Maskot

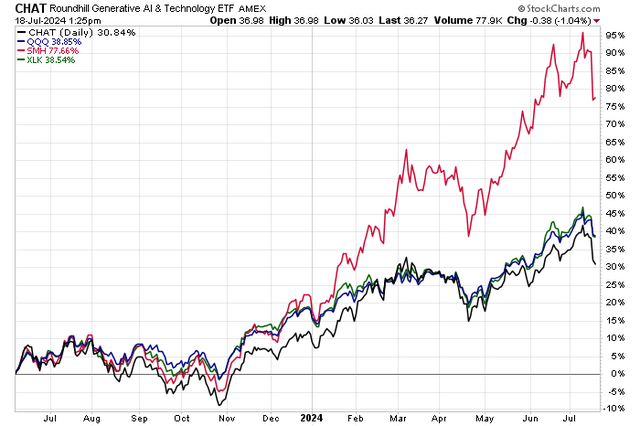

The Roundhill Generative AI & Know-how ETF (NYSEARCA:CHAT) has been up huge previously yr. Shares have rallied about 20% since mid-July 2023, and that’s after a major correction occurred from August by way of a lot of October final yr. Thus, it may appear to be I’ve egg on my face for placing a promote score on the ETF in late Q2 2023.

My assertion, although, was that CHAT’s excessive expense ratio and a “near-term peak” in AI froth warranted that traders ought to avoid the fund, favoring a longer-term view on ETFs like QQQ, XLK, and SMH. Following the Q3 pullback, shares of AI and tech-related equities soared, following historic seasonal patterns.

At this time, I reiterate a promote score for a number of the similar causes. With a excessive valuation, still-lofty expense ratio, and bearish seasonality on faucet, avoiding CHAT appears as soon as once more prudent wanting additional out into the second half. I’ll additionally element a key technical draw back transfer that has occurred.

CHAT: Underperforming Tech-Associated Index Funds

Stockcharts.com

In accordance with the issuer, CHAT is an actively managed ETF that seeks to personal shares of firms working throughout info expertise, semiconductors and semiconductors tools, software program and providers, system software program, software program analysis, synthetic intelligence software program, cloud infrastructure providers, community infrastructure, and AI providers industries.

CHAT has not caught the attention of many traders. Complete belongings beneath administration is simply $202 million as of July 17, 2024, whereas its annual expense ratio is excessive at 0.75%. Revenue traders received’t be drawn to the fund both contemplating that there’s no present dividend yield; that might change if the portfolio managers select so as to add holdings completely different from what it owns at the moment, as it isn’t a passive ETF.

Share-price momentum has been respectable within the final handful of months, however energy has turned south simply within the final handful of periods whereas relative energy in comparison with different lower-cost index funds within the tech space has been exceptionally poor. CHAT can also be a dangerous product when analyzing historic normal deviation traits and its present concentrated allocation.

Liquidity is a powerful level, nevertheless, regardless of its low quantity, although I might nonetheless encourage traders to make use of restrict orders contemplating that its 30-day median bid/ask unfold is materials at 13 foundation factors, per Roundhill.

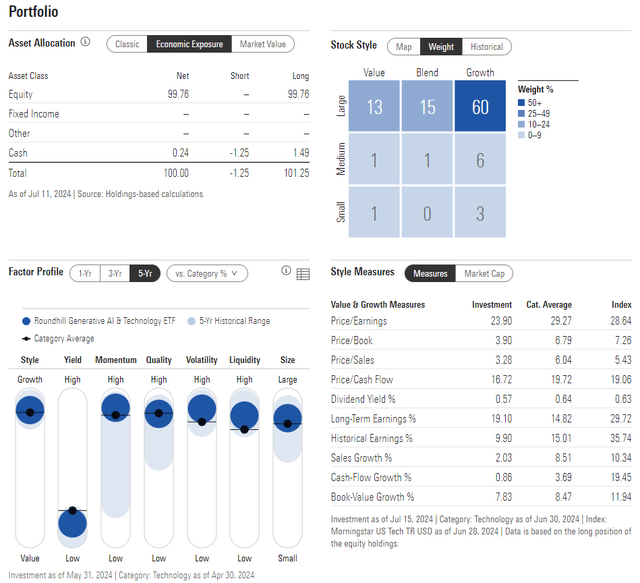

Trying nearer on the portfolio, the Damaging-rated ETF by Morningstar is concentrated within the top-right part of the type field, indicative of its bent to large-cap progress. That type has been in favor for a lot of this yr, however a key threat is that if we see a continued broadening out or rotation out there favoring small caps and worth. With a price-to-earnings a number of of 24, it’s a greater than two-handle earnings a number of premium to the S&P 500.

CHAT: Portfolio & Issue Profiles

Morningstar

CHAT’s present mixture of shares isn’t all that dissimilar from the Nasdaq 100 ETF and the Choose Sector SPDR Know-how ETF. Each QQQ and XLK are heavy into mega-cap tech, however traders pays a a lot decrease price for these merchandise.

