bjdlzx

Riley Exploration Permian (NYSE:REPX) would be considered a family-run company, as family members are in enough key positions to really control the company. Now, this is a relatively new company. But the Riley family has a long oil and gas history. Family-owned companies are generally conservatively run. That makes the sizable amount of debt incurred from a recent acquisition an interesting variance from typical family-owned company behavior. This event may indicate that insiders with experience see supportive commodity prices ahead (volatility notwithstanding) combined with a relaxing debt market. Therefore, the profitability goal of these acquired assets may be a safer strategy than one would assume given the industry events of 2015 through 2020.

Back in the heyday when the unconventional business was growing quickly, the use of financial leverage was far more common. It was also looked upon as “safe” because everyone “knew” that fantastic prices for oil were the norm until they were not in 2015. That caused a lot of reorganizations and big changes in lending attitudes. Now comes a deal like the latest for Riley Permian, and one would have to wonder if there are a few cracks in that “conservative balance sheet” mandate that has dictated both the debt market attitude and the stock market attitude. Both seem to have shorter memories than one would think after the last few years. It will take more than one deal to be sure. But it could be a straw in the wind.

Conventional Opportunity

In the meantime, this company is focusing on the conventional business. The specific area of interest makes this company a competitor of Ring Energy (REI) and PEDEVCO (PED). The advantage of the conventional business is there is less competition than there is on the unconventional side because “everyone knows” that unconventional is the place to be.

Note that less competition does not mean no competition, as there are plenty of other operators that have noted this opportunity as well.

Northwest Shelf

This conventional opportunity is in the Northwest Shelf. Ring Energy noted back in 2019, when a similar acquisition was made, that this acquisition had the potential to be more profitable than the legacy acreage which was already extremely profitable.

This company, Riley Permian, has the advantage of “jumping into” the Northwest Shelf as the total production. Therefore, the company has slightly less debt at roughly $385 million (current portion due and long-term debt) while having a total production of roughly 20,000 BOED in one of the more profitable parts of the Permian.

Ring Energy shows about $428 million of debt, along with another $15 million (give or take) of a deferred payment and a note payable. More importantly, the Ring Energy production is in several areas besides the Northwest Shelf. Therefore, the overall company profitability on the guided 18,500 BOED may be slightly less or different than is the case for Riley Permian.

Probably the largest advantage that Riley Permian has is that this is a relatively new company. Therefore, the startup of the company was not affected by the pandemic shutdown, whereas both PEDEVCO and Ring Energy were converting to operating companies when the pandemic hit. That has affected both companies in multiple ways that Riley Permian may not have to deal with.

For Ring Energy, in particular, the Northwest Shelf acquisition was considered a conservative transaction at the time. But that consideration changed quickly during the pandemic when the pandemic changed the debt market emphasis to production and key financial ratios “with no excuses”.

Similarly, PEDEVCO barely started any production when the pandemic hit and the debt market essentially “dried up”. Therefore, PEDEVCO now has a joint venture with Evolution Petroleum (EPM) to develop conventional assets and gain cash flow.

The debt market has some interesting rules and practices. Missing the pandemic, as Riley Permian did, may prove to be a significant competitive advantage that is as good as a moat for a long time to come.

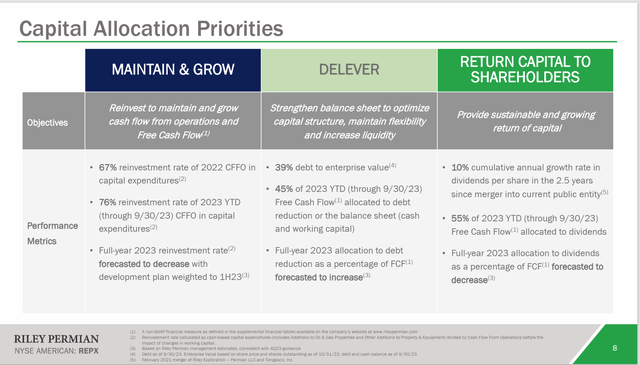

Deleveraging

Riley Permian management has made it a priority to deleverage.

Riley Permian 2024 Guidance Detailed (Riley Permian Corporate Presentation November 2024)

Unlike so many companies I followed between fiscal years 2015 and 2020, this company is likely to get the chance to delever the company and delever the company fast.

The company does pay a dividend. But the overall profitability allows for that. Without something like a pandemic or a recession on the horizon, such a plan appears feasible. However, that horizon can change very quickly in this industry. Therefore, paying a dividend while servicing the current debt may not be the wisest course of action. If anything, this strategy choice raises the investment risk somewhat, even if management gets away with it.

As noted above, the dividend has been growing. But the guidance is for the percentage of cash flow allocated to dividends to decline. Therefore, either the dividend will not grow for a while in the future, or it will grow slower than in the past. Under current industry conditions, there appears to be only a modest chance of a dividend cut.

