champc

It’s been a little over two months since I bought back into shares of The Gap, Inc. (NYSE:GPS), and about one month since I added to the position. In that time, the shares are up nicely, returning about 11.6% against a loss of about 1.9% for the S&P 500. This outperformance is obviously gratifying, but I need to remember that valuation matters with this stock. I sold previously just before a 24% plunge in value, and I want to review the name again to see if it’s time to take my winnings off the table, add more, or hold the position. I’ll make this determination by reviewing the latest financial results, and by looking at the valuation.

Welcome to the “thesis statement” portion of my article. It’s in this section where I give you the “gist” of my thinking so you can decide whether or not to go deeper or go do something more valuable with your time. This paragraph is specifically designed for people who might want a great deal more than what they can get from titles and bullet points, but much less than the tedium they’d be exposed to by in an entire “Doyle Original.” So, I’m going to take profits in The Gap today. Although I continue to believe that the dividend is well covered, and I really like the recent financial performance, the dividend yield has dropped precipitously. Given that investing is an inherently relativistic process, the notion of taking on the risk of stock ownership while being paid less than you get in a government bond makes very little sense to me. Thus, I’m taking my winnings off the table, and putting that capital to work in a risk-free investment. I’ll get paid more, and sleep better.

Financial Snapshot

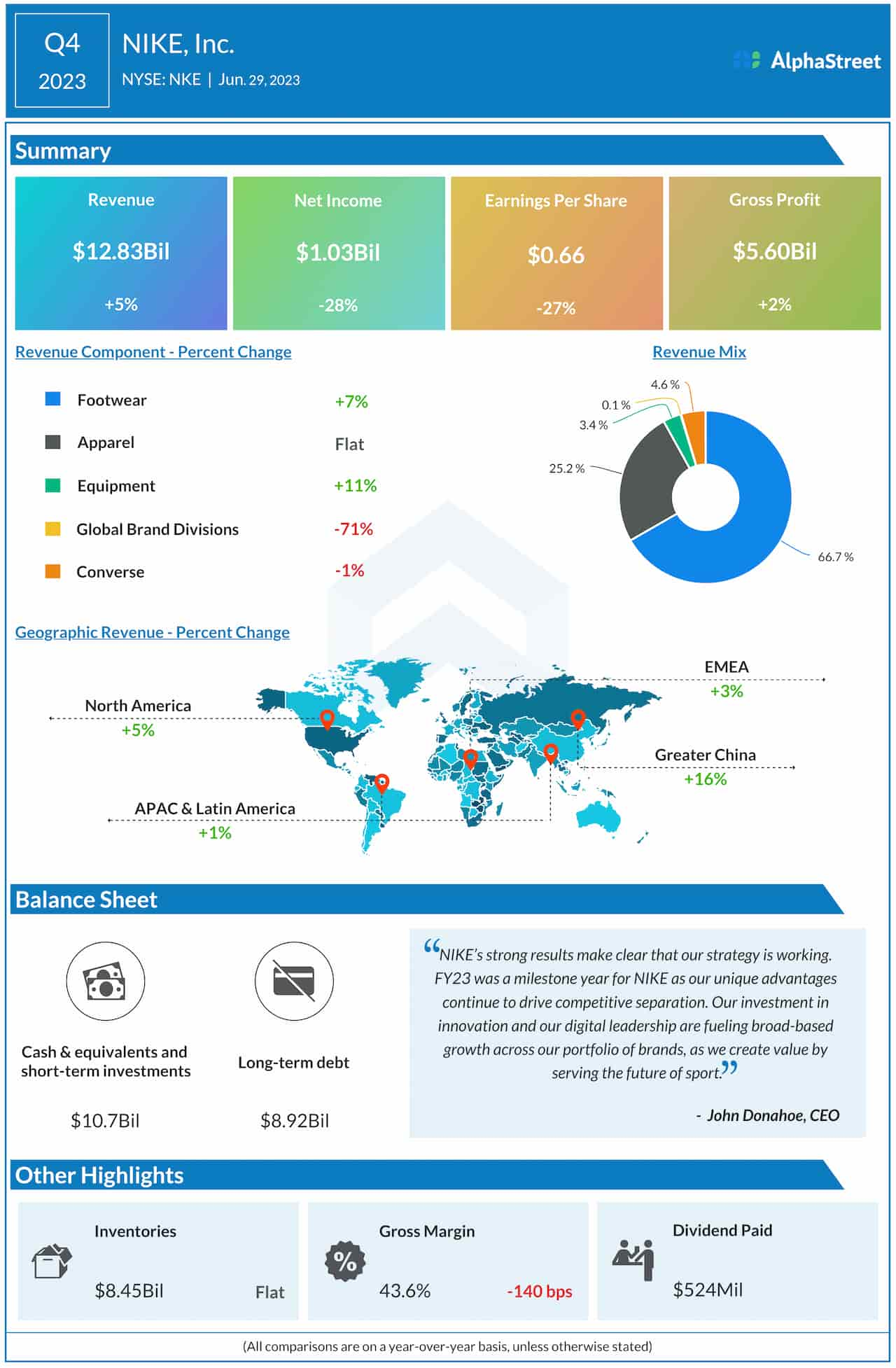

