Airbnb bans escalate, a “tsunami” could possibly be coming for this actual property area of interest, and “sinking” cities result in skyrocketing insurance coverage costs. The housing market adjustments each week, so we’re right here to interrupt down the headlines and sift by the hype so what may impression YOU. Dave Meyer and the whole On the Market panel are right here to debate 4 of the highest actual estate-related information tales from this week.

First, we focus on the industrial actual property credit score crunch that would trigger a “tsunami” within the workplace investing house. Subsequent, one main European metropolis will ban Airbnb by 2028 in an effort to provide locals a greater likelihood at shopping for their first house. Will it work, or is it only a transfer to get extra votes? With the mud of the NAR settlement settling, homebuyers may face 1000’s in charges to work with an agent, however will this cease homebuying?

Earlier than we go over our final headline, be sure you’re standing on strong floor as a result of “sinking” cities have gotten the brand new norm. Is your own home slowly sliding off a cliff? If that’s the case, your insurance coverage prices could possibly be rising even greater. We’ll get into this story and the remainder of the related actual property information on this episode!

Dave:

Think about a world with out Airbnb, wouldn’t it actually be the dream repair for the rental housing scarcity? What’s occurring with personal fairness companies? Are they swallowing up all that cut price industrial actual property on the market? And the way excessive are prices actually gonna get for first time house patrons following the NAR settlement? Hey everybody, welcome to On the Market. That is your host, Dave Meyer, and at this time we’ve pulled some actually juicy headlines for you that we’re gonna focus on and assist make sense of so you possibly can all make knowledgeable investing selections to assist me in that effort. Henry, how’s it going man? Thanks for being right here. Hey, glad to be right here as at all times, James, thanks for taking a, uh, break out of your Hollywood glamorous life-style to hitch us at this time. It’s

James:

Very glamorous <chortle>, however I’m blissful to be hanging out with my individuals.

Dave:

If y’all didn’t know, James is filming an A and e TV present, so he’s uh, gone huge time, uh, however he nonetheless makes time for us. Thanks. And Kathy, thanks for being right here with us. Glad to be right here. Alright, so the 4 headlines I acquired for the three of you at this time are type of spanning the entire world of actual property investing. First up, we’re gonna speak about personal fairness companies and what they’re doing within the industrial actual property house. Then we’re speaking a couple of world with out brief time period leases. Subsequent, we’ll speak about first time house patrons in a publish NAR settlement world. And lastly, we’ll speak about American cities which are actually sinking into the bottom and what which means for actual property traders. Earlier than we get into these headlines, be certain that to hit the observe button on Apple or Spotify to be sure you by no means miss an episode.

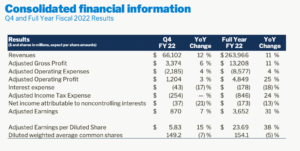

All proper, you guys are prepared. Let’s soar into this. Our first headline comes from James, your Neck of the Wooden, this Seattle Occasions, and the headline reads the Business Actual Property Credit score Crunch. There’s a tsunami coming. The important thing factors from this text are that one workplace values fell by virtually 1 / 4 final yr. That is a gigantic quantity, 25% in a single yr, and there’s virtually $1 trillion of debt linked to industrial actual property that can mature this yr within the us. We’ve talked about that loads, however I feel one of many attention-grabbing elements of this text that we wanna focus on is that non-public fairness companies try to benefit from alternatives for distressed properties. About 64% of the $400 billion that’s sitting on the sidelines proper now in personal fairness has been put aside for property investments in North America, which is the best share in 20 years. So I’m curious if you happen to suppose that is gonna put a backside to the market. Do we now have extra draw back? Is that this gonna shake up downtown areas? Kathy, let’s begin with you. What do you make of personal fairness involvement within the workplace market?

Kathy:

There’s simply a lot cash sitting on the sidelines ready for ready for offers, ready for offers to occur. And we hold speaking about actual property values, , all these foreclosures in actual property, however I don’t, it doesn’t appear like it’s gonna get that far. It seems to be like offers are gonna be carried out earlier than a foreclosures occurs within the type of personal fairness. That’s what they do. They sort of are available, save the deal, however then they get precedence, uh, to the opposite traders. So what I actually suppose the headline ought to say is that the sharks are coming after the ocean Lions <chortle> could be a greater one. Not, not a lot a tsunami simply wiping issues out, however reasonably, uh, extra consolidation of banks. I used to be sort of trying on the stats and in 1920 there have been over 30,000 banks within the us after all, after the, the, the melancholy that went down dramatically.