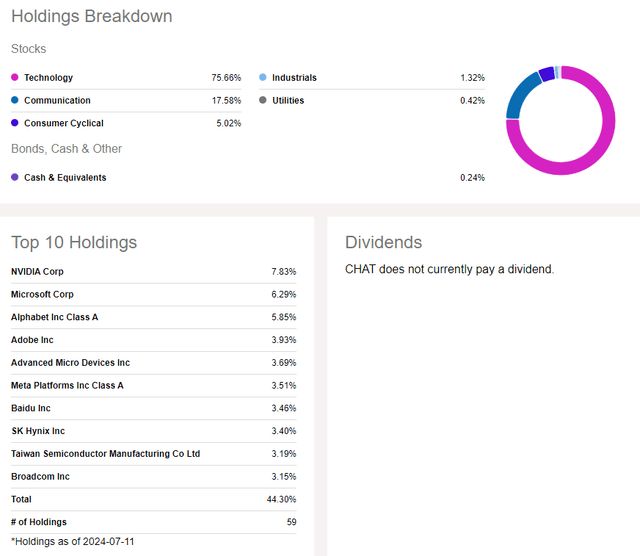

With greater than three-quarters of CHAT invested within the I.T. sector, being conscious of threat ought to tech’s efficiency sag to the broader market is vital. What’s extra, practically half of the allocation consists of the highest 10 holdings. Additionally, preserving tabs on main holdings corresponding to NVIDIA (NVDA), Microsoft (MSFT), and Alphabet (GOOGL) is vital.

CHAT: Holdings Info, No Dividend

Looking for Alpha

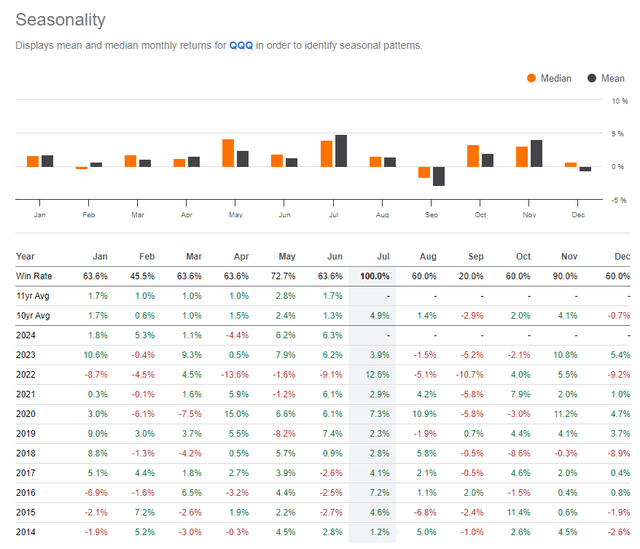

Seasonally, we’re as soon as once more coming into a bearish stretch. The picture under shows the historic traits on QQQ, which I imagine is an honest ballpark indicator of CHAT’s potential seasonal pattern.

The late July by way of September interval has been riddled with volatility and draw back worth motion, and we’ve seen that in every of the previous two years. So, calendar tendencies probably don’t favor CHAT proper now.

QQQ Seasonality Turns Weaker in August and September

Looking for Alpha

The Technical Take

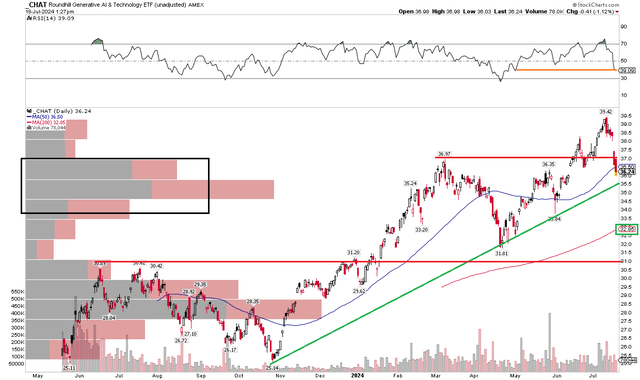

Cementing my promote score is the truth that technicals have turned much less favorable for CHAT. Discover within the chart under that shares have fallen under the March 2024 peak, which triggers a possible false breakout sample. Technicians prefer to say, “From false strikes come quick strikes in the wrong way,” and we might simply now be seeing that get underway. The ETF is decrease for 4 straight periods as of this writing with elevated draw back momentum, evidenced by a multi-month low within the RSI oscillator on the prime of the graph.

The excellent news for AI-stock bulls is that CHAT’s long-term 200-day transferring common stays upward sloping, suggesting that the bulls management the first pattern. Furthermore, there’s a respectable quantity of quantity by worth within the $33 to $36 vary that might supply some cushion in the course of the present selloff. Nonetheless, I might not be shocked to see the fund check the earlier resistance level of $31 if we see a trendline break.

CHAT: Bearish False Breakout Watch, Rising 200dma, $31 Assist

Stockcharts.com

The Backside Line

I’ve a promote score on CHAT. The fund has been an underperformer previously 13 months, regardless of a surge from November by way of mid-July. Technicals now seem weak on this high-fee tech ETF.