Anna Bliokh

In our previous assessment of Lattice Semiconductor Corporation (NASDAQ:LSCC), we delved into the remarkable upsurge of the company’s growth in 2022, which surged at an impressive 28.1%, fuelled by robust performances in the Communications & Computing (26.1%) and Industrial & Automotive (41.2%) segments, where Lattice expanded its product portfolio and increased its competitiveness. We believed these factors enabled the company to edge out other competitors. Additionally, our analysis indicated its growth was supported by the rising use of low-power FPGAs in EVs.

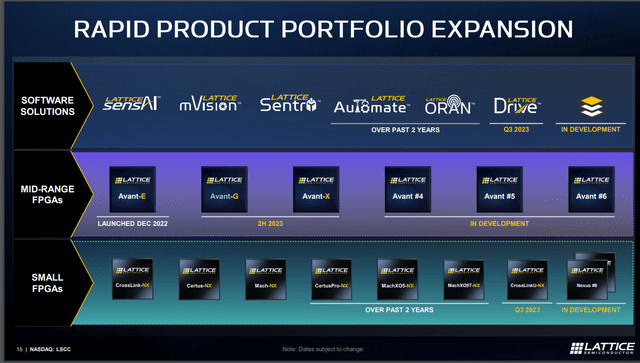

In this latest analysis, we focused on Lattice’s latest FPGA developments that could drive growth beyond 2024. Firstly, we analyzed the expansion of Lattice’s FPGA portfolio, expanding its low-power portfolio with Nexus and introducing mid-range FPGA solutions with the launch of Avant-G and Avant-X. We conducted a comparative analysis of their features against competitors’ offerings to gauge their competitive edge. Furthermore, we examined the potential for Lattice to capitalize on AI-driven applications utilizing its mid-range FPGAs. Lastly, we delved into the outlook for FPGA adoption across various end markets, updating our revenue projections for Lattice.

Expansion of FPGA Product Portfolio

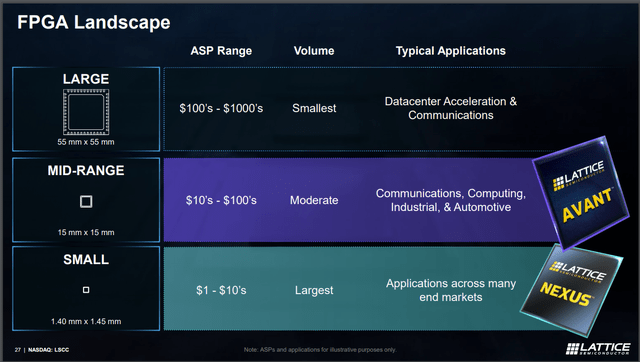

Firstly, we examined Lattice’s FPGA portfolio and compared it with top competitors (excluding Renesas) in the table for Low to Mid-Range FPGAs, with low-range FPGAs of fewer than 100,000 logic cells and mid-range spanning 100,000 to 500,000 logic cells according to Lattice.

|

Comparison of Low to Mid-Range FPGAs |

Lattice |

AMD |

Microchip |

Intel |

|

Number of Low-Range FPGAs (<100K Logic) |

3,454 |

2,790 |

1,150 |

2,981 |

|

Number of Mid-Range FPGAs (100K – 500K Logic) |

199 |

854 |

301 |

3,573 |

|

Total Low to Mid-range FPGAs |

3,653 |

3,644 |

1,451 |

6,554 |

Source: DigiKey, Khaveen Investments

Based on the table, Lattice has the greatest number of Low-Range FPGAs (<100K Logic elements), highlighting its advantage in this segment. In our previous analysis, we highlighted the company’s focus on “small size and power-efficient FPGA as a difference to its competitors in the FPGA market including Xilinx and Intel.”

Lattice Nexus Platform

Within the low-range FPGA portfolio, Lattice recently expanded its portfolio with its CrossLinkU-NX FPGA family, claiming to be the industry’s first low-power FPGAs featuring integrated USB, to accelerate USB-equipped system designs and embedded vision applications. In addition, the company highlighted in its earnings briefing Nexus as a “major contributor” to Lattice’s growth and the introduction of new FPGAs within the Nexus family.

