Dimitrios Kambouris/Getty Images Entertainment

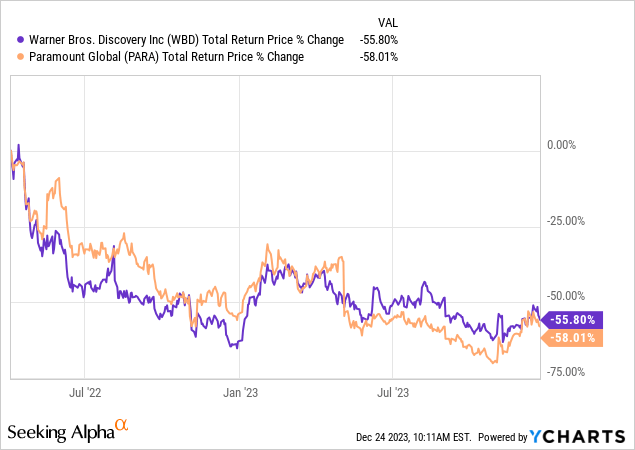

The reaction by Wall Street analysts regarding a possible merger between the two media companies was largely negative. Warner Bros. shares fell 5% on the news. Shares of both Warner Bros. Discovery (NASDAQ:WBD) and Paramount Global (PARA) have performed horribly, with both down over 50% since April 2022. They have been suffering from disappointing theatrical releases, unprofitable (Paramount+) to barely profitable (Max for WBD) streaming businesses and the slow death of cable networks. Warner Bros. guides for substantial gains in streaming earnings by 2025 and synergy savings. Discussions within Warner Bros. about whether it needs to make a deal with Paramount or another media company to make its streaming content package more attractive have been ongoing. These discussions are said to still require more time and further consideration.

The company reports in three segments: Studios, Networks (HBO, CNN, TNT, CBS, MTV, and Comedy Central), and the Direct-to-Consumer (DTC) segment. Studios comprises the earnings from feature films and licensing of television programs, Networks is for the domestic and international television networks, while DTC is for the premium pay-TV and streaming services. Studios, Networks, and DTC made up 22%, 74%, and 3% of the last quarter’s adjusted EBITDA respectively. Warner Bros. Discovery is available in 220 countries and 50 languages.

The analyst negativity towards a deal largely stemmed from the leverage of the companies, as well as the lack of scale compared to Netflix and Disney. This rationale for why a deal would be bad is a little hard to follow given a merger is precisely one way to address both of the issues analysts are worried about. Some analysts believe that even a combined company would not have enough content to support maintainable growth but clearly a wider variety would be offered by the combined company compared to what either could offer on its own. The regulatory review process would likely have no chance of proceeding quickly or smoothly given Lina Khan’s scrutiny of any merger that would pose anticompetitive concerns.

An offer from Warner Bros. would likely come in the form of an all stock offering given its heavy debt burden. This would compare poorly to potential competing bids that offer a cash component. Given the difficulty of making a deal happen, another option would be a joint venture that combines Max and Paramount+. The merger would promise billions in savings in studio operations as well as from combining the overlapping cable networks. The increased content offering would allow the company to compete against the other media giants (Disney (DIS) & Netflix (NFLX)) as another industry moves more firmly towards an oligopoly.

|

Company |

Market Cap |

EV/EBITDA |

P/E |

ROEQ % |

P/S |

Debt/Eq |

|

WBD |

27.48B |

3.52 |

– |

-10.35 |

0.65 |

1 |

|

PARA |

9.77B |

39.1 |

– |

-6.58 |

0.32 |

0.79 |

|

NFLX |

213.05B |

10.68 |

48.54 |

21.23 |

6.51 |

0.76 |

|

DIS |

166.6B |

16.42 |

70.74 |

2.42 |

1.88 |

0.51 |

Financials

The company’s financials paint a mixed picture just like the projections from the various analysts. On one hand the company has demonstrated the ability to consistently generate positive free cash flow including $2.851 billion in the last 9 months. However, net income was negative in 2022 as well as for the last three and nine month reporting periods. This was largely driven by amortization of acquisition related intangibles as well as restructuring expenses. The company operates with substantial leverage with a debt to equity ratio slightly below one. The average maturity of its debt is 15 years and the company was able to repay $2.4 billion in Q3. Fortunately, the company has less than three billion maturing annually on average over the next five years as it points out in the latest earnings presentation. The company goal is to achieve long term gross leverage (gross debt divided by the most recent four quarters of adjusted EBITDA) of 2.5 to 3 times

Discounted Cash Flow Valuations

A few DCF model variations that assume a 10% discount rate show us that Warner Bros. has the potential for substantial upside. Any optimistic projections require assumptions that it can sustain profitability and free cash flow while deleveraging the balance sheet. We need to see evidence of the often mentioned synergy savings. Warner Bros. had an average EPS of 0.65 over the last 5 years. If we assume an average 20% growth rate over the next 5 years, WBD is currently trading at 66% of fair value. This model shows WBD as undervalued if we assume at least an 11% growth rate over the next 5 years.

|

2022 |

2021 |

2020 |

2019 |

2018 |

|

|

Diluted EPS |

(3.82) |

1.54 |

1.81 |

2.88 |

0.86 |

If we excluded 2022 and start with the lowest EPS number from the prior four years from 2018 of 0.86 the model would look much different. In that case any average annual growth rate over 5% would show that WBD is trading at a discount to fair value.

Focusing on the presumed future growth driver, streaming, the company reported 95.1 million subscribers in Q3 which was 0.7 million less than reported for Q2. The company is aiming for $1B+ profitability from the direct to consumer subscription services globally by 2025. Warner Bros. expects the segment to be at least break-even in 2023 and projects $5.3B of overall free cash flow for the year.

Final Thoughts

An investment in Warner Bros. Discovery falls firmly in the speculative category given all the uncertainties and questions about the future of media and the leveraged balance sheet. Which streamers will grow or survive as consumers compare the different content offerings and cancel one subscription to jump to another. If Warner Bros. can achieve its synergy savings estimate of over $5 billion and the $1B plus profitability target for its streaming business the stock would shoot higher. This would especially be the case if we see real signs the company can deleverage the balance sheet. Given the uncertainty and large decline in the shares, we believe it’s time for an opportunistic initial investment in Warner Bros. with strategic additions during the ups and downs that will come with the ongoing merger discussions and shifts in the media landscape.