In my view, the financial results have been quite good recently. Specifically, net income has swung from a loss of $211 million, to a positive $99 million for the first six months of 2023. This result came about in spite of a 7% drop in revenue from last year to this. I’m particularly impressed by the fact that the company managed to drop COGS and operating expenses by a total of $831 million, or 12.8% and 7.5% respectively. Profitability has not returned to pre-pandemic levels, and remains about $296 million lower than it was in 2019, but it is certainly heading in the right direction.

In my last article on this business, I wrote about the sustainability of the dividend, and pointed out that it is very well covered in my estimation. In case you forget the gist of that article, I had a few reasons for thinking this. First, none of the company’s debt is due until 2029. Second, the cash hoard is enormous relative to the debt. At the moment, for instance, cash and equivalents represent about 91% of long term debt. Third, the company generates sufficient cash from operations relative to cash investments in the business. All of this suggests to me that the dividend is reasonably well covered here. Finally, we can’t forget about the fact that the company has returned to profitability.

Given the above, I would be willing to add to my stake here if, to paraphrase the tagline of a famous game show, the price is right!

The Gap Financials (The Gap investor relations)

The Stock

I’ve written it before, and I’m absolutely certain that I’ll write it again. I may risk boring my readers, but if it isn’t obvious to you by now, that’s very obviously a risk I’m willing to take. The more you pay for $1 of future gains, the lower will be your subsequent returns. This is why I try my best to buy shares when they are cheaply priced.

The corollary of this is that I seek to avoid companies when they’re priced too richly. This is because there’s a strong negative correlation between the price paid for an investment and the subsequent returns. Given that capital losses cause greater emotional pain than gains for the same magnitude bring pleasure, this is a guiding principle of my investing life. I try to never overpay for an investment.