A couple of examples of that is on Nexus, we’ve launched seven device families based on Nexus. Five of those device families are already in production. But there’s two more that go into production this year.” – James Anderson, CEO

Avant FPGAs

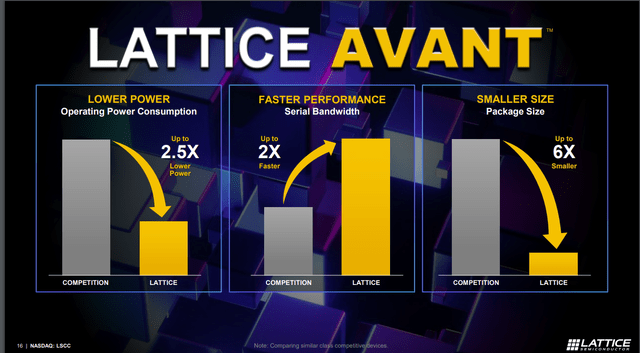

We identified that Lattice currently has only 199 mid-range FPGAs, which is significantly lower than competitors AMD, Microchip (MCHP), and Intel (INTC). Among these companies, Intel leads the way with a total of 3,573 mid-range FPGAs. However, from its earnings briefing, management announced its expansion in the mid-power FPGAs with the launch of Avant-G and Avant-X recently, following Avant-E. Additionally, Lattice expects the Avant portfolio to grow to between 15% to 20% of its total revenue in 3 to 4 years. From its Investor Presentation, management claimed Avant provides 2.5x lower power consumption and 2x faster performance than competitors.

Lattice

Hence, we compared Lattice’s latest mid-range FPGA products, Avant-G and Avant-X, with similar mid-range FPGAs from competitors to determine their performance competitiveness based on their memory rates, memory type, transceivers data rates, and process node.

|

Comparison of Mid-Range FPGA |

Avant-G (Lattice) |

Avant-X (Lattice) |

Spartan UltraScale+ (AMD) |

PolarFire (Microchip) |

Agilex 5 D-series (Intel) |

Agilex 5 E-series (Intel) |

|

Memory Rates (RAM) |

2.4 Gbps |

2.1-2.4 Gbps |

2.4-4.3 Gbps |

1.6 Gbps |

3.2-4.3Gbps |

2.4-3.7Gbps |

|

Memory Type (RAM) |

LPDDR4/DDR4 |

DDR5/LPDDR 4/DDR4 |

LPDDR5/DDR4/LPDDR4 |

DDR4/DDR3/LPDDR3 |

DDR5/ LPDDR5/DDR4/LPDDR4 |

DDR5/ LPDDR5/DDR4/LPDDR4 |

|

Transceivers Data Rates |

10Gbps |

25Gbps |

16.3 Gbps |

12.7 Gbps |

28 Gbps |

28Gbps |

|

Process |

16nm |

16nm |

16nm |

28nm |

10nm |

10nm |

Source: Company Data, Khaveen Investments

Based on the table, the two Avant FPGAs have a slower memory speed (up to 2.4 Gbps) compared to AMD (2.4 – 4.3 Gbps) and Intel (up to 4.3 Gbps), faster memory allows for quicker data access and thus reduced latency. In addition, the memory type could affect the power consumption and bandwidth of the FPGAs, and the most advanced types in the market are DDR5 and LPDDR5. Hence, Intel’s Agilex 5 series leads in this aspect, followed by AMD and Lattice. When it comes to transceivers’ data rates, Intel’s Agilex 5 series is the best with 28 Gbps. High transceiver rates allow for faster data exchange and bandwidth-intensive applications. Lattice’s Avant-X has a slightly lower rate of 25 Gbps, but the company claims it also offers “power efficiency, advanced connectivity, and optimized compute”. Other FPGAs’ data rates are significantly lower at a range from 10 Gbps to 16.3 Gbps. Lastly, in terms of process node technology used, Intel’s FPGAs are more advanced (10nm). More advanced process technology can offer increased logic density, decreased power usage and enhanced performance. On the other hand, Microchip falls behind in comparison to Lattice, AMD and Intel. We then ranked each of the factors and calculated the average ranking of all factors.

