BrianAJackson/iStock via Getty Images

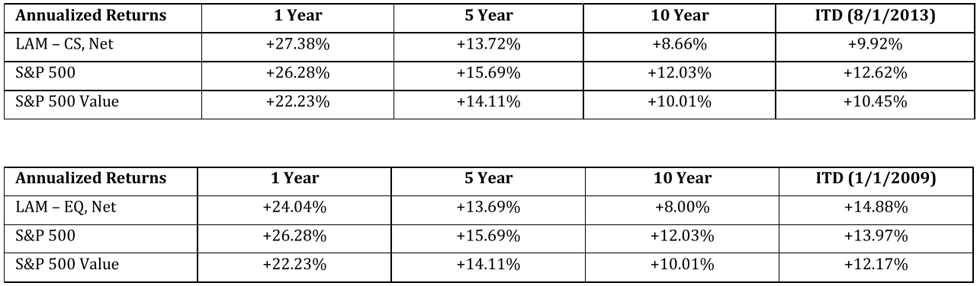

2023 was another good year for Lyrical. Our CS composite returned 27.2%, outperforming the S&P 500 (SP500, SPX) by 90 bps. It was a particularly difficult year to outperform given the outsized performance contribution of the Magnificent Seven mega-cap growth stocks. We, as value investors, do not own any of the Magnificent Seven, but fortunately we did own other strong performers that more than made up for it. 2023 is now the third calendar year in a row our CS composite has outperformed the S&P 500.

Compared to our style benchmark of the S&P 500 Value, it was an even better year. Our CS composite soundly outperformed it by 500 bps, even though that index also greatly benefited from mega-cap growth stocks. Compared with other value indices that were more style-pure, our outperformance margin was even wider. In 2023, we outperformed the U.S. large-cap value indices from Russell, MSCI, and FT Wilshire by more than 1,500 bps.

After a year of such strong returns, it is natural for investors to be concerned about valuation. With the S&P 500 forward P/E at nearly 20x at year-end, we share that valuation concern about the market, but with our CS composite at just 11x, we have no valuation concerns about our own portfolio. In fact, we continue to see significant upside potential.

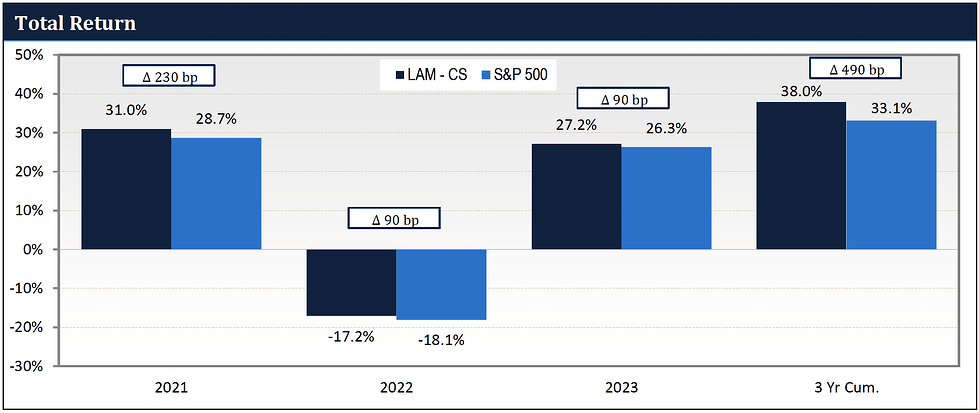

THREE YEARS IN A ROW

Lyrical’s CS composite has outperformed the S&P 500 in each of the last three calendar years. As you can see in the graph below, in 2021 we outperformed by 230 bps, in 2022 by 90 bps, and now in 2023 by 90 bps again.

