Murat Taner/The Image Bank Unreleased via Getty Images

As I expect the extension of the bull run in 2024, it might be a good strategy to capitalize on the uptrend through growth-focused ETFs like Vanguard Growth Index Fund ETF Shares (NYSEARCA:VUG). VUG not only offer the potential to fully capitalize on the potential bull run, but its diversified portfolio can also lower the risk factor during downtrends and tail events. A lower expense ratio, high liquidity and robust momentum also make VUG an attractive option to hold for the long term. This is an update to my previous article published last year.

The Bull Market is Likely to Last

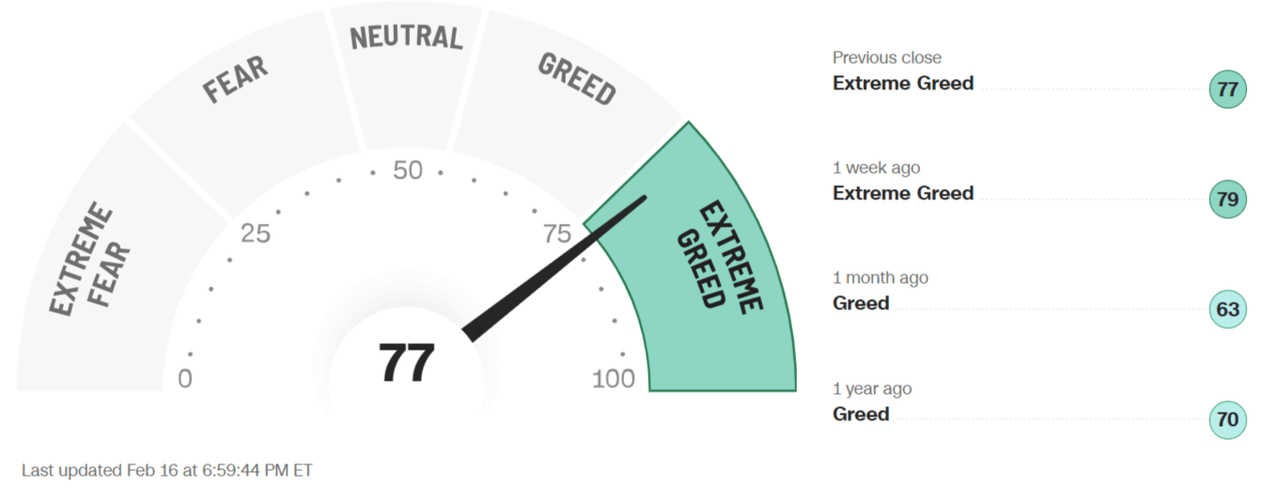

CNN Fear & Greed Index (CNN)

The US stock market extended the uptrend into 2024 with trends indicating that the bull run is likely to last for a longer time. For instance, CNN’s Fear & Greed index, which is composed of 7 technical indicators, suggests that the market’s mood is bullish and investors look extremely greedy to capitalize on the potential gains. Strong technical bullish indicators include low volatility along with solid breadth and strength of the market. The US market’s strength looks high given a large number of stocks trading around their 52-week high while a few trade near their 52-week low.

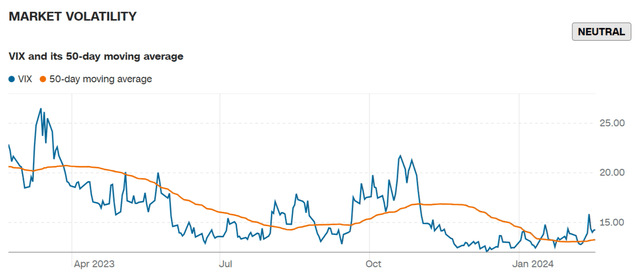

CBOE Volatility Index (CNN)

As the well-known CBOE Volatility Index has been trending lower, it signals a declining fear and low volatility. Numerous factors, such as economic and earnings strength, have been contributing to lowering investor fear in the stock market. The US stocks are also trading well above their 125-day moving average, while the put & call ratio hints at higher buying than selling.

Besides technical indicators, strong fundamentals favour the extension of the bull trend. The Fed has achieved its rate hike target and forecasts suggest at least three cuts in 2023. Interest rate cuts would bring more investor confidence in risky assets and contribute to economic and financial stability.

