everythingpossible

Elevator Pitch

I assign a Maintain funding ranking to WuXi Biologics (Cayman) Inc. (OTCPK:WXIBF) (OTCPK:WXXWY) [2269:HK] inventory. My earlier April 24, 2024 write-up assessed WuXi Biologics’ monetary outlook and valuation metrics. The corporate describes itself as “a number one international Contract Analysis, Growth and Manufacturing Group (CRDMO)” on its company web site.

This present replace highlights the corporate’s unfavourable US market prospects within the face of geopolitical dangers, and the positives referring to buybacks and a restoration in biotech funding. WXIBF is rated as a Maintain, taking into account each the great and dangerous relating to the inventory.

Buyers needs to be conscious that they will purchase or promote WuXi Biologics’ shares on the OTC market and the Hong Kong fairness market. The three-month imply each day buying and selling worth for the corporate’s Over-The-Counter shares was first rate, at round $0.5 million, in accordance with S&P Capital IQ information. However WuXi Biologics’ shares listed on the Inventory Change of Hong Kong are comparatively extra liquid, with a median each day buying and selling worth of roughly $80 million (supply: S&P Capital IQ) within the final three months. US brokerages reminiscent of Interactive Brokers and Hong Kong brokers like Increase Securities enable their shoppers to commerce in Hong Kong-listed shares.

US Market’s Prospects Are Unfavorable

Earlier in mid-Might this 12 months, WuXi Biologics disclosed in an announcement that “the revised model of” the Biosecure Act “consists of the Firm’s identify within the proposed definition of the time period “biotechnology firm of concern.”

Based on L.E.Okay. Consulting’s July 2024 analysis report analyzing this new laws, the Biosecure Act will “influence any firm that does (or needs to) obtain US federal authorities contracts (i.e., most international pharma corporations), and limit them from partnering with corporations of concern.”

WXIBF earned 47.3% of the corporate’s income in the newest fiscal 12 months from the North American geographical area, as per its 2023 annual report. WuXi Biologics’ prospects in its key US market might probably be affected by its inclusion within the record of “corporations of concern” for the Biosecure Act.

