Funtay/iStock via Getty Images

Just over six months ago, I wrote on Metalla Royalty & Streaming (NYSE:MTA), noting that there was zero reason to chase the stock at US$5.70 per share. This is because the stock was fully valued at over 1.0x P/NAV, timelines were looking like they’d be pushed on key projects, and we had just seen additional insider selling in April. Since then, the stock has suffered a 50% plus drawdown and been the worst performer in the royalty/streaming space and trades at a fraction of the value of when I noted that the stock looked to be topping out in 2021 at $13.50 per share. In this update, we’ll dig into the stock’s updated valuation, the recent acquisition of Nova Royalty (OTCQB:NOVRF) and whether the stock is worthy of investment at current levels.

Metalla Royalty Update – January 2021

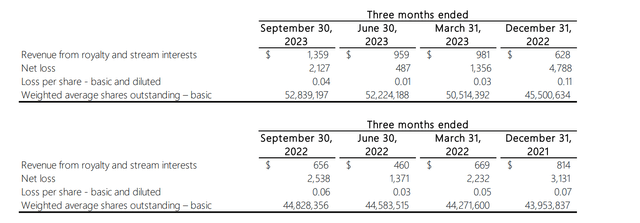

Q3 Results

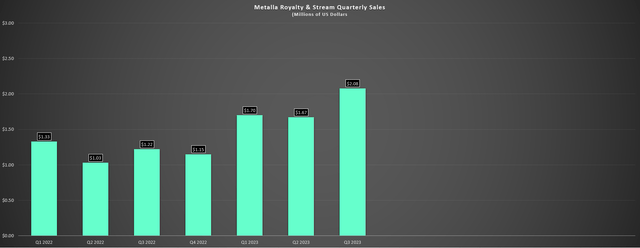

Metalla Royalty & Streaming (“Metalla”) released its Q3 results in November, reporting quarterly sales from royalties/streams of ~$2.1 million (1,095 gold-equivalent ounces), translating to a ~70% increase year-over-year. The higher sales were related to stronger metals prices and higher attributable production from assets like La Encantada, El Realito, Wharf and Higginsville, offset by no contribution from COSE/Joaquin. Unfortunately, the company still reported a net loss in the period ~$2.1 million, which included a $1.1 million impairment on its Beaufor royalty asset in Quebec and higher general & administrative expenses in the period ($1.0 million vs. ~$0.77 million). Meanwhile, Metalla’s share count was up in the period to ~53 million (+18% year-over-year), with shares issued under its loan agreements, sales under its At-The-Market Equity Program and royalty purchases, with its royalty/streaming portfolio increasing to 82 assets.

The company also issued ~164,400 shares to PI Financial at ~US$3.90 per share and ~143,800 shares to Trinity Advisors at the same price in a shares for services agreement related to a success fee for the Nova transaction.

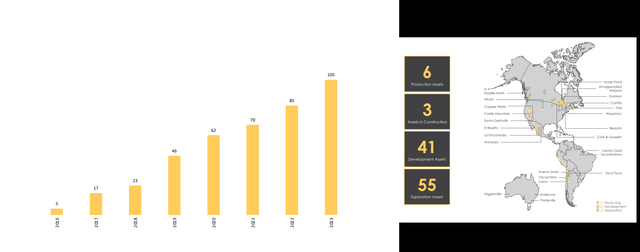

Metalla Total Royalties/Streams – Company Presentation Metalla – Royalty & Stream Quarterly Sales – Company Filings, Author’s Chart

While this was an improvement from the year-ago period, the major news came subsequent to quarter-end on a closing basis, with the company announcing the following:

- the closing of its proposed acquisition of Nova Royalty to increase its portfolio to 105 royalty/streaming assets

- an equity raise with Beedie Capital for ~$11.0 million for ~2.8 million shares at US$3.90 per share

- an amendment to its loan facility which has been extended to May 2027, with the interest rate increased to 10% (8% previously)

On a negative note, this has resulted in over 70% share dilution from Q3 2023 levels, with the company’s fully diluted share count now sitting closer to 96 million shares. On a positive note, the company has significantly increased the weighted-average life of projects/mines in its portfolio, and has added a new producing asset in Aranzazu (Zacatecas, Mexico) operated by Aura Minerals (OTCQX:ORAAF). Combined with a potential restart of the Endeavor Mine, and the start of production at Cote, Tocantinzinho and Amalgamated Kirkland next year, this will give the company 9-10 producing assets, a significant upgrade from just five producing assets in the same period last year.

