serts/E+ via Getty Images

Applied Materials, Inc. (NASDAQ:AMAT) stands out in the semiconductor industry, benefiting significantly from the artificial intelligence investment boom. Despite a general pullback in AI stocks, AMAT’s attractive valuation and solid financial health mark it as a lucrative investment. The firm’s wide-ranging array of products, covering different facets of semiconductor manufacturing, positions it well to skillfully handle the industry’s cyclical nature, ensuring steady performance despite fluctuations in the sector. This robustness is further bolstered by Applied Materials’ alignment with the growing complexity in AI chip production, suggesting potential for future growth. This article reviews the financial status of Applied Materials, analyzing its stock price to determine future trends and investment outlooks. It’s noted that the long-term trajectory for Applied Materials is predominantly bullish. Within this phase, any dips are seen as significant investment opportunities for investors.

Applied Materials’ Strategic Edge in Semiconductor and AI Markets

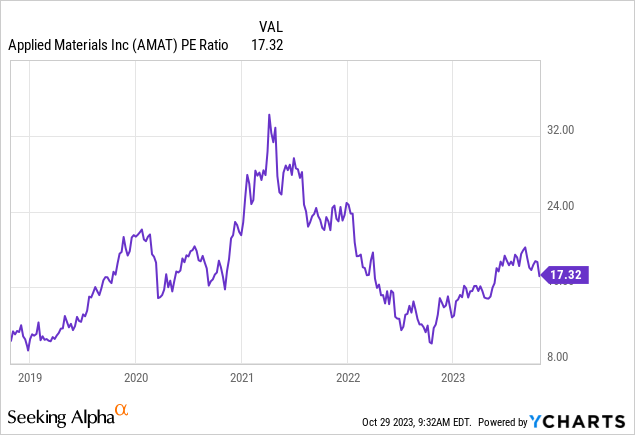

Applied Materials, recognized as a significant player in the semiconductor industry and a key beneficiary of the artificial intelligence investment boom, exhibits robust financial health and strategic foresight in its operational management. Recently, while stocks in artificial intelligence have seen a downturn, Applied Materials has not only demonstrated robustness amidst market volatility but also appears appealingly valued, trading at 17.32 times earnings. This valuation is notably lower than the average PE ratio of 25.22 for the Semiconductor Equipment & Materials industry. This pricing positions it as a highly reasonable investment opportunity, particularly considering its diverse portfolio.

Applied Materials’ strength lies in its wide-ranging product portfolio, which covers various aspects of semiconductor production, including etch and deposition, metrology, and advanced packaging. This diversity enables the company to navigate smoothly through the cyclical nature of the semiconductor industry. Despite downturns in specific chip sectors, Applied Materials has demonstrated commendable stability, with only minimal declines in equipment sales and a modest increase in its services revenue – a significant 22.8% of its total sales.

The firm’s performance is further enhanced by the increasing complexity and capital intensity of AI chip production, which aligns well with Applied Materials’ expertise in advanced semiconductor fabrication technologies. The company’s ability to capitalize on upcoming innovations, such as gate-all-around transistors and advanced chipset packaging, positions it favorably for future growth and aligns with emerging industry requirements.

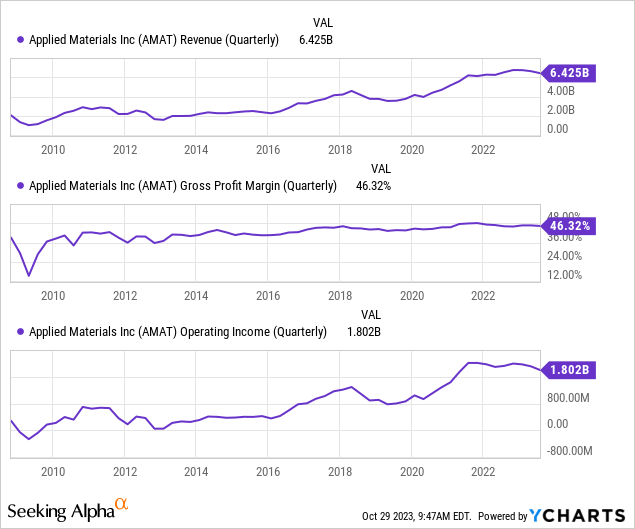

Financially, Applied Materials is not only advancing in technology but also excelling in corporate financial management. This is evident from its Q3 2023 results, showcasing a solid revenue of $6.425 billion, with a robust gross profit margin of over 46.32% and an operating income of $1.802 billion, reflecting around 28% of net sales, as shown in the chart below. The chart below presents an upward trend in revenue, gross profit margin, and operating income, signaling promising prospects for the company’s future profitability.