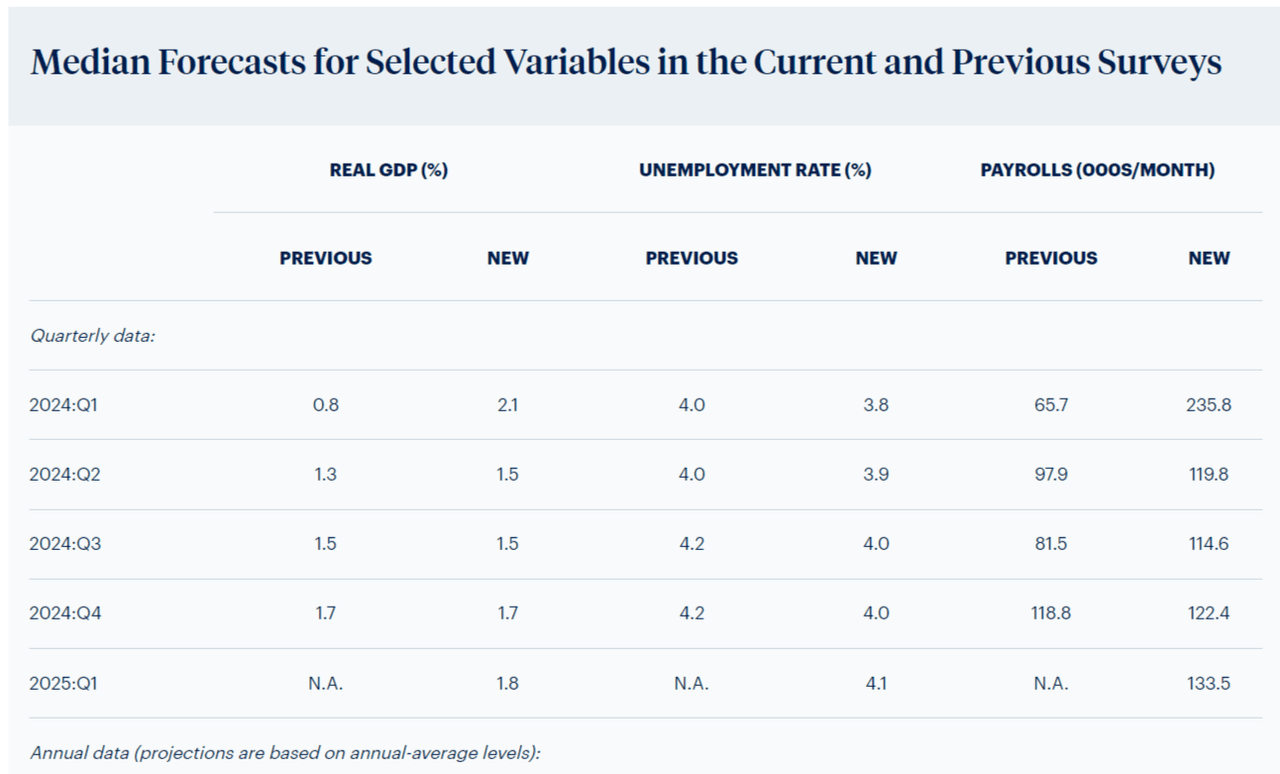

2024 GDP forecast (Federal Reserve Bank of Philadelphia)

The strong consumer spending, higher output and solid job market, which paved the path for exceptional GDP growth in 2023 compared to initial expectations for severe recession, is again likely to play a key role in strengthening economic growth in 2024. The Federal Reserve Bank of Philadelphia’s survey of 34 forecasters expects the US GDP to grow by 2.6% in 2024, up from 2.5% in 2023 and above from the previous forecast of 1.7%. Meanwhile, the Fed Atlanta anticipates even higher growth for 2024, with first-quarter GDP growth of 2.9%. The U.S. job market data backs higher forecasts. The US added 353,000 jobs in January and wages grew 4.5% more than a year earlier while unemployment continues to hover well below the targeted level of 4%.

