Jacobs Stock Photography Ltd/DigitalVision via Getty Images

Investment Summary

With a strong history of growth, NewMarket Corporation (NYSE:NEU) has been on a steady upward trajectory in the last 12 months and has yielded investors an investment return of over 50%. The company still trades at a slight decline to the sector, which makes it appealing still to rate as a buy in my opinion.

The company is included in the materials sector but more specifically the specialty chemicals industry where it makes and sells petroleum additives. The pricing environment has been difficult as in 2022 it shot up following the war in Ukraine, but it has since come down. However, some suggest that prices may stay elevated and companies like NEU still have a lot to gain in delivering to a demanding market trying to capitalize from what seems like present long-term growth opportunities. I tend to lean towards NEU still having a lot of potential to raise its bottom line and deliver sound ROI for investors. This concludes to me rating it a buy right now.

Market Overview Shows Positives

The company specializes in providing a comprehensive range of lubricant additives tailored to diverse applications across both vehicle and industrial sectors. These additives play a pivotal role in enhancing the performance and longevity of a wide spectrum of machinery and equipment, spanning from engine oils to hydraulic systems and beyond.

With a focus on optimizing operational efficiency and reducing friction, the company’s lubricant additives are engineered to excel in various contexts. In the realm of vehicle applications, they are instrumental in bolstering the efficacy of engine oils, ensuring smoother transmission fluid performance, and maintaining the health of powertrain and hydraulic systems. This translates to improved fuel efficiency, reduced wear and tear, and extended overall lifespan for vehicles of all types.

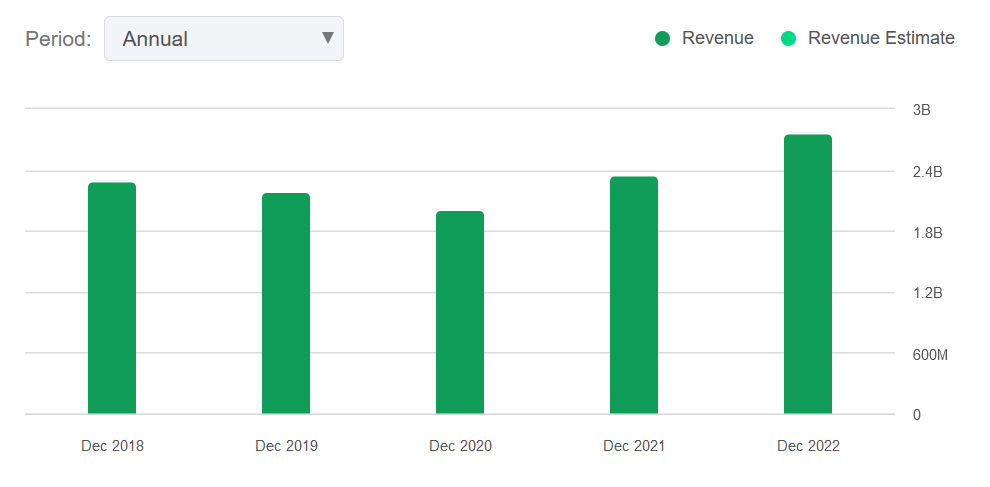

Revenue History (Seeking Alpha)

Following the higher cost of products, the company has been able to efficiently hike the prices of its additives and this has led to a very positive revenue increase over the last few years. The revenues are trending higher and so are the margins too for the business, which presents a very positive scenario for the company right now. There were some hiccups in 2022 primarily revolving around the war in Ukraine and the impact some of the lower shipments to these regions had on the revenues. But as we can see, 2022 still resulted in a decent YoY growth rate for the top line.