Then, um, then for 50 years there was about 13 to fifteen,000 banks. However after the SNL disaster, after which after the final recession of 2008, we sort of acquired all the way down to, I don’t know, 5,000, we’re about 4,000 banks now. Ooh, wow. So it simply sort of an instance of the larger banks are gonna be taking up a number of the small banks that fail, and that isn’t a brand new story. So extra consolidation within the banking business and possibly extra traders dropping because the personal fairness is available in and takes precedence. Those that sort of got here in early or invested early in a few of these industrial tasks are most probably gonna lose their, their fairness except in some way values rise dramatically over the subsequent decade.

Dave:

And only for anybody who’s not acquainted, personal fairness is a kind of funding automobile the place often rich people, pension funds, , retirement funds, pool their cash and make investments throughout a wide range of asset courses. It’s not truly all that dissimilar from an actual property fund, however reasonably than simply investing in industrial actual property, they spend money on quite a lot of various things. And one of many important issues about this story that’s so essential and that Kathy was alluding to is that through the recession or through the pandemic, excuse me, there was quite a lot of money. I feel all of us noticed that by way of cryptocurrency costs, actual property costs, inventory market costs, these kinds of funding automobiles additionally have been in a position to elevate a ton of cash as a result of what personal fairness does is that they exit and get cash from rich people and pension funds, however with quite a lot of them, they weren’t in a position to truly make investments earlier than rates of interest began to go up and the investing local weather began to vary.

In order that they’re sitting on quite a lot of that cash. Lots of these personal fairness companies raised billions and billions of {dollars} they usually’re simply sitting there ready until market situations change. And so the query then, and that what Kathy was alluding to is like, they may simply are available and begin scooping up some distressed belongings earlier than it truly will get to the purpose of a foreclosures, public auctions, all of that. So James, let me ask you, that is coming from the Seattle Occasions. Do you, do you see a tsunami coming and have you ever skilled any of that in Seattle? As a result of , your, your market is a kind of excessive worth downtown areas that always will get talked about once they speak about type of these detrimental loops that industrial actual property is in.

James:

We hold listening to in regards to the Doom loops and the tsunami doom

Dave:

Loops and tsunamis. Man, if you happen to had a greenback for everybody,

James:

<chortle>, I really feel like each six months there’s an article that claims tsunami of foreclosures someplace coming, whether or not it’s industrial actual property or whether or not it’s common foreclosures. Um, I don’t imagine so. I imply, I, I feel it doesn’t matter what, we’re going by a transition interval the place there’s sure sorts of investments which are being liquidated proper now and it’s not likely good ones which are secure and it’s not ones which are rented. They’re properties which are vacant or which are underneath development. Many of the gross sales that I see no less than are half constructed, half permitted in the midst of including worth. Not that there isn’t different gross sales happening, however I i I simply really feel prefer it’s like these stats are at all times so pumped up. So in that article I talked about being down 25%, however it’s additionally as a result of there’s only a smaller phase of gross sales. Like in two, from 2023, the industrial actual property transactions have been at $647 billion in 2022 is 1.14 trillion. And when you’ve a slower quantity of gross sales and costlier debt, quite a lot of simply the investments are getting traded round anyhow, individuals dispositioning repositioning their investments and shopping for one thing totally different. I’m sort of sick of this, this, this headline. It’s like, if it’s gonna come, let’s get it on. Nevertheless it by no means comes <chortle>.

Dave:

Yeah, it positively doesn’t. Henry, I’m gonna ask you, if you happen to have been the pinnacle of a hedge fund and also you had $400 billion <chortle>, what kind of belongings would

Henry:

You, what sort of island would I be on? Um,

Dave:

Yeah, precisely. <chortle>. Are you considering Caribbean? Are you considering South Pacific?

Henry:

Proper, proper, proper. Some, some heat sandy seashore someplace. Um, right here, right here’s my ideas on this. Like if you concentrate on the final actual property crash, it was due to monetary components, proper? Subprime mortgages, these sorts of issues. However the way you monetized the asset didn’t change, proper? You continue to purchased actual property that went up in worth over time that you just compelled or added worth to. However this can be a little totally different. So if I used to be a hedge fund supervisor, like I clearly benefiting from shopping for actual property at an inexpensive worth is a good suggestion. However quite a lot of the components enjoying into why industrial isn’t doing effectively aren’t simply financial associated. It’s extra associated to much less individuals must hire workplace house or need to hire workplace house. There’s not as many individuals available in the market anymore. And so I might solely be eager to go and put my cash into these belongings if we had a plan for a way we’re going to enhance that emptiness, perhaps with a special tenant base or, or doing one thing else inventive. However simply shopping for a distressed asset after which attempting to place the identical tenants in it who don’t need to hire it proper now, regardless that you bought it low cost, doesn’t imply you’re gonna have the ability to monetize it. Like it’s important to have a plan for, for, for this case.

