At first glance the answer seems obvious—no. But not everyone sees things that way. Here’s Bloomberg:

Biden will also ask lawmakers — as he did in last year’s budget request — to impose the 21% minimum on multinational corporations, which the White House says would result in substantial new taxes on pharmaceutical companies. He also wants to quadruple the tax companies must pay when they buy back their own stock to 4% from 1%. Democrats have proposed buyback taxes as a way to encourage companies to invest in workforces and equipment over share repurchases.

Corporations have several different ways of rewarding investors. One method is dividends. Another approach is to use a stock buyback, which leads to capital gains. Many investors prefer to receive capital gains, which are generally treated more favorably than dividends in the federal tax code (partly because the gains are not taxed until the stock is sold.) By taxing stock buybacks, the government would be raising the effective tax rate on capital formation.

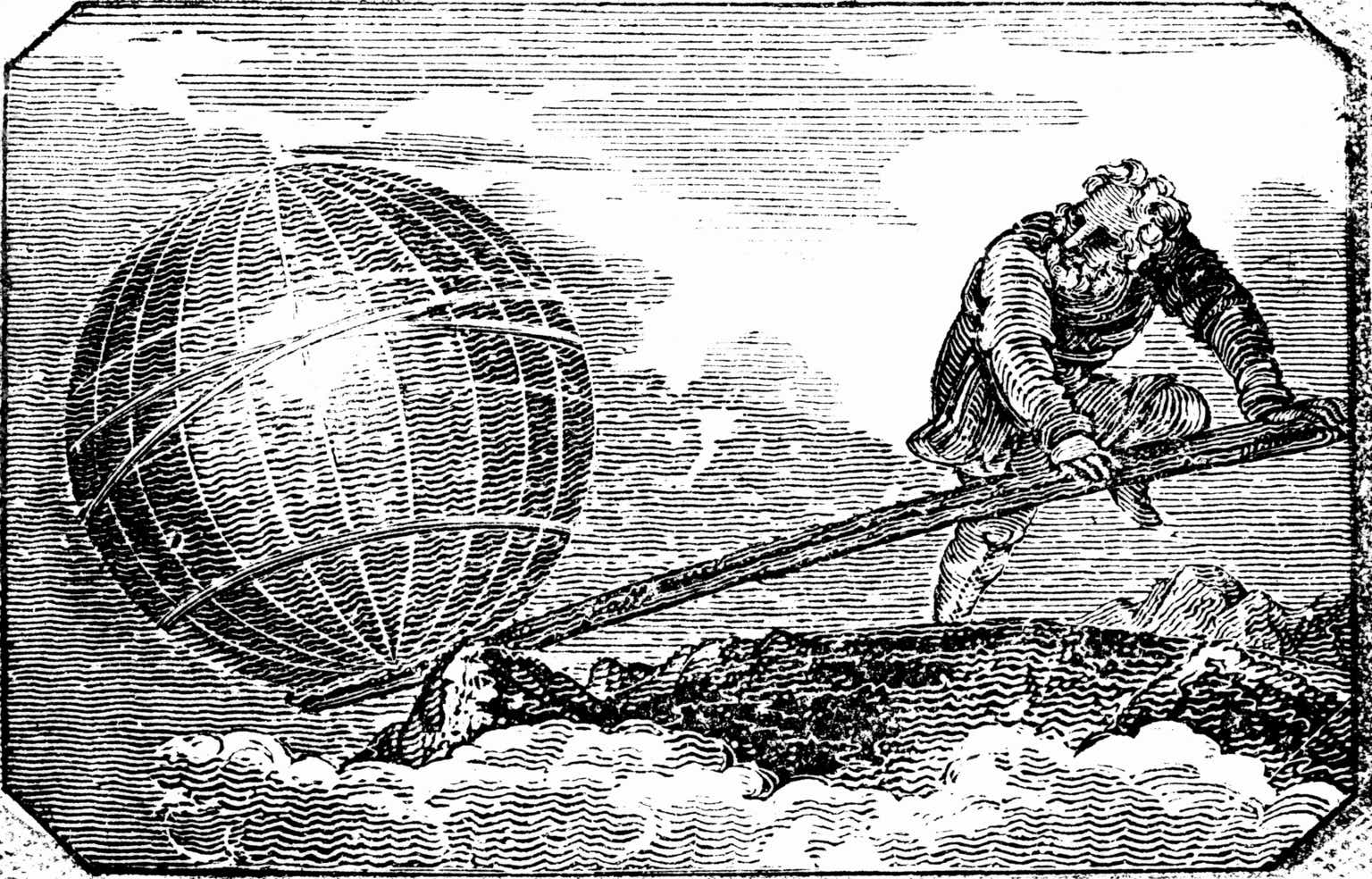

These taxes do not encourage investment—just the opposite. Instead, they tend to push investment into less productive areas. Thus suppose company A can earn a 5% rate of return on capital and company B can earn a 10% rate of return. Ideally, profits earned by company A would be paid out to owners, who would redirect funds to investments made by company B. This tax provision seems motivated by the desire to make each company more self sufficient, relying on its own internal funds for capital investment. But an economy where each organization is self-sufficient is much less efficient than an economy structured around specialization and trade.

Perhaps there is some other motivation for this proposed tax change. If so, I cannot imagine what it is.