|

Comparison of Mid-Range FPGA |

Avant-G (Lattice) |

Avant-X (Lattice) |

Spartan UltraScale+ (AMD) |

PolarFire (Microchip) |

Agilex 5 D-series (Intel) |

Agilex 5 E-series (Intel) |

|

Memory Rates (RAM) |

5 |

4 |

2 |

6 |

1 |

3 |

|

Memory Type (RAM) |

5 |

3 |

4 |

6 |

1 |

1 |

|

Transceivers Data Rates |

6 |

3 |

4 |

5 |

1 |

1 |

|

Process |

3 |

3 |

3 |

6 |

1 |

1 |

|

Average |

4.75 |

3.25 |

3.25 |

5.75 |

1 |

1.5 |

Source: Khaveen Investments

According to the table above, Intel’s Agilex 5 D-series has the highest ranking in all aspects, leading it to be ranked in first place, followed by Intel’s, Agilex 5 E-series. Avant-X and Spartan Ultrascale+ also have the same rank, but Avant X has a higher memory speed while Spartan has better memory type and higher transceivers data rates. Avant-G ranks fourth and Microchip’s PolarFire ranks last. Therefore, we believe that even though Intel’s FPGAs edge out other competitors, Lattice’s FPGAs still have some competitive advantages compared to Microchip, considering the company has just expanded its portfolio to mid-range FPGAs. Overall, we determined our performance comparison results contradict the management’s claim from its presentation, and we instead believe Intel is still the superior company in the mid-range segment.

Outlook

Overall, we examined the low to mid-range FPGAs of Lattice and its competitors. The company dominates with the largest product breadth in low-range FPGA with almost 3,500 products. Additionally, the company launched several new products in this range which further solidifies its product breadth. However, the company has not stood out as a mid-range FPGA manufacturer due to its low number of mid-range FPGAs as a new entrant competing against larger players like AMD, Intel and Microchip in this segment. In our previous analysis of Lattice, we also highlighted that AMD and Intel remain the top FPGA manufacturers with 53% and 26.7% market share in 2022. Lattice’s latest mid-range FPGA, Avant-G and Avant-X, lack competitiveness as it lags behind Intel’s and AMD’s mid-range FPGAs. However, we believe the company’s launch of Avant establishes its entry into the mid-range FPGA market and the roadmap below shows the planned development of future Avant FPGAs which could lead to the company improving some of its product specs lacking such as memory rates, memory type, transceiver data rates and process based on our FPGA spec comparison analysis above.

Lattice

AI Impact to FPGA Demand

Next, we examined how AI benefits Lattice’s FPGAs. Additionally, as management highlighted from its earnings briefing that AI-related revenue was around $100 mln in 2023, accounting for approximately 14% of Lattice’s total revenue, we also looked into what segments the company derives its AI-related revenue. According to the company’s CEO from its earnings briefing, Lattice estimated AI-related revenue from a wide range of AI-related applications including:

- “AI-optimized servers in the data center…Lattice devices are used in the control, management, and security of the AI computing system”

- “AI-enabled PCs, where Lattice solutions are used to run the AI inference algorithm that provides features such as user presence and gaze detection in PC systems like the Lenovo ThinkPad”

- “AI-enabled automotive ADAS systems, where Lattice solutions are used to aggregate and pre-process essential data that is used for AI processing”.

According to Informa Tech, FPGAs can serve as hardware accelerators in data centers, and they are especially beneficial for AI inferencing tasks as they have higher throughput and lower latency compared to regular processors or GPUs. In addition, Lattice highlighted that its FPGAs have a 2.5x lower power consumption than other FPGAs. In our previous analysis of Nvidia (NVDA), we derived a forecasted average growth rate for data center chip growth of 39%, driven by demand from cloud service providers ramping up infrastructure. Additionally, the company recently announced a partnership with Nvidia to utilize its power-efficient FPGAs to facilitate sensor fusion and bridging in Nvidia’s Jetson Orin and IGX Orin platforms, which fall under Nvidia’s Data Center segment. According to Nvidia, Jetson Orin is designed to accelerate energy-efficient autonomous systems, such as robotics, vision AI, and edge applications, whereas the IGX Orin is ideal for AI-powered industrial and medical applications.