Nova Royalty Acquisition & Metalla 2.0

Digging into the Nova Royalty acquisition a little closer, Metalla paid a ~25% premium to spot prices to acquire the company, and the company believes that this portfolio of 23 assets combined with growth from its current portfolio could allow it to morph into a ~30,000 gold-equivalent ounce [GEO] producer by 2030. Obviously, this is subject to the timely receipt of permits and partners green-lighting these assets, but it certainly helps that most of the core assets are held by larger operators that don’t have any issues funding these projects from a liquidity standpoint. In fact, new partners added to Metalla’s portfolio will include First Quantum (OTCPK:FQVLF), Hudbay Minerals (HBM), Lundin Mining (OTCPK:LUNMF), Glencore (OTC:GLCNF) and several others. Some of the more significant royalties that are likely to/could head into production within the next decade (or are already in construction) include:

- 0.42% NSR royalty on Taca Taca operated by First Quantum Minerals

- 0.315% NSR royalty on the Copper World Complex operated by Hudbay Minerals

- 0.083% NPI royalty on Josemaria operated by Lundin Mining Corp

- 0.98% NSR royalty (open pit operations)/0.49% NSR royalty (underground) on Vizcachitas operated by Los Andes Copper

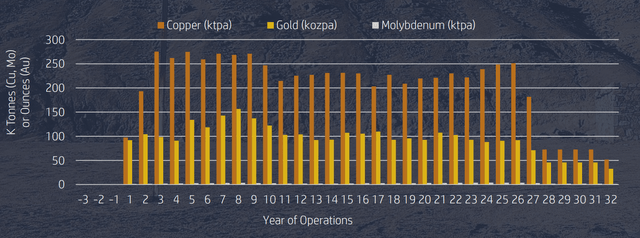

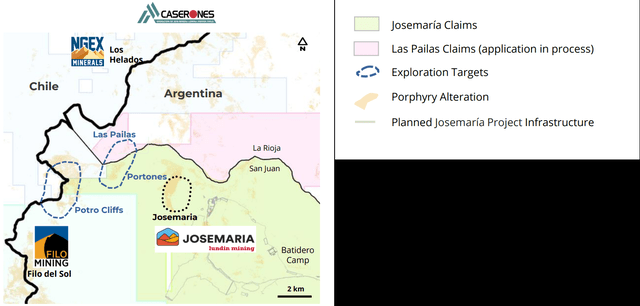

Josemaria & Copper World Projects – Lundin Mining/Hudbay Minerals Presentations

While the NSR royalty is relatively small on Taca Taca (Argentina), this is by far the most significant future contributor, with the potential for upwards of $2.2 billion in revenue per annum even at conservative copper price assumptions or upwards of $9.0 million in attributable cash flow to Metalla. As it stands, the ESIA approval for the massive copper-gold-moly project in Argentina is expected in 2024 (previously expected in 2023), suggesting that construction could start in 2025, with first production before the end of the decade. This would certainly be a needle-mover for Metalla given that attributable cash flow from Taca Taca would exceed all of its expected FY2024 cash flow next year, helping to improve Metalla’s current multiple of ~60x forward cash flow.

Taca Taca Production Profile – First Quantum Presentation Vicuna District & Josemaria Claims – Lundin Mining Presentation

As for other assets, Josemaria (Argentina) is a phenomenal asset that was recently acquired by Lundin Mining, and having this asset in the portfolio might excite some investors. However, it’s important to note that royalties are payable for only ten years, which doesn’t provide nearly the same multi-decade production profile, and this is not nearly as significant as Taca Taca. This is because the company holds a 0.083% net profits interest [NPI] vs. what some investors might be more used to (net smelter returns, or NSR). Obviously, some cash flow is better than none on a project set to produce over 150,000 tonnes of copper and ~300,000 ounces of gold in its first ten years. Still, the allure of having an asset like this would have been its long-term upside in the prolific Vicuna District under a team like the Lundins and inflation-protection with an NSR vs. the relatively small NPI it holds on the asset like other royalty companies hold at Caserones.