Dave:

It’s, yeah, it’s identical to all these people who find themselves like purchase the dip within the inventory market the place they’re identical to, oh it went down. Purchase it. Like, okay, perhaps that can work for some belongings that can work for some shares that can work. Nevertheless it’s not identical to an automated factor. Simply be you purchase when costs are low.

Henry:

Should you purchase an workplace complicated that’s 80% vacant and it’s been 80% vacant for the previous six months, simply ’trigger you bought it at a steal doesn’t remedy the issue of you with the ability to put tenants in it. It might be cheaper so that you can maintain that asset however nonetheless not creating wealth.

James:

What Henry simply stated is essential, and I’ve realized this lesson <chortle>, uh, in 2008 we purchased a constructing and we thought we simply ripped the deal of the century. You already know, we purchased this constructing, it was like 10,000 sq. toes. We paid 900 one thing thousand for it. It was one million {dollars} under appraisal. And we simply thought we hit a house run and we purchased effectively under alternative prices, all of the metrics you’d need. However then what we discovered is that nobody desires to hire it and nobody desires to lease it. It’s a serious drawback. And you could possibly purchase no matter industrial actual property you need, but when it’s not gonna pay you {dollars}, doesn’t matter. And we needed to pack up our entire workplace, transfer into this constructing that was 35 minutes from Bellevue the place we have been transferring after which we, we actually needed to micro out these items. It was like, I swear it was like the primary

Henry:

Coworking house.

James:

Yeah, <chortle>, sure. Nevertheless it was positively not as fancy. It was like, Hey, you could possibly take this workplace for 9, 9 bucks and we have been simply renting all these places of work. However , I feel the massive factor about this industrial actual property is as soon as somebody figures out learn how to repurpose this actual property Sure. Into one thing extra usable and extra in demand, then it’s gonna actually, you’re gonna see a tsunami, then they will use the phrase tsunami of buying <chortle>. Nevertheless it’s, nobody’s figured it out actually but.

Henry:

Yeah. I’m telling you, whoever figures out learn how to flip vacant workplace into reasonably priced housing goes to make some huge cash. ’trigger these are the 2 huge issues.

James:

Hammocks and mini fridges.

Henry:

<chortle>.

Dave:

Yeah. Properly, I, I’ve, I I agree. I feel personally it’s in all probability gonna take some like authorities subsidies ’trigger it’s simply not worthwhile in the best way that’s proper now. However I simply wanna say this like doom and gloom about personal fairness I feel is like so overblown and is sort of the other of what individuals ought to be occupied with. Traders play an important function in setting the underside of any market. This occurred in 2009, 2010, 2011. Nobody wished to purchase houses, no customers, no house patrons wished to, it was traders who began to go in shopping for issues off auctions, shopping for issues that had been sitting available on the market. And that that units the underside, that will get confidence, that will get transaction quantity going once more. And the identical factor goes to need to occur in industrial actual property ultimately. Like if you happen to don’t need it to be personal fairness coming in to set the underside, who else is gonna do it?

Like we’d like somebody to return in and begin shopping for these belongings and making them worthwhile. That’s gonna begin the subsequent cycle for industrial actual property that I feel we’ve all been sitting round and ready for. So I’m all for it. I might like to begin to see a few of this dry powder are available off the sidelines. I feel to me that may be an indication that perhaps I need to get again into industrial actual property <chortle>. We’ve hit our first headline on industrial properties and personal fairness companies, however we now have three extra headlines after this fast break. Follow us.

Welcome again to on the Market. Let’s get again into it. All proper, let’s transfer on to our second headline right here, which reads, what does a world with out Airbnb appear like? This comes from the BBC, this story follows Barcelona like quite a lot of different cities that introduced a complete ban on short-term leases beginning in November, 2028. In order that they’re not even actually grandfathering individuals in, they’re simply saying 4 years from now, it’s carried out. At present there are about 10,000 short-term leases in Barcelona. And by returning these to long-term leases, the town is mainly hoping to supply some reduction to the housing scarcity disaster. There are clearly bigger questions right here about tourism and who will get to profit from a spot, vacationers, locals, each, all of this. However this isn’t one thing new. This has been actually fashionable in main cities and though personally I’ll simply provide you with my opinion on the headline. I don’t suppose Airbnb short-term leases as an entire are going away. However I’m curious, James, let’s begin with you. Do you see a world the place Airbnbs are now not welcome, let’s say main metro areas? ’trigger that does appear to be the pattern. Locations like Dallas, New York, I do know Denver now Barcelona, um, are beginning to ban them. Do you suppose this might pattern may proceed from right here?

