Mario Tama/Getty Images News

Since its establishment, Fast Retailing (OTCPK:FRCOY) has seen its key brand Uniqlo and lower-priced sister brand, GU, embark on an impressive pace of store rollouts, underpinned by the mass appeal of its ‘basics’ clothing line. The company’s recent fiscal Q1 2024 results marked another positive chapter in the story, as top-line challenges in the core Japan business were more than offset by growth internationally. Add to that solid cost control efforts and you get a bottom-line result running well ahead of Street expectations yet again. In the near term, monthly data indicates sales will continue to be challenged for Uniqlo Japan, so the onus for more beats-and-raises remains on cost and Uniqlo International’s pace of store expansion.

Fundamentally, there isn’t much to fault here. And in the small world of global fashion compounders, this is perhaps the one with the biggest addressable market opportunity – by virtue of its mass appeal. So even though Fast Retailing doesn’t churn out the highest ROEs (albeit still very respectable in the high-teens %) vs key global peer Inditex (OTCPK:IDEXF), it makes up for it with a longer runway in higher growth Asian markets. No surprise then that the stock scores quite highly on growth and profitability (per SeekingAlpha’s Quant ratings).

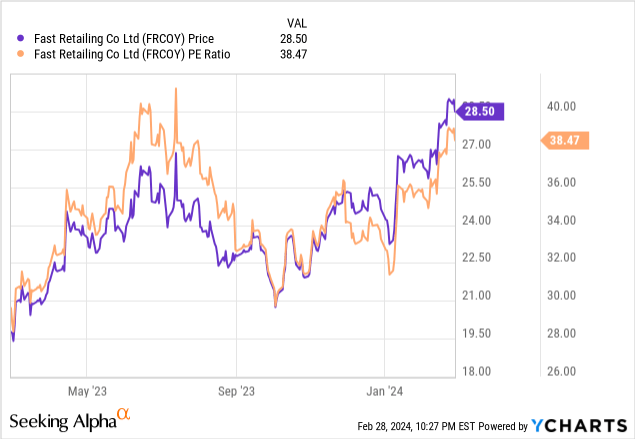

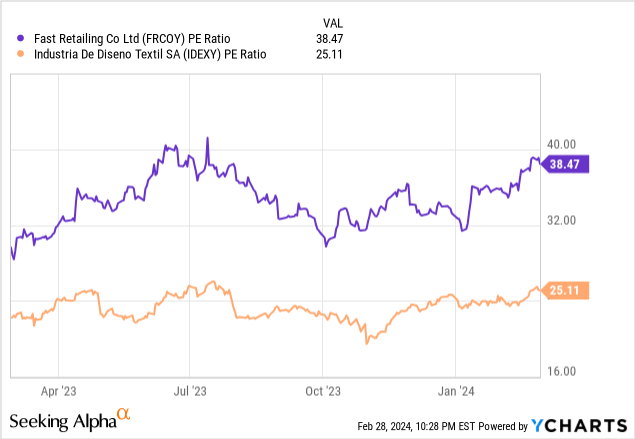

Still, the biggest risk, as I highlighted in my prior coverage, is overpaying for an investment, and that rings particularly true here. Following a rally that has been down more to re-rated valuations than earnings, Fast Retailing is now priced at nearly 40x earnings – a long way from its track record of low-teens % earnings growth and a key reason the stock scores an ‘F’ grade on the SA valuation scorecard. With Japan also poised to transition out of ultra-loose monetary policy, possibly as soon as April, pricey stocks like Fast Retailing may well be first in the firing line. Pending a meaningful pullback, I would sit this one out.

Profitability Strong Across the Board

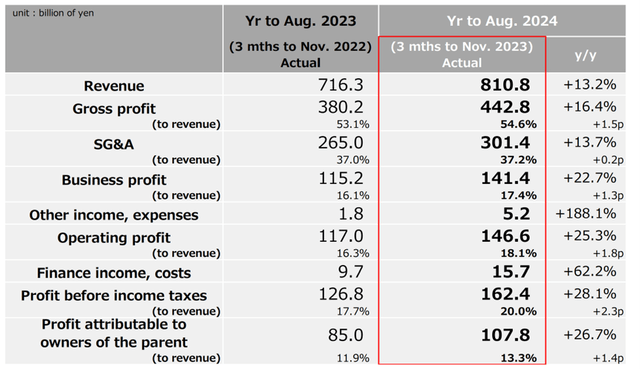

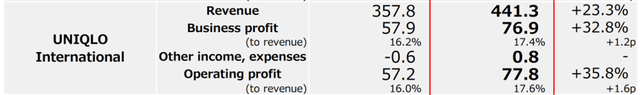

Fiscal Q1 was much better than expected for Fast Retailing, defying concerns about a higher inflation/slower growth backdrop. To recap, overall growth of business profits and profits attributable to shareholders hit +23% YoY and +27% YoY, respectively, outperforming Street expectations into the print. Uniqlo International was the top-line growth engine, as expected; this time around, though, it wasn’t just the higher-growth Asian markets but also Western markets that contributed. In any case, Uniqlo’s ability to grow through a challenging international backdrop, bodes well for the near-term outlook.

