georgeclerk

Investment Thesis

It’s no secret that the past three months have posed significant challenges for the financial markets. The increase in interest rates, reaching decade highs both in the US and Europe, coupled with an economic slowdown in China, has dealt a substantial blow to the markets. However, the luxury segment has been hit even harder due to fears of consumers cutting back on spending.

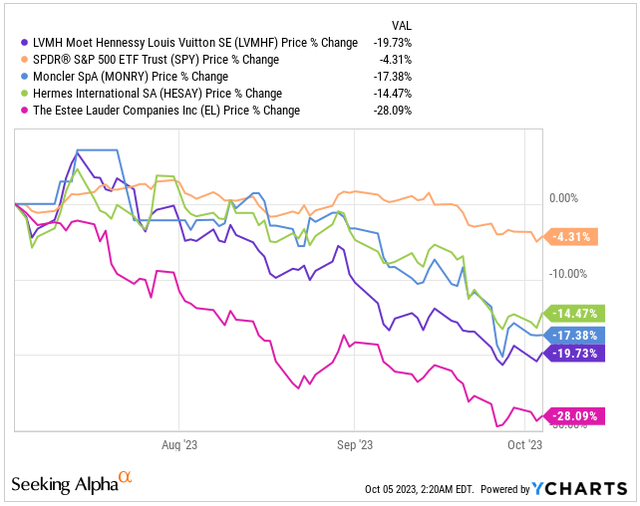

During this period, the S&P 500 Index (SPY) has experienced a 4.3% decline. In comparison, luxury giants like LVMH (OTCPK:LVMHF) (OTCPK:LVMUY) have fallen by 19.7%, Moncler (OTCPK:MONRY) by 17.3% Hermes (OTCPK:HESAY) by 14.5%, and Estee Lauder by a significant 28%.

3-Month Performance (Seeking Alpha)

In summary, LVMH’s stock was doing exceptionally well after its impressive earnings report in July, almost hitting new all-time high. But things took a turn, and since then, the stock price has dropped significantly, about 20% from its peak of €905 to the current €718.

I wrote an article right after their strong H1 2023 results, praising the company’s performance and its promising future. However, it seems I might have been a bit premature in my optimism. LVMH needed some time to settle down after its fantastic run in 2023.

Previous Article (Seeking Alpha)

Now, does that mean that I would change my investment thesis today?

Certainly, I wouldn’t. LVMH remains Europe’s pinnacle of quality, with excellent management, a robust competitive advantage, and an iconic brand presence that promises a thriving future.

Despite the current short-term challenges, I see this as an extraordinary opportunity with valuation even more appealing, giving long-term investors a rare chance to buy the best bread for a fraction of the cost.

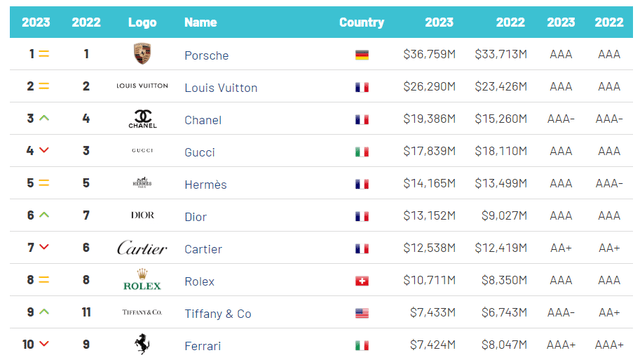

Delving into the specifics of brand values, it’s crystal clear that among the top 10 most valuable luxury brands in Europe, LVMH’s stable includes three heavyweights: Louis Vuitton, Dior and Tiffany & Co. This only strengthens my belief in the company’s enduring power and its potential for sustained growth.

Brand Value (Brand Finance)

To prove my commitment, I’ve backed up my words with action. I doubled down on my LVMH position, purchasing more shares at the recent low of €700. This move has increased my total LVMH holding to 5.5% of my portfolio, positioning it just behind the largest position of ASML (ASML).

The Slowdown in US Sales and China’s Economic Challenges Are Genuine, Yet Exaggerated

One of the primary reasons for the sharper decline in luxury company stocks in relation to total market was the widespread concern about a potential slowdown in luxury spending, particularly in the US. Several companies signaled this concern, with LVMH even reporting a contraction in sales growth in the US during Q2, with a decline of -1%.