James:

Um, I do. You already know, we now have an enormous housing disaster happening and quite a lot of occasions in politics they like to start out putting blame on issues after which transferring laws simply to, , attempt to act like they’re getting one thing carried out once they’re not <chortle>. I did, it’s, i, it it’s a huge concern. Like I used to be, , on this article, one factor that jumped out to me was, , in British Columbia, uh, premier David Emby, uh, put the difficulty out and what he stated, he goes, if you happen to’re flipping houses, perhaps that’s why I grabbed my consideration. Uh, if you happen to’re shopping for locations to do brief time period leases, if you happen to’re shopping for a house, uh, to go away it vacant, then we constantly ship the identical message. Don’t compete with households and people. And so politicians at the moment are placing this into, into what they’re attempting to do to get votes.

And it’s a message they’re, they’re attempting to dump on which they need to. Inexpensive housing is a matter. Price housing is an excessive amount of, and so how can we get it down? However then they begin pointing the, they, they, they wish to level fingers on the traders which are additionally trending which are simple to level the finger at, proper? It’s like, this isn’t even gonna repair actually a lot. However I do suppose this regulation will get worse and worse. And I at all times get shocked by like how a lot it will get tightened. And if I’m getting shocked at this time, which means it could possibly be a really nasty shock in three years. Should you personal brief time period leases, you actually wanna watch the, uh, the laws as a result of if there’s main adjustments happening and it’s not gonna be grandfathered in, you wanna put that in your forecasting to promote and reposition it at a special kind of asset class.

Dave:

Henry, do you suppose it’s gonna work?

Henry:

Do I feel it should create housing? I imply,

Dave:

Yeah. Do you suppose it’ll truly enhance affordability of rents in Barcelona?

Henry:

Right here’s my, my normal take is that if you concentrate on main metros such as you have been speaking about, um, the place I feel, uh, the issue is, is in these main metros the place you’re in a position to take smaller properties, proper? Properties that may usually be rented to people who find themselves in all probability struggling for housing and monetize them on short-term leases. Yeah, I feel that this might completely assist alleviate some strain by way of housing. However if you happen to have a look at locations like Scottsdale, Arizona the place it’s these multimillion greenback huge houses typically getting used as Airbnbs, I don’t suppose that banning these are gonna have a lot, uh, are gonna have a lot implication on the reasonably priced housing or the, or the, or individuals with the ability to purchase houses inside that, that a part of the nation. So, uh, perhaps it’s that a number of the laws could have some type of cap on or some type of restrict on the scale of the home you’re ready to do that on. Like, you possibly can’t do it on, , a 3 mattress, two bathtub, 59 sq. foot house, however you are able to do it on a, , eight mattress, seven bathtub, , McMansion someplace.

Kathy:

Yeah. So it’s, it’s unhappy in a means as a result of mattress and breakfast have been round for therefore lengthy. VRBO has been round, , if you happen to hire trip houses, , that’s been round earlier than Airbnb. It’s simply that Airbnb made it a lot extra accessible to so many individuals. Uh, , it was once that if you happen to wished to have a resort, it needed to undergo the entire allowing course of and there needed to be at a sure a part of city. I reside in a trip city and there’s speak about this on a regular basis that they, they will’t get sufficient children within the faculties and there’s not sufficient households residing right here as a result of so many houses have was leases. So it’s actually, for some cities it’s onerous. I sort of love what, uh, Southern California has carried out. A minimum of Los Angeles. Los Angeles County has, um, not banded, which is superb, <chortle> as a result of it’s California.

Um, however they acknowledge that lots of people want the earnings. So it’s too, it’s like a special story for individuals who simply perhaps wanna hire out an A DU on their property or a room of their home, or they’re gonna go on trip and need, need to hire it out. So LA has a regulation the place it must be your major residence, and I feel that’s cool. You already know, I feel that enables individuals to have the ability to afford to reside in one of the vital costly locations within the nation as a result of they will hire little elements of it out. Uh, however to have a full on enterprise the place you personal a bunch of Airbnbs and also you’re a resort operator, mainly that’s working an excessive amount of underneath the radar. That’s, that’s extra new and, and that does should be regulated as a result of inns get regulated, proper? So, um, that once more, that’s only a answer.

You possibly can’t simply purchase a home and put it on the, and purchase 10 of ’em and put ’em on the Airbnb market in la. So I don’t love banning it fully. I feel it’s essential to have it. I hope that each one of those trip areas will no less than think about nonetheless the, the previous mannequin of getting a a, a Airbnb, proper? That’s my, my mother-in-law and her mom, uh, it, they’d a b and B in, in upstate New York for 100 years. <chortle> like guess this farm has been within the household and that’s how they have been in a position to make these funds on the farm was renting out rooms and having, having a, b and b. So, , hopefully it’s not completely banned, however there’s just a few regulation that it’s important to get, , you’ve acquired, there can solely be a sure quantity within the metropolis. Perhaps that’s what Park Metropolis does, is it’s important to get a allow to have that Airbnb and there’s a restrict to what number of there will be.

