Bim

I have received several requests to revisit Brookfield Infrastructure (NYSE:BIP) (NYSE:BIPC) that I covered recently. Initially, I wanted to do it after the Q3 results. But BIP’s drop has been too painful for investors to wait.

I issued a bullish rating for BIP when it was trading close to $30 about a month ago. It closed last week at ~$26. The drop was related to the increase in long-term interest rates and BIP kept trading in sync with utilities. In this post, I will try to address one issue: how dangerous are higher interest rates for BIP?

Throughout the post, I will be talking about BIP but the analysis is equally applicable to BIPC though it is more expensive and less desirable at least for the US investors.

I have also to remind my readers that BIP has always been a rather risky investment mostly due to perennially high leverage. This risk, however, is offset, at least partially, by the quality of the management team, the quality of its assets, and support from its parent Brookfield Corporation (BN).

Despite the drop, I consider my recent analysis valid and will not repeat it here. For the reasons I explained in that post, BIP becomes attractive when its yield is above 5%. Currently, it is 1.53/26 ~ 5.9% and will become higher when BIP increases its dividend in January – I expect at least a 6% increase.

BIP’s leverage

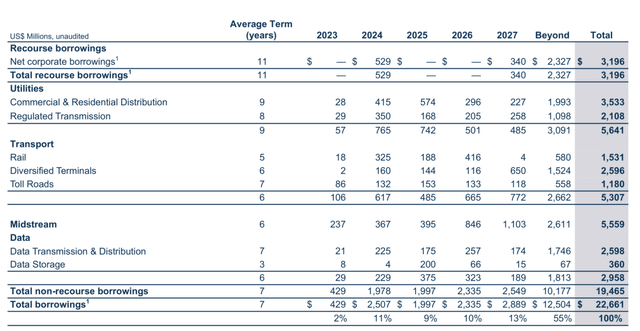

BIP has two types of debt – recourse on the corporate level and non-recourse on the asset level. Corporate debt is more dangerous, and so it represents a small fraction of the total debt (~$3B of ~$23B) as seen on the slide below that shows the maturity profile for BIP’s proportional debt in millions USD. BIP’s debt is mostly investment grade (BIP has a BBB+ credit rating for its recourse debt) and ~90% of it has fixed interest.

Company

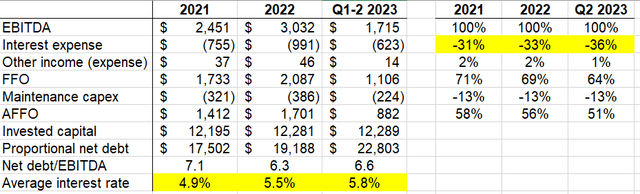

The next table shows the proportion of BIP’s cash flows used to service debt:

Author, Company

I marked the most important lines in yellow. All dollar figures are in millions.

BIP’s average interest rate is growing in line with the general trend. It was 4.9% in 2021, 5.5% in 2022, and 5.8% in H1 2023. Proportional net debt is growing as well due to BIP’s growth. Both factors led to the growth in interest expense from $755 in 2021 to $623 in H1 2023. But cash flows have grown as well.

Measured against EBITDA, interest expense was 31% in 2021, 33% in 2022, and 36% in H1 2023. This figure also keeps creeping higher though not that fast. However, the actual situation is much better than it seems due to HPC.

Heartland Petrochemical Complex (“HPC”)

HPC is a part of BIP’s Midstream sector. Here is its description from the Q2 Supplementary: “525,000 tonnes per year of polypropylene production capacity in Canada”. That’s it. BIP’s annual report barely mentions HPC at all. We can find slightly more information about HPC in the Q2 Letter to Shareholders:

At HPC, we completed repairs at the propane dehydrogenation (“PDH”) facility that resulted in the temporary shutdown of the entire complex for much of the quarter. During the repair period, we accelerated planned maintenance to take advantage of the downtime. Prior to the outage, both the PDH and Polypropylene facilities achieved nameplate capacity for sustained periods. Valuable operational learnings have been considered in the subsequent ramp-up, which took place in July, and the complex is achieving high operating capacity. Looking ahead, the third quarter is anticipated to partially contribute to results, while the fourth quarter is expected to provide full run-rate contribution.