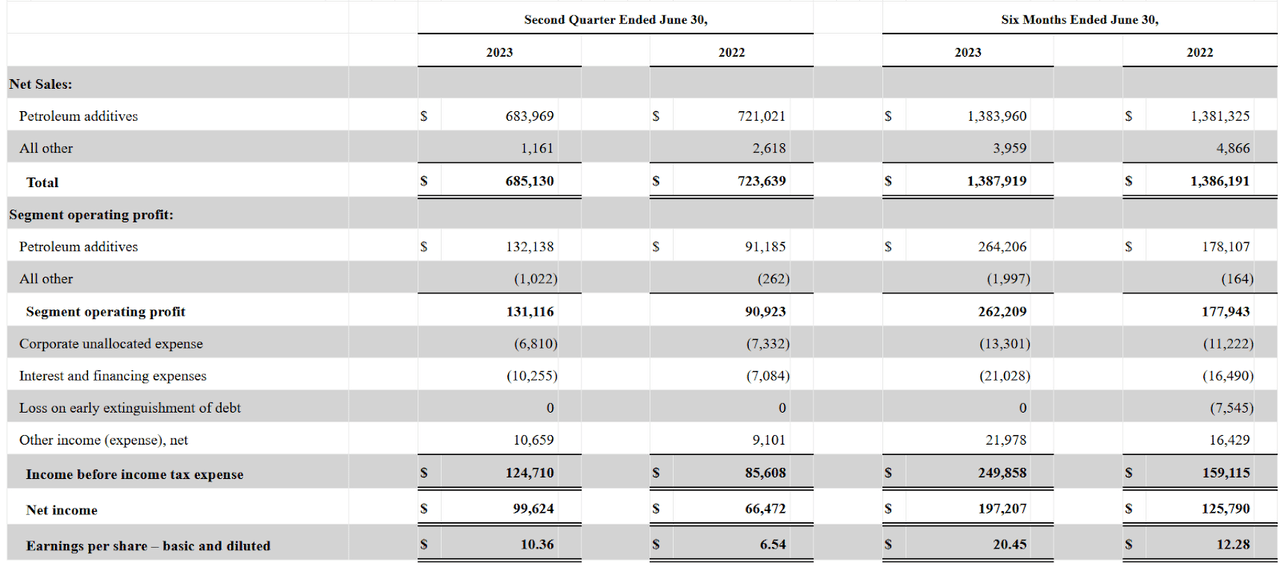

Income Statement (Earnings Report)

In the last report as well we can see the petroleum additives increasing its operating profits at a fantastic rate YoY as NEU is efficiently expanding margins. Going from operating profits of $91 million a year prior, it now sits at over $130 million. This improvement eventually resulted in NEU posting an EPS of $10.36 and values the company at an FWD p/e of under 13 right now. That leaves a near 10% discount to the sector, which in my opinion is sufficient enough to warrant a buy, especially when accounting for the dividend and the buybacks the company is doing.

Seeing NEU still able to offset lower shipments with better prices and more favorable ones showcases the resilience of the business model. The company stated in the last report that shipments dropped by over 16% on a QoQ basis, which would make most investors worried I think, but seeing the bottom line almost double still YoY puts any worries to rest in my opinion. Investors should be aware of the introduction of some earnings volatility that NEU brings, but over the long term, this often balances out. Short-term challenges aren’t indicative here of enough risk not to buy into NEU.

Risks

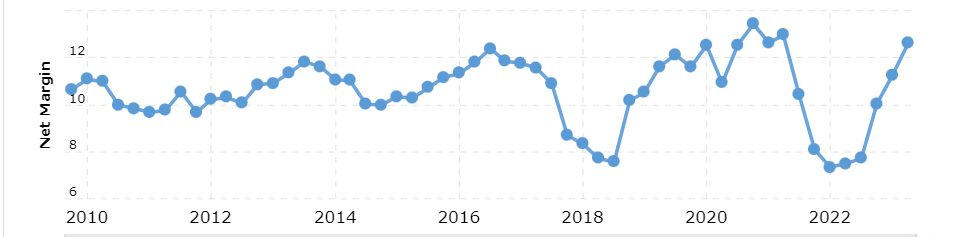

Although there has been a recent uptick in profit margins, it’s important to acknowledge that the situation remains sensitive and subject to potential shifts. A particularly noteworthy factor in this equation is the prevailing inflationary pressures that are exerting their influence on the global economic landscape.

The company’s operations, as a microcosm of the broader economy, are not immune to the impact of inflation. If these inflationary tensions persist or escalate, there is a real possibility that profit margins could face renewed contraction. Inflation has the potential to drive up costs across various aspects of the business, from raw materials and production inputs to logistics and distribution.