Dave:

Yeah, I, I feel there are quite a lot of inventive options. I do wanna name out that there was some tutorial research about this. Most not too long ago within the Harvard Enterprise Assessment, it was a research of New York, which did basically ban, uh, short-term leases most often. And what it discovered was that there was very, little or no impression on affordability. It was like 1%, or I, I overlook the precise quantity, however it was very, very low. And the impression on affordability actually occurred on greater finish, very costly, uh, residences. So it wasn’t actually even serving to the decrease earnings of us that it was supposed to assist. Now that’s simply in New York. There isn’t any realizing if that may work the identical means in different markets. However I do suppose it’s worthwhile noting that the little little bit of statistical evaluation, information evaluation has been carried out on this, exhibits that it doesn’t have an enormous impression.

However I feel, , I, I get why individuals are doing it and I type of perceive that even past the affordability factor, there’s type of like a psychological factor right here, uh, happening that folks need housing for his or her pals and for his or her neighbors and their household, even when it doesn’t have as a lot of a greenback cent and cents factor. I, I do suppose that is smart, no less than in these huge areas. Um, however I, I actually doubt there’s gonna be like a holistic ban throughout the board. I feel we’ll see a moderation identical to there’s in each business, , each business there’s a gold rush, there’s a loopy interval after which there’s regulation and Airbnb. Quick-term leases had its day the place it was going loopy and it was fairly unregulated. And now we’re gonna see a step again and that’s gonna be okay in the long term for traders and for communities.

However we’re type of on this type of like realignment interval, which is at all times a bit awkward. All proper, let’s transfer on to our third story, which comes from the Indiana Gazette. The headline reads, first time house patrons may face 1000’s in new prices following the NAR settlement. NAR is the Nationwide Affiliation of Realtors. Should you haven’t been following the story, we’ve put out quite a lot of exhibits each on the BiggerPockets podcast and available on the market about what’s happening there. However mainly the enterprise mannequin of actual property brokers could be very a lot up within the air. And at this level individuals are actually sort of simply guessing or making no less than educated guesses about what’s going to occur. However this text talks about that the actual fact type of assumes the worst case situation, proper? Which is that reasonably than sellers, I ought to say worst case situation for house patrons. And that situation is the place reasonably than sellers paying the 2 to three% fee to the client’s agent, the client’s simply gonna have to return out of pocket for the very same quantity, which might come to someplace between 80 $512,500. So James, I’ll ask you first your actual property agent. Do you suppose something’s actually gonna change, like this ruling goes to have an effect on? How is your corporation gonna change from it?

James:

I don’t suppose it’s gonna change a lot in any respect. It’s only a matter of construction on a deal. I imply it, on the finish of the day, a purchaser’s prepared to pay a sure worth for a property and whether or not the fee’s added on high or paid individually or paid by the vendor, paid by the client, doesn’t matter. It’s all the identical worth. You already know, it’s, it’s, it, I imply it’s sort of like once you’re shopping for an task deal. While you’re shopping for an task deal, you’re paying a charge to a wholesaler and the commissions cost to the client as a closing value. It’s not paid for by the vendor, paid by anything, however you’re nonetheless simply paying the identical worth for the property. Like whether or not the vendor’s paying it or I’m paying it, so long as I’m at that each one in quantity, it actually doesn’t matter.

And the most important impression brief time period is that the housing market goes up 3% hastily as a result of it’s simply now the price of a home goes up 3% throughout the board, which I wouldn’t thoughts my items would go up in worth, however we’re already seeing patrons beginning to push again. Proper now, nationwide, there’s extra stock coming on-line, issues are getting absorbed for much less. And I can inform you a technique, form, or type, relying on the con the, the market cycle, whether or not it’s a purchaser’s market, vendor’s market, somebody’s gonna pay for it. And is it gonna value the patrons extra? Properly, perhaps at this time if we’re brief on housing, but when it goes right into a purchaser’s market, they’re gonna pay much less. It goes with the cycle of actual property, identical to every other factor. While you’re buying

Dave:

Kathy, what does your crystal ball say about what’s gonna occur with commissions? Do you suppose that we’re gonna have this, uh, worst case situation?

