JINGXUAN JI

This article is part of a series that provides an ongoing analysis of the changes made to Baillie Gifford’s 13F portfolio on a quarterly basis. It is based on their regulatory 13F Form filed on 01/26/2024. Please visit our Tracking Baillie Gifford 13F Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q3 2023. The 13F securities represent roughly 40% of their overall Assets Under Management. The portfolio is diversified with around 300 13F securities. 50 of those positions are significantly large (more than ~0.5% of the portfolio) and they are the focus of this article.

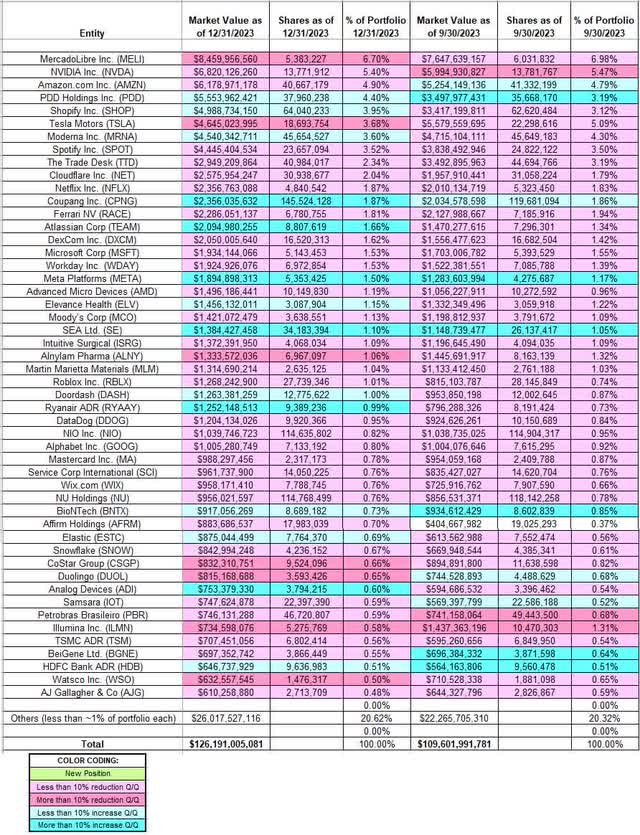

This quarter, Baillie Gifford’s 13F portfolio value increased from ~$110B to ~$126B. The top three holdings are at ~17% while the top five holdings are close to ~26% of the 13F assets: MercadoLibre, NVIDIA, Amazon.com, PDD Holdings, and Shopify.

Note: Although the following positions are really small compared to the overall size of the portfolio, it is significant that they have sizable ownership stakes: 10x Genomics (TXG), AbCellera Biologics (ABCL), Adaptimmune Therapeutics (ADAP), Akili Inc. (AKLI), American Superconductor (AMSC), Appian Corporation (APPN), Axon Enterprise (AXON), Broadridge Financial (BR), Certara (CERT), Chegg (CHGG), Cellectis (CLLS), Copa Holdings (COPA), Coursera (COUR), Codexis (CDXS), Denali Therapeutics (DNLA), Digimarc (DMRC), EverQuote (EVER), Gingko Bioworks (DNA), HashiCorp (HCP), Howard Hughes Corp (HHC), Joby Aviation (JOBY), Jumia Technologies (JMIA), Lemonade (LMND), Mobileye (MBLY), NuCana Inc. (NCNA), Nanobiotix (NBTX), Oddity Tech (ODD), Pacira Biosciences (PCRX), Recursion Pharma (RXRX), Redfin Inc. (RDFN), Remitly Global (RELY), Sana Biotech (SANA), SiteOne (SITE), Sprout Social Inc. (SPT), Staar Surgical (STAA), Sweetgreen (SG), Teladoc (TDOC), Tencent Music Entertainment (TME), Upwork (UPWK), Warby Parker (WRBY), Wayfair Inc. (W), YETI Holdings (YETI), and Zillow Group (Z).

Stake Increases:

PDD Holdings Inc. (PDD): PDD is a 4.40% of the portfolio stake built over the three years through 2021 at prices between ~$19 and ~$197. There was a ~11% stake increase during Q2 2023 and that was followed by a ~15% increase last quarter at prices between ~$68 and ~$103. This quarter also saw a ~6% increase. The stock currently trades at ~$142.

