Wirestock

In the wake of an uptick in consumer discretionary spending during Q2, Ford Motor Company (NYSE:F) has found itself navigating a landscape of both promise and peril. Consumer confidence has clearly boosted Ford’s prospects, but the road ahead is not without challenges. In a notable disclosure during its recent earnings call, Ford emphasized the sluggish pace of electric vehicle adoption. Adding to the complexities, the United Auto Workers union has thrown a formidable spanner in the works with strikes affecting Ford and other major players including General Motors Company (GM) and Stellantis (STLA). Moreover, Ford’s recent partnership with Chinese battery giant Contemporary Amperex Technology (CATL) is raising concerns, especially at a time when the relationship between the U.S. and China is deteriorating. A group of 26 Republican House Energy and Commerce Committee members have expressed concerns about this partnership, citing potential national security risks and a deepening reliance on China for electric vehicle supply chains. Ford faces the daunting task of balancing its global ambitions with domestic sensitivities at a time when the auto sector is facing structural headwinds. Amid all these challenges, I continue to believe in Ford’s journey, including its electrification strategy. For this reason, I believe the recent pullback offers a good opportunity to double down on Ford stock.

Ford Model e Is Affected By Pricing Pressures

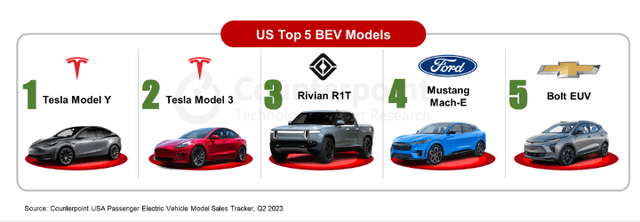

Ford, similar to its competitors, has found itself at the intersection of shifting market dynamics in the auto industry with EVs taking center stage. Recent data from Cox Automotive paints a compelling picture of the electric vehicle revolution in the United States. The second quarter of this year witnessed a historic surge, with nearly 300,000 new full battery-electric vehicles (BEVs) sold, a remarkable 48.4% surge from the same period in 2022. Tesla, Inc. (TSLA) asserted its dominance as the leading supplier of EVs in the United States, with sales topping 175,000, a significant 34.8% increase over the previous quarter.

Exhibit 1: Top-selling BEVs in the U.S. in Q2

Counterpoint Research

Despite the robust numbers, the path to widespread EV adoption is full of challenges. A noteworthy sign is the decline in EV market share in the U.S. to 7.2% from 7.3% in Q1. However, the average price paid for an EV fell over 20% year-over-year in June, indicating a shift in the affordability paradigm for eco-conscious buyers. Another survey by Cox Automotive shows that more than half of customers are interested in adopting an EV into their vehicle lineup. Nonetheless, adoption remains subdued, hampered by higher prices despite some improvements this year and economic uncertainty.

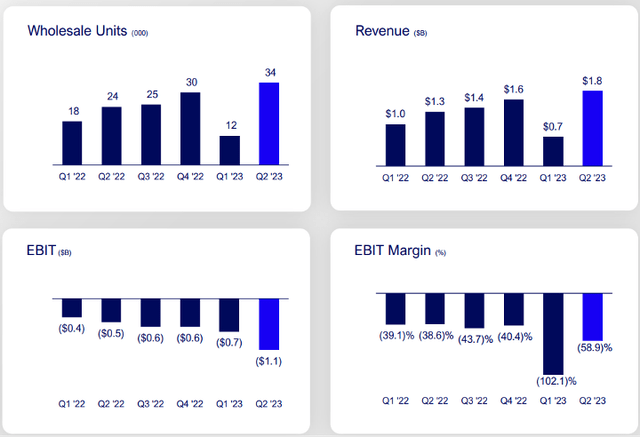

For Ford, the journey as an EV maker is marked by significant milestones and occasional setbacks. Despite a 39% increase in revenue for Ford Model e in Q2, the road ahead for Ford is not without challenges, as indicated by a steeper-than-expected loss of $1.08 billion during the quarter. The company hopes to turn things around by the end of 2026, with an 8% profit before taxes and interest from the EV business.