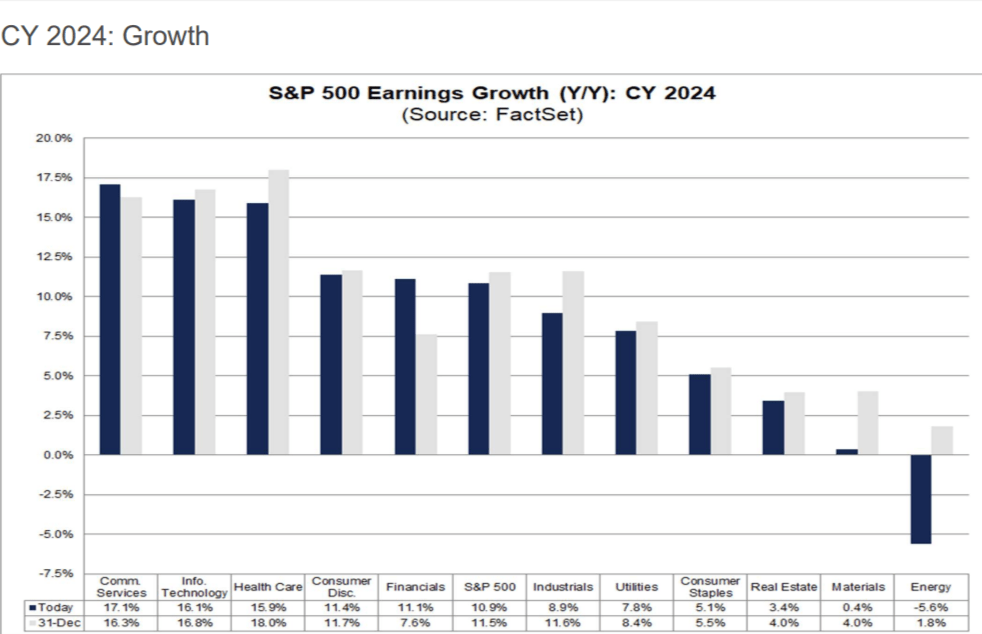

2024 earnings forecast (FactSet)

Earnings growth also backs the uptrend. The S&P 500’s earnings are likely to grow at a double-digit rate in 2024, thanks to robust growth from the information technology, communication and consumer cyclical sectors. The earnings growth trend has already begun in the final quarter of 2023, with the communication, consumer cyclical and tech sectors reporting 45%, 32% and 20% earnings growth, respectively.

Microsoft (MSFT), which is the largest tech company, is expected to generate 20% earnings growth in fiscal 2024. The actual number may exceed Wall Street expectations because of Microsoft’s leading position in the AI market, which is expected to grow at a compound annual rate of 37% by 2030. Microsoft topped revenue and earnings expectations in the December quarter, thanks to its cloud revenue growth of 24% compared to the past year period. Azure revenue grew 30% year over year and reflects 6% growth from the previous quarter due to AI. Wedbush Securities analyst Dan Ives believes Microsoft’s robust results and guidance are just the beginning of the benefits of its leading position in artificial intelligence.

“With over 60% of the MSFT installed base seeking to implement AI functionality across the entire enterprise and commercial landscape over the next few years based on our estimates, we believe that this is the early innings of a major monetization opportunity as the company doubles down on its AI strategy with its Copilot generate significant demand,” Wedbush Securities analyst Dan Ives said.

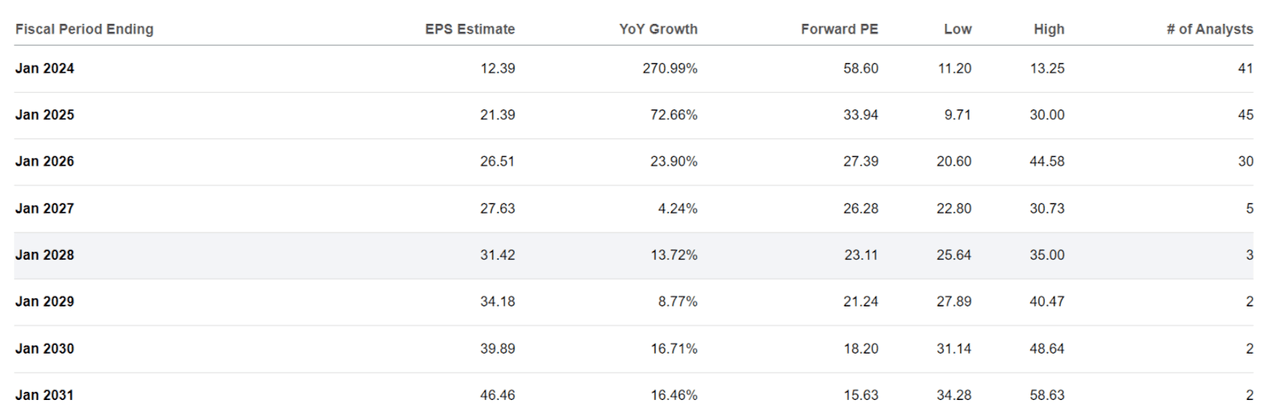

NVIDIA earnings forecast (Seeking Alpha)

NVIDIA’s (NVDA) whopping share price rally also appears sustainable because the company anticipates massive revenue and earnings in fiscal 2024 due to high demand for its AI-related chips in data centres. Wall Street expects NVIDIA’s earnings per share to hit $40 levels by 2023 from $12 per share in 2024. NVIDIA’s revenue grew more than 200% in the September quarter and the company forecast December-quarter revenue to be between $20 billion.

