Tippapatt

China’s biotech company Gracell Biotechnologies Inc. (NASDAQ:GRCL) is ending the year with quite the bang, having seen an almost 360% uptick this year. But the party might not last for long.

As it happens, it’s being acquired by the Anglo-Swedish pharmaceuticals company AstraZeneca PLC (NASDAQ:AZN), now best known for its COVID-19 vaccine. The stock had already rallied by 190% this year before the news broke, and is up by another 60% since, bringing it to the current 2023 highs.

Price Chart (Seeking Alpha)

Now that the stock has risen so much, the first question is whether there’s still a trading opportunity in GRCL. And the second question is what the acquisition means for AstraZeneca going forward.

Little trading opportunity in GRCL

The deal values Gracell Biotechnologies, which is developing a cancer treatment, at USD $1.2 billion. This is split into a per-share price of USD $2 per share (USD $10 per ADS), which is payable in cash as well as USD $0.3 per share payout (USD $1.5 per ADS), which will be paid when regulatory milestones are achieved. AstraZeneca will pay USD $1 billion in cash when the deal is wrapped up by the end of the first quarter of 2024.

As I write, GRCL’s price has already risen to USD $9.92, which is very close to the USD $10 that AstraZeneca will pay, so there’s less than a 1% gain to be made now. That the price will go to the exact USD $10 level is almost a given, but if it fluctuates, there can be trading opportunities with the stock. If there’s a counteroffer at a higher price, of course, GRCL can run up further, but that’s just a matter of speculation right now.

What the deal means for GRCL

On the face of it, the buyout price looks somewhat disappointing as the company was valued at USD $19 per share when it was listed in January 2021. However, AstraZeneca’s offer is much more than the earlier high of USD $6.1 it reached this year. It’s also a 62% premium over the closing price before the offer price was released.

Moreover, GRCL is now under the aegis of a leading cancer treatment provider, which the company expects to support its research. AstraZeneca can also provide access to its target markets. Also, following the U.S. Food and Drug Administration recently following up on reports of malignancies for patients receiving the CART-T cell therapy that GRCL also provides, speculatively, it may even be a good time to sell out.

AstraZeneca gains momentum in China

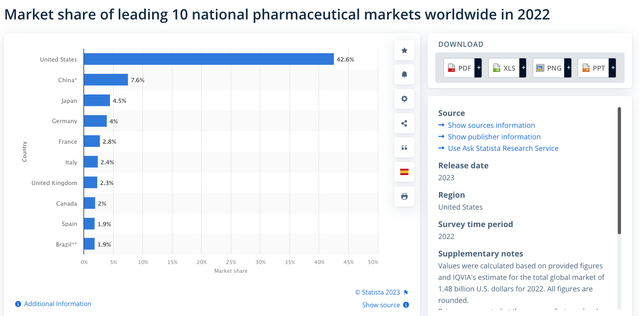

AstraZeneca, in turn, gets to expand its oncology portfolio, which is key to the company, in that it accounted for over 37% of the company’s revenues for the first nine months of the year (“9M 2023”). The acquisition also allows it to expand into the Chinese market. While the U.S. is far ahead of all other countries as far as the size of the pharmaceutical market is concerned (see chart below), China is still the second-biggest market.

Statista

China already has a respectable 13.6% share in AstraZeneca’s revenues, but the company has recently expressed optimism on the market, which could imply a growing share in the future. In its outlook released with the half-year earnings update, the company had upgraded the forecast specifically for China to “low-to-mid single-digit” growth, the same as its expectations for total revenues at the time, from the earlier “low single-digit growth.”

The latest deal also needs to be seen in context with the headway AstraZeneca has recently made in China. Last month, it entered into an exclusive license deal with Shanghai-based Eccogene for its obesity treatment.

In recent months, it has also received approvals in China for key treatments like the cancer treatment Imfinzi, which alone accounts for over 9% of the company’s revenues. Similarly, Soliris which is meant for specific nerve disorders and is part of AstraZeneca’s rare diseases portfolio, also received the country’s approval. The treatment also contributed a notable 7.2% to the company’s revenue in 9M 2023.

Limited financial impact

However, the acquisition hasn’t moved its price materially, which isn’t surprising at all. Typically, acquirers’ stocks fall on such news. But it’s a relatively small acquisition for the company, or what it terms as “bolt-on” acquisitions.

The cash payout to Gracell is just 21% of AstraZeneca’s cash and cash equivalents as of September 30, 2023. Further, as a pre-revenue company, there isn’t expected to be a top-line impact for now either. It will dent the company’s profits for now, though, with a trailing twelve months (TTM) loss of USD $68.1 million. However, even this is just 1.15% of AZN’s TTM profits.

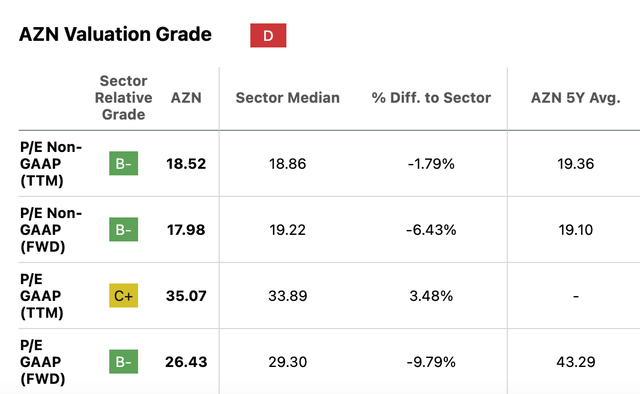

Following from there, it doesn’t significantly impact the stock’s TTM P/E from the current level of 35.1x either, since it rises to 35.3x. When the stock is looked at in terms of all other market multiples, it still looks attractive compared to its five-year average levels (see table below). In its latest update, the company also upgraded the outlook for both revenue and earnings, which is a positive for AstraZeneca.

Seeking Alpha

In sum

That the latest development is more significant for Gracell Biotechnologies stock than AstraZeneca is clear. And it was to be expected. GRCL is a pre-revenue company, whose buyout price is significantly higher than the trading price before the announcement.

The price is still lower than the IPO price, but it still looks fair when compared to the trading price over the past year. Also, the buyout brings GRCL under the ambit of a leading oncology player, which can be mutually beneficial for both companies. With the Gracell Biotechnologies Inc. stock price having risen almost to the acquiring price, however, there’s little trading opportunity here. So I’d go with a Hold on GRCL.

AstraZeneca, on its part, makes further inroads into the China market with the deal, which is the second-biggest pharmaceuticals market after the U.S. The company through its collaborations and approvals for drugs has already been making headway into the country.

The cost to the company is limited too, whose share price hasn’t moved much since the announcement. Even considering the impact of GRCL, the company’s cash position and profits would continue to look strong. The TTM P/E does rise a bit going by the latest financials for both companies, but not enough to alter the outlook on AstraZeneca in any way. I had given it a Buy rating the last I checked, and I retain that. In sum, it’s a win-win for both companies at present.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.