Moreover, Applied Materials has declared a quarterly cash dividend of $0.32 per share on its common stock, set to be paid on December 14, 2023, to shareholders recorded as of November 24, 2023. This dividend, integral to Applied’s capital allocation strategy, complements the $707 million returned to shareholders via dividends and share repurchases in Q3 2023, with about $13.4 billion still available for future share buybacks. This robust distribution and buyback policy might positively influence Applied Materials’ stock price by reflecting the company’s financial strength and commitment to shareholder returns.

The company is expected to announce the Q4 2023 earnings on November 16, 2023. For Q4 2023, Applied Materials forecasts its net sales to be around $6.51 billion, with a possible variation of plus or minus $400 million. The company anticipates non-GAAP adjusted diluted EPS to range between $1.82 and $2.18. Should the actual figures exceed these expectations, it could positively influence the stock price of Applied Materials.

Exploring Long-Term Technical Trends

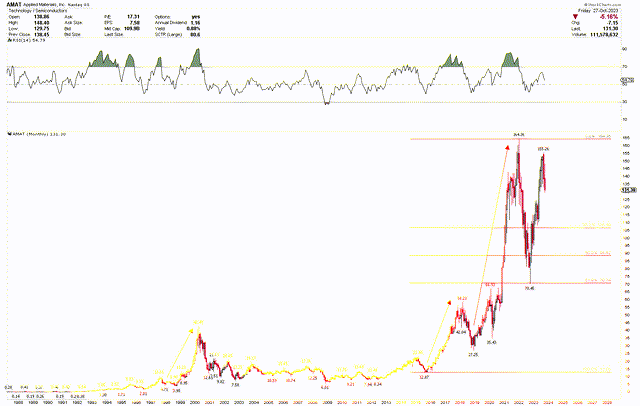

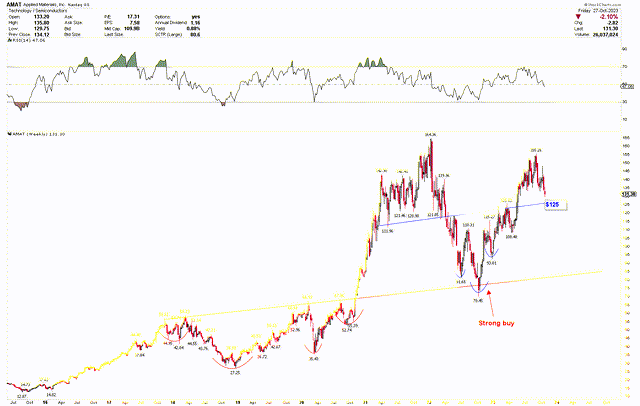

The technical analysis for Applied Materials reveals an impressively bullish pattern, as evidenced by the monthly chart below. A trend is observed where the stock consistently climbs, showing substantial upside movements. These surges occur in various stages, and after each surge is completed, a swift yet significant correction typically follows. A remarkable milestone for Applied Materials was recorded post-2015, with the stock bouncing from a low of $12.87 in 2015 to an all-time peak of $164.36. This remarkable ascent after 2015 is attributed to several critical factors, including strategic initiatives, industry growth, and broader economic influences.

AMAT Monthly Chart (StockCharts.com)

Primarily, the semiconductor sector, pivotal to Applied Materials’ core operations, saw exponential growth. This was propelled by escalating demand for sophisticated chips across various devices such as smartphones, computers, vehicles, and industrial equipment. Emerging technologies like 5G, AI, and IoT further amplified this demand, boosting the need for advanced semiconductor production tools – an area where Applied Materials shines. In addition to these market drivers, the company’s dedication to research and development, alongside smart acquisitions, kept it at the forefront of innovation. The global chip shortages further spotlighted the essential nature of semiconductor production capacity, thus benefiting leaders in the field, including Applied Materials. The firm’s financial health, characterized by sustained revenue increases and profitability, coupled with these industry trends, made it a magnet for investors, contributing to significant stock price movements.