Besides mega-cap information technology stocks, fast-growing consumer cyclical and communications stocks, such as Amazon (AMZN) and Meta Platforms (META), are likely to add to the upside. Amazon generated 12% revenue growth in 2023 while its operating income surged to $36.9 billion from $12.2 billion in the past year. Wall Street expects Amazon’s revenue and earnings growth momentum to continue in the following years. Meta significantly topped the December quarter estimates as its quarterly revenue grew 25% year over year and earnings of $5.22 per share increased substantially from $1.76 per share in the year-ago period. Wall Street expects its 2024 earnings to hit a record $20 per share in 2024 compared to $14.87 per share in 2023. There are a number of other players in the growth category with high double-digit revenue and earnings growth forecast.

Growth Investing Likely to Outperform

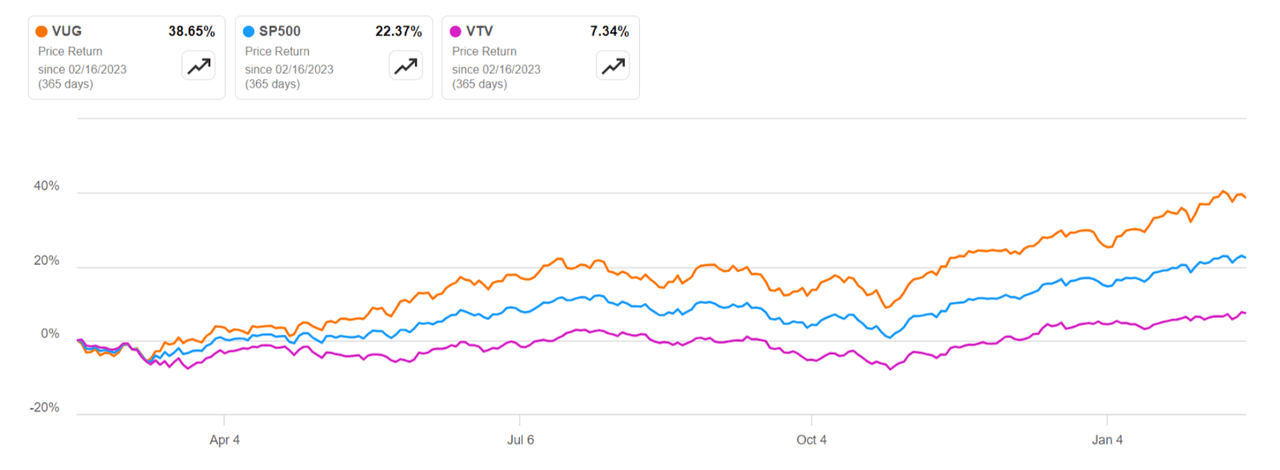

VUG Vs. VTV and S&P 500 share price (Seeking Alpha)

Growth investing thrived in the last twelve months, outperforming value and the S&P 500 by a large percentage. For instance, VUG’s share price rallied nearly 39% in the last twelve months compared to S&P 500 and Vanguard Value Index Fund ETF Shares (VTV) gains of 22% and 7.34%, respectively. The outperformance is mainly attributed to improving economic trends and strengthening investor confidence in high-beta stocks. Historical trends also suggest that investor confidence increases in growth stocks during economic expansion while the value category performs well during bear runs.

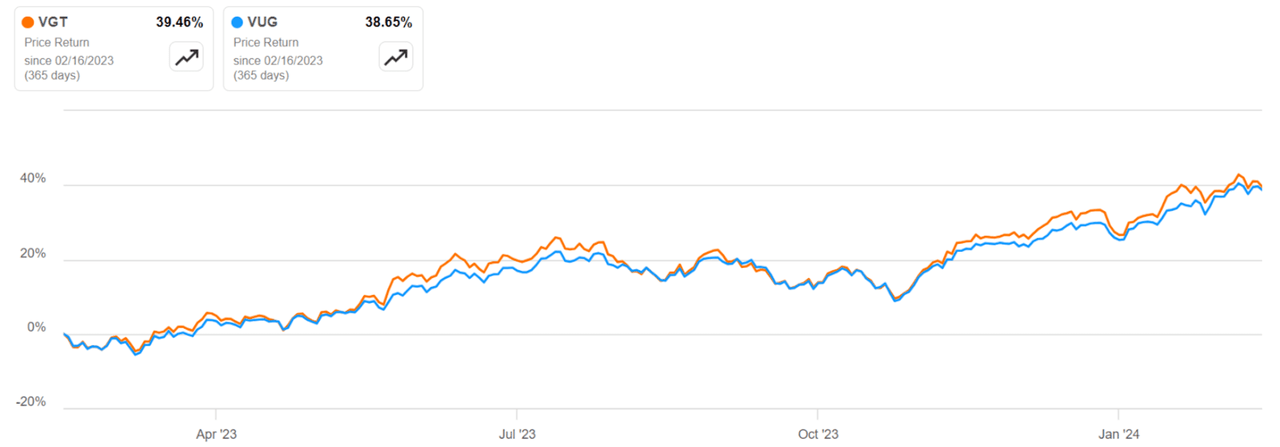

VUG Vs. VGT share price performance (Seeking Alpha)