While this is not the clearest text, it seems that BIP, so far, has not been particularly successful in launching the plant. HPC produced something in Q1, did not work in Q2 at all, and is supposed to operate at full capacity in Q4. But how big is HPC? I could not find any numbers in the current BIP filings.

HPC was the main reason BIP acquired Canadian Inter Pipeline precisely two years ago. Based on my notes regarding this acquisition, HPC was supposed to generate about CAD 450-500M of EBITDA, and the total project cost was estimated at ~ CAD 4B. 70-85% of EBITDA should be based on long-term (10-year duration on average) contracts that are structurally similar to “take or pay” contracts used for pipelines.

My numbers might be not up-to-date but they are still showing the importance of the project. HPC alone should increase BIP’s EBITDA by 10% at least. If we further assume that the $4B cost is equally split between debt and equity, HPC consumes more than 10% of BIP’s invested capital (displayed in the table above) WITHOUT producing any EBITDA in Q2!

Company

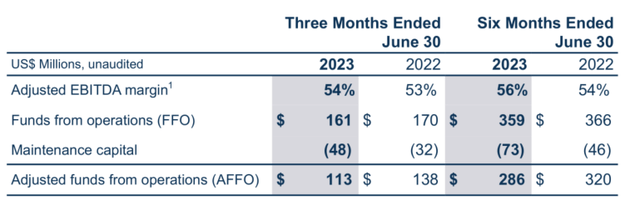

Above is another slide from the Q2 Supplementary showing the performance of the Midstream segment. If you compare results for three and six months, AFFO in Q1 was $173 vs. $113 in Q2. What is the reason for this difference in the segment that consists mostly of stable pipelines? We can attribute a significant part of it to HPC which was operating at partial capacity in Q1 and was not working at all (being under repair) in Q2.

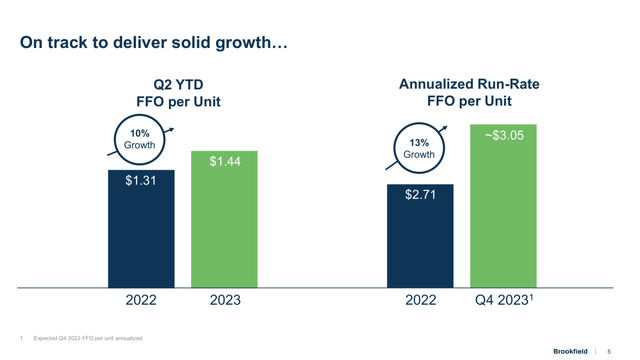

CEO Sam Pollock is counting on quick progress towards the end of 2023 as follows from the slide from recent Brookfield’s Investor Day:

Company

Why is BIP so shy about HPC and does not mention it directly most of the time? My notes of 2021 indicate that HPC was supposed to be commissioned in early 2022. Probably, full capacity towards the end of 2022 was in the offing back then. I.e. BIP is one year late with this project. Ever upbeat and victorious Brookfield should be reluctant to draw attention to this setback and that may be the explanation.

Performing at full capacity, HPC is expected to materially increase cash flows and make interest expense as a share of EBITDA lower or at least comparable to 2021 when interest rates were low! In its turn, this should help BIP to refinance whatever maturities are due.

Conclusion

If my analysis is correct, so far leverage has not become more dangerous for BIP despite interest rate increases. While the stock has been trading like utilities recently, its growth potential is superior to the latter. I tend to think that BIP’s drop is not justified. Eventually valued by the weighing machine of the market (as opposed to the voting machine in charge currently), the stock should trade higher, perhaps close to a 5% yield. Today it means $1.53/0.05 ~ $31 or ~$33 assuming a 6% distribution bump in January. On the bright side, the stock may revisit the high thirties once interest rates change their direction.

At the same time, I am very far from stating that BIP is a low-risk stock – its leverage is still high and will not become lower due to its mode of operation. However, this risk may have failed to increase that much over the last year.

So far, we have not even seen any signs of support from its parent. But it might be coming in the form of buying by BN. BIP is quite likely to initiate its buybacks on a more modest level as well.