Source: FactSet, Lyrical Analytics

We are very proud of these results. Normally, we would not take pride in modest outperformance, as we aspire to deliver much more than what we produced in this period. However, the market backdrop over these past three years has included: recession fears, inflation, strong sector crosscurrents, a banking crisis, AI mania, and the Magnificent Seven. Considering all that, we do take pride in these results, and still believe much greater outperformance lies ahead given the growth characteristics of our portfolio and the wide valuation spread relative to the S&P 500.

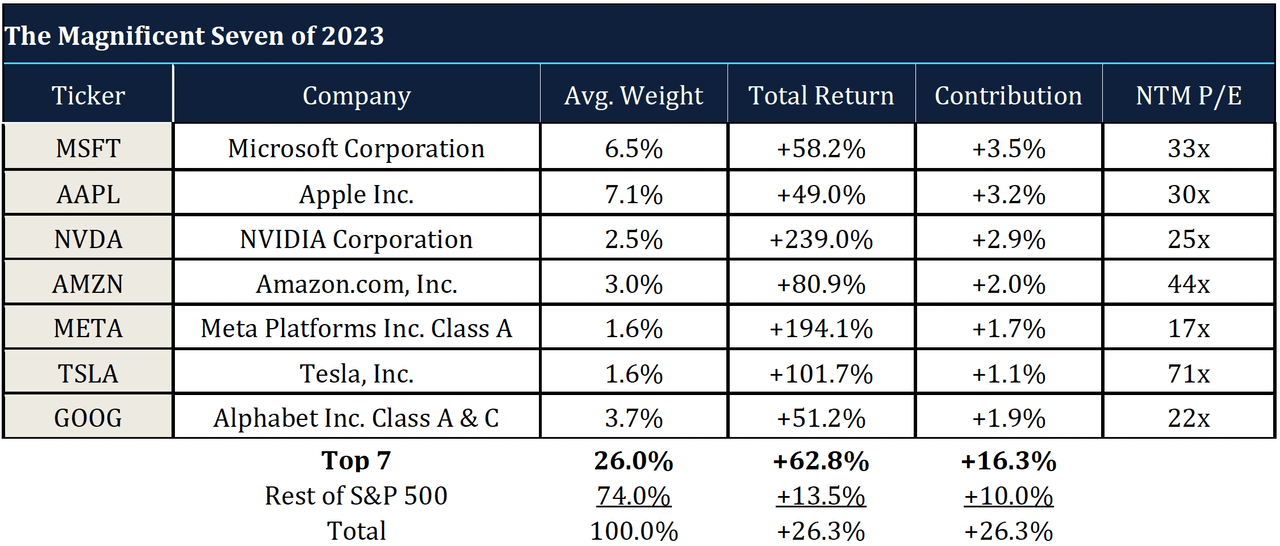

THE MAGNIFICENT SEVEN

The Magnificent Seven is the popular nickname for the seven mega-cap growth stocks that drove much of the returns of the S&P 500 in 2023. Specifically, the seven are: Microsoft (MSFT), Apple (AAPL), NVIDIA (NVDA), Amazon (AMZN), META, Tesla (TSLA), and Alphabet (GOOG,GOOGL).

We have not owned any of the Magnificent Seven, which makes sense given that we are disciplined value investors. As you can see by the P/Es in the table below, these stocks do not fit in the value category. The priciest of the seven are Tesla at over 70x forward earnings and Amazon at 44x. Microsoft and Apple have P/Es in the 30s, and NVIDIA and Alphabet have P/Es in the 20s. META at 17x is the only one with a P/E below the S&P 500’s, but it is still more than 50% pricier than our CS Composite P/E of 11x.

Source: FactSet

While we have seen FANG stocks propel the S&P 500 over the last decade, their impact on the return of the S&P 500 in any of those years pales in comparison to what the Magnificent Seven did in 2023. With a weighted average return of 62.8% and a combined average index weight of 26%, these seven stocks contributed an astounding 16.3 percentage points of the 26.3% index return.