However, this setback was mitigated during the quarter by the reopening of China. The Asian region as a whole experienced a significant uptick, reporting an impressive 34% growth throughout Q2.

Certainly market fluctuations are a natural part of the economic landscape, influenced by varying global conditions and this brings me to the point of dependence on the Asian market and the recent economic challenges it’s been facing.

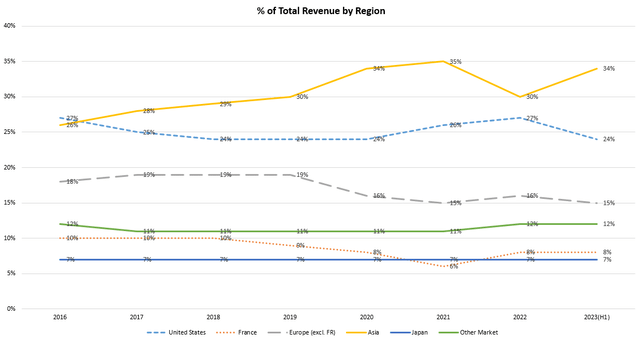

As shown below, LVMH has heavily relied on the Asian market, with its revenue dependence on this region growing from 26% in 2016 to over 34% in 2023. During the same period, the company has experienced a slight decrease in revenue dependence on both the US and Europe, with sales declining over the last 7 years. France, Japan, and other markets have remained relatively stable over the years.

% of Total Revenue by Region (Author’s Graph (Data LVMH IR))

The news is buzzing with China’s challenges: slowing growth, a possible real estate crisis, and deflation looming on the horizon. While these issues are undoubtedly significant, I can’t help but think that in the West, they might be a bit exaggerated. It seems like our leaders perceive China as an adversary, which could be influencing the way these concerns are portrayed.

On Monday, the World Bank revised its growth forecasts for China and East Asia, marking down China’s expected growth rate for 2024 from 4.8 percent in April to 4.4 percent. Keep in mind that the GDP growth rate in US during Q2 2023 was 2.1%.

China isn’t yet in a crisis, but it’s facing a significant problem: a crisis of consumer confidence. This issue is intricate and has far-reaching implications for Chinese consumers and both domestic and international companies.

As Q3 of 2023 started, China’s economic momentum slowed, slipping into a deflationary phase that caused consumer prices to drop for the first time in over two years, especially in July.

Customs data painted a worrying picture, showing a 12.4% plunge in imports in July compared to the previous year.

Exports also took a substantial hit, declining by 14.5%, surpassing the expected 12.5% drop. Although these declines eased slightly in August, with exports decreasing by 8.8% and imports by 7.3% YoY, signaling a relief.

This drop in consumer confidence led people in China to delay significant purchases, opt for more budget-friendly alternatives, and restrict spending to essentials.

However, the real question is, will this genuinely affect the demand for luxuries?

In my opinion, relying solely on exclusivity or high prices is no longer sufficient; brands must establish deeper connections with consumers to build trust and encourage spending.

LVMH has found a sweet spot in the market. Even though their products come with a hefty price tag, they symbolize prestige and their rich heritage makes them incredibly desirable, establishing a powerful emotional bond with consumers.

What is a bit worrying is that young consumers in China, are under financial pressure. In June, the unemployment rate for urban workers aged 16 to 24 reached a staggering 21.3 percent.

However, to understand the potential impact on LVMH, we must consider their target demographic. LVMH specifically focuses on women aged 18 to 54 with substantial annual incomes of $75,000 or more, indicating significant disposable income. While a small portion of this group faces unemployment challenges, potentially affecting sales to some extent, I believe the concerns might be exaggerated in relation to luxury retailers.

In the current landscape, merely being expensive or perceived as a luxury brand is not enough anymore. The market is still there, but brands will have to put in much more effort to connect with consumers and encourage them to spend.

With that said, I don’t anticipate a substantial decline in sales volume for LVMH in the Asian region. What does concern me is the possibility of a deflationary spiral, which might exert pressure on prices.

However, I believe the luxury segment won’t lower its prices significantly. The price is what makes these products desirable and sets them apart from general retailers in the first place.