However, after hitting a high at $164.36, the stock became excessively overbought, leading to a notable pullback. This decline found support at the 61.8% Fibonacci retracement level of $70.45, from which the stock rebounded notably, reaching back towards $155.26, and is now consolidating at higher levels – a bullish indicator. The stock’s resilience indicates market strength, suggesting it could be a good investment opportunity during dips.

The long-term bullish momentum in Applied Materials is further underlined by the weekly chart, showcasing a sturdy base formation between 2018 and 2020. This phase is characterized by an inverted head and shoulders pattern, with the lowest point at $27.25 and the shoulders at $42.04 and $35.43. Breaking out of this formation, the stock surged to new highs. Post reaching these highs, it retraced back to the breakout point of $70.45, precisely hitting this support level and triggering another rally. This upturn is denoted by a secondary inverted head and shoulders pattern, with the lowest point at $70.45 and the shoulders at $81.68 and $93.01. The pattern broke through at around $125, leading to another climb to $155.25. Currently, the stock is returning to its recent breakout point of $125, presenting a robust buying prospect for long-term investors, who might consider entering around $125 for potential gains.

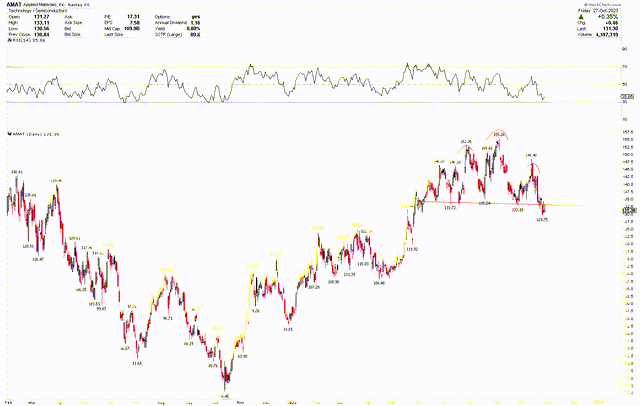

AMAT Weekly Chart (StockCharts.com)

In the short term, as shown in the daily chart, a head and shoulders pattern has developed, with the peak at $155.26 and the shoulders at $152.95 and $148.40. This pattern broke at $133, with the stock moving toward $125 or possibly lower in the short term. This downturn is viewed as an attractive buying window for long-term investors, signifying a chance to invest in anticipation of future price increases. The target of $125 on the daily chart is also considered solid support observed on the weekly chart.

AMAT Daily Chart (StockCharts.com)

Market Risk

The semiconductor industry is notoriously cyclical, and despite Applied Materials’ diversified portfolio, downturns in the sector can negatively impact demand for their products. Global economic fluctuations such as recessions, trade policies, and currency volatility can pose significant risks. Additionally, technological evolution and competition in the sector remain critical factors, where rapid advancements or competitive solutions could potentially affect Applied Materials’ market share and profitability. Regulatory changes and supply chain disruptions, especially in critical markets like the U.S., China, and the EU, are other factors that could impact operations and costs.

Moreover, fluctuations in the stock market, influenced by broader economic factors and investor sentiment, can affect Applied Materials’ stock price. The company’s shares, as shown in the technical analysis, have experienced significant volatility, with periods of overbuying followed by corrections. This sensitivity to market sentiments, along with the potential risks from rising interest rates and inflation, can impact investor appetite for Applied Materials’ stock. Additionally, the company’s potential over-reliance on specific sectors or major clients could present risks if these sectors face downturns or if relationships with critical clients change. If the stock price falls below the solid support level of $125, it could pave the way for an additional decline, potentially reaching as low as $106.

Bottom Line

In conclusion, Applied Materials is a substantial investment opportunity in the semiconductor sector, buoyed by its robust financial performance, diverse product portfolio, and technological leadership in the AI and semiconductor innovation space. Despite the inherent cyclicality and market volatility, Applied Material’s strategic foresight in financial management and consistent focus on research and development, coupled with its resilience in a fluctuating market, highlight its potential for sustained growth. However, investors should be mindful of the industry-specific risks, economic fluctuations, and broader market sentiments that could impact the company’s performance and stock valuation. Balancing these risks with Applied Materials’ strong market position and growth prospects is vital for potential investors navigating this dynamic sector. Investors may consider buying Applied Materials at the current price, nearing the $125 support level, and further increase positions if the price drops to $106.