Roman Tiraspolsky

Pricey readers/followers,

I am a long-time and long-term investor within the telco sector. Over 15% of my portfolio is invested in communications firms of assorted sorts, principally telecommunications or telecommunications-adjacent kind of companies. Telenor (OTCQX:TELNF) (OTCQX:TELNY) is one of the biggest positions right here, and I’ve a price foundation of round 101 NOK seen from the native ticker TEL, on the Norwegian market.

On this article, we’ll take a look at the outcomes for 2Q24 and see what upside the corporate can provide. That is related as a result of the corporate has really seen a fabric upside in its share worth, and we’re now above 130 NOK/share. I’ve not purchased firm shares at this worth in a number of years, and whereas the implied yield of seven.25% continues to be adequate, the query is what kind of upside we see.

Will we nonetheless have a 15% annualized at this worth, or are we seeing the potential for a “much less good” upside going ahead?

Telenor is among the largest Scandinavian telcos. It has A-credit, lower than 50% long-term debt/cap, and some of the aggressive choices and infrastructure networks in all of Scandinavia. Additionally, including to this, Telenor has managed to outperform in secondary segments – particularly Asia. And these segments are one thing the place many different telcos, together with Telia, (OTCPK:TLSNY), have really failed prior to now.

So on this article, we’ll see if the corporate’s valuation and developments can nonetheless be thought-about to be price it at the moment.

Telenor – An upside requires good outcomes in addition to forecasts.

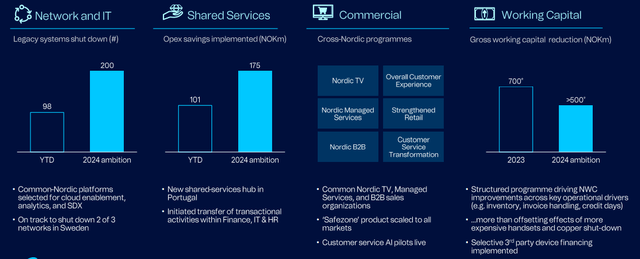

Telenor is within the midst of shutting down nationwide legacy programs and infrastructures, and this reveals within the firm’s outcomes. Over the course of YTD, Telenor has shut down at least ~100 legacy programs already, with a goal of #200 for the 2024 interval. We’re speaking concerning the shutdown of networks.

As well as, it is working to remodel its Nordic phase to higher efficiencies and add synergies on the Asian market, with a continued deal with digital safety. Price packages and effectivity packages are what you see in the event you take a look at the present outcomes – and our focus ought to at the least partially be on this and on these.

Telenor IR

The advantages of such synergistic developments are, as I see them, comparatively clear. The discount of OE packages for the enterprise will result in price financial savings, much less workforce required, and which can in flip result in OpEx declines, upwards of 1-2B for the long run.

These modifications are essential as a result of Scandinavia is a really mature market. Whereas there will probably be a level of churn between the three largest gamers, Tele2, Telenor, and Telia, essentially the most that can seemingly occur is a few slight actions – however revenue will kind of be the identical. One of the best I consider we are able to hope for is inflation-adjusted development with out a lot quantity development, and earnings development, except the corporate finds a solution to make it extra environment friendly (because it’s attempting to do right here).

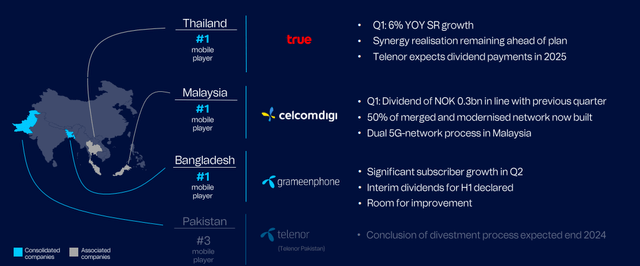

Quantity development and extra vital bottom-line development would as a substitute be popping out of Asia, as you see under.

Telenor IR

Telenor has “tried” just a few issues, as you may see right here. Pakistan is the newest geography that the corporate is exiting, and future focus is probably going now to stay on Thailand, Bangladesh, and Malaysia, which all are displaying good developments. From true, the corporate is now anticipating dividend funds, which is what we buyers have been ready for a while right here.