Although the technology sector has been in focus in the last twelve months when it comes to generating high returns, I believe the growth category looks more attractive than tech sector-focused investing. For instance, VUG’s shares rally was up slightly from Vanguard Information Technology Index Fund ETF Shares (VGT) in the last twelve months. VUG’s higher returns than the tech-focused ETF reflect the benefit of its diversification to fast-growing sectors like consumer cyclical and communications. VUG’s portfolio is composed of 211 growth stocks with a significant concentration in mega-cap technology, communication and consumer cyclical sectors. The information technology sector represents 47% of VUG’s portfolio while consumer cyclical and communication stocks make up 17% and 13%. Its top 10 stocks represent 55% of the entire portfolio with a magnificent 7 representing the major percentage.

Moreover, with tech-focused ETFs like VGT, investors won’t be able to benefit from stunning gains from the magnificent 7 group, which generated more than 100% share price growth in 2023. VGT’s portfolio contains only three stocks from the group, including Microsoft, Apple (AAPL) and NVIDIA. I believe exposure to fast-growing stocks such as Meta, Amazon, Telsa (TSLA) and Alphabet (GOOG) (GOOGL) can make a big difference in returns due to their strong earnings growth power and solid share price momentum. For instance, Meta’s shares rallied 180% in the last twelve months and Wall Street anticipate its earnings to grow by 34% year over year in 2024.

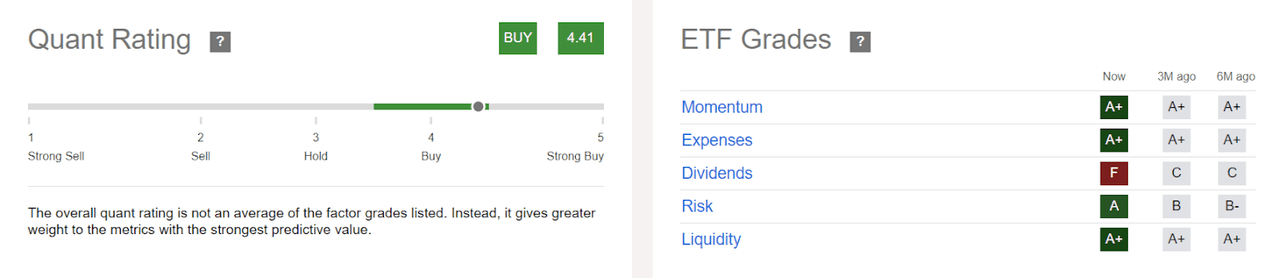

VUG quant rating (Seeking Alpha)

Chasing tech ETFs carries a higher risk than growth-focused ETFs like VUG due to a lack of portfolio diversification to other sectors. Seeking Alpha’s quant rating also hints at strong momentum and a low-risk factor for VUG. It earned an A-plus grade on the momentum factor while an A on the risk factor. On the flipside, VGT earned a B grade on the risk factor due to a lack of portfolio diversification. VGT’s expense ratio of 0.10% is also higher than VUG’s 0.04%.

I also prefer VUG over its peers such as SPDR Portfolio S&P 500 Growth ETF (SPYG) and Vanguard S&P 500 Growth ETF (VOOG) because of its low expense ratio, better portfolio mix and high share price momentum. VUG shares are up nearly 40% in the last twelve months compared to a 30% increase from SPYG and VOOG. VUG is ranked 13 out of 84 growth-focused ETFs based on Seeking Alpha quant rating while SPYG and VOOG stand at 27th and 29th spot.

In Conclusion

As prospects of the extension of the bull run are high in 2024, it might be a good strategy to chase the bull run with growth-focused ETFs like VUG. Its portfolio of 210 stocks with a concentration on mega and large-cap stocks from the technology, consumer cyclical and communication sectors increases its potential to fully capitalize on the potential bull while lowering the risks associated with sector-focused investing. Moreover, its low expense ratio and higher liquidity make it a solid pick for long-term investing.