JHVEPhoto/iStock Editorial through Getty Photos

Be aware: All quantities in Canadian {Dollars} except disclosed in any other case.

We had instructed promoting TELUS Company (TU) and changing it with AT&T Inc. (T) in our final piece. T was buying and selling decrease in all comparative metrics like EV to EBITDA, Worth to FCF, and Worth to PE. Certain, T signaled a dividend lower which is anathema to traders, by no means thoughts, that TU didn’t cowl its dividend from free money move. We believed that the final decade belonged to TU, whereas now known as for a altering of the guard with the subsequent belonging to T. We elaborated on our rationale and left our readers with:

The TELUS foray into heady development areas is working at current because the market is ok with fairness choices.

Possibly that works out, possibly it doesn’t. Typically, you will not discover the analysts on the huge Canadian banks placing out a adverse opinion on an fairness issuer. So in case you are anticipating a bell on the high, you will not get it.

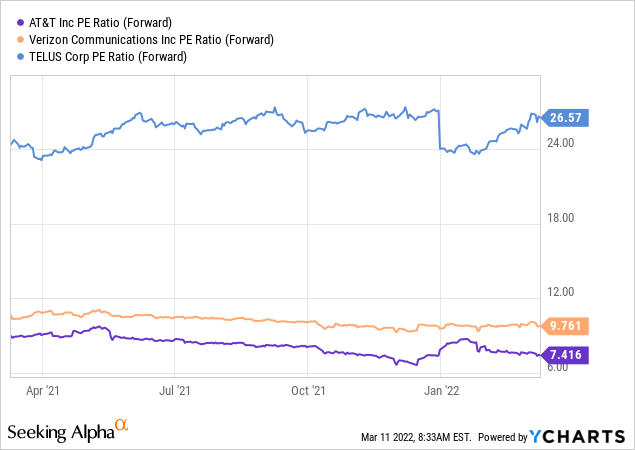

We see their aggressive positions inside their respective markets as very related and neither will get an edge for that. However the present valuation metrics are very compelling for AT&T as a complete and in order for you development, you probably will get it from the spun-off division. AT&T might need underperformed TELUS, however as we confirmed above, all of it got here from a valuation compression for AT&T and a valuation growth for TELUS. Promote TELUS, Purchase AT&T.

Supply: TELUS: A Change to AT&T Is Justified

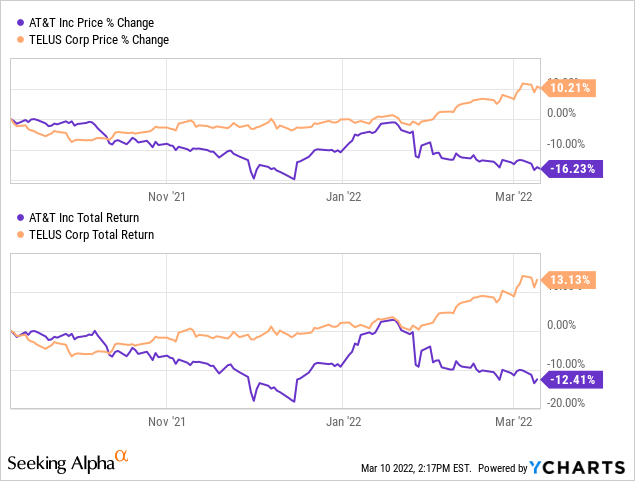

The get together continued for TELUS and it handily outperformed T.

So a Mea Culpa is so as? Hardly, and we inform you why.

This fall-2021

There was nothing improper with the reported outcomes. Complete income for 2021 got here in at $17.26 billion, up a wholesome 11% from 2020. Adjusted EBITDA adopted an identical rope and expanded to a 14% enhance over 2020. The place the numbers get outlandish is the place the market is pricing this “development”. Remember the fact that even the expansion we see solely got here within the adjusted EBITDA numbers. Reported earnings have been $1.04 per share a 2% decline vs 2020. The shares are thus buying and selling at 32X 2021 earnings. This quantity does enhance after we begin going additional and additional out however not by a lot. TELUS for instance remains to be buying and selling at 27X 2022 earnings and 24X 2023 earnings. Let’s examine that to what Telecoms ought to be buying and selling at. AT&T (T) for all its points trades at 7.5X earnings. Verizon Communications Inc. (VZ), which has given traders far much less grief than AT&T, trades at underneath 10X.

Each firms additionally offer you a greater yield with VZ yielding nearly a complete proportion level greater than TELUS.

