Vladimir Zakharov

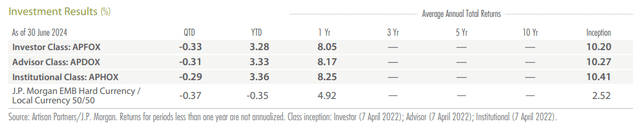

Funding Outcomes (%)

Previous efficiency doesn’t assure and isn’t a dependable indicator of future outcomes. Funding returns and principal values will fluctuate in order that an investor’s shares, when redeemed, could also be price roughly than their unique price. Present efficiency could also be decrease or increased than that proven. Name 800.344.1770 for present to most up-to-date month-end efficiency. The efficiency data proven doesn’t mirror the deduction of a 2% redemption charge on shares held by an investor for 90 days or much less and, if mirrored, the charge would scale back the efficiency quoted.

Efficiency Dialogue

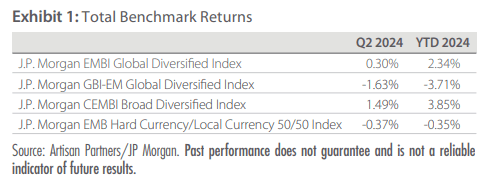

The portfolio outperformed the J.P. Morgan EMB Exhausting Forex/Native Forex 50/50 Index in Q2 and stays forward of the index yr thus far. The portfolio outperformed the J.P. Morgan GBI-EM International Diversified Index for Q2 however trailed the J.P. Morgan EMBI International Diversified Index and J.P. Morgan CEMBI Broad Diversified Index for the interval. The portfolio outperformed all indices yr thus far apart from the J.P. Morgan CEMBI Broad Diversified Index.

Investing Setting

As rising and developed international locations proceed to grapple with ongoing inflation and challenges to progress, differentiation out there and variations in efficiency have gotten extra pronounced. Corporates outperformed all different rising markets debt (EMD) sectors in Q2 as company credit score spreads tightened on the again of steady fundamentals and supportive technicals. Native forex bonds had been the worst performing EMD sector for the interval, as rising markets currencies continued to weaken towards a stronger US greenback. Exhausting forex sovereigns had been flat for the quarter as spreads widened reasonably.

Lingering inflationary pressures throughout the globe have led to stalls within the disinflation course of in some international locations and areas. As policymakers proceed to judge monetary situations, central banks are discovering themselves at various phases of the financial coverage cycle. International locations equivalent to Hungary, Mexico and Brazil have seen the disinflation course of gradual and inflation reaccelerate. Many of those international locations had been early movers in 2021 to lift charges, however now their central banks are being compelled to pause or gradual the tempo of price cuts. In the meantime, international locations which have remained prudent and held charges regular for longer proceed to see sturdy disinflation, equivalent to Serbia, which simply started chopping charges in June.

Developed markets have remained in sync by this cycle, however they’re now starting to diverge from each other. The Fed and BOE saved charges unchanged throughout Q2, whereas the ECB minimize charges by 25bps in June, its first rate of interest minimize in virtually 5 years and a notable divergence from friends. The ECB stopped in need of indicating future price cuts are anticipated, and it even raised its inflation forecasts for 2024 and 2025. The Fed continues to evaluate fluctuating alerts from each inflation and the labor market, and revised its price minimize forecast all the way down to just one minimize for this yr. US inflation topped forecasts initially of Q2 however has since slowed to its lowest tempo in three years. Conversely, the labor market confirmed indicators of cooling initially of the quarter however demonstrated resilience towards the top of the interval. After the BOJ ended its period of unfavorable rates of interest in Q1, the rate of interest differential between Japan and its developed market friends continued to widen because the BOJ left charges unchanged all through the quarter.

Rising markets issuance slowed in Q2 relative to Q1 however has remained sturdy, reaching 85% of the 2023 complete by the top of the primary half. Company issuance ticked up barely in Q2, whereas sovereign issuance declined however stays properly above its common quarterly issuance seen prior to now 5 years. A number of international locations took benefit of the wholesome new problem market to problem for the primary time in a very long time, equivalent to El Salvador. El Salvador’s distinctive issuance included a traditional amortizing bond in addition to a warrant that may pay an adjusted payout to traders if the nation agrees to a take care of the Worldwide Financial Fund, or it receives a credit standing improve.