The rest of the S&P 500, what we call the “S&P 493,” returned 13.5%, which is nearly 50 percentage points lower. (Note: the S&P 493 return is very close to the 13.9% return of the S&P 500 Equal Weight index.)

While our CS composite outperformed the full S&P 500 by just 90 bps, it outperformed the S&P 493 by 1,370 bps, and the S&P 500 Equal Weight by 1,330 bps.

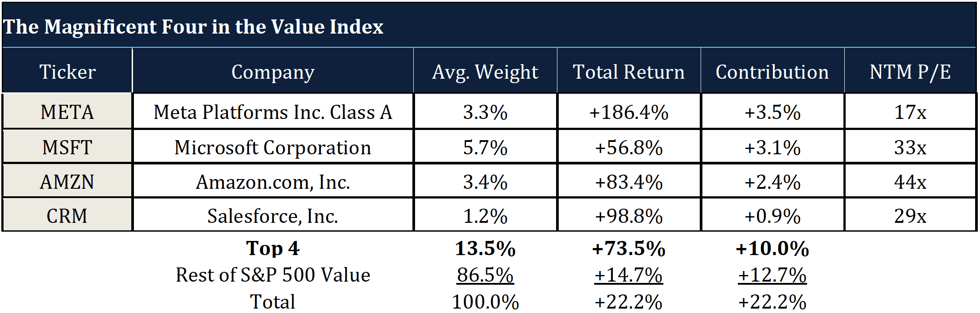

GROWTH STOCKS IN THE VALUE INDEX

Surprisingly, the S&P 500 Value index return was also significantly impacted by mega-cap growth stocks, despite the word “value” in its name. The four largest contributors to the S&P 500 Value index return were Meta, Microsoft, Amazon, and Salesforce, which you can see in the table below. These stocks had an average index weight of 13.5%, and had an extraordinary average return of 73.5%, contributing 10 percentage points of the 22.2% index return. Without these four mega-cap growth stocks, the index would have had a 14.7% return, 750 bps less.

Source: FactSet

Even with the S&P 500 Value hugely benefiting from these four mega-cap growth stocks, our CS composite outperformed it by 500 bps, and excluding these four stocks it outperformed by 1,250 bps.