The numbers look outright ridiculous by any measure. As unhealthy as these numbers look they worsen when different metrics are checked out. For instance, TELUS had 58 cents of free money move per share, leading to an over 200% dividend payout ratio. Free money move is not going to cowl the dividend in 2022 both.

However I Get Progress!

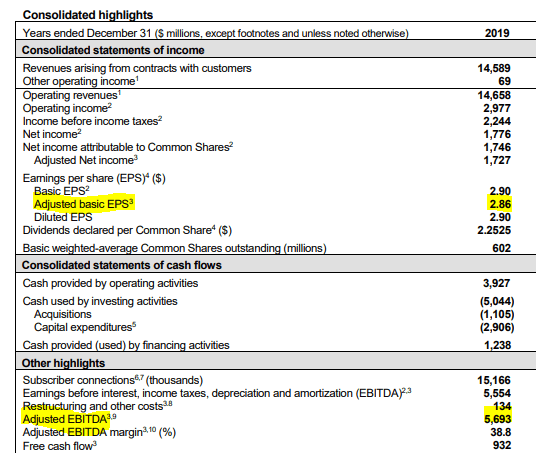

The phantasm of development is moderately implausible and within the case of TELUS the 2020 reset actually helps. What we imply by that’s TELUS reported EPS of $1.43 (adjusted for two:1 inventory cut up) in 2019. Adjusted EBITDA was $5.7 billion.

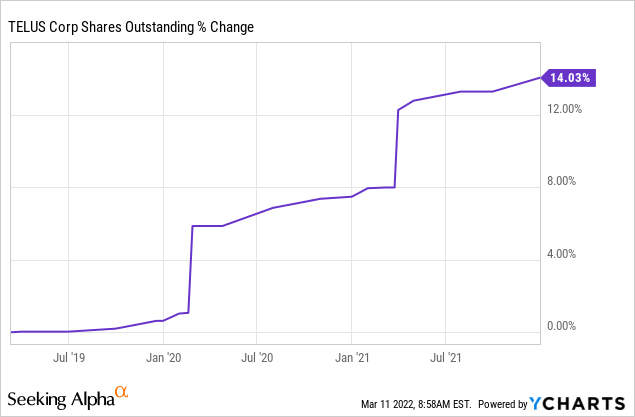

TELUS 2019 Earnings (TELUS Monetary Statements)

By 2022, we will probably be at an EPS of $1.20, a strong 16% decline over three years. However maybe adjusted EBITDA is your factor. Okay, that does enhance from $5.7 billion in 2019 to maybe $6.45 billion in 2022. That could be a 13% enhance over three years, about 4% compounded. Take into account us not even remotely impressed. That’s whole adjusted EBITDA. Adjusted EBITDA per share ought to be down by the point the ultimate share counts are in for 2022. Diluted shares are already up 14% over the past three years so any development we’re seeing has not improved per share metrics.

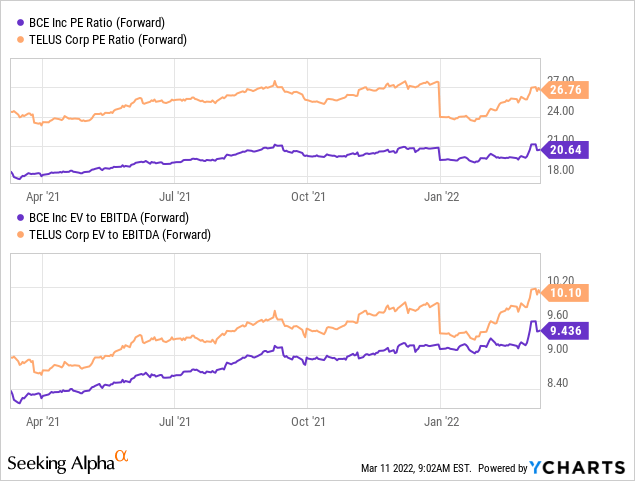

Valuation is getting stretched even when measured in opposition to BCE Inc. (BCE) which might be the closest Canadian peer.

Verdict

We’re downgrading shares to a Robust Promote from only a Promote. On this case we at the moment are truly shorting the shares as the chance reward over the subsequent 12 months seems extremely compelling. We have now substantial lengthy positions within the Telecom business and see this hedge as a low danger one, in comparison with others accessible. Key catalysts for a revision will probably come as EBITDA development stalls in 2022. Inflation just isn’t a good friend of slow-growing, richly valued firms and TELUS will probably be no completely different. We have now a $25 CAD ($19.50 USD) value goal in a single 12 months.

Please observe that this isn’t monetary recommendation. It might seem to be it, sound prefer it, however surprisingly, it’s not. Buyers are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their aims and constraints.