Sovereign spreads widened throughout Q2 resulting from a mix of elevated issuance within the first half of the yr and a extra challenged world progress outlook. Regardless of the widening, spreads stay beneath their 15-year common ranges. The re-inclusion of defaulted Venezuela and PDVSA bonds in sovereign indices contributed to an outsized one-day adjustment in spreads, ensuing within the index widening by ~50bps in Q2. But, sovereign indices that exclude defaulted bonds widened by solely ~5bps in Q2.

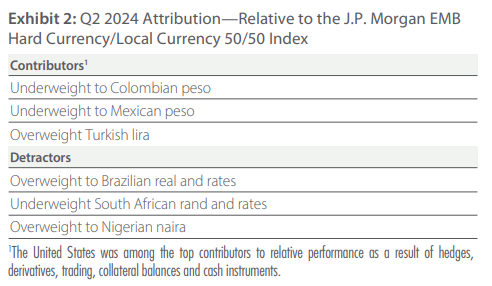

Rising markets currencies had been broadly weaker because the US greenback appreciated, pushed by market expectations of extended increased rates of interest within the US. Political occasions spurred fluctuations in native forex markets.

For instance, after the presidential elections in Mexico, the place Claudia Sheinbaum and the ruling Morena get together secured a congressional majority, the Mexican peso plummeted by greater than 7%, native rates of interest surged, and credit score spreads widened. The South African rand and bonds rallied following the nation’s elections in Might the place the ruling Africa Nationwide Congress (ANC) get together misplaced its majority for the primary time since independence and was compelled to type a “Authorities of Nationwide Unity” with different events, together with the Democratic Alliance (DA).

Whereas rising markets debt stays on the mercy of an more and more unsure world macroeconomic backdrop, native occasions throughout the globe proceed to form idiosyncratic returns. In Bolivia, the highest army commander led army models that stormed the federal government palace in a failed coup try, sending sovereign bonds weaker. Argentina bonds rallied after Congress accepted President Milei’s omnibus invoice that features proposals to slash state spending and reforms anticipated to draw overseas investments, ease labor legal guidelines, and facilitate privatization. Zambia’s multiyear default concluded after the federal government efficiently secured a take care of bondholders, boosting greenback bond returns. Georgian sovereign bonds declined after the federal government reintroduced and handed a Russian-style Transparency Legislation, leading to massive protests.

Portfolio Positioning

In our view, the portfolio stays conservatively positioned as geopolitical uncertainty persists and valuations have turn out to be much less enticing. The crew took benefit of sure sovereign credit score alternatives in Africa and Latin America that stay enticing regardless of tight unfold ranges. These international locations proceed to display sturdy fundamentals, wholesome progress outlooks and enticing valuations. The portfolio stays obese period in rising markets and underweight period in developed markets relative to the J.P. Morgan EMB Exhausting Forex/Native Forex 50/50 Index, translating to an total underweight period positioning relative to the index. The crew decreased its native charges publicity in Asia because the disinflation course of has stalled in lots of international locations. Elsewhere, the portfolio stays obese native charges in Latin America, the place fiscal and political reforms proceed to reinforce fundamentals in sure international locations. The crew decreased the portfolio’s forex publicity throughout Q2 as inflationary and geopolitical uncertainties grew, particularly in Jap Europe and Latin America, however stays obese relative to the index.

The EMsights Capital Group continues to seek for international locations with enhancing storylines the place market costs should not absolutely reflecting fundamentals. General, valuations in EMD are fuller, warranting a extra conservative strategy for now. We proceed to hunt out idiosyncratic occasions within the company and sovereign area that form the market panorama and drive divergence between the areas and international locations. The worldwide financial system continues to face challenges, a lot of that are serving as tailwinds that preserve the rising markets debt outlook robust. With one of many busiest election cycles on document, rising geopolitical tensions and monetary consolidation proceed to current exploitable volatility occasions.

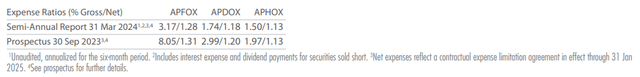

Fastidiously think about the Fund’s funding goal, dangers and expenses and bills. This and different necessary data are contained within the Fund’s prospectus and abstract prospectus, which will be obtained by calling 800.344.1770. Learn fastidiously earlier than investing.