OUR UNCOMMON COMBINATION

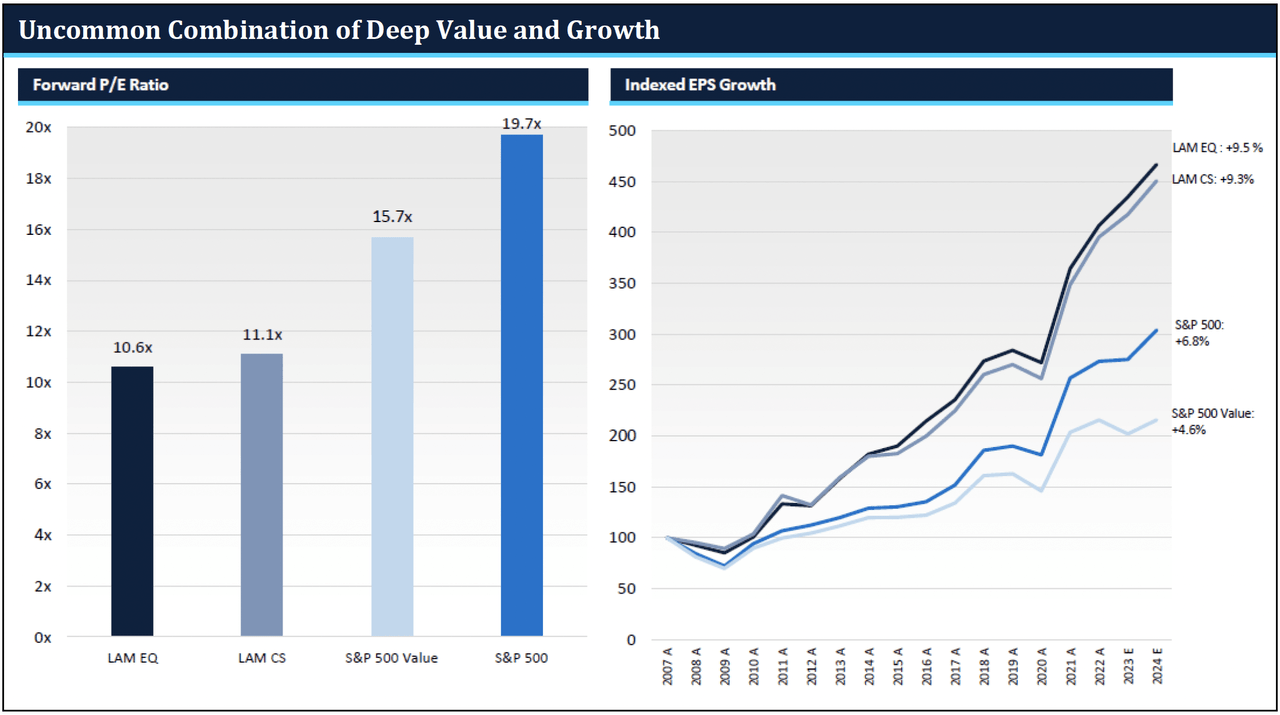

Throughout our firm history, our portfolios have had a lower forward P/E than the S&P 500 with comparable growth. Today, we do not just have comparable growth, but superior growth, as you can see in the line graph below.

The stocks in our portfolios have a growth history of over 9% per annum going back to 2007, compared to less than 6.8% for the S&P 500. Additionally, the earnings history of our portfolio has exhibited less economic sensitivity than either the S&P 500 or the S&P 500 Value, with less earnings impact during the COVID shutdowns of 2020 and during the Global Financial Crisis of 2008-09.

Source: FactSet, See Notes below.

In the bar chart above, you can see the valuation of our portfolios compared to the S&P 500. Even after a 27.2% return, our CS composite ended 2023 with a forward P/E of 11.1x. This uncommon combination of both deep value and attractive growth is the signature characteristic of Lyrical’s investment approach.