Besides that, Lattice has also developed SensAI, a software stack that utilizes its FPGAs for inferencing, allowing customers to “develop and deploy FPGA-based Machine Learning / Artificial Intelligence solutions”. In PCs, Lattice’s SensAI can help extend battery life by 28% or detect user presence and attention using its Face Framing Technology. Moreover, Lattice claimed that its software can also enhance security and optimize systems in PCs. According to Counterpoint Research, the global AI PCs market is expected to grow at a CAGR of 50% reflecting the strong demand for AI PCs’ advanced security and increased efficiency.

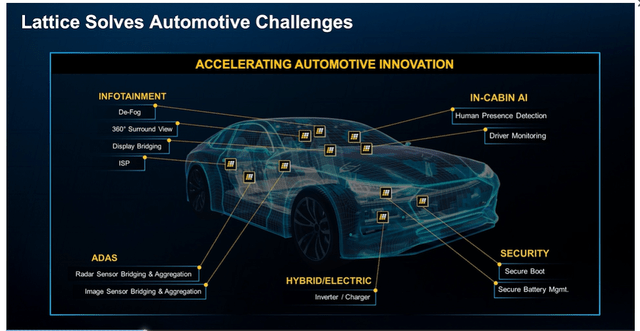

Lattice also has mVision that helps deploy solutions such as “machine vision, robotics, ADAS, video surveillance, and drones”. Additionally, Lattice has highlighted that its FPGAs are also used in automotive ADAS and Infotainment systems by enabling parallel sensor processing, low-power interfaces and “hardware-based security” capabilities. For example, Lattice’s FPGAs are also used to support ADAS “side radar applications” for Mazda’s (OTCPK:MZDAY) CX-60 and CX-90 SUV. We highlighted a strong demand for ADAS applications with a market CAGR of 18.7%.

Outlook

|

End Market |

Forecast CAGR |

|

Data Center |

39% |

|

AI-enabled PC |

50% |

|

ADAS |

18.7% |

|

Average |

35.9% |

Source: Counterpoint Research, Acumen Research, Khaveen Investments

The table above consists of the market CAGR of AI applications including data centers, AI-enabled PCs, and the ADAS market. Overall, we calculated the average CAGR to be 35.9%. In addition, the company management also expects higher AI-related revenue in the next few years as highlighted by the quote below.

We expect our AI-related revenue to more than double over the next few years based on the growing pipeline of AI-related design wins. – James Anderson, CEO.

Hence, from the management guidance of Lattice’s AI-related revenue to be $200 mln, we assumed the company to achieve this in the next three years and accordingly calculated the CAGR to be 26%. Compared with our derived average market CAGR of 35.9%, it surpasses management’s forecast and therefore we believe management’s guidance of $200 mln in AI-related revenue could be reasonable.

End Markets Growth Outlook for FPGAs

Finally, we examined the end market outlook for FPGAs and subsequently forecasted the company’s revenue. Lattice’s Avant and Nexus are low and mid-range FPGAs, that target applications in Communications, Computing, Industrial & Automotive.

Lattice

Communications and Computing

According to Lattice, the company provides solutions for “computing systems such as servers and client devices, 5G wireless infrastructure, switches, routers, and other related applications” in this segment. For Computing, FPGAs can accelerate data centers and their computing capabilities by freeing up processor resources and reducing power consumption. According to Intel, FPGAs can perform better than GPUs when “the application demands low latency and low batch sizes”. In our previous analysis of Microsoft (MSFT), we estimated that the cloud market will be growing by a forward average of 23% driven by data volume growth. We believe data center demand to be a good gauge of FPGA demand in Computing, as FPGAs are used in data center servers to offload “compute-intensive tasks from the CPU and GPU” due to their low latency and energy efficiency. For Communications, given their low latency and the ability for parallel processing, FPGAs are suitable for processing massive data flow required in the 5G RAN. We highlighted in our previous analysis of Qualcomm that the penetration rate of 5G devices is projected to “reach 83% by 2027 from 62% in 2023”, boding well for the demand for 5G services.

Industrial and Automotive

For this segment, the company offers solutions to “industrial Internet of Things (“IoT”) and “Industry 4.0”, machine vision, robotics, factory automation, advanced driver assistance systems (“ADAS”), and automotive infotainment.”

