Capuski

Investment Thesis

The United States Natural Gas Fund, LP ETF (NYSEARCA:UNG) is often the go-to exchange-traded fund (“ETF”) for investors that are bullish on natural gas. And while I’m very bullish on natural gas, I explain here why investing in UNG may not be the best way to express one’s bullish view of natural gas.

Natural Gas’ Exciting Prospects

The future of natural gas holds exciting prospects in the global effort to lower net carbon emissions. Often referred to as a “bridge fuel,” natural gas has already played a crucial role in reducing greenhouse gas emissions by replacing coal in electricity generation. But it’s important to recognize that natural gas is more than just a transitional energy source; it can be a destination fuel in the broader context of the energy transition. This is because natural gas offers significant advantages in terms of lower emissions compared to coal and oil, making it a cleaner and more efficient energy source.

As we move towards a sustainable energy future, it’s clear that a mix of energy sources will be essential. Natural gas, alongside nuclear power, can serve as a reliable complement to intermittent renewable energy sources like solar and wind.

While renewables are vital for reducing emissions, they are also subject to weather-dependent fluctuations, which can lead to energy supply challenges.

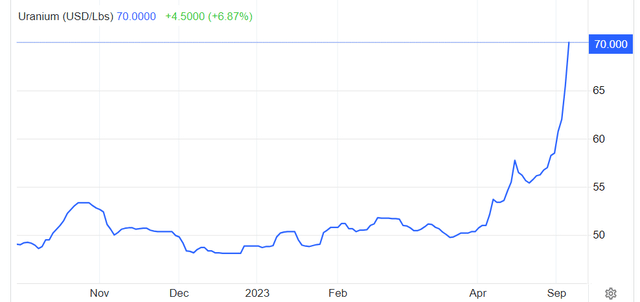

Indeed, I believe that investors are already coming around to this idea, when it comes to nuclear power, with uranium prices soaring in 2023.

Trading Economics

Incidentally, I’ve already discussed about investing in uranium here.

What’s more, natural gas power plants can provide a stable and flexible energy source that can quickly ramp up or down to meet energy demands, making them an ideal partner for intermittent renewables. Furthermore, advancements in carbon capture hold the promise of reducing emissions from natural gas even further, making it a vital component of our future energy landscape.

The rapid adoption of electric vehicles, or EVs, and the growing influence of artificial intelligence (“AI”) are poised to drive a massive surge in electricity demand. However, the current electrical grid infrastructure is ill-prepared for the challenges posed by this increased load.

Furthermore, the variability of energy supply, especially from renewable sources like wind and solar, means that our grid must adapt to handle fluctuations in electricity generation and consumption efficiently. Upgrading and modernizing our grid to accommodate these changes, while crucial, are expensive and will take years to ensure a stable and sustainable energy supply as we transition towards a cleaner and more electrified future.

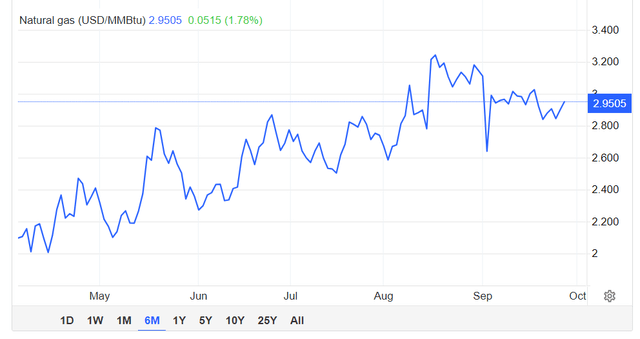

I argue that this point of view is no longer farfetched, but in actuality starting to be reflected right now in the natural gas market.

Trading Economics

Think about it like this, natural gas prices have moved more than 30% higher in the past 6 months. Yes, you may retort that it’s pushed back from a 30-year low price, once adjusted for inflation.

While I recognize that consideration, indeed, I’d already written about that exact situation back in February when I argued this re-pricing of natural gas would happen in an analysis titled, The Cure For Low Prices.

Now, as I noted in the introduction, there are very important risks of investing in UNG.

Risks of Investing in UNG

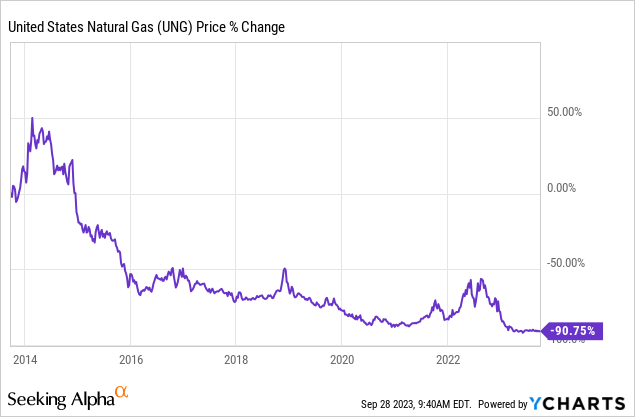

Investing in UNG involves a few risks that you should understand. UNG is designed to track the price of natural gas, but it doesn’t buy and store actual gas. Instead, it uses futures contracts, which are financial agreements to buy or sell gas at a predetermined price in the future. This means that if the futures market for natural gas doesn’t move in the direction UNG anticipates, you can lose money.

UNG’s mechanics are based on rolling over its futures contracts. As each contract approaches its expiration date, UNG sells it and buys a new one for a later date. This process is called “rolling,” and it can lead to a situation where UNG is buying high and selling low if prices are rising or staying constant.

This can result in a loss over time, even if natural gas prices rise overall. Indeed, you can see UNG’s performance over the past 10 years above.

So, while UNG can provide exposure to natural gas prices, it’s essential to be aware of these risks and understand how they work before investing.

So, Where Should I Invest?

I believe one should invest in the producers of natural gas. Personally, I’m invested in Antero Resources (AR), as that business is mostly unhedged to natural gas prices. But there are many other low-cost natural gas producers in the Appalachian Basin that you may also consider if you wish. My only advice is to spend 5 minutes looking over their respective balance sheets before you invest.

The Bottom Line

I’m bullish on natural gas for its potential to reduce carbon emissions, but investing in the United States Natural Gas Fund, LP ETF may not be the best choice. Natural gas has a significant role in our transition to cleaner energy. But remember, UNG relies on futures contracts and can be impacted by market movements, posing risks for investors. Instead, readers may consider investing in natural gas producers like Antero Resources or others in the Appalachian Basin for more direct exposure to natural gas prices, but do your research first!