Net Margin (Macrotrends)

The cadence at which the company executes share repurchases might experience a deceleration in the upcoming quarters and beyond. This potential slowdown could be attributed to the company’s heightened debt load, which in turn leads to increased interest expenses. A critical factor contributing to this scenario is the potential impact on cash from operations, especially if it’s adversely affected by additional bouts of inflationary pressures or the emergence of a recession. So far though, the repurchases have been steady, and last quarter the company spent over $14 million in buybacks alone. Cash flows are still solid as demand is consistent and NEU can leverage its situation efficiently into better margins, which should fuel dividend growth for years to come in my opinion.

Financials

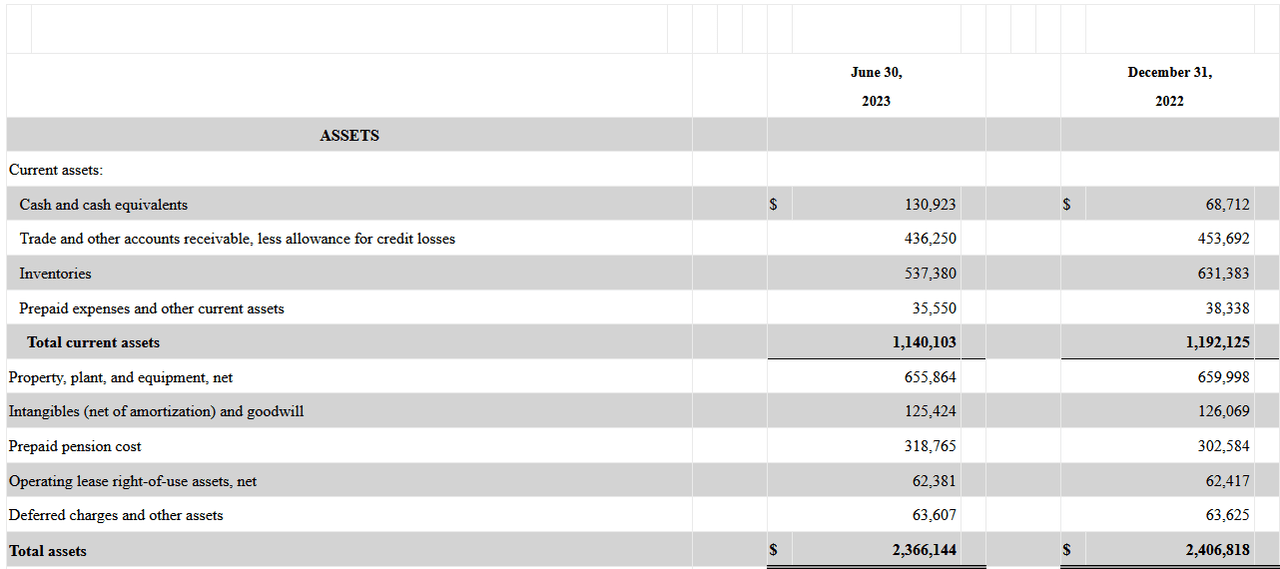

Balance Sheet (Earnings Report)

On the asset front, the company has done very well for itself as the cash position is at $130 million currently, a nearly 100% increase from December 31, 2022. This can have some impact on the nearly $1 billion debts the company has gathered up, but not as much as I would perhaps would have liked to see. I often value companies that have around 30% of their long-term debts in cash better than others. With NEU though, they have managed to build up a strong FCF margin of nearly 10% which is helping offset some of this. As we saw in the last report too, despite lower shipments, positive pricing conditions are heavily offsetting some of that, ensuring that NEU still can grow earnings over the long term. So to conclude, I think NEU is solid, while there are some points I’d like to see improved, like lower debts and more cash, one has to admit the FCF they have is more than enough to limit risk.

Valuation & Wrap Up

NEU has been trending upwards solidly over the last 12 months but isn’t necessarily at a premium to the sector either. With a p/e under 13 I consider it a buy as the discount together with the yield and quality business model makes it reasonable.

Stock Price (Seeking Alpha)

I would consider the company a buy as long as a 10% discount on earnings in comparison to the sector can be established. I am in the coming quarters also watching out for more dividend raises and continued buybacks to help bolster my buy thesis. For the moment, I am rating NEU a buy and view it as a great way to get exposure to the industry.