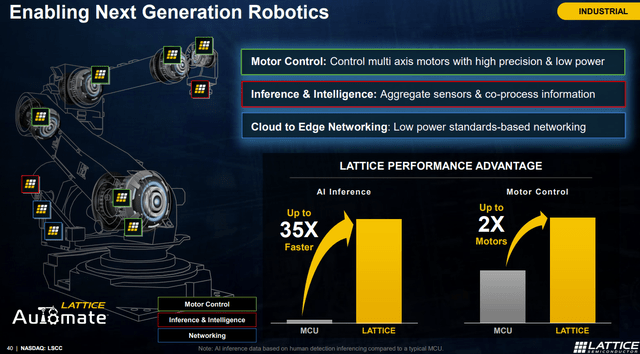

For Industrial, from our previous analysis of ADI (ADI), we highlighted strong growth in the semicon industrial market with a CAGR of 7.21%, driven by smart grid deployments and digitalization of factories. Intel’s case study explains how FPGAs could enable the transformation of smart factories with their parallel computing capabilities. Moreover, Lattice’s Automate 3.0 solution stack is also used to accelerate smart automation system development, including “robotics, embedded real-time networking, predictive maintenance, functional safety (FuSa) and security”.

Lattice

For Automotive, the ADAS market is expected to grow at a CAGR of 18.7%. Moreover, McKinsey expects the automotive software market to grow at a CAGR of 9.4%, driven by Software-defined Vehicles as consumers demand safer and more advanced cars. FPGAs could help car manufacturers improve various features and enable SDVs, such as zonal architectures, power efficiency, real-time networking, and infotainment interfaces. Lattice claimed that its FPGA offers 2x faster connectivity speed and 5x more independent sensor interfaces. The chart below summarizes how Lattice’s software is used in various automotive applications.

Lattice

Consumer

In the Consumer segment, the company’s products are used in applications including “smart home devices, prosumer devices, sound bars, high-end projectors, Augmented Reality (“AR”) / Virtual Reality (“VR”), and wearables”, FPGAs can accelerate processing power, enable real-time sensor fusion and object recognition for AR applications, and optimize power consumption. We highlighted that the AR/VR market CAGR is 42.24% in our previous analysis of Apple (AAPL), driven by demand in consumer and enterprise applications.

Outlook

|

Segment Revenue ($’000s) |

Our Previous Forecast (2023) |

Actual Revenue (2023) |

Difference |

|

Communication and Computing |

326,092 |

257,536 |

-68,556 |

|

Growth % (YoY) |

18.7% |

-6.3% |

-25.0% |

|

Industrial and Automotive |

397,793 |

433,482 |

35,689 |

|

Growth % (YoY) |

24.5% |

35.7% |

11.2% |

|

Consumer |

49,064 |

46,136 |

-2,928 |

|

Growth % (YoY) |

0.0% |

-6.0% |

-6.0% |

|

Licensing and Services |

15,730 |

-15,730 |

|

|

Growth % (YoY) |

-8.2% |

8.2% |

|

|

Total Revenue |

788,678 |

737,154 |

-51,524 |

|

Growth % (YoY) |

19.4% |

11.6% |

-7.8% |

Source: Company Data, Khaveen Investments

In our previous coverage, we projected the company’s 2023 revenue based on its historical 5-year average growth rate. Our forecast was higher compared to its actual 2023 revenue growth of 11.6%, attributed mainly to the unanticipated market headwinds highlighted by management.

|

End Market Growth |

Market CAGR |

Lattice’s 5Y Average |

|

Computing and Communication |

14.6% |

16.6% |

|

Industrial and Automotive |

12.96% |

23.7% |

|

Consumer |

6.60% |

-9.3% (4Y average) |

Source: Grand View Research, Khaveen Investments

Comparing the market CAGR and the company’s 5-year historical average revenue growth, we observed that these two are slightly in line with the Computing and Communication segment (14.6% and 16.6%). However, for the Industrial & Automotive and Consumer segment, the market CAGR differs significantly from the company’s historical average growth. Therefore, we believe that basing our forecast on its historical growth is more in line than using market CAGR. However, we also took into account the management guidance for the company in 2024 where management expects Q1 revenue to be between $130 mln to $150 mln with Q2 unexpected to rise significantly but H2 revenues to be higher than H1, reflecting improving market conditions and its new Nexus and Avant product launches in that period.

