more likely to change anytime quickly, because the fund’s weak efficiency and subsequent slashing of the distribution following 2022 is contemporary within the minds of buyers. Those that had been shopping for this fund at a premium had been notably damage when the fund dropped to an enormous low cost. Those that purchased after the crash, as I did myself, are in a unique boat, in fact.

That mentioned, since I picked up my place, it has nonetheless lagged behind the SPDR S&P 500 ETF (SPY). Given the multi-asset and brief positioning, I do not actually count on it to beat SPY, both, over longer durations of time. I’ve nonetheless been proud of the outcomes, even with a bit extra market volatility currently, although if the low cost would cut I would be even happier.

Typically, I am not a fan of lengthy/brief funds—however for now, I am making an exception, and I will proceed to hold on to my comparatively small and speculative place. If the fund can preserve its robust efficiency this 12 months and may elevate its payout for subsequent 12 months, that would draw some buyers again in. If the low cost narrows sufficiently sufficient or the fund begins creeping again up and including leverage liberally, I would be keen to exit swiftly.