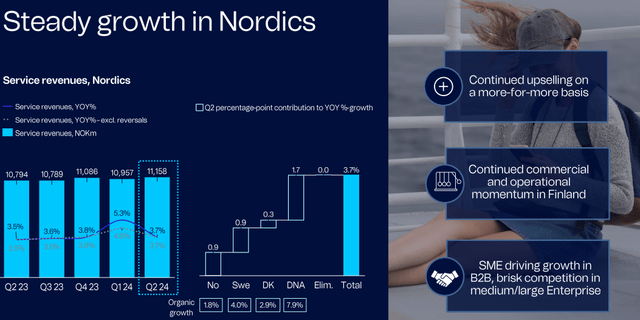

The 2Q24 financials, if we take a look at them with a chilly, calculating eye, are usually not unhealthy. Prime-line development of 4.5% is above friends and common, and EBITDA of three.8% YoY by way of development can also be good. CapEx/Gross sales stays above 15%, however is trending downward, and with the effectivity provides, we see a means for it to go all the way down to under 15%.

Additionally, the corporate continues its custom of being an FCF “minting machine”. For the quarter, we’re at 2.2B NOK, which signifies that we’re transferring in the direction of Telenor with the ability to “mint” $1B of FCF on a run-rate, annualized foundation pretty quickly if issues enhance right here.

There may be additional positivity to this whenever you notice that one of many causes the OpEx is up is that prices in Asia are up (within the house geographies, they’re really flat). The group EBITDA development can also be pushed by Nordics right here, which signifies that the potential for development from Asia continues to be very a lot there.

Telenor IR

The attraction of Telenor has at all times been the next to me.

We’re speaking a very steady house base of Norway with Nordic nations added, which permits for loads of steady FCF, which in flip permits Telenor to speculate loads of capital in considerably higher-risk initiatives. That is additionally precisely what it has been doing in investing in Asia. Given the corporate’s steady base, this has been completed with out placing any vital pressure on the A-rated steadiness sheets. The corporate can also be transferring ahead with a number of synergistic mergers in Asia, designed to unlock worth. With Telia out of the sport in Asia and EMEA and Tele2 targeted on the Baltics, that are rising however not as a lot, Telenor stays the only real Scandinavian Telco that works with Asia and does so effectively.

That could be a vital upside. The ensuing mergers from the corporate’s synergy-seeking measures have created market-share main gamers in these nations, as you may see above.

Some analysts want to see Telenor divest a few of the extra noncore Asian operations – me, I say that Telenor needs to be cautious right here. I agree on the Pakistan divestment, however would not wish to see extra instantly right here as a result of I consider the rest has vital worth.

Supplied you may deal with the volatility that the Asian operations convey to firm outcomes, this should not actually be an enormous concern to you. If thought-about pretty, I say that Tele2 is a greater capital allocator than Telenor, particularly with the previous’s buy of former Com Hem. This was an absolute masterstroke that Telenor has not but been in a position to present. However even when placing Telia (OTCPK:TLSNF) in context right here, with its undoubtedly poor document of capital allocation, all of those three gamers stay essentially engaging to me on the proper worth.

This has to do with very stable dividends, however above all, mission-critical infrastructure throughout 2-3 nations.

It is for that purpose, coupled with dividend, coupled with double-digit upside, that I say that Telenor is an “simple” purchase on the proper worth.

Let’s take a look at the present valuation.

Telenor Valuation – Lots to love, however the upside is all the way down to 13% per 12 months at most till 2026E.

Since my final article, which you’ll find right here, the corporate has outperformed the index. Provided that we’re above 130 NOK, it is a good time for an replace of the fair-value estimate in addition to the potential upside we are able to get from Telenor.

It is also an excellent time to try this right here as a result of for the primary time in a few years, as I can recall, the upside is now lower than 15% per 12 months. It isn’t a complete lot much less – round 13.5% annualized at a conservative upside to my long-term PT of round 150 NOK. I’ve had this PT for a really very long time.

