Up to date on Might twentieth, 2022 by Quinn Mohammed

A singular concentrate on high quality dividend shares and revenue technology may help buyers endure the worst financial storms. When instances get robust, it’s comforting to know {that a} dividend examine is on the best way, in good instances or unhealthy.

Nonetheless, there’s a draw back, which is lacking out on fast-growing firms that don’t but pay a dividend. A chief instance of that is Salesforce (CRM), which has generated annualized returns north of 15% every year for the final decade. Salesforce inventory had soared to a market cap above $200 billion simply previous to 2022, however since then, shares have fallen 39%. In consequence, Salesforce trades at a $156 billion market cap at the moment.

Beforehand, Salesforce was a mega-cap inventory, outlined as these with market caps above $200 billion. The entire variety of mega cap shares varies relying upon market circumstances, however there are usually 25 to 40 within the US, so there are loads to select from for buyers.

We have now created a downloadable listing of megacap shares. You possibly can obtain a free spreadsheet of all 20+ mega cap shares (together with essential monetary metrics equivalent to price-to-earnings ratios and dividend yields) by clicking on the hyperlink beneath:

An funding in Salesforce inventory made again in 2010 would now be value greater than 8 instances your preliminary capital. Now that Salesforce is a mega-cap inventory and worthwhile, buyers is perhaps questioning whether or not the corporate will ever pay a dividend.

Enterprise Overview

Based in 1999, Salesforce.com Inc. is the world’s #1 buyer relationship administration platform, and a instrument that helps firms keep linked to prospects. Salesforce helps over 150,000 companies run their firms extra successfully by enabling them to benefit from cloud, cellular, social, web of issues, synthetic intelligence, voice and blockchain to create a 360-degree view of their prospects.

For the complete 12 months fiscal 2022, the corporate generated $26.49 billion in gross sales and non-GAAP earnings-per-share of $4.78. This fiscal 12 months 2023, Salesforce anticipates $32.0 billion to $32.1 billion in gross sales and earnings-per-share within the $0.46 to $0.48 vary on a reported foundation and $4.62 to $4.64 on an adjusted foundation. Roughly 93% of the $163 billion market capitalization firm’s income is derived from subscriptions and help.

Supply: Investor Relations

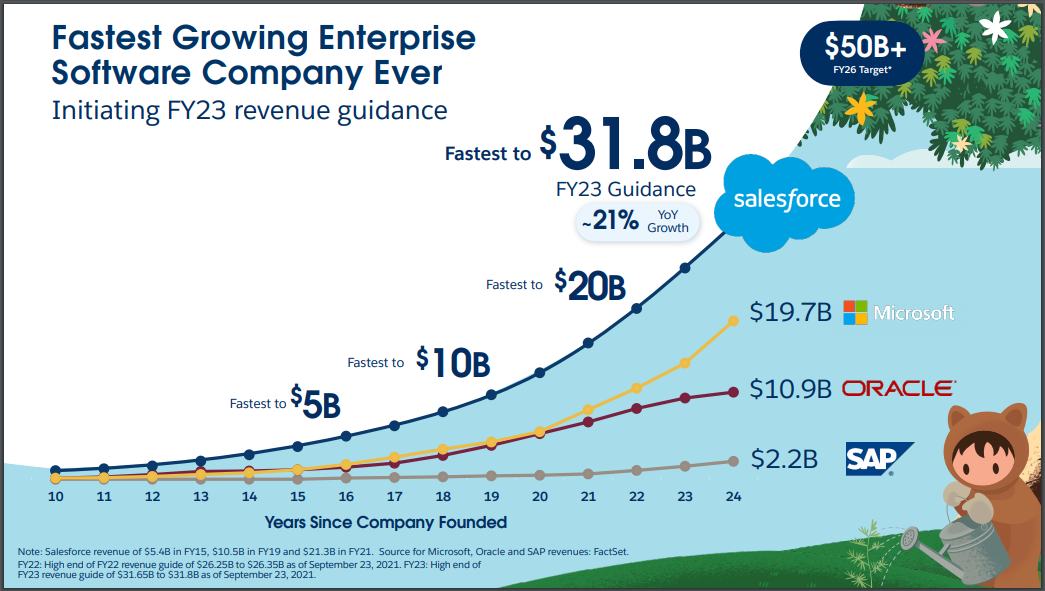

Salesforce has put collectively an enviable progress file, having elevated its gross sales from $1.7 billion in fiscal 12 months 2011 to $26.5 billion in fiscal 12 months 2022, representing an annualized compound progress price of 28% every year.

Furthermore, the corporate anticipates this sturdy progress trajectory will proceed, forecasting that gross sales will hit $50 billion by fiscal 12 months 2026. This might imply progress would gradual to 18% yearly, however that is nonetheless exceptionally spectacular coming off a bigger and bigger base.