|

Lattice Revenue Forecasts ($’000s) |

2023 |

2024F |

2025F |

2026F |

|

Communications and Computing |

257,536 |

236,241 |

264,274 |

305,582 |

|

Growth % (YoY) |

-6.3% |

-8.3% |

16.6% |

15.6% |

|

Industrial and Automotive |

433,482 |

392,581 |

472,879 |

580,030 |

|

Growth % (YoY) |

35.7% |

-9.4% |

23.7% |

22.7% |

|

Consumer |

46,136 |

47,771 |

41,740 |

37,854 |

|

Growth % (YoY) |

-6.0% |

3.5% |

-9.3% |

-9.3% |

|

Total Revenue |

737,154 |

676,592 |

778,893 |

923,466 |

|

Growth % (YoY) |

11.6% |

-8.2% |

18.9% |

18.6% |

Source: Company Data, Khaveen Investments

Overall, we forecasted the company’s total revenue to decline by 8.2% in 2024 based on management guidance reflecting the anticipated market headwinds highlighted in the first half and the potential recovery in the second half. In 2025 and beyond, we forecasted the revenue growth for each segment based on the updated 5-year historical growth rate. Particularly for the Consumer segment, we used 4-year past growth as the company restructured this segment in 2019 by winding down its smartphone products.

Risk: Competition in FPGAs

AMD (Xilinx) recently announced the development of low-cost Spartan UltraScale+ FPGAs highlighting their high I/O-to-logic-cell ratios and advanced security features, including “NIST-approved post-quantum security” and tamper-resistant circuits. This development is likely to pose challenges to Lattice’s low to mid-range FPGAs. As AMD is the leading player in the FPGA market by market share, we believe Lattice may face increased competition, prompting them to innovate further to maintain their competitive edge in the low-cost FPGA segment. Furthermore, we believe that Renesas, a new entrant into the FPGA market, may further lead to intensifying competition.

Verdict

Khaveen Investments

All in all, despite expected market growth headwinds in 2024, our analysis indicates a strong potential for Lattice to sustain growth by expanding its product portfolio in low- and mid-power FPGAs. We anticipate significant strides from the company’s expansion into the mid-range FPGA market. However, we also take note that while Lattice’s mid-range FPGAs outperform Microchip’s offerings, they still lag behind industry leaders like AMD and Intel, though the company’s roadmaps indicated future product developments which could see improvements in product performance to better compete against leading players. Furthermore, we believe that Lattice could benefit from the strong growth in AI-related applications such as data centers, AI-enabled PCs, and ADAS systems as our market analysis showed an average CAGR of 35.9%, surpassing the management’s forecasts. Delving deeper into end-market prospects for FPGAs, we identified key growth drivers across various end markets and how Lattice is capitalizing on these drivers. Overall, we believe that Lattice is poised to capitalize on the growing demand for AI applications, further strengthening the company’s position in the FPGA market.

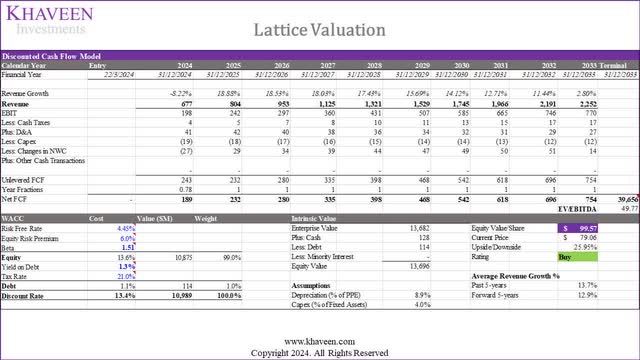

Based on a discount rate of 13.4% (company’s WACC), and terminal value based on its 5-year average EV/EBITDA of 49.77x, our model shows an upside of 25.95%. In addition, our updated model shows a higher upside as we previously used the industry’s EV/EBITDA ratio, which was only 20.13x. We updated the ratio as the company’s historical EV/EBITDA was significantly higher than the industry average (27.78x). Based on our updated DCF, we obtained a price target of $99.57 and upgrade the company to a Buy rating.