To back up my argument, even Bank of America views luxury retailers as a potentially wise investment amidst the recent concerns. Although the turnaround might not happen overnight, they see them as a promising option at moment.

High quality company trading at a discount

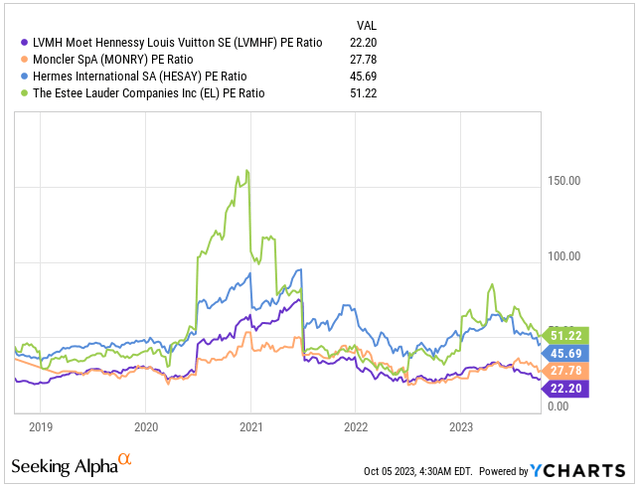

Since my first article on LVMH, the company’s PE ratio has dropped to 22.2x FY23 earnings, aligning with the 20% decrease in stock price. This stands in stark contrast to its five-year average of 33x earnings, indicating a significant drop.

However, we must consider the impact of rising interest rates, which will increase the company’s cost of capital. Considering that interest rates in Europe have risen from negative territory to over 4%, it’s unlikely that the company will trade anywhere near its previous PE ratio of 33x. Instead, I anticipate the fair value for this top-tier European company to be around 26x its earnings. This suggests a discount of approximately 15%, without factoring in potential future growth.

PE Ratio (Seeking Alpha)

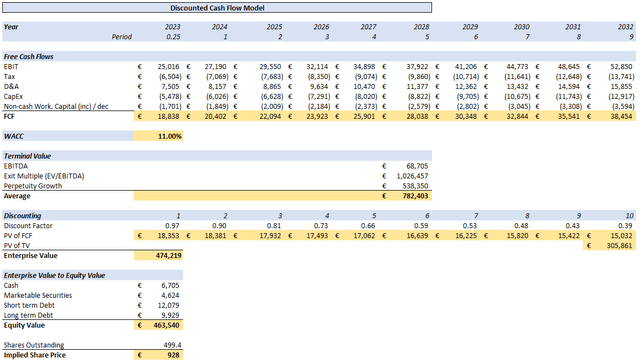

In my original article, I estimated revenue and operating income CAGR of 8% over the next 10 years. Despite my continued optimism, supported by the company’s strong pricing strategies, expanding market presence, and potential M&A, when using reversed DCF model, today’s stock price suggests a much lower growth rate of about 4.2% over the next decade, which stands in stark contrast to the CAGR 12.5% LVMH delivered over the course of last decade.

This significant disparity implies a notable undervaluation of the company’s growth potential. Granted, we must account for the higher cost of capital, raising the WACC from my initial 9.8% assumption to 11%.

Even with this adjustment, the Fair Value remains at least €928. This represents a substantial 22.6% discount from today’s market price of €718, which, considering the company’s exceptional quality, I believe is a bargain.

Other assumptions for DCF:

- Tax 26%

- D&A and CAPEX at 30% and 22% of EBIT respectively

- EV/EBITDA 14.94x

- Perpetuity Growth 3.5%

DCF Model (Author’s Table)

Game Plan and Conclusion

In my view, LVMH stands out as Europe’s top-tier company, boasting strong competitive advantages, heritage brands, and a skilled management team led by Bernard Arnault’s family, who own a significant 41.4% stake in the company.

Personally, I am heavily invested in LVMH, making it a cornerstone of my portfolio. Recently, I increased my shares during a market dip caused by the slowdown in US sales and economic worries in China, factors that could potentially impact LVMH’s sales growth.

However, I firmly believe the current price of around €718 is a fantastic deal, representing a significant 19% discount according to my analysis.

Given my substantial investment, I won’t be adding more shares at these levels. But, if the price drops further, I’m open to expanding my stake at €650 and €600, seizing the opportunity for additional investment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.