Fast Retailing

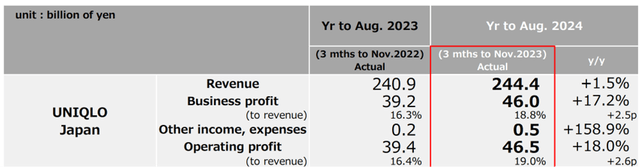

Perhaps more impressively, Uniqlo Japan found enough margin levers to deliver an equally impressive high-teens % business profit growth. Cost control was key – better order management helped to insulate margins from spot USD/JPY volatility. Gains from other initiatives, such as merchandise development and SG&A cost discipline, also helped and should sustain through the coming quarters. Though a favorable base effect also helped (largely down to big currency fluctuations in fiscal Q1 2023), Uniqlo Japan’s ~270bps YoY gross margin swing to 52.2% was still a very solid result.

Fast Retailing

Continuing to Tough it Out in Japan

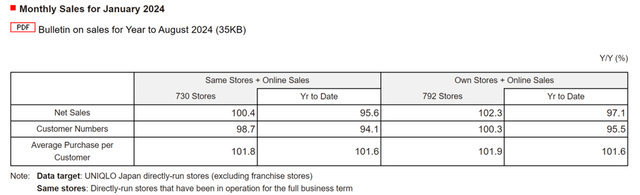

Heading into fiscal Q2, expect another round of consensus earnings revisions – not only on evidence of more growth from Uniqlo International but also resilience at Uniqlo Japan, where margins are increasingly taking precedence over a slowing top-line. That said, monthly sales reports for Uniqlo Japan haven’t been too bad either, as, despite warmer than usual weather through December/January, same-store and online sales were up slightly YoY (+1.8% YoY spending; traffic down 1.3%). By comparison, Japanese retailer Ryohin Keikaku (OTCPK:RYKKF) has seen a far bigger hit in its apparel business (sales down ~10% in January), exacerbated by inventory shortages. In the likely scenario that the margin gains Uniqlo Japan delivered in fiscal Q1 also carry through fiscal Q2, I wouldn’t rule out another high-teens % earnings growth print.

Fast Retailing

International Momentum to Sustain the Growth Engine

While Uniqlo Japan’s performance could swing things at the margin, the future earnings path overwhelmingly rests on growth at Uniqlo International. Growth has been strong, even though a post-COVID rebound in China, the company’s key overseas growth market, hasn’t been as swift as expected. The key here is Uniqlo International’s diversified footprint, which has allowed it to tap into top-line momentum in Southeast Asia and, more surprisingly, in Western markets, to compensate. So even in the likely scenario that we see Chinese sales growth run at a slower pace than pre-COVID, I’m not too concerned about the long-term pace of net store openings at Uniqlo International. As for the existing store base, there’s ample room for same-store sales to continue on its growth path, particularly if management extends its recent success on the product value front into the future. On balance, a 30-40% segmental earnings growth pace (in line with fiscal Q1) is well within reach here.

Fast Retailing

Of course, yen movements and its impact on earnings will also swing the international P&L in the near future, as Fast Retailing’s growing overseas contribution means it has been a net beneficiary from the weaker yen (at the expense of its domestic business). Thus far, Japan’s central bank has opted for a very gradual monetary policy normalization path, even with inflation on the rise, so I don’t expect this earnings tailwind to meaningfully reverse anytime soon.

Japan’s Premier Fashion Compounder is Priced to Perfection

Fast Retailing’s differentiated focus on ‘basics’ and its longer growth runway, by virtue of its higher-growth end markets, sets it apart relative to the rest of the global fashion industry. So does its sustained track record of earning significantly above its cost of equity for a prolonged period, as reflected in its high fundamental grades on SeekingAlpha’s Quant scorecards. Coming off a strong fiscal Q1, the company also looks on track for another very solid year of earnings growth (hence the ‘A-‘ momentum grade), buoyed by contributions from Uniqlo International and resilience in Japan.

The catch here is, as always, the premium valuation (‘F’ rated per SeekingAlpha Quant). After all, this is a stock currently priced at nearly 40x (thirteen turns above key global peer Inditex!) on an earnings base growing in the low-teens %. While I don’t deny this is the type of ‘compounder’ stock that could grow into its multiple over a long enough time frame, it’s probably best to err on the side of caution for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.