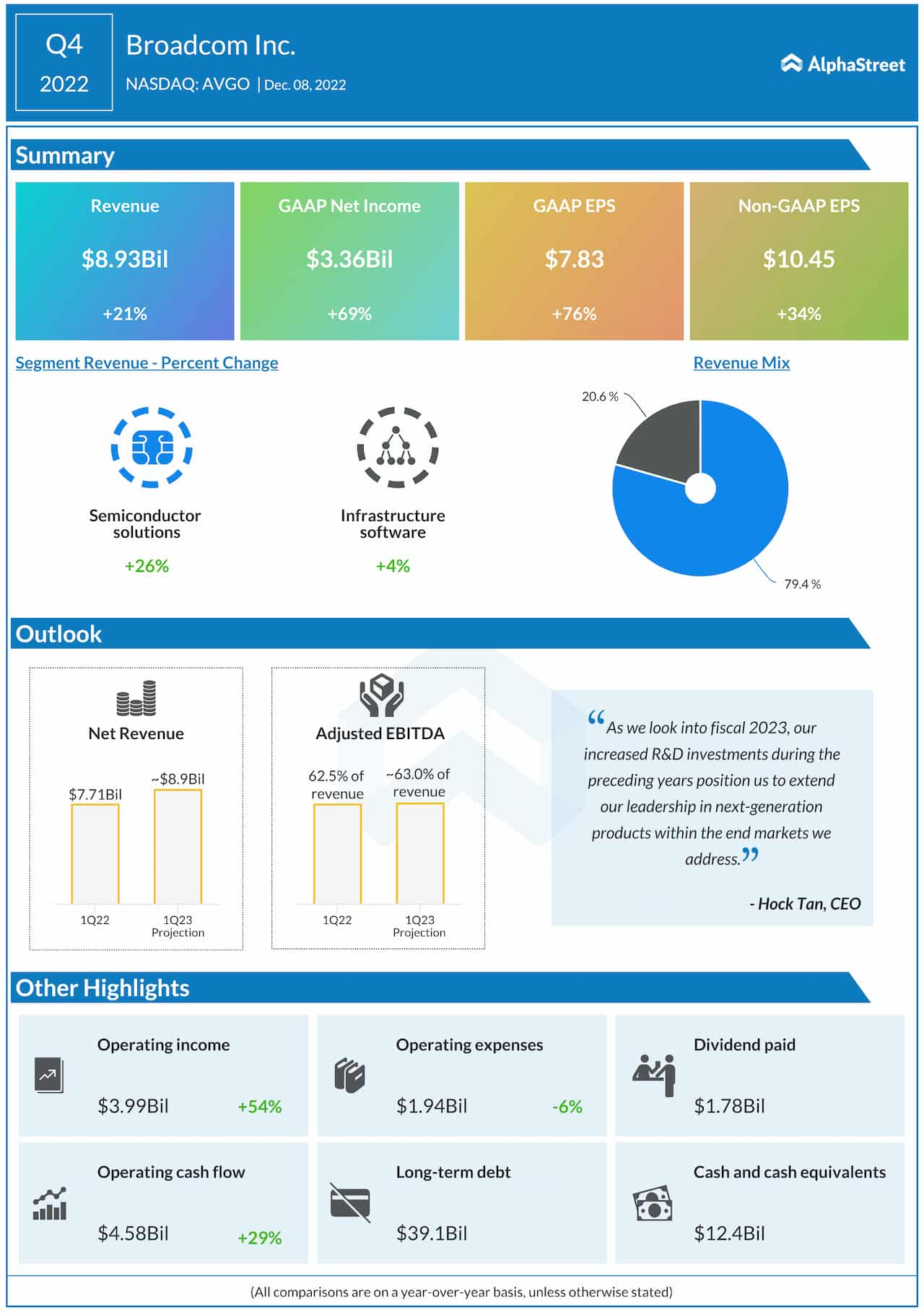

Firstly, a latest survey carried out by L.E.Okay. Consulting suggests {that a} significant proportion of US biopharmaceutical corporations are evaluating their present provide partnerships with Chinese language corporations.

As per the chart introduced under outlining L.E.Okay. Consulting’s survey of biopharmaceutical corporations, near a 3rd or 32% of US respondents “have began to judge choices to shift away from our present Chinese language companions.”

The Outcomes Of L.E.Okay. Consulting’s June 2024 Biosecure Act Survey

L.E.Okay. Consulting’s July 2, 2024 Analysis Report

It’s affordable to imagine that a few of WXIBF’s shoppers, particularly these reliant on the US authorities for funding or new enterprise, could possibly be considering a diversification of their provide chains within the face of heightened geopolitical dangers.

Secondly, WuXi Biologics appears to be moderating its tempo of investments within the US market.

A June 18, 2024 Yicai World information article talked about that WuXi Biologics just lately notified the “authorities of Worcester, MA” that the corporate “would droop a USD300 million native enlargement venture, first introduced in January.” Additionally, one other Chinese language CRDMO firm WuXi AppTec (OTCPK:WUXIF) (OTCPK:WUXAY) was additionally reported to have diminished its workers power within the US in Might this 12 months.

It will not be a shock to see WuXi Biologics and its friends pull again on investments of their US operations, if the outlook for this market has gotten dimmer.

Thirdly, WXIBF’s Chinese language friends have just lately issued unfavourable monetary steering.

Joinn Laboratories China [6127:HK] introduced on July 10 that the corporate’s prime line is predicted to lower between -4% YoY and -29% YoY in 1H 2024, and it anticipates that it’ll stay loss-making. Alternatively, Asymchem Laboratories (Tianjin) [6821:HK] revealed on the identical day that its 1H 2024 core web earnings might fall by 69%-73% YoY. It’s unlikely to be a coincidence that two Chinese language CRDMO gamers have each disclosed unfavorable steering on the identical time.

To sum issues up, the outlook for WuXi Biologics’ US operations is unfavorable. The Biosecure Act might probably immediate a few of its shoppers to change to non-Chinese language companions. Chinese language CRDMO gamers have both scaled down their operations within the US or guided for weaker monetary performances.

Biotech Funding Restoration And Engaging Potential Buyback Yield Are Key Positives

A possible restoration in biotech funding and the corporate’s continued buybacks are the intense spots for WuXi Biologics amidst geopolitical issues.

In my earlier Might 8, 2023 article, I famous “a rising fee setting” may counsel that “WuXi Biologics’ clients get into financing points” which “might translate into under expectations gross sales.” In different phrases, weak biotech funding constrained by excessive rates of interest was a headwind for WXIBF previously. However there may be hope that issues will get higher on this entrance.

In search of Alpha’s Sentiment Survey signifies that near 80% of respondents imagine {that a} fee lower will materialize earlier than the tip of 2024. Decrease rates of interest are likely going to drive a restoration in biotech funding, which is able to increase the outlook for CRDMOs generally and WuXi Biologics.

Individually, WuXi Biologics’ continued share repurchases counsel that the inventory’s potential buyback yield (buybacks divided by market capitalization) for 2024 is likely to be interesting.

The corporate has spent an estimated HK$1,355 million (equal to three% of market capitalization) on share buybacks within the first half of 2024. Assuming that WuXi Biologics continues repurchasing its personal shares at the same tempo within the second half of this 12 months, its 2024 buyback yield could possibly be as excessive as 6%.

In a nutshell, WXIBF’s precise monetary efficiency may exceed expectations on the again of a restoration in biotech funding supported by fee cuts, whereas its engaging buyback yield presents some type of valuation assist for the corporate’s shares.

Closing Ideas

I’ve a combined view of WuXi Biologics as a possible funding. The inventory’s buyback yield is engaging, and the corporate will doubtless profit from a extra favorable fee setting which is supportive of biotech funding. However WuXi Biologics was just lately named as a “firm of concern” within the Biosecure Act, which has unfavourable read-throughs for its US market outlook.

The corporate’s shares are additionally moderately valued based mostly on the Worth-To-Earnings Development or PEG metric of 0.91 occasions. The inventory’s PEG ratio is calculated based mostly on its consensus subsequent twelve months’ normalized P/E of 10.5 occasions and its consensus FY 2024-2028 normalized EPS CAGR projection of +11.5% (supply: S&P Capital IQ). A rule of thumb suggests {that a} inventory with a PEG of near 1 is buying and selling at a good valuation.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.