Kathy:

Yeah, I can’t, I can’t say I don’t have a crystal ball anymore. ’trigger Wealthy purchased me one. Now I’ve one <chortle>, uh, dunno learn how to use it. However I feel if something got here out of this, it’s that folks now notice that they will negotiate and for some cause patrons didn’t notice they may, however they at all times may. You already know, you, it’s simply, all of it depends upon provide and demand. Like James simply stated, if it’s a purchaser’s market, which implies that there’s much more stock available on the market and it’s onerous to promote your own home, you’re gonna pay your agent no matter that you must pay to get that house bought. Should you’re anyone attempting to purchase a house in a vendor’s market, which implies there’s not quite a lot of stock and also you gotta work onerous and also you want an agent that may battle for you, you’re gonna pay no matter that you must to that agent.

However perhaps the, the itemizing dealer doesn’t want as a lot as a result of there’s so many patrons. So once more, it’s simply all up for negotiation. And that’s, to me, the nice factor that got here out of that is now individuals are like, oh, I simply thought it was set. It by no means was set. You possibly can at all times, at all times negotiate. Um, they usually might or might not settle for that negotiation, proper? It’s gonna be as much as the brokers. I actually don’t suppose something’s gonna change a lot within the construction of it. Uh, I’m seeing it throughout of individuals saying, yeah, I, , simply put it within the worth of, of the house in order that I don’t have to return out of pocket. And I feel once more, an increasing number of patrons are gonna be taught that there’s other ways to pay that charge. It may be in, , within the worth of the house in order that it’s, you get to have the mortgage on it and also you don’t have to return out of pocket. Or perhaps you simply say, I’m gonna come out of pocket and I’m paying you half of what you need. And, and if it’s gonna shut rapidly, , perhaps they’ll settle for that. So I’ve not seen costs come down and I feel quite a lot of areas haven’t seen costs come down. Some areas have, however that’s due to provide and demand, not due to this.

Dave:

Henry, I do know you’ve an excellent and longstanding relationship together with your agent. You gonna begin, uh, negotiating with him about each deal. <chortle>

Henry:

Completely not, man. So key to my enterprise, pay that man what he wants.

Dave:

Yeah, completely. Properly, do you, do you suppose, uh, have you ever, I imply I do know we, he’s been on the present just a few occasions. Do you suppose, uh, he’s altering his strategy in any respect? Or what do you see occurring right here?

Henry:

I don’t know. I’m, I’m sort of with Kathy. I don’t suppose a lot is gonna change right here. Um, I feel it’s, they’re making an enormous deal about, uh, simply an excessive amount of unknown. Um, and there’s, there’s a number of methods to get issues paid for. And we additionally speak about like there’s, there’s, there’s probably, , incentives that may are available and, and packages that folks may join which may embrace a few of these commissions in order that they will, housing will be extra reasonably priced. Like we do not know what’s coming. However proper now, uh, there I simply haven’t seen a lot of a change. Individuals are nonetheless paying the three% as a result of they really feel just like the brokers are serving to them do what they should do with a purpose to get into a house. So I don’t, I don’t suppose it’s a, I don’t suppose it’s an enormous deal. There’s methods to maneuver that cash round. There’s, it’s simply, it’s, I feel good brokers who present a very good high quality of service aren’t gonna have an issue getting paid or creating wealth. And I feel brokers who don’t work onerous, now you’ve acquired individuals which are gonna have the ability to pull your card and say, Hey man, like why am I paying you 3%? Completely since you’re not doing what I want you to do. Like I, that is what that is. Enterprise ought to be, proper? <chortle>, yeah, that is completely what enterprise ought to be.

Dave:

Completely. I clearly dunno what’s going to occur and, and nobody actually does. However, uh, i, I agree. I feel it’s gonna be much less impactful than individuals suppose. The one factor I do really feel like fairly sure is that individuals are not gonna be popping out of pocket this quantity. It’s both like Kathy second be baked in or if it does wind up that folks begin paying out of pocket, I can virtually assure it’s not gonna be 3% as a result of that’s simply not a, an quantity individuals are gonna come out of pocket for. There’s gonna be brokers providing minimize charge providers or simply attempting to place, do the quantity play the place they do much more homes at a less expensive worth. However I really feel fairly assured that you just’re not gonna begin seeing individuals writing checks to their agent for 3% of the acquisition worth. That looks like in all probability the least possible end result. So Indiana Gazette, I don’t purchase it. I’m sorry, <chortle>, we do need to take a fast break, however we now have another headline for you once we’re again.