Exhibit 2: Ford Model e performance in the second quarter

Earnings presentation

During the earnings call, Ford CEO Jim Farley said:

The near-term pace of EV adoption will be a little slower than expected, which is going to benefit early movers like Ford.

The company is now on track to achieve a 600,000-unit EV production run rate by 2024, a timeline adjusted by a year from its initial forecast. Ford stays agile in its response as the industry goes through waves of transformation. Recent announcements of lower suggested retail prices for the all-electric F-150 Lightning pickup truck underscore the automaker’s commitment to adapting to market dynamics. The price premiums that once separated EVs from their internal combustion counterparts are shrinking, with price reductions exceeding $3,000 in the second quarter and nearly $5,000 for the first half of the year. This transition, while presenting short-term challenges, aligns with a broader industry trend toward greater affordability.

To navigate this electric transformation, Ford has secured massive support from the U.S. government—a conditional $9.2 billion loan to construct three battery factories, representing the largest government backing ever extended to a U.S. automaker. This substantial injection of capital underscores the government’s keen interest in bolstering the domestic electric vehicle and battery industries and reducing its dependency on China. This, in turn, leads us to Ford’s second significant challenge: its recent announcement of a strategic partnership with CATL, the global leader in lithium-ion battery manufacturing.

The Scrutinized Partnership With CATL

With a massive $3.5 billion investment, Ford is poised to construct a state-of-the-art battery plant in the heart of Michigan, a move underpinned by CATL’s cutting-edge technology. The motive for this formidable collaboration arises from the urgent need to establish a strong footing in the developing EV market. However, beyond the surface of this collaboration is a complicated tapestry of economic, geopolitical, and ethical factors that have thrown Ford into the limelight of congressional investigation.

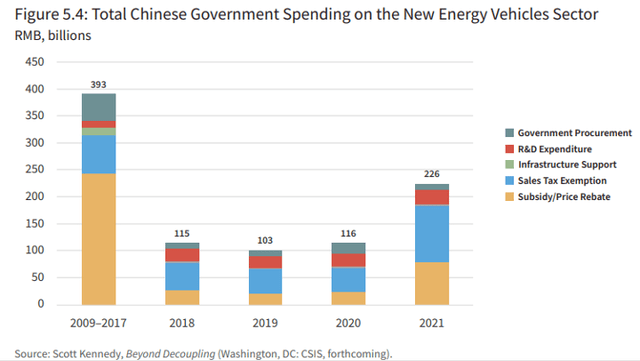

According to the Center for Strategic and International Studies, China’s dramatic growth in the EV space is typical of its strategic vision, since it invested over $130 billion in subsidies into this industry between 2009 and 2021. The result is a formidable stronghold on key segments of the global battery supply chain, with more than 80% of lithium-ion battery cell manufacturing capacity now located within China, as per BloombergNEF.

Exhibit 3: Chinese government spending on new energy vehicles

BloombergNEF

Ford is embarking on this collaborative path under the watchful scrutiny of U.S. lawmakers. The chairs of the House Select Committee on the Chinese Communist Party and the House Ways and Means Committee have demanded transparency in the form of licensing agreements, communications between the parties involved, and potential tax credit discussions with the Biden administration. Their investigations go deeper, delving into the delicate balance of employment between American and Chinese workers, eligibility for federal tax funding, CATL’s involvement with Xinjian company connected to forced labor practices, and the crucial question of whether this deal truly reduces the United States’ reliance on China for critical electric vehicle components.

According to Reuters, the House letter states:

We are concerned that the deal could simply facilitate the partial onshoring of PRC-controlled battery technology, raw materials, and employees while collecting tax credits and flowing funds back to CATL through the licensing agreement.

In its defense, the automaker claims that this collaboration will promote supply chain diversification and provide the United States with the ability to develop more economical and durable batteries domestically, eliminating the need for imports. Yet, amid these discussions, another problematic topic emerges—the alleged ties of CATL to a company established in Xinjiang, a region marred by systemic human rights violations as identified by the United Nations. While CATL has publicly divested its stake in the Xinjiang Zhicun Lithium Industry Company, lawmakers have scrutinized this move. Records reveal their transfer to an investment partnership with a former CATL manager in a leadership role — a sequence that has fueled doubts and demands for clarification.

