grandriver/E+ via Getty Images

Investment Thesis

Hims & Hers Health, Inc. (NYSE:HIMS) is growing rapidly, but at the same time, it’s rapidly becoming more profitable. Indeed, I make the case that Hims is cheaply valued. What’s more, given that it has no debt on its balance sheet, there’s minimal risk to invest in this stock.

Here I have a frank discussion of the risks that are weighing on the stock, and how notwithstanding those risks, I’m super bullish on this stock and firmly believe that within the next twelve months, this stock will be at least at $12 per share. And likely more.

The Short Report

At its core, the short report on Hims puts into focus the question of the following assertion, can Hims turns its substantial efforts to acquire customers into profitable customer? This is it at its most simple.

And I have to agree, that this concern is something that I’ve had for a long time. I’ve echoed this concern on countless occasions.

Furthermore, as I’ve consistently argued, the primary bearish stance against Hims revolved around its strategy of aggressively investing in customer acquisition, seemingly outpacing the returns from those customers.

To put it plainly, the bear thesis asserted that marketing expenses would perpetually surpass Hims’ revenue growth rates. However, I maintained the perspective that Hims’ customer retention would extend well beyond the initial acquisition costs, ultimately resulting in favorable economics for the average patient.

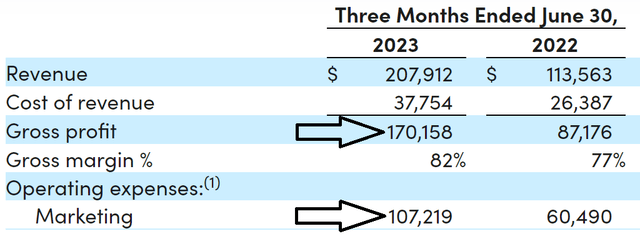

Illustratively, in Q2 2023, while marketing expenses increased by 77% year-over-year, revenues surged by an impressive 88% year-over-year. A more than 10% outperformance. This pivotal moment signals a significant turning point for the company, pointing towards an increasingly profitable trajectory in the foreseeable future.

HIMS Q2 2023

Similarly, gross profits were up 95% y/y, while marketing was up 75%. Again, I believe this puts a large dent on the bear thesis. Even if the bull thesis hasn’t been fully vindicated, I believe this is a strong step in the right direction.

Furthermore, it’s worth noting that not only did Hims significantly reduce GAAP losses, cutting them by more than half from $20 million in the previous year to just $7 million in the most recent quarter, and this positive trend is anticipated to continue as we look ahead.

Questionable Brand Equity

The short report goes on to say,

we believe HIMS remains largely a quick and easy outlet for completely commoditized ED pills and hair loss solutions, and its physician consultations are overwhelmingly asynchronous, check-the-box affairs designed to maximize the issuance of prescriptions and sale of medications, endowing HIMS with questionable medical credibility or enduring brand equity.

And I don’t disagree. In fact, I believe that this is very true. Patients seek out HIMS for ED pills and hair loss. I don’t believe that anyone is making a different assertion. Ultimately, as it stands, that’s exactly what Hims does. Yes, Hims has other nascent avenues that they are investing in. And yes, the ultimate economics of those other verticals are uncertain.

That’s why Hims’ business is small and fluid. Otherwise, it wouldn’t be a small upcoming business. It would be a large established business.

Moreover, as to its questionable brand equity, I point directly to the app store.

HIMS Apple Store

You don’t get to be so highly rated by thousands of users unless you are providing value. This, in my opinion, is elementary.

I’m not saying that Hims hasn’t got risks to the bull thesis, Hims clearly does. In fact, here are some investment risks that still loom large.

Top 2 Investment Risks

Does Hims have a moat? Superficially no.

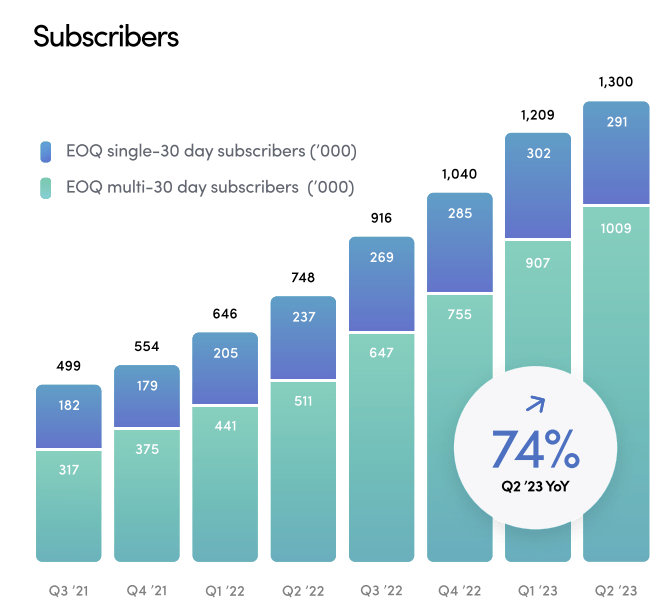

You can get competing products elsewhere online and often for a cheaper price. I would counter this by saying that when you get more than 1 million paying subscribers, you have to be doing something right.

HIMS Q2 2023

Even though I believe that the graphic above speaks for itself, I don’t wish to overstress and put even more emphasis on the bull case in this section.

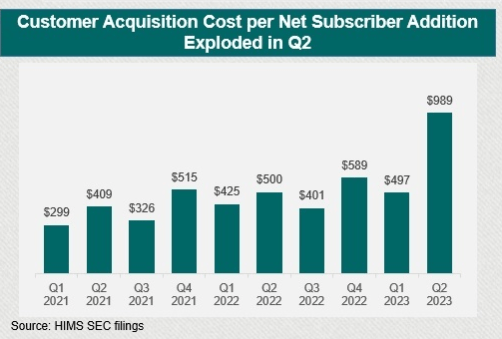

The next top risk consideration is that Hims saw its customer acquisition costs per net subscriber increase in Q2, see below.

Sprucepointcap

A combination of higher social media costs, plus a slowdown in total subscriber growth sequentially, churn-adjusted, translated into subscriber acquisition rates jumping higher.

Admittedly, I believe that Hims would be playing around with its pricing, which would impact its costs relative to revenues in the quarter. However, I frankly believe that this is something that the company is watching. Moreover, this detail shouldn’t overshow the fact of the matter: that Hims continues to make its path towards increasing profitability. In 2024, Hims believes it can reach $40 million in EBITDA. And this company has a long history of under-promising and overdelivering.

The Bottom Line

In examining Hims & Hers Health, Inc., I find myself agreeing with some aspects of the short report. These concerns, centered around the sustainability of Hims’ customer acquisition strategy and the question of enduring brand equity, have echoed in my mind for some time.

However, recent financial data, such as the impressive revenue and gross profit growth in Q2 2023, significantly bolster my bullish stance. While the company is not without its risks, the potential for continued profitability and the reduction in GAAP losses signal a promising trajectory.

Hims may not have an impenetrable moat, and customer acquisition costs per net subscriber did increase in Q2, but with over a million paying subscribers, there’s something compelling about its approach.

While I acknowledge the uncertainties, I firmly recommend Hims & Hers Health, Inc. stock as it seems to be headed in the right direction, making it a top investment. Finally, just to recall, the time to buy into a stock is when it is out of favor and cheaply priced at approximately 33x next year’s EBITDA. Not when its valuation is hyper-extended.