Finally, as for the Copper World Complex (Arizona, United States) and Vizcachitas (Chile), these projects can produce a combined ~260,000 tonnes of copper in their first ten years, translating to a combined ~$10 million in cash flow per annum assuming both projects are online by 2030 (only half of Vizcachitas Pit covered by royalty). Hence, between these four copper assets alone, Metalla could see its annual cash flow generation increase to over $20 million by 2030, and even under conservative copper price assumptions. In summary, there’s no question that Metalla got a solid price for the Nova Royalty portfolio, and it’s certainly helped to increase its net asset value per share.

So, what’s the overall verdict on the deal?

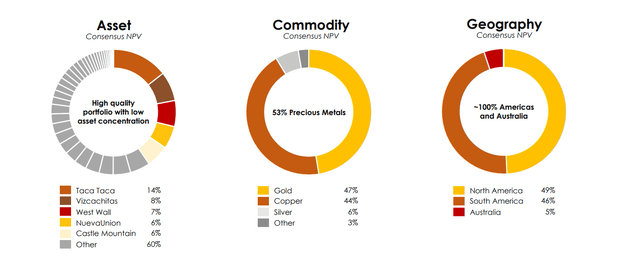

While I think Metalla paid an attractive price for these assets, I’m less elated with the significant pivot to copper, which has diluted its precious metals exposure materially. In addition, although the purchase price was more than reasonable, the company used depressed currency to complete the deal, offsetting the fact that it was acquiring Nova Royalty at a price well off its highs and the timing aspect to get the deal done counter-cyclically. Finally, although the deal helps to improve its P/NAV multiple, it hasn’t done much to help its cash flow multiple given that only one of Nova’s assets is producing, and it’s possible we could see some multiple compression given that base metals companies (Nova focused on copper and this has reduced Metalla’s precious metals exposure to just 53%) trade at a discount to precious metals names, which is certainly evidenced by Horizon Copper’s (OTCPK:RYTTF) valuation despite having exposure to three world-class assets held by large operators with lowest-quartile costs.

Asset Consensus NPV, Commodity Consensus NPV & Geography Consensus NPV – Company Presentation

Royalty/Streaming Landscape

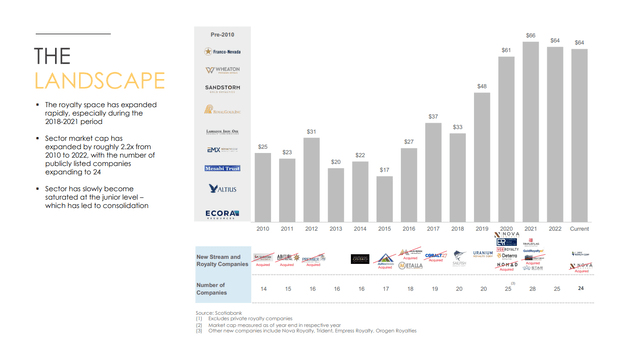

Looking at the royalty/streaming landscape today, there’s no question that we’ve seen considerable growth in the number of names participating in this model given the immense success of the big three royalty/streaming companies that have trounced the performance of gold (GLD) and the Gold Miners Index (GDX). In fact, there are over twenty royalty/streaming names currently despite several being acquired (Maverix, Great Bear, Nomad, and now Nova). This has significantly increased competition in the space and while this normally wouldn’t be an issue as the bigger names typically stay in their own lane, the competition has become so fierce that even the larger companies are picking off smaller royalties/streams to ensure they can secure future growth, and they certainly have the advantage with the ability to transact with cash and low-cost debt vs. shares, higher-cost debt, and lacking scale to even bid on some assets that are disadvantages.

Evidence of smaller deals include even Wheaton (WPM) coming in to do a smaller royalty on Black Pine instead of its usual streams ($3.6 million for 0.5% NSR), well below its average transaction value that’s north of $100 million.

Royalty/Streaming Landscape – Metalla Presentation

The other unfortunate development is that it’s getting more and more difficult to grow for the big six royalty/streaming companies and the bottom three in this group have now grown to the scale where they also have large advantages over the juniors vs. having a smaller gap from a cash flow generation standpoint in 2021 due to acquisitions, M&A and organic growth. Hence, even though the environment is better than ever with streams/royalties being a more attractive source of funding for those companies with weaker share prices and/or the inability to raise much equity due to investor appetite, this hasn’t improved the environment for the smaller junior royalty/streaming companies. So, while they might be able to get the odd deal done and Metalla has certainly done some decent deals on individual assets over the past several years, the IRR on these deals for juniors going forward should continue to shrink with competition stronger than ever and the quality of assets should also decline given that the big six are not going to let the better opportunities slip out of their grasp, especially given their far lower cost of capital.