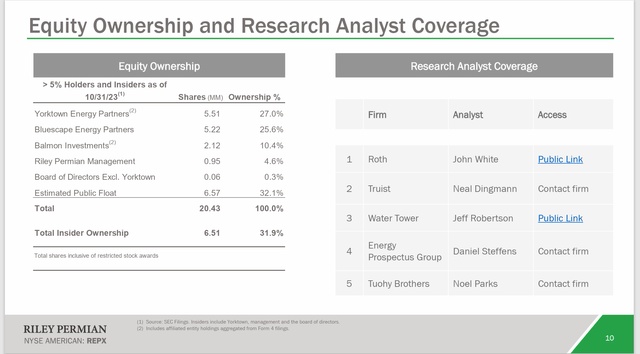

Insiders And Major Holders

The large majority of this stock is concentrated with just a few institutions.

Riley Permian Schedule Of Major Shareholders (Riley Permian Corporate Overview Presentation November 2023)

Anyone considering an investment in Riley Permian needs to consider the very small number of shares in public hands (that are available for trading) compared to the overall amount of stock issued and held. If any of those major institutions shown above decide to “get out” it could cause a major stock price disruption for months at a time.

Furthermore, the small amount of stock available to the public will severely limit institutional interest, which often results in a more liquid trading situation and better corporate valuations.

Current members of the Riley family gained control of the company back in fiscal year 2020 through a reverse merger. Therefore, previous company and stock price history may not be relevant to an investor considering this company for investment purposes. The acquisition noted earlier of most of the production came still later than that.

Therefore, this is similar to an IPO in a lot of respects. The company has really not had the history necessary as a public company. The stock price therefore could be unusually volatile and vary from expected valuations for extended lengths of time.

Now the stock is listed on the NYSE. That puts an end to some of the things that can occur in a situation like this. But this is still a relatively new company.

Upcoming Earnings

What should be happening is that earnings should be settling down. Any major purchase (and this last purchase was most of current operations) is going to come with deferred maintenance and probably some reworks, along with other one-time items. It often takes about a year to see what normal operations look like.

This management did mention that costs were coming down. That happens with both optimizing the operations of the purchase and technology advances sweeping the industry.

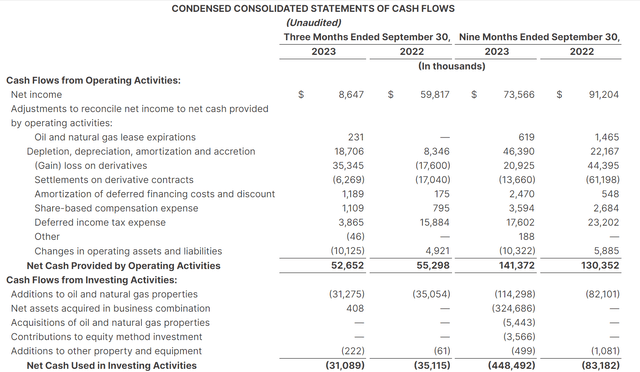

Riley Permian Third Quarter 2023 Cash Flow Statement (Riley Permian Third Quarter 2023, Earnings Press Release)

What you can tell from the cash flow statement is that much of the cash flow is going right back into the business. Considering what this costs, that does not leave much cash to repay debt (let alone pay the dividend they are paying). Therefore, management, as management hinted, has some decisions to make.

Living within your means, making choices. Those choices will affect the forward valuation, as a dividend policy likely means less growth. For me, I would prefer to see more growth now and a dividend later after the debt ratio becomes a lot better. But I am not management.

Since the business was acquired recently, within the fiscal year, there is every chance that cash-out-the-window will decline as operations are optimized. Readers know I cover Ring Energy and that company has posted in my older articles that these types of wells breakeven in the received price for oil in the $20 range. That is extremely low and very profitable. These conventional wells are also long-lived, with a different decline rate from unconventional (more money sooner).

Therefore, management can and probably will make choices that will result in considerable organic growth (or possibly more accretive acquisitions). But understand that this is basically a brand-new operation by a “name” management through a reverse merger. Therefore, an investment here is a big vote on management’s reputation and past record. I would probably not sell until management sells the company because they often treat long-term holders pretty well.

Now, if the stock price clearly outruns the prospects “by a mile” I would sell. But it is way too early to tell that and there are too many unknowns in what is basically a startup situation.

Summary

Riley Permian represents a speculative strong buy opportunity for those who understand the risks of a relatively new controlling entity at the helm of a stock that has been listed for a long time. Reverse mergers usually completely change the company’s characteristics.

That stated, the conventional opportunity that this company has focused upon is unusually profitable, as much of the industry and the market is focused upon the unconventional part of the industry. While the management is relatively new and the company is leveraged, I like the management’s chances of succeeding.

Despite the rather generous dividend yield at current price levels, this issue is a good deal riskier than the typical upstream company. It is definitely not for a typical income portfolio strategy. If anything, that dividend is probably contraindicated until the debt levels are considerably lower.

However, the chances of good solid profitability, company growth, and a successful outcome appear to be good at the current time. This is one very volatile industry where commodity price outlooks can change overnight. That makes this issue solely for more venturesome investors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.