Present and future portfolio holdings are topic to danger. The worth of portfolio securities chosen by the funding crew could rise or fall in response to firm, market, financial, political, regulatory, or different information, at occasions better than the market or benchmark index. A portfolio’s environmental, social and governance (“ESG”) concerns could restrict the funding alternatives obtainable and, consequently, the portfolio could forgo sure funding alternatives and underperform portfolios that don’t think about ESG elements. Non-diversified portfolios could make investments bigger parts of belongings in securities of a smaller variety of issuers and efficiency of a single issuer could have a better affect on the portfolio’s returns. Worldwide investments contain particular dangers, together with forex fluctuation, decrease liquidity, completely different accounting strategies and financial and political programs, and better transaction prices. These dangers sometimes are better in rising and fewer developed markets, together with frontier markets, and embody new and quickly altering political and financial constructions, which can trigger instability; underdeveloped securities markets; and better probability of excessive ranges of inflation, deflation or forex devaluations. Mounted revenue securities carry rate of interest danger and credit score danger for each the issuer and counterparty, and traders could lose principal worth. Basically, when rates of interest rise, mounted revenue values fall. Excessive-yield securities (junk bonds) are speculative, expertise better value volatility, and have a better diploma of credit score and liquidity danger than bonds with a better credit standing. Use of derivatives could create funding leverage and enhance the probability of volatility and danger of loss in extra of the quantity invested.

The J.P. Morgan (JPM) EMB Exhausting Forex/Native forex 50-50 is an unmanaged, blended index consisting of fifty% JPM Authorities Bond Index-Rising Market International Diversified (GBIEMGD), an index of local-currency bonds with maturities of multiple yr issued by EM governments; 25% JPM Rising Markets Bond Index-International Diversified (EMBIGD), an index of USD-denominated bonds with maturities of multiple yr issued by EM governments; and 25% JPM Company Rising Market Bond Index-Broad Diversified (CEMBIBD), an index of USD-denominated EM company bonds. The index(es) are unmanaged; embody web reinvested dividends; don’t mirror charges or bills; and should not obtainable for direct funding.

Info has been obtained from sources believed to be dependable, however J.P. Morgan doesn’t warrant its completeness or accuracy. The Index is used with permission. The Index might not be copied, used, or distributed with out J.P. Morgan’s prior written approval. Copyright 2024, J.P. Morgan Chase & Co. All rights reserved.

This abstract represents the views of the portfolio managers as of 30 Jun 2024. These views could change, and the Fund disclaims any obligation to advise traders of such adjustments. Securities named within the Commentary, however not listed right here, should not held within the Fund as of the date of this report. Portfolio holdings are topic to vary with out discover and should not meant as suggestions of particular person securities. All data on this report, except in any other case indicated, contains all courses of shares (besides efficiency and expense ratio data) and is as of the date proven within the higher right-hand nook. This materials doesn’t represent funding recommendation.

Attribution is used to judge the funding administration selections which affected the portfolio’s efficiency when in comparison with a benchmark index. Attribution shouldn’t be precise, however must be thought of an approximation of the relative contribution of every of the elements thought of.

This materials is offered for informational functions with out regard to your specific funding wants, and shall not be construed as funding or tax recommendation on which you will rely in your funding selections. Traders ought to seek the advice of their monetary and tax adviser earlier than making investments with a view to decide the appropriateness of any funding product mentioned herein.

Notional worth adjusts for derivatives’ exposures to the market worth of a contract’s underlying safety, somewhat than the market worth of the contract itself, and represents an approximation of the portfolio’s financial and danger exposures at a time limit. Delta measures the sensitivity of a by-product contract to adjustments in value of its underlying safety; the derivatives contract’s worth could also be overstated or understated with out delta-adjustment.

Artisan Companions Funds supplied by Artisan Companions Distributors LLC (APDLLC), member FINRA. APDLLC is an entirely owned dealer/seller subsidiary of Artisan Companions Holdings LP. Artisan Companions Restricted Partnership, an funding advisory agency and adviser to Artisan Companions Funds, is wholly owned by Artisan Companions Holdings LP.

© 2024 Artisan Companions. All rights reserved.

Authentic Publish

Editor’s Word: The abstract bullets for this text had been chosen by Searching for Alpha editors.