Development Prospects

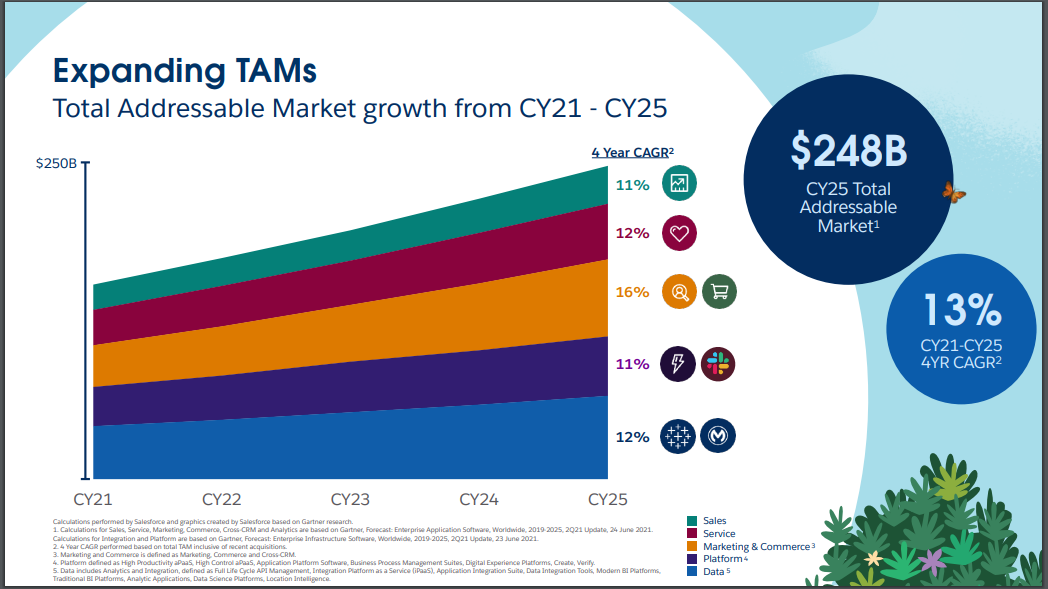

To attain this progress, Salesforce has a wide range of giant and rising markets:

Supply: Investor Relations

Not solely is there a big addressable market to go after, however a wide range of alternatives supply the potential for double-digit progress charges. Because of this even when Salesforce retains its share of the market fixed, it may nonetheless have a protracted progress tailwind.

At first, progress was distinctive, however the numbers have been fairly a bit smaller. As the corporate grew to become a lot bigger, progress remained sturdy – an essential side for the corporate and one of many causes shareholder returns have been so distinctive.

As the corporate will get bigger and bigger, the speed of progress will gradual, but it surely’s clear that there stays a big tailwind on the firm’s again.

Aggressive Benefits

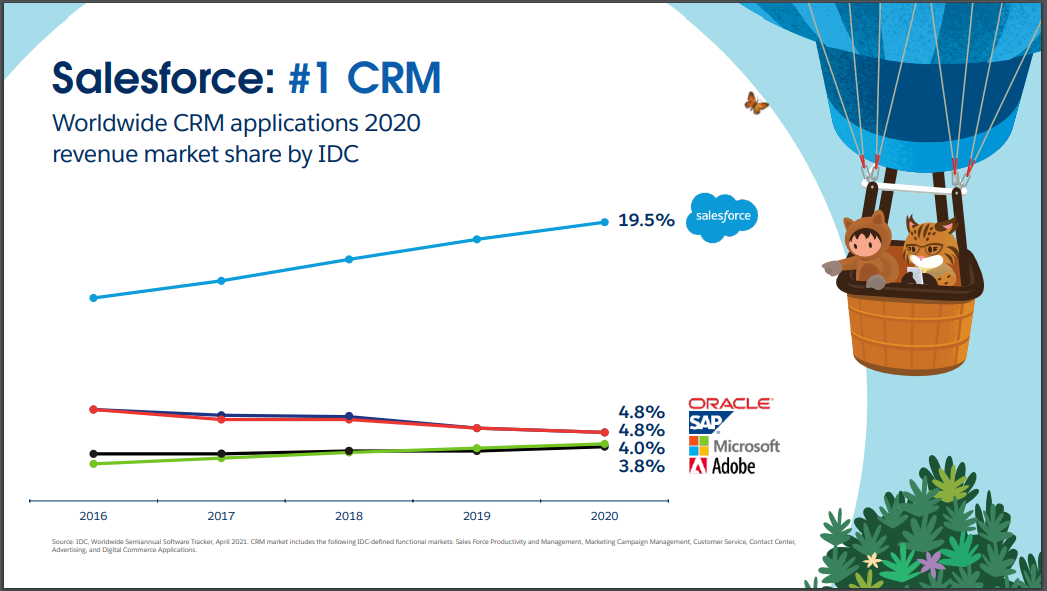

Supply: Investor Relations

Put merely, Salesforce is the dominant buyer relationship administration platform and has earned the CRM ticker. Furthermore, the corporate’s share of the market has been rising, as the corporate solidifies its management and continues to outpace among the most revered firms within the know-how area.