VALUATION SPREAD STILL EXTREMELY WIDE

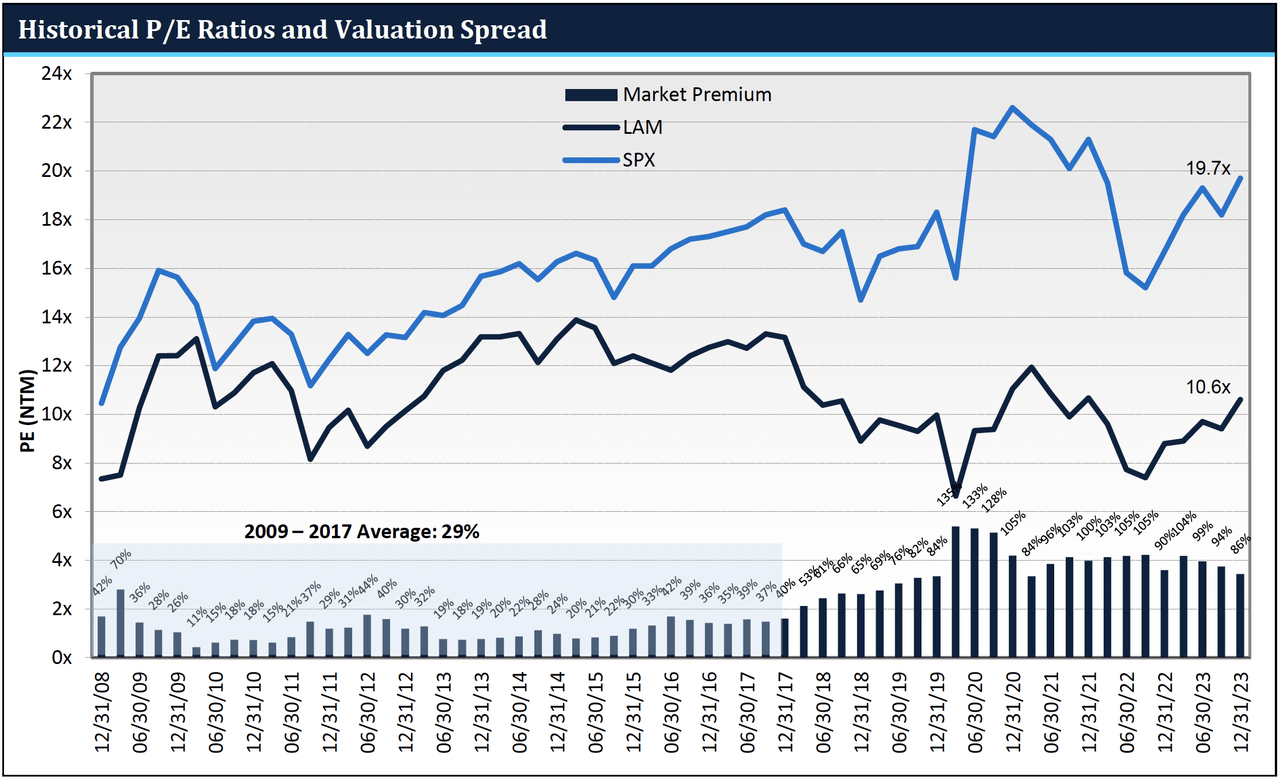

The S&P 500 ended 2023 with a forward P/E of 19.7x, which is more than 25% above its 15-year average. By contrast, our CS composite forward P/E is not above, but actually slightly below our 15-year average.

Presented on the graph below are our current and historical portfolio P/E ratios and the P/E of the S&P 500, with the bars at the bottom showing the valuation spread between the two. (Note: In this graph we use our EQ composite which has a longer history than CS). The valuation spread of our portfolio relative to the S&P 500 remains extremely wide at 86%, and it is over 90% pro-forma for our recent exit of Broadcom.

Source: FactSet

Source: FactSet

We continue to expect at some point this spread will revert to the pre-2018 average of about 30%, but we have no way to know when it might happen. Admittedly, the valuation spread has been stubbornly high for over three years now, but if we are right and the spread does revert from ~90% to ~30%, it could drive ~50 percentage points of cumulative excess return, likely spread out over several years.

CONCLUSION

Overall, 2023 was a very good year. Our CS composite generated strong absolute returns of 27.2%, which outperformed the S&P 500 by 90 bps and our style benchmark of the S&P 500 Value by 500 bps. We achieved this outperformance despite not owning any of the Magnificent Seven growth stocks that significantly boosted the returns of both those indices. Excluding the impact of those mega-cap growth stocks would increase our outperformance to 1,370 bps vs. the S&P 500 and 1,250 bps vs. the S&P 500 Value.

While it is sensible to have valuation concerns about the S&P 500, we have no such concerns about our own portfolio, as our portfolio P/E is slightly below our 15-year average. We believe we own a great collection of resilient, growing companies at deeply discounted valuations, and thus continue to see significant upside potential.

The valuation spread between our portfolio and the S&P 500 remains extremely wide at 86% (90%+ proforma for our recent exit of Broadcom). At some point, we expect that spread to revert to where it was in the past, and in the process drive substantial outperformance.

We have been waiting a few years now for this to happen, and we still do not know how much more waiting might be required. The wait has been frustratingly long, but on the other hand, it has not been all that bad either. While we have not generated the magnitude of outperformance we target, we have still outperformed the S&P 500 in each of the last three calendar years.

Outperforming by a little is a pretty good way to pass the time while waiting to outperform by a lot.