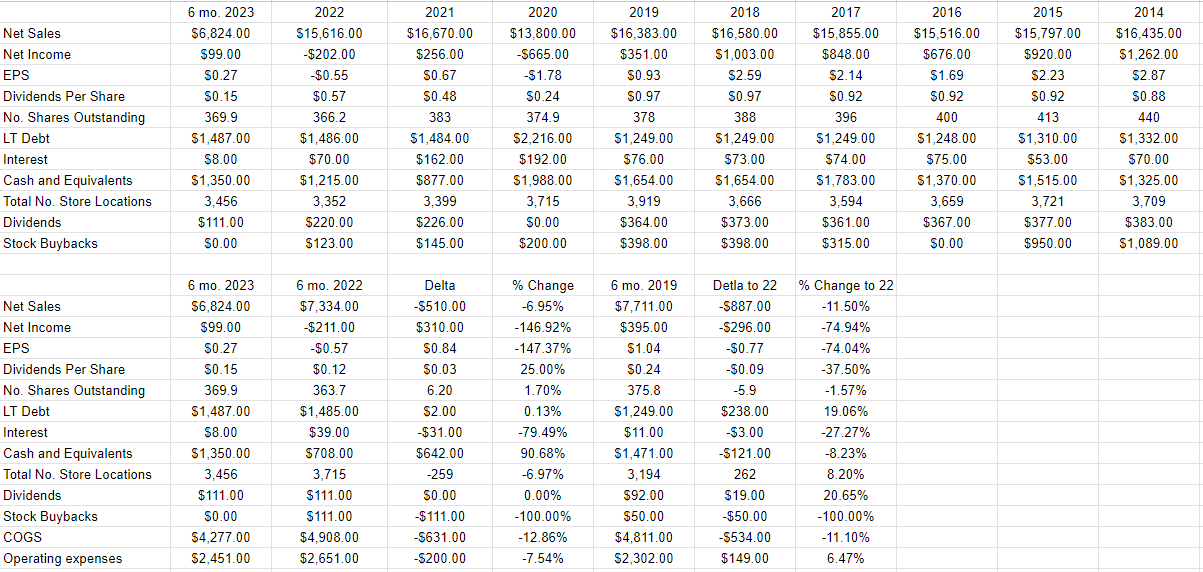

My regulars know that I measure the value of an investment in a few ways, from the simple to the more complex. On the simple side, I look at ratios of stock price to some measure of economic value, like earnings, sales, cash flow and the like. When I bought back my shares in July, the market was paying about $0.21 for $1 of sales, and the dividend yield was about 6.65%. Fast forward to the present, and the shares are only slightly more expensive on a price to sales basis, per the following:

Source: YCharts

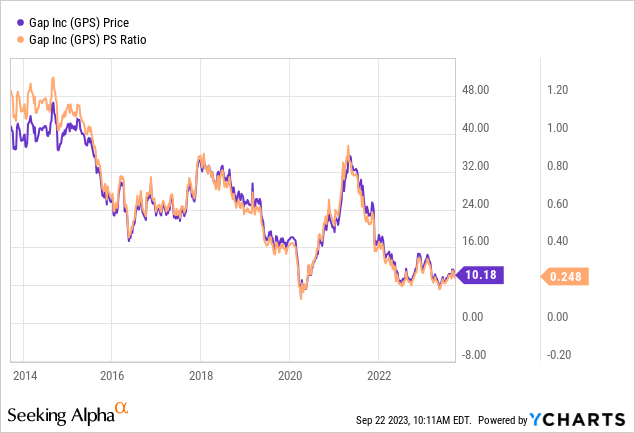

Source: YCharts

The problem, from my perspective, is that the dividend yield has absolutely collapsed, and is now about 30 basis points lower than the 20-year Treasury Bond. I certainly like the direction that The Gap is going, but I will acknowledge that there’s risk here. Although the dividend is very well covered in my view, there’s actually much more risk here than there is with a 20-year government bond. The idea of being paid less while taking on more risk makes little sense to me.

In addition to looking at simple ratios, I want to try to understand what the market is currently “thinking” about a given company’s future. In order to do this, I turn to the work outlined in books like Penman’s “Accounting for Value” and Mauboussin and Rappaport’s “Expectations Investing.” The idea expressed by these books is that the stock price itself has some interesting information embedded within it, including the market’s “thoughts” about a given company’s future. The greater the expectations, the more risky the investment. According to the approach outlined by Penman’s work, the market currently “thinks” that The Gap will grow at a rate of about 3.5% from current levels. In my view, that forecast is neither particularly rich, nor is it excessively pessimistic. In my view, it represents fair value.

In my view, investing is an inherently relativistic process. When you buy “X”, you are definitionally eschewing any number of “Ys.” For my part, I always want to find that combination of lower risk and higher return among various investment choices. Given that it’s possible to earn more cash from a risk-free bond at the moment, I see very little reason to continue to hold this stock. I will acknowledge that the shares remain very cheaply priced according to some measures, and as a result I may miss out on upside. I’m an investor and not a speculator, though. For that reason, I care about generating as much cash as possible from my capital. If I can generate more cash while taking on less risk, I will do so. Thus, the capital that has been tied up in The Gap is about to be replaced with government bonds.