Although I am a huge fan of Ford’s ambitious plans to concentrate on the EV supply chain, the company’s partnership with CATL may come under increased scrutiny in the coming months, dealing a blow to the company’s market value.

UAW’s Unprecedented Demands

Finally, a formidable challenge that could exert a far-reaching impact on the entire automotive industry lies in the labor negotiations with the United Auto Workers. Labor negotiations between the UAW and the three Detroit automakers—General Motors, Ford, and Stellantis—have taken center stage, placing the industry at a crossroads.

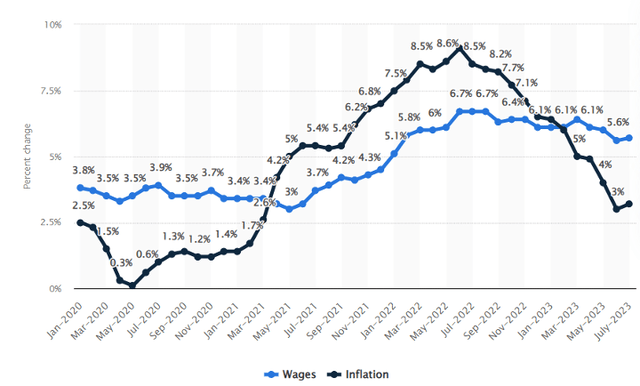

The UAW, the voice of autoworkers seeking to enhance their livelihoods, has laid down a resolute set of demands. Among their key demands are higher wages, improved benefits, enhanced job security, and a more significant share of the burgeoning profits garnered by automakers in recent years. According to Statista, a pivotal shift occurred in April 2021 when the rate of inflation outpaced wage growth, standing at 4.2% compared to a 3.2% increase in wages. Although wage growth surpassed inflation for the first time since March 2021 in February 2023, it remains insufficient to offset the impact of persistently higher inflation rates.

Exhibit 4: Inflation Rate and Wages Growth (Jan 2020 – Jul 2023)

Statista

At the heart of their proposition lies a bold request—wage increases north of 40% over the proposed four-year contract, effectively amounting to an annual increment of around 10%. For the automakers, these negotiations take place within a landscape teeming with challenges. With rising costs, intensifying global competition, supply chain disruptions, and the industry transition toward electric and autonomous vehicles, long-term commitments that could potentially limit flexibility and competitiveness appear increasingly daunting.

Yet, even as automakers grapple with the magnitude of the UAW’s proposals, they have extended counteroffers. General Motors, for example, tabled an offer that includes a 16% wage increase, along with additional payments addressing inflation catch-up and rising cost-of-living. Ford also presented its own offer in late August, encompassing a 15% wage increase accompanied by additional lump-sum payments. However, Wells Fargo analyst Colin Langan cautions that the path ahead remains uncertain, forecasting a potential 45-day strike encompassing all three Detroit automakers. These negotiations are taking place amid a labor shortage and a surge in worker activism across various industries. For example, in August, the Allied Pilots Association, representing 15,000 American Airlines (AAL) pilots, effectively influenced the airline to implement a pay raise of over 46% over four years, including an immediate increase of more than 21%. The UAW could leverage tight labor market conditions and public support for workers’ rights to pressure the automakers for better terms.

The stakes are undeniably high, and the outcome of these discussions bears significant ramifications for the automotive industry, the labor movement, and the broader U.S. economy. If an extended strike occurs, it has the potential to interrupt vehicle manufacturing and sales, as well as send shockwaves across supply chains and consumer spending.

Takeaway

With the EV market appearing to be cooling, following a period of stellar growth, Ford faces its own unique set of challenges. Concerns surrounding its partnership with CATL and the looming threat of a labor strike cast shadows over the company’s short-term performance. While a new agreement is likely to materialize, the risk of a prolonged strike disrupting production remains a concern. Nevertheless, beneath these uncertainties, Ford Motors is well-positioned to capitalize on recovering consumer spending, and I believe the company is the most attractively valued American automaker with a strong footing in the EV sector and quantifiable catalysts that could help the stock price move higher.