Andrew Wellington, Managing Partner, Chief Investment Officer

|

THIS IS NOT AN OFFERING OR THE SOLICITATION OF AN OFFER TO INVEST IN THE STRATEGY PRESENTED. ANY SUCH OFFERING CAN ONLY BE MADE FOLLOWING A ONE-ON-ONE PRESENTATION, AND ONLY TO QUALIFIED INVESTORS IN THOSE JURISDICTIONS WHERE PERMITTED BY LAW. THERE IS NO GUARANTEE THAT THE INVESTMENT OBJECTIVE OF THE STRATEGY WILL BE ACHIEVED. RISKS OF AN INVESTMENT IN THIS STRATEGY INCLUDE, BUT ARE NOT LIMITED TO, THE RISKS OF INVESTING IN EQUITY SECURITIES GENERALLY, AND IN A VALUE INVESTING APPROACH. PLEASE SEE WWW.LYRICALAM.COM/NOTES FOR A DISCUSSION OF CERTAIN MATERIAL RISKS OF AN INVESTMENT IN LYRICAL’S STRATEGIES. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. LAM – CS RESULTS ARE UNAUDITED AND SUBJECT TO REVISION, ARE FOR A COMPOSITE OF ALL ACCOUNTS. NET RETURNS INCLUDE A 0.75% BASE FEE. LAM – EQ RESULTS ARE UNAUDITED AND SUBJECT TO REVISION, ARE FOR A COMPOSITE OF ALL ACCOUNTS, AND SHOW ALL PERIODS BEGINNING WITH THE FIRST FULL MONTH IN WHICH THE ADVISOR MANAGED ITS FIRST FEE-PAYING ACCOUNT. NET RETURNS INCLUDE A 0.75% BASE FEE AND 20% INCENTIVE ALLOCATION ON RETURNS OVER THE S&P 500 VALUE®, SUBJECT TO A HIGH WATER MARK PROVISION.

THE S&P 500® IS WIDELY REGARDED AS THE BEST SINGLE GAUGE OF LARGE-CAP U.S. EQUITIES. THE INDEX THE INDEX INCLUDES 500 LEADING COMPANIES AND COVERS APPROXIMATELY 80% OF AVAILABLE MARKET CAPITALIZATION. THE S&P 500® VALUE DRAWS CONSTITUENTS FROM THE S&P 500®. S&P MEASURES VALUE USING THREE FACTORS: THE RATIO OF BOOK VALUE, EARNINGS, AND SALES TO PRICE. S&P STYLE INDICES DIVIDE THE COMPLETE MARKET CAPITALIZATION OF EACH PARENT INDEX INTO GROWTH AND VALUE SEGMENTS. NOTES: ALL MARKET DATA IS COURTESY OF FACTSET. INDEXED EPS GROWTH DEPICTS THE HISTORICAL CHANGE IN EARNINGS PER SHARE OF THE COMPANIES IN THE LAM U.S. VALUE EQUITY STRATEGIES USING WEIGHTS IN THE LAM-EQ COMPOSITE AS OF DECEMBER 31, 2022. ACTUAL HOLDINGS, AND THEIR WEIGHTS, VARIED OVER TIME. EARNINGS PER SHARE IS COMPUTED USING CONSENSUS EARNINGS DATA PER FACTSET, WHICH INCLUDE CERTAIN ADJUSTMENTS FROM REPORTED, GAAP EARNINGS. PERIODS MARKED WITH AN “E” INCLUDE ESTIMATED EARNINGS PER SHARE. THE HISTORICAL PORTFOLIO P/E (NTM) CHART COMPARES THE WEIGHTED AVERAGE NEXT TWELVE MONTHS P/E RATIOS AS OF THE BEGINNING OF EACH QUARTER FOR THE LAM-EQ COMPOSITE AND THE S&P 500 INDEX. ACTUAL BEGINNING OF QUARTER LAM-EQ COMPOSITE WEIGHTS ARE USED. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.