Welcome again to the present. All proper, effectively let’s transfer on to our final story, which is unquestionably a subject that we haven’t coated earlier than. It comes from CNBC and it says US cities are sinking, like actually sinking. Right here’s what this implies for owners. This story says that lamb subsidence, which is a time period I’ve by no means heard of, however it’s enjoyable to say <chortle> lamb subside land subsidence, there we go. Is when the lamb under a metropolis is sinking due to pure and artifical causes. That is occurring in cities like New York, Miami, new Orleans, San Francisco, so quite a lot of coastal locations. And that is saying that the price of house possession will be pushed up 8% due to this occurring. I additionally truly, simply so as to add to the story, I noticed this text about Nantucket, which is clearly tremendous excessive priced space, however this house had misplaced like, I don’t know, it’s like 60% of its beachfront and dunes due to erosion. So these kinds of, , na nature induced prices I feel are on the rise and individuals are beginning to pay extra consideration to ’em. I’m gonna ask you, Kathy, you reside in Malibu close to the seashore, <chortle> in a, in an costly space that’s onerous to get insurance coverage. Do these kinds of issues fear you on a private stage about your private house?

Kathy:

Our home is on a hill and it’s on bedrock, so I really feel, I really feel positive, however our PCH the highway that I must take to get anyplace would possibly get worn out. So yeah, I truly do fear a little bit bit about it. I bought a condominium on the seashore. We lived in a, in a condominium once we first moved to Malibu and I bought it due to the problems that that constructing is consistently having. Plus it’s previous and it’s onerous to have beachfront properties. They, they’ve extra points ’trigger there’s a lot wetness there and water is among the worst issues for, for, for property. And once you’ve acquired fog and, and ocean spray in your property, these, there have been houses in Malibu that simply acquired swept off into the ocean. So it’s, it’s at all times a little bit bit riskier to be ocean entrance.

I’d reasonably hire and personal there. Um, we even have seen buildings sink. There’s, there’s the millennium, which was one of many greatest excessive rises in San Francisco that has been shrinking and other people have misplaced quite a lot of their fairness there. It’s, it’s simply perhaps the best way it was constructed, um, that’s having points. If I have been a playing particular person, I might say your greater problem in California for certain is earthquakes. And nobody appears to fret about that. No person’s acquired insurance coverage for it. Uh, <chortle> they realize it’s coming, , we all know it’s coming. Most of us reside on the fault. So, , individuals take dangers. They reside the place they wanna reside. If I’m guessing this sinking, it’s a gradual sink, , it’s gonna be years if not many years. Um, however if you happen to’re, if you happen to’re proudly owning in these areas, you’re taking a danger. I might, I might not need to personal in Miami personally, that’s floor zero for lots of the local weather change points you bought, we all know hurricanes are, are headed there regularly. I can’t deal with that sort of stress <chortle>, so I’m not into it and I’m at all times a little bit bit shocked at how many individuals are transferring there and what they’re paying for being in a sort of excessive danger space. However then I have a look at me and I’m like, right here I’m on a fault line. So responsible <chortle>.

Dave:

Yeah, however this isn’t like, I suppose this can be a enjoyable phrase to say land subsidence, however it’s not likely totally different from every other pure hazards, proper? Like I’ve invested in Houston for instance, and I made very certain to take a look at flood maps to be sure that I wasn’t investing in a floodplain. I’ve personal a property within the Colorado Mountains and I made certain to spend money on an HOA that does correct hearth mitigation. So like I, I suppose that is one thing to consider, however it’s no totally different from every other concern about sustaining your property and ensuring it’s in a protected house.

Henry:

It’s a brand new scary factor to pay attention to when you’re contemplating investing someplace. However I don’t suppose it’s something like, I don’t suppose you’re constructing is right here at this time, gone tomorrow, proper? Like, it’s not that sort of a factor. What issues me about it’s what are insurance coverage firms going to do or not do about this new danger that folks might pay attention to. I feel they’re gonna see it as a chance, a, to have additional protection or enhance protection or not cowl these sorts of issues. After which, in order that’s what you want to pay attention to. Like how is that going to have an effect on your general return on funding? Um, or are you going to have the ability to be coated and might you tackle that danger? Um, however I imply I, it it, it is smart if you happen to suppose we’re extracting groundwater in locations and constructing very tall, heavy buildings on high of the land in some unspecified time in the future, yeah, you’re going to suppose the, the earth is constantly consuming buildings. That’s what occurs. Like that’s not new. Like, that’s not new. That’s why we get depreciation from the federal government on our, on our belongings as a result of the bodily constructing deteriorates over time. However my greatest concern is what occurs with insurance coverage. And might you are expecting that? I simply don’t know that you just

James:

Can. And that’s simply one thing that everybody has to be careful for is like, I’m attempting to get insurance coverage on my home in Newport Seaside that we’re flipping proper now. It’s a nightmare. We acquired a coverage, I acquired canceled in 60 days, then I’ve been on pressure place insurance coverage, then I’ve shopped out. I can’t even get sufficient insurance coverage to cowl the entire constructing then to get insurance coverage. They need me to gate off the entire property. And I’m like, what goes, like I acquired counter tops getting in and also you need me to gate this entire factor. I’m like this, it’s, it’s nuts. I employed 5 totally different insurance coverage brokers to go discover me a coverage one acquired me one carried out. It’s unreal. The price and simply having primary protection, proper? Like that’s why I’m leaving. I’m like, this doesn’t make sense. Should you can’t get regular primary protection on your investments to just be sure you’re getting insurance coverage or simply primary wants that you just want. I don’t realize it it for, I don’t wanna make investments there anymore. That’s simply how I have a look at it. ’trigger it, that doesn’t actually make sense and I feel there’s at all times gonna be one thing sinking. Mega earthquake is gonna come not, I imply I’ve heard about this mega earthquake in Seattle since I used to be a little bit child that the earthquake’s coming, all of Seattle’s gonna fall into the Puget Sound after which mate, Mount Rainier is gonna explode and canopy us all with Ash. I’m like, effectively, okay, that doesn’t sound good, <chortle>, however it

Dave:

<chortle>. Yeah, it doesn’t, it doesn’t. So

Henry:

No, that does positively doesn’t sound good.

James:

<chortle> this stuff are going to occur, however so long as you’ve the protection and if you happen to can’t get protection and insurance coverage for like even what Dave, Dave made a very good level about simply researching your market. Like what are, what’s happening? Is it flood pains? Is there fires? Is there, regardless of the environmental is, be sure you can get protection and if not, don’t cope with it. That’s my opinion. ’trigger it’s identical to if you happen to can’t get it at this time or it’s actually onerous to get it at this time, it’s gonna get more durable tomorrow. And if it’s actually costly at this time, it’s gonna get much more costly tomorrow.

Dave:

Yeah, completely. It’s a fantastic level on insurance coverage. I simply wanna name out too that like the price related to this sinking and different points should not simply insurance coverage, however in addition they do get mirrored in native and municipal taxes as a result of whether or not you’re paying for them as a house owner or the federal government goes to pay for them to create resiliency or to restore issues which are damaged. Like the cash’s gotta come from someplace and they also’re gonna both elevate taxes or go it on to owners by way of property taxes. So a technique or one other, when you’ve these kinds of bills in an space, it’s going to impression you, however you clearly need, in case you are nonetheless snug with that and wanna spend money on the world, you wanna be sure that your property is as effectively positioned as attainable inside that bigger

Kathy:

Market. And so essential to grasp the native rules. Like in California, the Coastal fee sort of guidelines <chortle>, all people. Um, and one of many issues that they’ve determined is they need the ocean to run freely and to do her factor. And they also, you possibly can’t truly put up a brand new sea wall. You simply, in case your sea wall falls aside, you don’t get to construct a brand new one in order that the ocean can, can, can thrive. And so there’s multimillion greenback properties proper on the seashore who now can’t actually shield themselves. And there’s this well-known story about this man in Laguna Seaside who did it anyway. And uh, <chortle>, the coastal Fee got here in and stated, that you must tear that down and purple tagged it and so forth. So the coastal fee, not elected officers, however they actually name the pictures and make the principles that you just simply gotta know what your native space is, who, who’s in cost? <chortle> of constructing legal guidelines

James:

In Newport Seaside. Two houses slid in our neighborhood, slid off the hill. It’s like hastily they went from a $5 million property to work nothing. And the coastal fee gained’t even allow them to construct a home again there. Now there’s homes all around the road, however they’re going, no, now that’s a park. I imply, what do you do if you happen to can’t get correct insurance coverage? You possibly can’t rebuild a home there. You’re toast. Yeah, don’t, don’t fiddle with with, uh, with individuals that may make these sort of calls.

Dave:

All proper, effectively that’s it for our headline present. Thanks all a lot for being right here, Henry, Kathy, James, we enormously respect your time and your perception. And if you happen to wanna join with these positive traders and speaking heads, we’ll put their contact info within the present notes under. Thanks all a lot for listening to this episode of the BiggerPockets Community. I’m Dave Meyer and we’ll see you subsequent time.

On The Market was created by me, Dave Meyer and Kaylin Bennett. The present is produced by Kaylin Bennett, with modifying by Exodus Media. Copywriting is by Calico content material and we wanna lengthen an enormous thanks to everybody at BiggerPockets for making this present attainable.

Assist us attain new listeners on iTunes by leaving us a score and assessment! It takes simply 30 seconds and directions will be discovered right here. Thanks! We actually respect it!

Focused on studying extra about at this time’s sponsors or changing into a BiggerPockets companion your self? Electronic mail [email protected].

Notice By BiggerPockets: These are opinions written by the creator and don’t essentially signify the opinions of BiggerPockets.