But it surely nonetheless marks a distinction. In my final article, I made it clear that the corporate was now not low cost. I nonetheless say that there’s upside sufficient right here to “Purchase” the corporate, however ought to the corporate go up even to a 133 NOK, I’d transfer my score to a “Maintain”, and begin an exit above or round that 150 NOK goal.

The corporate has a decent moat, given its place in Norway in addition to different nations – and the size of its enterprise. On the similar time, the corporate’s very established infrastructure requires a really excessive repairs – leading to a really excessive price of capital. Sustaining such a community is rarely low cost.

I consider that Telenor can at most be forecasted, even with its Asian operations, to generate top-line development of 5-6% per 12 months. The results of the merger in Thai/Malaysia will present money move readability, however not more than that – since you additionally need to take Asian FX into consideration, which is not precisely traditionally steady.

Telenor is nice attributable to a 40%+ EBITDA margin, which for Telcos is “up there”. That can also be why I am very prepared to “Maintain” right here, even ought to the corporate’s share worth rise. The corporate will also be thought-about some of the unstable Scandinavian telcos attributable to publicity to Asia.

Normalized P/E at the moment is round 12x. That is to be put subsequent to a normalized P/E of round 16x on a 5-year foundation, and round 16 on a 20-year foundation. The normalized P/E for Telenor is due to this fact 16x.

Forecasting at 16x P/E, the corporate has an annualized upside right here of round 13% per 12 months, of which round half is the corporate’s present dividend. The upside is due to this fact rather more muted than earlier than. I nonetheless suppose it is adequate, however I additionally say there are different higher-yielding investments offering glorious returns outdoors of Telenor.

My PT for the longest time has been 150 NOK. I am not altering that. It implies round a 15x P/E ahead valuation a number of, which is conservative sufficient for me.

TELNF is the ADR we’re right here. As a result of it is a 1:1 SHARE ticker, you may FX-translate the value instantly, which signifies that my USD goal for TELNF is round $13.7 right here, which nonetheless provides an honest sufficient upside.

Dangers?

Dangers for Telenor – Largely the Asian volatility

Do not count on all that a lot to vary on a quarter-on-quarter foundation. The chance right here will stay the components related to the Asian markets. Each FX and the volatility within the political state of affairs there. There’s additionally the truth that regulators may, and have prior to now, enhance market competitors by encouragement, which may work towards Telenor.

And as to political instability, you solely want to have a look at what occurred to Telenor’s Myanmar operations. They had been absolutely impaired in -21 because of the political coup, and this has remained an overhang on the inventory for a while since. Now, Thailand and Malaysia are usually not Myanmar, however they don’t seem to be as steady as Telenor’s house nation both.

So, there are the dangers I presently see to the inventory.

Thesis

- I view Telenor as top-of-the-line telcos in all of Europe, based mostly on its fundamentals and markets. Safer than Orange, and safer than Tele2/Telia. Maybe Deutsche Telekom (OTCQX:DTEGY) is likely to be as protected, however lower than half the present yield.

- Based mostly on this security and this yield in addition to this upside, I am marking this firm as a “Purchase” and contemplating it with a PT of 150 NOK/share. I’m nonetheless not reducing my PT right here as of 2024. The goal for the ADR is $13.7/share right here as of August of 2024.

- I consider the proper solution to spend money on the enterprise is native shares solely, not ADRs. The native share trades on the Oslo Share alternate underneath the image TEL, and I’d not spend money on any Norwegian firm besides by shopping for the native share.

Keep in mind, I am all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly huge – firms at a reduction, permitting them to normalize over time and harvesting capital features and dividends within the meantime.

2. If the corporate goes effectively past normalization and goes into overvaluation, I harvest features and rotate my place into different undervalued shares, repeating #1.

3. If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again all the way down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed below are my standards and the way the corporate fulfills them (italicized).

- This firm is total qualitative.

- This firm is essentially protected/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is presently low cost.

- This firm has a sensible upside based mostly on earnings development or a number of expansions/reversions.

I can now not name the corporate “low cost” right here, but it surely fulfills each different one in every of my funding standards. if it had been to rise above 133 NOK, I would most likely decrease my score to “Maintain”.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.