Shopify Inc. (SHOP): The ~4% of the portfolio SHOP stake was built in the 2017-2019 timeframe at very low prices. Since then, the position had seen minor trimming. The last three quarters of 2022 saw a one-third stake increase at prices between ~$26 and ~$73. The stock currently trades at $81.55. The last few quarters saw minor trimming while this quarter there was a marginal increase.

Note: they have a 5.32% ownership stake in the business.

Moderna Inc. (MRNA): A small position in MRNA was established in Q1 2020. H2 2020 saw the position built to over 24M shares at prices between ~$58 and ~$157. Next quarter saw another ~85% stake increase at prices between ~$105 and ~$184. Since then, the activity has been minor. The stock currently trades at ~$102 and the top five stake is at 3.60% of the portfolio.

Coupang Inc. (CPNG): CPNG had an IPO in Q1 2021. Shares started trading at ~$48 and currently go for $14.53. The 1.87% of the portfolio stake was built over the five quarters through Q1 2022 at prices between ~$17.50 and ~$48.50. The position was increased by 22% this quarter at prices between $15.17 and $18.11.

Atlassian Corp (TEAM): The 1.66% TEAM stake was increased by 21% this quarter at prices between $170.84 and $245.05. The stock currently trades at ~$248.

Meta Platforms (META) and SEA Ltd. (SE): The 1.5% stake in META was increased by 12% last quarter at prices between ~$283 and ~$325. That was followed by a ~25% increase this quarter at prices between ~$288 and ~$358. The stock currently trades at ~$394. The small 1.10% position in SE was increased by 20% last quarter at prices between ~$35 and ~$67. This quarter saw another 31% increase at prices between $35.11 and $46.69. The stock is now at $39.57.

Note: they have a ~6.5% ownership stake in SEA Ltd.

Analog Devices (ADI), BioNTech (BNTX), Doordash (DASH), Elastic (ESTC), Elevance Health (ELV), HDFC Bank ADR (HDB), and Ryanair ADR (RYAAY): These small (less than ~1.2% of the portfolio each) stakes were increased during the quarter.

Note: They have significant ownership stakes in Doordash, Elastic, Elevance Health, and Ryanair.

Stake Decreases:

MercadoLibre Inc. (MELI): MELI position goes back to 2010 when a 2.25M share stake was built at prices between ~$35 and ~$73. The position size peaked at 6.56M shares in 2014. The stake increase happened at prices between ~$60 and ~$140. The two years through Q2 2023 saw a ~39% increase at prices between ~$635 and ~$1946. The stock currently trades at ~$1796. It is now the largest 13F position at 6.7% of the portfolio. There was a ~11% trimming this quarter.

Note: they have a ~11% ownership stake in the business.

NVIDIA Inc. (NVDA): A large stake in NVDA was first purchased in 2016 at prices up to ~$28. The position has seen periodic selling since. Recent activity follows. The six quarters through Q2 2022 saw a ~20% reduction at prices between ~$125 and ~$330. That was followed by a 12% selling last quarter at prices between ~$409 and ~$494. The stock currently trades at ~$610 and the stake is now the second largest at ~5.40% of the portfolio. There was marginal trimming this quarter.

Amazon.com Inc. (AMZN): AMZN stake was a very small position purchased in 2004. The period through 2009 saw a large position built at very low prices. Since 2014, the position has seen selling. Recent activity follows. 2020 saw a one-third reduction at prices between ~$89 and ~$170. The six quarters through Q2 2022 had seen another ~40% selling at prices between ~$102 and ~$187. The stock is now at ~$159. It is still a top-three stake at 4.90% of the portfolio. The last four quarters saw minor increases while this quarter there was marginal trimming.

Tesla Motors (TSLA): The TSLA stake was first purchased in 2013 at very low prices. The period through 2019 saw the original position almost triple at prices up to ~$28. There was minor trimming in the next two quarters and that was followed with a ~55% selling in H2 2020 at prices between ~$81 and ~$235. The last twelve quarters have seen another ~85% reduction at prices between ~$109 and ~$407. The stock currently trades at ~$183 and it is still a fairly large stake is at 3.68% of the portfolio. They are harvesting gains.

Spotify Inc. (SPOT): The original SPOT position goes back to a Series G funding round in 2015 when the company was valued at ~$8B. They had an IPO in 2018. Shares started trading at ~$150 and currently go for ~$214. H2 2019 saw a ~25% stake increase at prices between ~$112 and ~$157. That was followed with a ~27% increase over the three quarters through Q3 2022 at prices between ~$86 and ~$244. The last five quarters saw minor trimming.