This has allowed the corporate to generate an unmatched progress price:

Supply: Investor Relations

Along with its spectacular progress story during the last 20 years, Salesforce additionally derives aggressive benefits from its first-mover benefit, cementing itself because the “gold commonplace” within the trade and its monetary place.

As of the latest report, Salesforce held $5.5 billion in money, $5.1 billion in marketable securities, $22.9 billion in present property and $95.2 billion in complete property in opposition to $21.8 billion in present liabilities and $37.1 billion in complete liabilities. Lengthy-term debt stood at simply $10.6 billion.

It’s essential to notice that $48 billion of the corporate’s complete property are comprised of goodwill. This ends in a barely much less spectacular monetary stance, but it surely additionally captures the concept that Salesforce is rising each organically and thru acquisitions. Holding a sound monetary footing and having the ability to purchase firms will proceed to be essential as Salesforce matures.

Will Salesforce Ever Pay A Dividend?

Talking of maturing, the query as as to if or not Salesforce can pay a dividend could be thought of alongside a “maturity scale.” Any profitable enterprise works by means of completely different phases of needing and allocating capital. At first, firms are normally capital-intensive, requiring vital funds for progress funding. Fairness and debt are issued to lift funds, whereas money flows haven’t but materialized.

Within the progress section, profitability is feasible, however the focus is usually on reinvestment as a substitute. This normally means reinvesting all money flows and persevering with to hunt extra capital by way of debt or fairness.

As soon as an organization begins to mature, the cycle begins to unwind itself. Debt and fairness can nonetheless be used, however usually the income being generated are greater than sufficient to service, maintain and even develop (albeit at a slower price) the now a lot bigger enterprise. Additional, debt is lowered to a manageable degree and an organization could start repurchasing shares. Lastly, a dividend is taken into account, indicating that the corporate is sustainable and producing extra funds.

After we take into consideration these three phases, Salesforce remains to be very a lot within the progress section.

Whereas the historical past of income progress detailed above is outstanding, the underside line doesn’t inform the identical story. Within the 2012 by means of 2016 interval, Salesforce posted a loss every year. Within the 2017 by means of 2022 interval, earnings-per-share totaled $0.26, $0.17, $1.44, $0.15, $4.38 and $1.48. And whereas earnings-per-share are anticipated to prime $4+ this 12 months, a constant development has not but developed.

Even when Salesforce started paying a $1.50 annual dividend, this may solely indicate a present dividend yield of about 1.0%. Extra importantly, it could interrupt the corporate’s progress thesis. Within the brief to intermediate-term Salesforce is just not anticipated to pay a dividend. The main target might be on continued progress, reinvestment, and acquisitions.

In fact, that doesn’t imply that the corporate won’t ever pay a dividend. There are three issues to look out for, which could give us a clue as to when this might happen:

- Manageable debt load

- Stabilizing share depend

- Maturing progress

The debt load is already manageable, a product of the comparatively capital mild enterprise mannequin paired with a desire for issuing fairness.

The share depend, alternatively, has gone from 509 million in fiscal 12 months 2010 to 974 million on the finish of fiscal 12 months 2022 – equating to a 5.6% annualized progress price. When the share depend begins stabilizing, with out the corporate taking up extra debt, this might point out a turning level in capital allocation.

Lastly, when administration signifies or the corporate’s financials start to indicate maturing progress, this might likewise be an inflection level. This isn’t anticipated within the brief or medium-term, however it’s one thing to observe over time.

Closing Ideas

Salesforce has been an distinctive funding over the previous 20 years, on account of an exceptional income progress file. Finally, the worth buyers are putting on shares relies on the highest line progress changing to bottom-line outcomes. Nonetheless, for the foreseeable future, the corporate remains to be very a lot targeted on progress and reinvesting within the enterprise. Because of this extra funds won’t be obtainable and the chance of a dividend within the short-term seems distant.

Over the long-term, if Salesforce is profitable in changing its sturdy prime line to a constant bottom-line outcome, there could come a day when the corporate has extra money obtainable. Specifically, seeing a stabilizing share depend and maturing progress trajectory may sign a turning level in capital allocation technique. When this time comes, a dividend will not be that far off for this progress firm.

See the articles beneath for evaluation on whether or not different shares that presently don’t pay dividends, will someday pay a dividend:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].