Valuation

Based on ~96 million fully diluted shares and a share price of US$3.10, Metalla trades at a market cap of ~$300 million. This may look like a steep valuation for a company set to generate barely $8.0 million in revenue in FY2024 that continues to report net losses, but the company has significant growth bought and paid for with an estimated net asset value of ~$560 million. This leaves the stock trading at ~0.54x P/NAV after factoring in over $10 million in potential milestone payments and estimated corporate G&A, giving it one of the lower P/NAV multiples among its junior royalty peer group.

Metalla Royalty – Royalty, Net Losses & Average Share Count – Company Filings

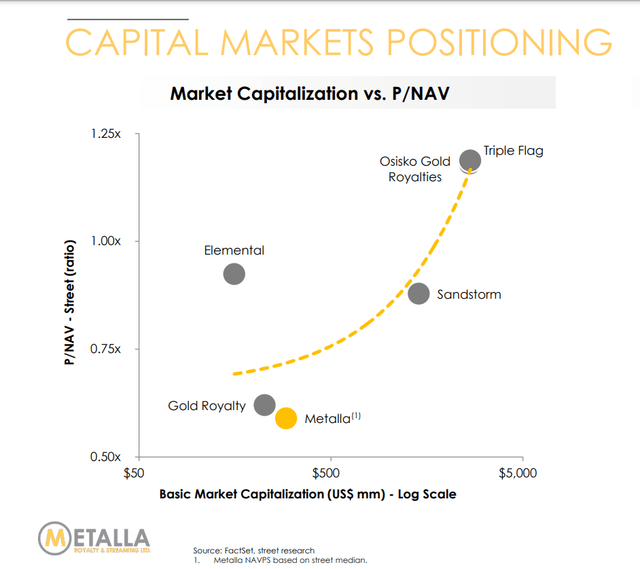

However, while royalty/streaming stocks will trade at lower P/NAV multiples in bear markets and much higher multiples in frothy markets, I don’t believe in valuing stocks based on where they might trade when investors are rushing into a sector in a bull market when things are frothy as there’s no guarantee on the timing of this occurring. Instead, I prefer to use more conservative multiples and I think a fair and realistic multiple for junior royalty/streaming companies in the current environment is 0.80x – 0.90x NAV. This is especially true when even mid-scale royalty/streaming names are struggling to work their way out of the 0.90x to 1.20x P/NAV range like Osisko Gold Royalties (OR) and Sandstorm (SAND). Plus, as noted previously, juniors are at a disadvantage, with a higher cost of capital and majors hungrier than ever, evidenced by majors doing smaller deals than usual to secure new royalties.

Market Cap vs. P/NAV Royalty/Streaming Companies – Metalla Website, FactSet

Using what I believe to be a fair multiple of 12.0x forward cash flow and 0.90x P/NAV and a 75%/25% weighting to P/NAV vs. cash-flow to reflect Metalla’s smaller scale, higher weighting to base metals and its high proportion of NAV tied to development vs. producing assets, I see a fair value for the stock of US$4.20. This translates to a 34% upside from current levels, suggesting that there could be further upside for Metalla to reach its fair value estimate. However, I am looking for a 40% discount to fair value when it comes to junior royalty/streaming companies to ensure a margin of safety. So, while MTA certainly has upside from these levels, the stock’s ideal buy zone doesn’t come in until US$2.52 or lower.

Summary

Metalla has certainly made a transformative acquisition and significantly increased its net asset value, but it has come at a cost of over 70% share dilution and the possibility of multiple compression and less investor interest from precious metals focused investors as its leverage to gold/silver has declined materially. Plus, while some of these assets will certainly be significant contributors once in production with long mine lives, investors will have to wait till later this decade to see the most advanced ones (Taca Taca, Josemaria, Copper World) head into commercial production. Finally, while the stock is reasonably valued, I don’t see enough margin of safety after this 20% rally. In summary, I continue to see far more attractive bets elsewhere in the sector, and I would view any rallies above US$3.68 before March as an opportunity to book some profits.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.