Note: they have a ~11.9% ownership stake in the business.

The Trade Desk (TTD): The 2.34% TTD position was first purchased in the 2018-2019 timeframe at prices up to ~$28. H1 2021 saw a ~80% stake increase at prices between ~$52 and ~$90. The three quarters through Q3 2022 had seen a ~16% trimming. The stock currently trades at ~$68. The last four quarters saw only minor adjustments while this quarter there was a ~8% trimming.

Note: they have a ~9% ownership stake in the business.

Cloudflare Inc. (NET): The ~2% NET stake was purchased during Q2 and Q3 2020 at prices between ~$21 and ~$42. The three quarters through Q2 2022 saw a ~19% selling while the next two quarters saw a ~10% increase. There was a ~23% stake increase during Q2 2023 at prices between ~$41 and ~$71. The stock currently trades at ~$80. The last two quarters saw marginal trimming.

Note: they have a ~11% ownership stake in the business.

Netflix Inc. (NFLX): NFLX is a 1.87% of the portfolio stake established in the 2015-2016 timeframe at prices up to ~$130. There was a ~20% trimming over the two years through Q1 2023. That was followed by a ~15% reduction next quarter at prices between ~$318 and ~$445. The stock currently trades at ~$570. The last two quarters saw a ~15% further selling.

Ferrari NV (RACE): RACE was a ~18M shares stake that was established in 2016 at prices between $34 and $58. The period through 2020 saw the stake reduced to ~13.5M shares at higher prices. There was a ~15% selling in Q2 2021 at prices between ~$199 and ~$217. The three quarters through Q1 2023 saw another ~30% reduction at prices between ~$180 and ~$270. The stock currently trades at ~$340. There was minor trimming in the last three quarters.

DexCom Inc. (DXCM): A small stake in DXCM was first purchased in 2012. The stake remained small till 2016 when a substantial ~6.1M share position was built in the low-20s price range. The period through 2019 saw the stake reduced to ~4.8M shares through periodic selling. Recent activity follows. There was a ~30% stake increase in Q4 2020 at prices between ~$79 and ~$103. Q4 2021 saw a ~16% reduction at prices between ~$130 and ~$163. The stock currently trades at ~$122. The last several quarters have seen minor trimming.

Alnylam Pharma (ALNY): The bulk of the ~1% of the portfolio stake in ALNY was built in 2019 at prices between ~$69 and ~$124. The stock currently trades at ~$180. The last two years saw minor trimming.

Illumina Inc. (ILMN): The ILMN stake goes back over a decade to 2011 when a large 13.5M shares stake was built at prices between ~$25 and ~$75 per share. The period through 2020 saw a ~50% stake increase through incremental buying at higher prices. There was a ~30% selling in the three quarters through Q2 2023 at prices between ~$189 and ~$243. That was followed by a ~25% reduction last quarter at prices between ~$129 and ~$192. The stake was decreased by 50% this quarter at prices between ~$93 and ~$143. The stock currently trades at ~$141.

Advanced Micro Devices (AMD), Alphabet Inc. (GOOG), Affirm Holdings (AFRM), J Gallagher & Co (AJG), BeiGene Ltd. (BGNE), CoStar Group (CSGP), Duolingo (DUOL), DataDog (DDOG), Intuitive Surgical (ISRG), Martin Marietta Materials (MLM), Moody’s Corp (MCO), Microsoft Corp (MSFT), Mastercard Inc. (MA). NIO Inc. (NIO), NU Holdings (NU), Petrobras Brasileiro (PBR), Roblox Inc. (RBLX), Snowflake (SNOW), Samsara (IOT). Service Corp International (SCI), TSMC ADR (TSM), Wix.com (WIX), Watsco Inc. (WSO), and Workday Inc. (WDAY): These small (less than ~1.5% of the portfolio each) stakes were decreased during the quarter.

Note: they have significant ownership stakes in Affirm Holdings, Duolingo, Samsara, and Wix.com.

The spreadsheet below highlights changes to Baillie Gifford’ 13F holdings in Q4 2023:

Baillie Gifford Portfolio – Q4 2023 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Baillie Gifford’ 13F filings for Q3 2023 and Q4 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.